Ecommerce Banking & Finance 101: Getting Cash for Your Company

Ecommerce is a unique business from a finance and banking standpoint. Ecommerce companies have highly irregular cash flows. Often, we're doing business in multiple countries and jurisdictions, and, not to mention, most people just don't understand what exactly ecommerce is—especially bankers!

In this article, I'll walk you through the basic challenges of banking and finance for ecommerce companies and share some tips and strategies for overcoming them.

The Unique Financing Needs of Ecommerce Companies

The financing needs of e-commerce companies is very different compared to other companies. The cash flow cycle for most ecommerce companies looks something like this:

- You have lots of cash in the bank and you're cash rich.

- Then you pay for 3 to 6 months of inventory up-front.

- Suddenly, you're cash broke.

- You wait for the inventory to be delivered (often 60 to 90 days after you've paid for it or at least placed a deposit)

- Your product gains traction and you gradually sell the inventory

- Then you're even richer!

- But then you order even more inventory this time because your product now has traction.

- Now you're even more cash broke.

These cash flow needs of ecommerce companies are very different compared to many other companies. Others have big up-front cash demands for things like equipment and real estate improvements, and it can be years until they're able to repay this money.

Imagine opening a gym. You'll need to spend hundreds of thousands of dollars on gym equipment and building improvements and wait several years to be able to pay back that loan.

With ecommerce companies, it doesn't take us long to get back the money we paid in inventory. The problem is, the second we get that money back, we need to buy more inventory. The risk profiles of an ecommerce company and a gym business are very different.

For example, the gym company has a loan backed by an asset that normally doesn't expire or go bad, and that is normally a one-time expenditure. The ecommerce company has a quicker cash cycle, but the asset securing it is also less liquid and may be subject to expiration and spoilage.

Many ecommerce companies also get to profitability fairly quickly. However, most ecommerce companies also are relatively cash poor until an exit. It's a big reason why many ecommerce owners exit their companies: to tap into the locked in cash in their companies.

Cash is King in Ecommerce

The experienced ecommerce seller knows that cash is king. Being able to build a 7-figure brand is very much dependent to how much cash you have.

I chronicled building a million dollar brand from $0 to $1million in 12 months. As much as I would like to attribute this all to hard work, intelligence, and cunning good looks, the reality is that I had one enormous benefit: I had a recent cash event that gave me a healthy amount of cash to invest into the new brand.

How much money you can make is also directly related to how much cash you have. It's why ROI is such a critical metric in ecommerce. If you only have $10,000 in assets for your ecommerce business, it's going to take much longer for your company to hit 7 figures than if you have $100,000.

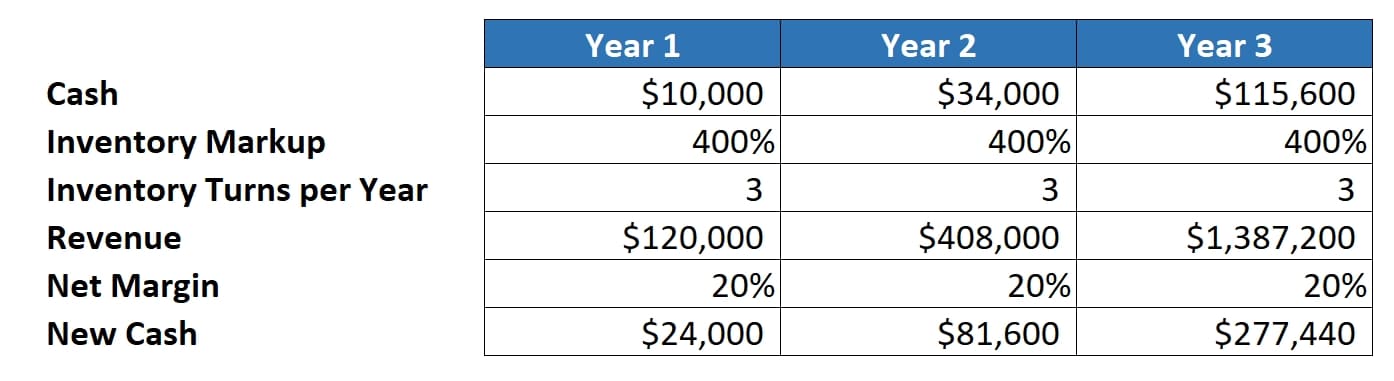

Consider these growth projections for an ecommerce company with $10,000 in cash to start with.

