Rebuilding a Million-Dollar Brand: 5 Year Update

Every year since 2017, I've chronicled rebuilding a 7-figure brand from absolute scratch after the sale of my previous company. That goal has been achieved (see the 18-month update), but I continue to give a yearly update on the performance of the brand.

In this article, I will give a five-year update (I can't believe it has been that long!) which will detail revenues, wins, losses, and goals for the next year.

We have an episode about this subject on the podcast. If you'd like to listen, you can find the episode by clicking here.

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 48 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 36 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 24 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 18 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 12 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 6 month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 60 Day Update

Revenue Update

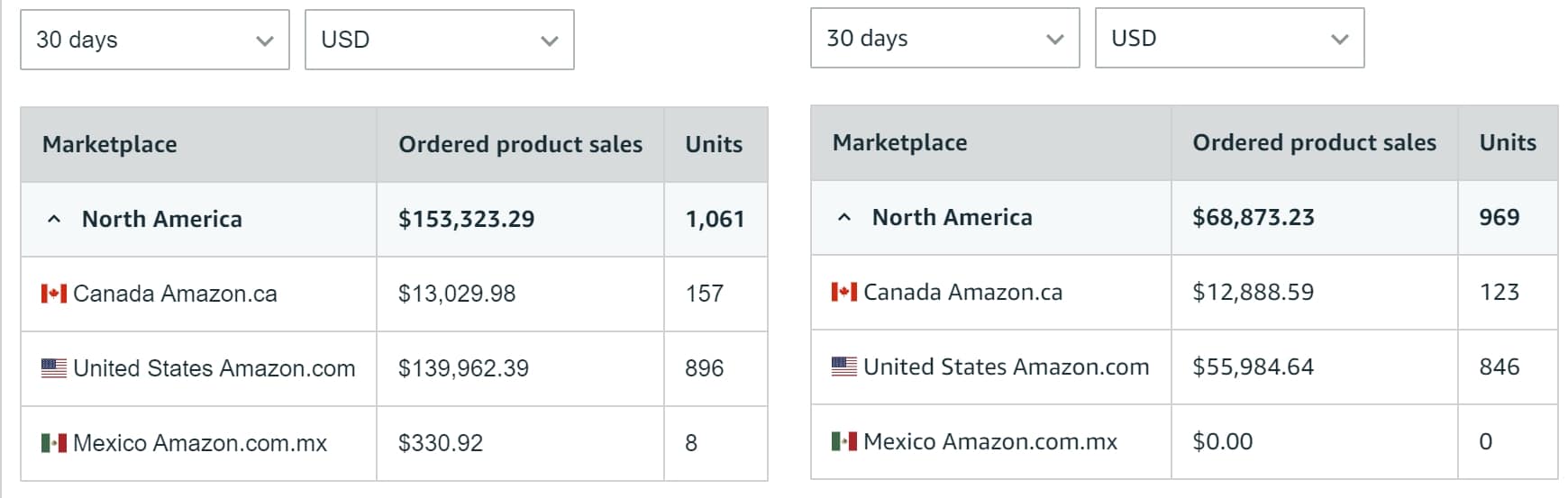

The revenue for June 2022 was $224,772 across all brands. Not bad, but this number is down significantly, over 35%, from 2021's revenue of $356,789. As I've talked about in many of our Brand Updates, the reason for the revenue drop has been a combination of three things:

- significant reduction in advertising costs (good)

- less COVID demand (bad), and

- more competition for many of our top-selling products.

I'll get into more of these here shortly.

| July 2017 | April 2018 | July 2019 | June 2020 | June 2021 | June 2022 | |

| Amazon.com | $10,788 | $32,237 | $76,710 | $155,957 | $283,758 | $195,946 |

| Amazon.ca | $1,180 | $12,145 | $21,700 | $41,405 | $63,283 | $25,917 |

| Amazon.com.mx | $1,180 | $12,145 | $21,700 | $41,405 | $1058 | $330 |

| eBay.com | $994 | $554 | $0 | $1,074 | $2,363 | $584 |

| Shopify | $552 | $629 | $2,469 | $4,230 | $6,327 | $1,995 |

| Total | $13,514 | $45,565 | $100,879 | $202,666 | $356,789 | $224,772 |

Month zero for these brands was July 2017, the first month that I actually had products in Amazon FBA warehouses ready to sell.

