Amazon seems to be making steps to finally enforcing a long-standing requirement for sellers to hold product liability insurance.

Sellers awoke Tuesday to find a lengthy email from Amazon's Vice President of its Trust and Fraud Department appearing to make an announcement about a revision of Amazon's A to Z Guarantee program. In reality, the real takeaway from the email was an announcement regarding Amazon launching the Insurance Accelerator program to help sellers obtain product liability insurance.

What Did Amazon Say?

In the announcement, Amazon said that it will pay for A to Z Guarantee claims seeking compensation for personal injury and/or product damage under $1000 and will not seek compensation from sellers who hold valid insurance.

Amazon also announced that as of September 1, it is changing when a seller needs to obtain product liability insurance from once the seller has reached $10,000 in sales for three consecutive months to once they obtain $10,000 in sales in any month.

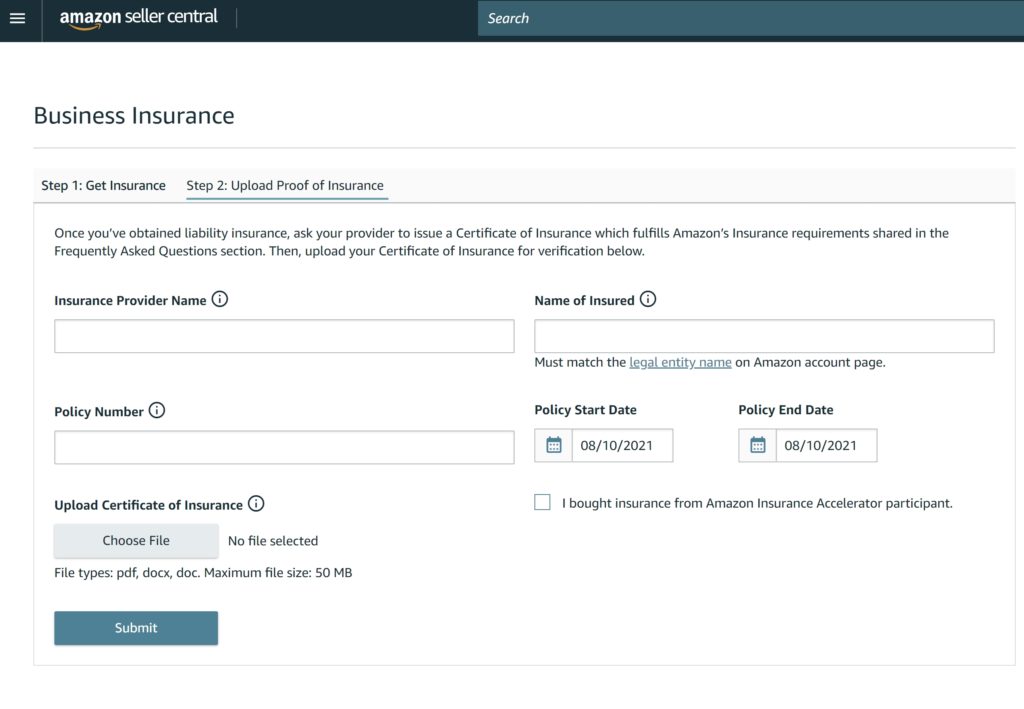

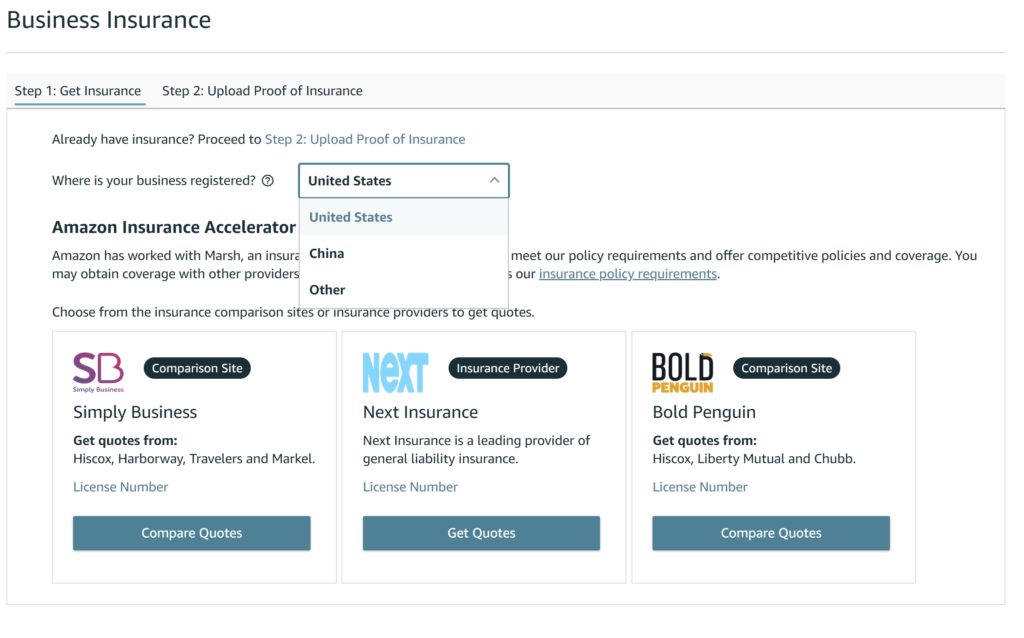

Finally, Amazon also announced the launching of the Insurance Accelerator program. Similar to IP Accelerator that helps sellers obtain a trademark, the Insurance Accelerator is a marketplace of Amazon-vetted insurance providers.