Assuming you turn your inventory three times per year (meaning that it takes you roughly 4 months to sell out of your inventory) and healthy net margins of 20%, you'll break $1million revenue in year 3.

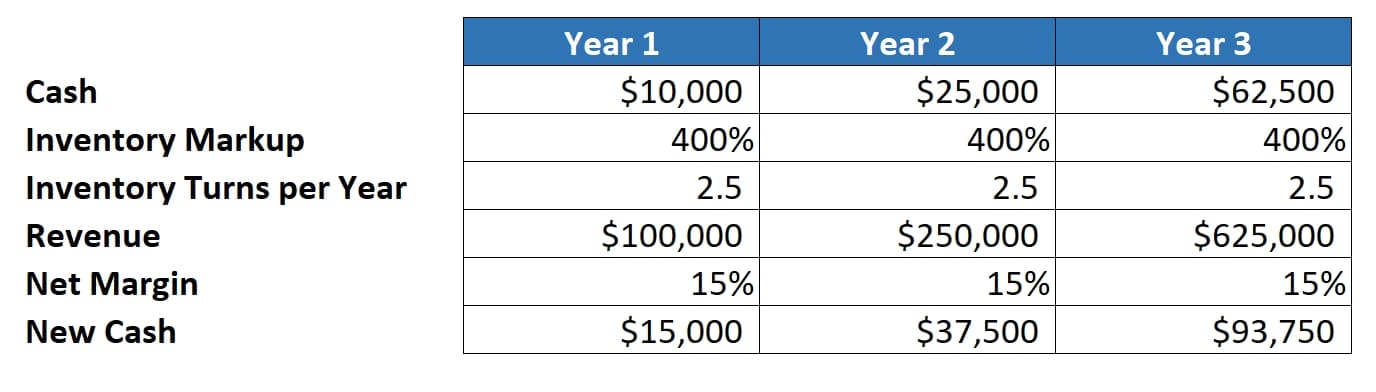

Now imagine a more modest projection of 2.5 turns per year and 15% margins (which is more realistic in my opinion).

With these more modest projections, you'll barely break $600,000 in year 3.

Many ecommerce entrepreneurs I've sat down with are disheartened to learn that their growth is going to be limited not by their effort or their brand's potential but by cash.

There's an easy solution to this glass ceiling though: get more cash.

Where to Get Cash for Your Ecommerce Company

So you know you that you need cash. But where do you get it from? There's basically two types of financing that you can get: financing from banks and financing from non-bank sources. Let's look at the latter first.

Non-Bank Sources of Financing

Outside of banks, there are other financing options at your fingertips such as

- Amazon/PayPal/Shopify Working Capital

- Kabbage

- Crowd-sourced Financing

- Credit cards

Amazon, Shopify, and PayPal all offer some type of working capital financing scheme which offers you a loan as a percentage of your sales. Interest rates for all three of these can be quite high: upwards of 20%. This is FAR higher than almost any bank will offer you.

However, they have one advantage: you essentially get approved with the click of a button because these marketplaces and software can see your exact sales history and, in the case of Amazon, they physically have your collateral (your inventory).

Unfortunately, all three of these companies are restricted largely to America for the time being. Canadians, Europeans, and others are out of luck.

Kabbage, on the other hand, is one of the most popular small business lenders available, and they specialize in giving loans up to $250,000 and, compared to banks, are relatively painless to apply for.

Crowd-sourced financing options are popping up regularly, and one of the more popular ones among ecommerce sellers is KickFurther. Sellers essentially give a short bio of their company and products, request an amount they need financing for, and indicate for how long and how much they're willing to give. Individual investors can then browse profiles and make investments in companies they like.

Finally, credit cards are always an option for raising money, although they often have the highest rates, especially on cash advances (which is essentially what you'll be doing). Fortunately, with ecommerce increasing in popularity, there are a handful of credit cards popping up with more favorable lending terms such as Brex.

Personal Guarantees

No matter where you get your financing from, a personal guarantee is likely going to be part of the deal.

A personal guarantee holds you liable if the company defaults on its debt. In other words, your company going bankrupt won't protect you even if the company is an LLC.

Getting Financing from Your Bank

The first place most people look to get financing is their bank. There's one massive pro and one massive con to bank financing.

The massive pro with bank financing is that lending rates are generally far lower than the other non-bank financing. Currently, I have a $50,000 loan and $100,000 loan both at below a 5% interest rate. Amazon lending can't even come close to this. The major downside, however, is that the amount of bureaucracy and paperwork you need to go through can be horrendous.

If you do go with bank financing, what kind of loan do you need?