What's the Reason for the Revenue Drop?

I mentioned in the previous section the reasons for the big revenue drop, but let me address them in more detail here.

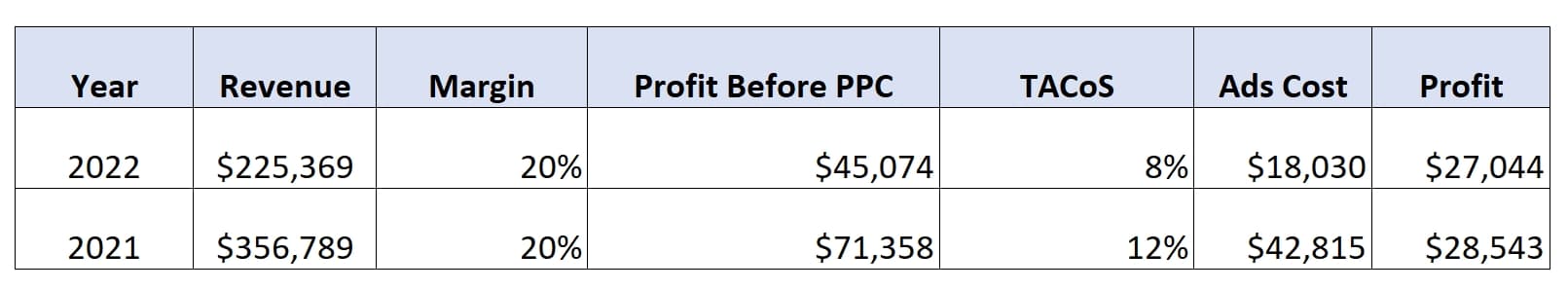

Decrease in TACoS from 12% to 8%

Total Advertising Cost of Sales, or TACoS, is basically the most important metric I'm tracking month over month.

One of the main concerns I had addressed in last year's update was TACoS being far too high: it was 12%, compared to 8.7% in 2021. For a low-margin company like ours, this cost wasn't sustainable at any time and especially more so given the fact that I could see the writing on the wall last year that revenues would almost certainly be down this year.

I spent a good chunk of Q1 this year working on getting our TACoS down and managed to do so wonderfully: I got it down to just over 8%. The result was that even though revenues were down 35%, profits in June this year ($27,044) were actually basically identical to June of last year ($28,543)—these are essentially our gross profits minus ad costs, and net profits are much smaller.

Decrease in COVID-Related Demand

A lot of our products benefited very well from COVID. People were going outdoors a lot more and needed things like tents. If you can recall, last year in Spring, we had another COVID wave, and things were beginning to shut down again. Subsequently, we got a bit of a bump in COVID-related demand. Even the biggest pessimist knew that things were likely to be better in 2022, and that's exactly what happened—people are back to traveling and staying in hotels instead of tents.

More Competition for Best-Selling Products

The more troubling thing about the revenue drop is the fact that it was partly caused by fierce competition for some of our products. Many of our best-selling products from when the company first launched are new at the point of facing a huge influx of competition. So much so that eventually, they could be retired (once we sell through the 25 years' worth of inventory we have for them!).

In fact, if you look at year-over-year sales numbers for the same products, those are down well over 50%. Had we not launched any new products, I suspect revenue could have been down well over 60%. Thankfully, we had a couple of product launches in the pipeline, and we've had one absolute monster success with a particular product.

Wins and Losses

I'll give a high-level overview of some of the wins and losses for the company over the last 12 months:

Wins

- New Hero Product. Hiding a lot of the pain of the decline in sales of existing products was the success of one of our new products. This product is doing about $30,000 to $50,000 in monthly sales and is accounting for roughly a third of our profit. There are dangers in having such a big chunk of sales accounted for in a single SKU, but for the time being, things are good.

