How to Sell on Amazon UK and Amazon Europe

If you’re reading this blog then you know that one of the things we continuously preach is the need for sellers to start selling internationally as soon as possible. Yes, there’s still a lot of fruit on the Amazon.com tree but it’s being picked by more and more people. But there’s other trees, if you look just a little further on the horizon, specifically Canada and Europe.

In this article we’ll discuss how to start selling on Amazon.co.uk and Europe. In my experience, Canada is the easier international market to conquer, and you may also be interested in our companion article, How to Sell on Amazon.ca. However, the UK and Europe are the much bigger markets with the greatest potential. This article will give you all of the information you need to get started.

Sell in the UK First and Then Worry About the Rest of Europe

For years I’ve looked into selling into Europe, however, I always got dismayed when I formed the impression that it was too complex and hard. The truth of the matter is that selling into the UK is pretty simple. Selling into a dozen or so other countries in the EU is hard. There’s a famous Mark Twain quote that goes “The secret of getting ahead is getting started. The secret of getting started is breaking your complex, overwhelming tasks into small manageable tasks, then starting on the first one.” This quote couldn’t be more applicable here – focus on selling in the UK first and then worry about the rest of Europe.

There are some steps for selling in the UK which can be used for the EU, specifically in terms of a VAT number, but these similarities will disappear once Brexit happens (and even before then there are still a lot more steps to selling in the EU than just in the UK). If you focus on selling just in the UK first then the whole process is much less intimidating.

The Opportunity

OK, you know that Europe is huge – 700 million people or nearly twice as much as America. But let’s not fool ourselves – Europe is a continent, not a country. Despite the European Union, Europe is a fragmented continent and there’s not really 700 million potential customers. On top of this, Amazon North America did about $80 billion in sales in 2016 (and it’s safe to say the vast majority of this is in the USA). Amazon Europe did abut $20 billion. So Europe in total is about 25% the size of North America.

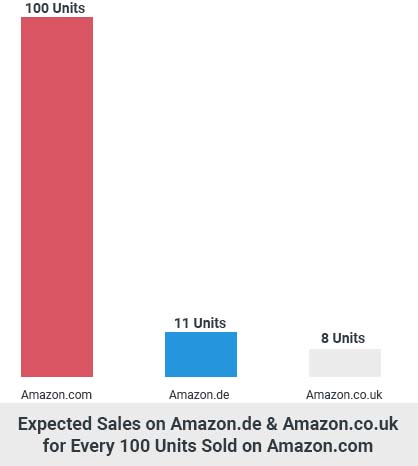

On top of this, of all of Amazon’s traffic in Europe, 42% come from Germany, 31% from the UK and the rest is spread across Western Europe. Really, Europe right now consists basically of Amazon.co.uk and Amazon.de.

So if you do some simple math, if you sell 100 widgets on Amazon.com (ignoring Canada and Mexico for simplicity) you can expect to sell about 8 on Amazon.co.uk and 11 on Amazon.de. We’re using a lot of estimates to derive this number but it’s pretty consistent with my anecdotal evidence. The competition is less fierce in Europe for the most part, so you can probably expect your sales to be slightly higher than this.

So Should You Sell on Amazon.co.uk?

So we know that Amazon.co.uk will give you an 8% boost to your sales roughly and Amazon.de would give an 11% boost. Is this worth it? If these were just other sales channels, like an eBay, with no real additional costs then the answer would be an easy yes. But it's not that simple.

The real main problem with selling into Europe, aside from the cost of VAT registration and administration (spoiler alert: this is about £500 to register and £250/year in administration thereafter) the big cost is shipping your inventory to the UK. And to be exact, the cost of shipping isn't the real issue as shipping to London or Los Angeles is roughly the same. The problem is your inventory will turn about 10x slower in the UK than in America and therefore you have to ship less or store more, neither of which are ideal situations.