Amazon Has Previously Required Product Liability Insurance But Rarely Enforced It

Amazon has required sellers to hold product liability insurance for many years now once their sales reached $10,000 per month for three consecutive months, so the announcement is not a significant revision of the long-standing requirement for sellers to hold insurance. However, it has been a widely known secret that Amazon has very rarely enforced this insurance requirement for sellers.

Will Amazon Start to Enforce the Insurance Requirement?

As mentioned, there is no significant change to the Business Solutions Agreement, i.e., TOS, requiring sellers to obtain insurance. It has been a requirement for many years. The question is if Amazon will now be starting to enforce this requirement.

Amazon made no mention of enforcing the product liability requirement for sellers. Instead, at this time, their tact appears to be to incentivize sellers to voluntarily obtain insurance in order to obtain A to Z Guarantee seller benefits (specifically, Amazon paying personal injury/property damage claims up to $1000).

What Will Happen if Sellers Don't Have Product Liability Insurance by September 1, 2021?

Once again, Amazon made no mention of enforcement regarding the long-standing product liability insurance requirement.

It would appear as though there will be no widespread action taken against sellers who do not hold product liability insurance come September 1, 2021 (when the threshold for when sellers are required to obtain product liability insurance changes). Given the fact that a very large percentage of sellers who require product liability insurance likely does not currently have insurance, it would seem unlikely Amazon will be enforcing the insurance requirement immediately to avoid disruption to the Amazon marketplace. However, this may be the first step towards Amazon enforcing the insurance requirement at a future date.

Why Is Amazon Doing This Now?

Amazon has come under increased scrutiny from courts regarding whether it can be held liable in product liability lawsuits. Amazon has been named in thousands of product liability lawsuits, but courts have historically ruled that Amazon is not liable for the products sold from its merchants. However, recently, courts have started to declare that Amazon could be liable, specifically in 2020 when the California Court of Appeals stated in Bolger v. Amazon.com that Amazon could be strictly liable for an allegedly defective battery manufactured by a third party and sold on its website.

What Is the Insurance Accelerator Program?

The Insurance Accelerator Program is a program similar to the IP Accelerator program that provides a marketplace of Amazon-vetted insurance providers that U.S. and Chinese sellers can work with. Currently, there are no insurance providers listed for non-Chinese and non-American sellers.

There is no word yet on how competitive the insurance rates provided by the Insurance Accelerator-approved insurers are.

Conclusion

Many sellers have suspected for some time that Amazon would eventually start to take action towards enforcing its product liability insurance requirement. While the announcement made does not specify Amazon changing its approach to enforcing this policy, it could be the first step towards eventually enforcing this requirement.

Do you currently hold product liability insurance for your company? If so, share with us your experience obtaining insurance in the comments section below.

Great article. Thanks Dave. Do you have any rule of thumb on what is considered as a completive product liability insurance rate?

Generally rates seem to be around 0.0025% to 0.01% of revenue.

Hi Dave,

Thanks for the great article. Do you have any recommendations for insurance providers that would provide product liability insurance for non-US companies selling on Amazon.com? We are a Canadian LLP and we are having huge issue finding an insurance provider willing to cover us.

Give one of the brokers a shout, like Hub insurance.

I am an Amazon seller, having business registered in UK and selling on amazon US and UK. amazon is requiring me to provide liability insurance coverage proof. can i get one for my company ?

Yes, but you’ll need to talk to a U.S. insurance broker/provider.

Sorry, me again.

In the email I received today, it does state this:

“You are required to provide proof of liability insurance, and our records show you have not done so. As of September 1, 2021, Section 9 of the Business Solutions Agreement (https://sellercentral.amazon.com/gp/help/G1791) requires you to obtain and maintain at least $1 million of commercial general, umbrella, or excess liability insurance, within 30 days after exceeding $10,000 in gross proceeds in sales in one month on Amazon.com or if otherwise requested by Amazon.”

Look at the last line of the above statement where it states, “or if otherwise requested by Amazon.”

So, it’s $10,000 per month or if otherwise requested by Amazon?

As small a seller that I am, f they are actually expecting me to lay out more money for insurance, I will have to close my account!!

Great Amazon!!

Yes, there’s a $10,000 threshold. You can contact seller support to confirm.

Yes, Dave thanks for your quick response but my point is, it’s stated “or otherwise requested by Amazon.”

So, Amazon is going to enforce that I buy Liability Insurance even though I never sell anywhere even close to $10,000 a month but maybe just $50 a month??

Thanks again.

Best,

Todd

My understanding is that you’re exempt.

Hi Dave. Great article thanks. We are a UK company finding it hard to get insurance. We have always had liability insurance but we are advised that the policy is not acceptable for Amazon USA. Can you recommend a US insurance company that will insure a UK company for this type of insurance. Thanks

There must be some other issue with your UK insurance. Our Canadian insurance is accepted. Most US providers will only cover US companies.

Hi Dave, thank you for this article. Did you get yours from Hub insurance? I’m having issues finding a reasonably priced policy. I’m a Canadian seller, selling in the US and have contacted numerous insurance companies and brokers. Most of them declined and the lowest one is 6,000$/ year but our company only makes around 10-11,000$/month we just can’t afford that policy.

Any suggestions would be very helpful, thank you.

Marnie