- PPC is currently well-optimized, and TACoS is at 8%. In 2021, I specifically mentioned our PPC as a cause for concern. This year, I consider it one of our strong points and wins for the year. Getting from 12% TACoS to 8% was a massive turnaround for the better.

- Canadian Fulfillment Setup. There have been many challenges for our sales in Canada this year, specifically in getting inventory into Amazon warehouses. UPS stopped picking up earlier in the year due to capacity issues, and Amazon was looking for reasons to reject LTL shipments for the same reasons. We now have a decent 3PL working within the Vancouver area and have a pretty good system of getting goods back and forth from the US and Canada.

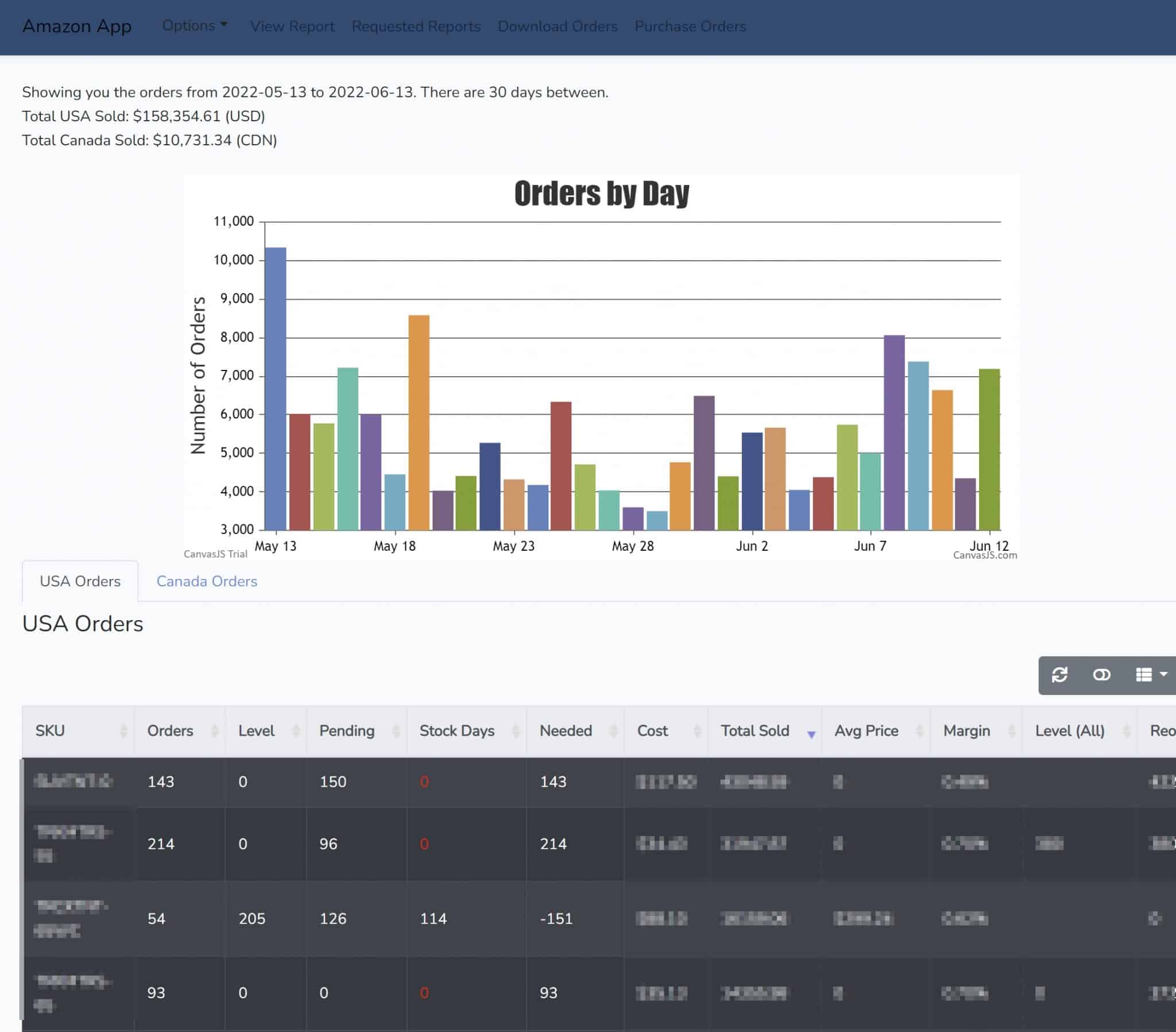

- Proprietary Inventory/Order Management Software. I used to be a huge advocate of the Order Management software Linnworks. However, last year, they changed their pricing model significantly without any real improvement to the product. Out of principle alone, I refused to pay the price increase and instead decided to do the incredibly intelligent thing (/sarcasm) of spending 100+ hours custom coding our own Inventory/Order Management software that could easily be purchased off the shelf.

The software doesn't do anything revolutionary, but it has helped us get better at reordering from China and restocking to FBA warehouses because it accounts for some of our seasonality better than off-the-shelf software can do.

Losses

- Massive decline in same-product YoY Sales. As I've mentioned, if it weren't for our new home run product, year-over-year sales would have been down over 50%. Hopefully, this is the bottom of the decline, and next year will be stronger for our Spring/Summer sales. But with the economic doom and gloom seemingly here, I'm not totally optimistic.

- Big drop in blog traffic. One of our content sites in May this year took a massive drop in traffic due to a Google Algorithm update—it was close to a 70% drop. While we've never done anything black hat for this site, the overall quality of the site has been admittedly not up to standard, which eventually catches up to you. Part of our reason for hiring two new people recently was to try and increase our overall site content.

Goals for 2023

Here are some of the goals going forward for the next 12 months and into 2023.