Let's take a simplistic example. You ship three months of goods in a 20′ container to the US. We know your sales in the UK will be about 8% of the U.S. This means you either a) ship a 20′ container of goods to the UK and store 37.5 months worth of inventory there or b) ship 8% of a container (2.16 CBM of LCL Freight) to the UK. Can you still be profitable with a shipment that is only 8% of your average size or will the cost of shipping kill your margins? Are you comfortable storing inventory for longer?

There's a few no brainer situations to get into the UK:

- You have ridiculously high profit margins and you can absorb higher shipping/storage costs

- Your inventory turnover time is weeks, not months

If you are buying widgets for $1 and selling them for $100 you can probably afford to pay a bit extra in shipping and still make a killing. Most of my businesses make around 10-20% net profit so the equation isn't nearly that black and white for me (and it probably isn't for most people). The other situation is when you turn over your inventory so quickly that you're comfortable storing inventory for a longer duration of time. For example, I know some people who sell an entire container of the same widget every 2 weeks. For these people, storing goods for 25 weeks instead of 2 weeks doesn't ruin their cash flow.

Getting Started in Europe vs Getting Started in America

I was intimidated by selling in Europe for the longest time but it’s not that hard. The problem is that compared to selling in the US, anything that requires more than 5 lines of information (which is what it takes to sell on Amazon.com) is hard.

Let’s summarize what you need to sell with Amazon.com FBA compared with Europe:

| Amazon.com FBA (USA) | Amazon.co.uk/.de/etc. (Europe) | |

| Business Registration Requirements | No business registration needed | UK none needed, rest of Europe requires one “Fiscal representation” |

| Sales Tax Registration Requirements | Sales tax registration is voluntary until someone finds out | Required in at least one EU country and required before even opening a Seller Central account in Europe |

| Shipping into FBA Warehouses from Outside of EU (i.e. from China) | Ship into FBA without any duties/tax as long as it is under $800 | (VAT) and duties have to be collected on essentially anything entering the EU |

With Amazon.com anyone can open up an account without any tax or business registration numbers. This is due in large part to the fact that the US has no federal sales tax or VAT. Further, anyone can ship goods into America without having to make so much as a formal customs declaration (no duties!) as long as those goods are declared at $800 or under (and of course, no seller would ever under declare their goods).

To sell on Amazon.co.uk you need to follow these steps:

- Register for VAT in the UK

- Get an Economic Operator Registration and Identification (EORI)

- Ship your stuff into the UK

- Remit VAT quarterly

The hardest part in this entire step is registering for VAT (and you cannot even open a Seller Central account before you have this) and that really isn't that hard (it's a monetary cost more than a huge time cost). But compared to selling on Amazon.com it can seem hard.

How Amazon European Fulfillment Works

If you use Amazon.com FBA you know that you can chose between inventory placement, where you ship all your goods into one place (but pay extra for it) or distributed inventory where you ship to multiple warehouses across the U.S. Europe is kind of similar. You have a few different options to fulfill your inventory:

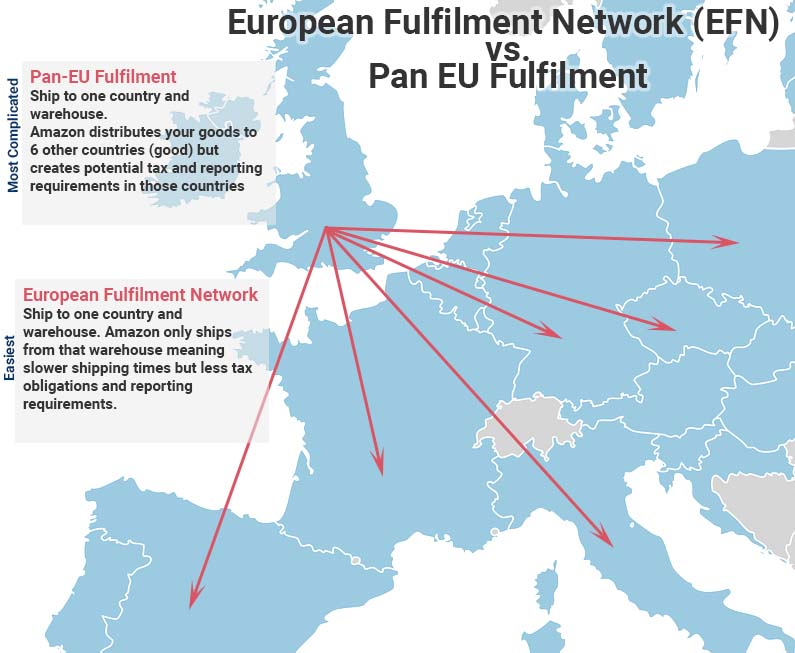

European Fulfilment Network (EFN): Ship to a single warehouse. Amazon will ship all goods from that warehouse to other countries (i.e. if you store your goods in the UK, they will ship from the UK to orders from the UK as well as to Germany, France, etc.)

Pan-European FBA: Ship to a single Amazon warehouse. Amazon will then distribute your goods across Europe as they please.

Multi Country Inventory (MCI): Choose where to store goods in multiple warehouses around the EU.

Central European FBA: German marketplace + stock stored in Poland and Czech Republic.

OK so let’s cut to the chase and lets also forget Brexit for the time being (this won’t impact things for at least a couple of years. The easiest and most simple way to get started is to ship your goods into the UK using European Fulfillment Network (EFN). Your goods will automatically be available for UK customers and you can still ship to other European customers from your UK warehouse, albeit at slower speeds, and with a 35,000 Euro limit to each other country, more or less. I won't go into the the full details of what is termed Distant Selling VAT Thresholds, but it means that you can ship a certain amount of products (averaging about 35,000 Euros but it varies per country – see here) from one country in the EU to another country into the EU without having to register for VAT in that country. If you're familiar with sales tax nexus in the U.S., this is very different as it does not matter if you have any permanent establishment or if you warehouse goods in that EU country or not, you still need to collect VAT if you ship more than those thresholds into those countries.

Pan-European FBA sounds great but it is going to require 7 “Sales Tax Registrations” (aka VAT) Registrations and 64 VAT filings per year. Does this sound fun? Didn’t think so. This is a good time to mention that sales tax/VAT in Europe is nothing to joke with. This isn’t like some U.S. Congress that can’t get their act together, with sales tax which no one really knows how to handle. The authorities in Europe are on top of this and I have at least one friend who was sent a bill for over $100,000 from Europe for uncollected VAT. More on this later though.

How to Register for VAT in the UK

The easiest way is to use a VAT service. Almost everyone I know has done this (it costs about $700 to register, more on this later). I won’t go into detail about how to self register but apparently somehow you can do it through the HMRC website (the UK government authority responsible for taxation).