The type of loans most ecommerce companies need is called an operating loan or operating line of credit. You’re using the money to buy inventory, pay for shipping, pay for duties and then continuously doing this cycle over and over again. This is in contrast to many businesses where there’s a big capital outlay for a one-time purchase such as some piece of equipment or real estimate improvements.

Many banks are averse to giving operating loans. They want their money secured with some type of equipment or real estate.

However, some banks are very open to it. In both America and Canada, typically smaller banks/credit unions are more amenable to operating lines. Among the big banks, Chase (in America) and RBC (in Canada) tend to be the most flexible.

What's the Difference Between a Loan and Line of Credit?

A loan, also referred to as a term loan, is a fixed amount of lending that typically has a fixed payment (normally monthly) that is paid during the duration of the term. A line of credit (sometimes referred to as an overdraft on your account) on the other hand, can be used as needed and you only pay interest on the amount you have borrowed.

Lines of credit are typically the most ideal for ecommerce entrepreneurs, but the limits also tend to be much lower than a term loan.

Can I Get Lending if I Don't Have Any Assets?

One of the terrible catch-22s about getting lending is that often, lenders, especially banks, want to lend you money against your assets, i.e., either cash you have in the bank or a home. If you have $0 personal equity, getting lending is MUCH more difficult.

If you find yourself in this boat, then you will likely need to look outside of banks for money and turn to non-bank financing.

How to Get Bank Financing for Your Ecommerce Company

Financing from banks for ecommerce can be tricky because normally, the money is being used to finance inventory. Inventory is a highly variable asset. Your inventory level goes up and down and it can also be perishable. Compared to a fixed asset such as a piece of real estate or heavy machinery, its value over time is much less certain.

Aside from the variability of your inventory value, there is also the issue that you're paying for inventory often 30 to 60 days before you receive the goods—also referred to as Work in Progress (WIP).

Banks don't like this as it adds a considerable risk factor. This is an instance where it's possible to inquire about getting a Letter of Credit (not to be confused with a line of credit). A letter of credit essentially is a guarantee from your bank to your supplier that the payment will be released when certain deliverables are met (generally some type of shipping documentation such as a BOL). Letters of Credit are often only used in much higher transaction amounts ($50,000+).

Assuming you don't want a single-transaction letter of credit, the other option is to get a line of credit. Ideally, you simply secure the line of credit against an asset you already have, i.e., a piece of real estate or a deposit in the bank. If you don't have this, you can pursue having your inventory be your asset that the loan is secured against.

However, not all banks have an appetite for this. It's better to look at the Small Business Administration backed loans in America or Export Development Canada (EDC) backed loans in Canada.

Raising Money through Angels and VCs

The final option of raising capital is by raising money through angels and venture capitalists.

Angel investors are individuals using their own money to invest in companies while venture capitalists (VCs) are a fund of pooled money from many investors. When I was younger, I used to think angel investors were called angels because they gave money to businesses out of the goodness of their hearts, not because they expected any equity in return.

Wrong! Both VCs and angels will want a share of your company and their demands probably will not different significantly.

This is a broad simplification, but the biggest difference between VCs and angels is likely going to be their expected return. An angel investor may be happy getting a 200% or 300% return on their money.

A venture capitalist, on the other hand, is typically looking to make many investments with the expectation that the vast majority of them will fail and one or two will give a massive return on their investment (i.e., 100x).

Raising money from angels or VCs is a topic too vast to cover here. However, the interest in D2C (direct to consumer) brands from VCs and angels is huge right now.

The “everything or broke” risk profile you accept from raising money may be much different compared to what you're comfortable with, so be aware of the price you're paying by accepting outside funding.

Conclusion

There's no quicker way to hit a ceiling in your ecommerce company's growth than having limited cash flow.

Cash will dictate the success of your company. You can have the hottest widget known to man with thirteen patents, but if you don't have the cash to finance it, your growth will be severely limited.

Have you gotten financing from any other sources not discussed in this article? Let me know below.

Thanks Dave, good article.

The main thing is to have a demand for your product.

Dave, good article. As an FYI, AccrueMe does not require a personal guaranty. In fact we don’t charge interest, fees or require monthly payments. We are paid when it’s right for the business, not on a predetermined schedule. In return we get a small % of profits which is set-up so the seller always wins. If inventory is stuck on the water and there is no profit, we earn zero too. Here’s a podcast with Mike. Happy to discuss:-). Don

https://www.ecomcrew.com/e384-accrueme/

Thanks for the clarification!