- Keep TACoS below 9% but increase PPC revenue by 10%. As part of our exercise in getting PPC costs down, we've seen a big drop in revenue from PPC. I'm going to work on slowly trying to increase our PPC revenue again, specifically by focusing on Sponsored Brands (text ads and video).

- Improve existing product line significantly for 3 to 5 products. Some of our existing products have gotten stale and haven't been significantly improved in years. The cause? Laziness. There's some low-hanging fruit in terms of significantly improving our products and giving them a competitive advantage which would also likely increase our overall customer rating by a couple of tenths of a point.

- Buy a Canadian warehouse. This is my blue ocean goal for 2023 if commercial real estate prices drop here in Vancouver (currently, $1m gets you a roughly 2,000-square-foot warehouse) and if the company generates enough discretionary income to justify the purchase. This is more of a 12- to 24-month goal, but I'll likely start actively looking sometime next year.

Hey Dave! Thanks for the update. Curious about your thinking related to buying your own warehouse? Are there tax benefits to doing this in Canada like there are in the US? Also, it sounds like you are willing to get back into running your own warehouse instead of a 3PL?

For reference, I’ve run my own 5,000 SF warehouse for my FBA business for the last 5+ years, before just selling the business a couple of months ago. Almost every prospective buyer (especially aggregators) seemed to prefer a 3PL though it didn’t seem to impact valuation much, just their interest – the idea being that is more work on the integration side.

Yep, that’s one of the issues with moving into a warehouse – it’s definitely an issue if I ever decide to sell and a lot of the time moving everything to a 3PL will be a contingency on the sale. We’re getting into a soft economy – bad for selling a business, good for buying commercial real estate, so that’s my thought process a bit. It’s definitely expensive here. I rounded the numbers a bit, so it’s not quite $500 SF but it’s close.

Also, $1mm for 2,000 SF of warehouse sounds crazy expensive? That’s $500 PSF. Even when I account for CAD to USD. I’m in suburban Charlotte, NC and its more like $100 to $120 per SF.