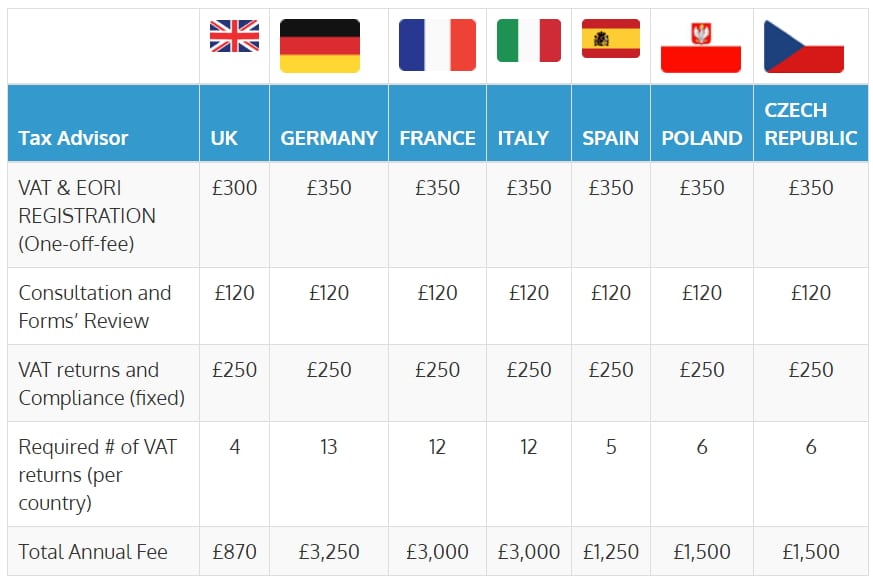

There are two main services which most people seem to use: www.avaskaccounting.com and www.simplyvat.com. Here’s a price list from Avask Accounting.

These fees are in line with what SimplyVAT charges. In summary, you’re looking at about £550 to register for VAT (or about $750US) and about £250 in annual fees later (about $350US).Amazon has periodically been offering partnerships through large accounting firms like KPMG for around the same price. I’ve never used them myself but my feeling is that you will be gauged long term for in filing fees and be given minimal one on one advice.

The paperwork is fairly mundane and getting your VAT number takes about 4-6 weeks on average.

The paperwork for filing for VAT is extremely minimal, especially when compared to many state regimens in the U.S.. You essentially report what your gross sales were, how much VAT is due on those sales (which should be a very simple calculation) and also how much VAT you paid on purchases. So if you imported £10,000 worth of widgets, you would have paid £2000 in VAT at the time of import. If you sold those widgets for £25,000 you will owe £5000 in VAT. This means that you will ultimately owe £3000 to the UK government in VAT. If you paid VAT on any other services along the way, which you almost certainly did for things such as for shipping and warehousing, you can claim that back here too.

Economic Operator Registration and Identification

There’s a second thing you need in order to sell into the UK and that’s what they call an Economic Operator Registration and Identification number (EORI). If you’re familiar with importing into the US then this is similar to being an Importer of Record. This number is very easy to get and you can technically apply for it yourself (https://www.gov.uk/eori). However, most VAT services will register this for you.

Do I Really Need to Register for VAT? I See Mixed Information (Yes You Do Need to Register)

If you have researched VAT numbers et al for selling in the UK, you have probably read a bunch about selling thresholds, distance selling rules, and other confusing verbiage. If you are an American company, Canadian company, or any other non European company, these don’t apply to you. You need to register for VAT.

VAT in Europe and How It’s Different from Sales Tax

VAT seems to be a really confusing idea to Americans and even us Canadians who have a sales tax system that has components of VAT. There’s a few main differences between VAT and your traditional USA sales tax. Here they are:

- VAT is collected at every transaction and you can claim that back. For example, if you pay $100 in shipping, there is $20 in VAT incorporated into that which you can claim back.

- VAT is incorporated into the item price, not as a separate line item (so make sure you adjust your prices accordingly!)

When you import your goods into the UK you are going to pay VAT (which is 20% for almost all items) at that time of import. For example, if you import £1000 worth of goods you will pay £200 in VAT. If you then sell those goods for £2000 you will have to remit £400 in VAT for those sales. BUT you can claim a deduction of that £200 you paid on import. You can also claim a refund on any other things you are charged VAT on along the way.

Seller Beware – Make Sure VAT Is Calculated On Your Margins

Sellers need to be really careful to make sure they calculate the correct margins on their products. For example, let's say you sell a product for £20 which costs you £13. You would actually lose money on this transaction because of VAT.

Sale Price: £20

Cost of Goods: £13

Amazon Fees (estimated): £4

VAT @ 20% of Sale Price: £4

Profit: – £1

Remember, that VAT is blended into your item price. If you forget to incorporate it into your prices you could sell your items at a big loss. Make sure you take this into account.

How to Ship from China to the UK

This will be one of your biggest challenges if you're planning to sell on Amazon.co.uk. As I mentioned earlier, you face the dilemma of shipping either too much product to the UK (and tying up your cash) or shipping a smaller amount (and paying more for shipping).

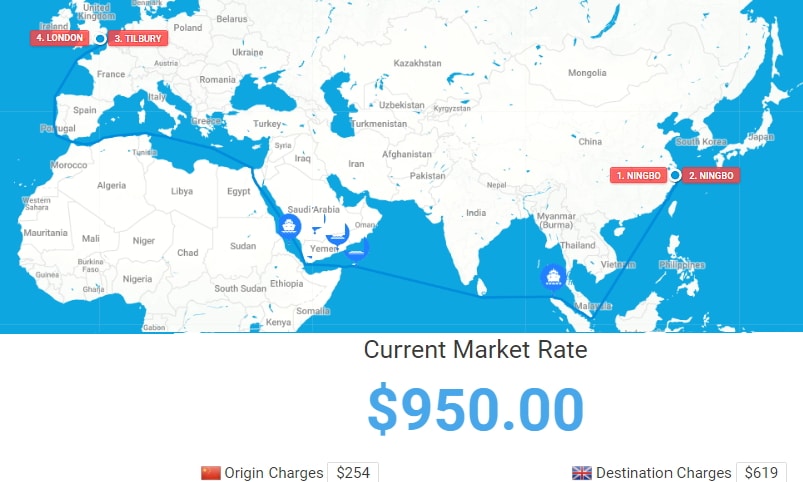

The good news is that sea shipping to the UK is actually cheaper in most cases than to the U.S. By using one of my favorite websites, Sea Rates, we can see that the current market price to ship a 20′ container from Ningbo, China to Tilbury, UK is about $950US. The same container to Los Angeles is closer to $1450. The shipping time to the UK is about twice as long (28 days) as it is to Los Angeles so be aware of this.

If you can ship a full container into the UK and have your turnover time be 3-6 months you're probably sitting pretty (meaning that same container would only take 1.5-3weeks to sell in the U.S.!) as your shipping costs will be lower than to the U.S. The same principles I discuss in How to Ship from China to Amazon.com apply here, specifically about when to use a middle man or not. In the UK there are no shortage of great middle men and freight forwarders, as like the U.S. and Canada. I've heard great things about Regional Express who can help arrange shipments from China to Amazon warehouses and do all of your FBA prep.

The biggest challenge will come from people who are shipping from China to the U.S. and taking advantage of the highly advantageous $800 de minimis and similarly advantageous $2500 threshold for no formal customs entry. Such generosity does not exist in the UK as the de minimis threshold in the UK is only £15. This means essentially every shipment into the UK will need formal customs brokerage, to pay duties, and to pay VAT. If your margins can support this then great. If they can't then you may be stuck being a U.S. only seller.

Conclusion

This guide should give you solid fundamentals for starting selling on Amazon.co.uk and, down the road, the rest of Europe.

Are you interested in selling in the UK or the rest of Europe but still have questions? Post them in the comments below. If you're an experienced European seller and have anything to add then please share them as well.

Great article Dave! I was looking for this info everywhere! This is by far the best explanation!

Thanks Anthony!

This is super helpful, you’re awesome for putting this together.

Thanks Kevin.

Dave you are missing one part that is highly debatable. If you have to register with UK Companies House as it is still debatable whether or not you are considered to have a PE in UK by selling FBA. If you are, you must register and pay corporate tax

Hi Mike – thanks for offering this other consideration.

Many thanks Dave and Mike, great and very helpful article.

Glad it helped Al :)

Really good article. I wonder what has changed since Brexit since I’m guessing this line no longer applies!

“…OK so let’s cut to the chase and lets also forget Brexit for the time being (this won’t impact things for at least a couple of years)”