How to Rank Items & Keywords Well on Amazon: Statistics & Analysis

We all have our opinion of what works well for ranking when selling on Amazon and what doesn't. Rarely though has anyone tried to take an objective statistical approach to it.

In this article, I reviewed over 1000 listings on Amazon to try to determine some common characteristics that high ranking and low ranking items have. What are the factors you can address to have your product keywords rank well?

I looked at the easiest to measure (and control) variables of pricing, titles, and reviews to determine the best way to optimize listings on Amazon according to these factors.

Related Reading: Advanced Amazon A9 SEO Tactics & Strategies

How I Gathered the Data

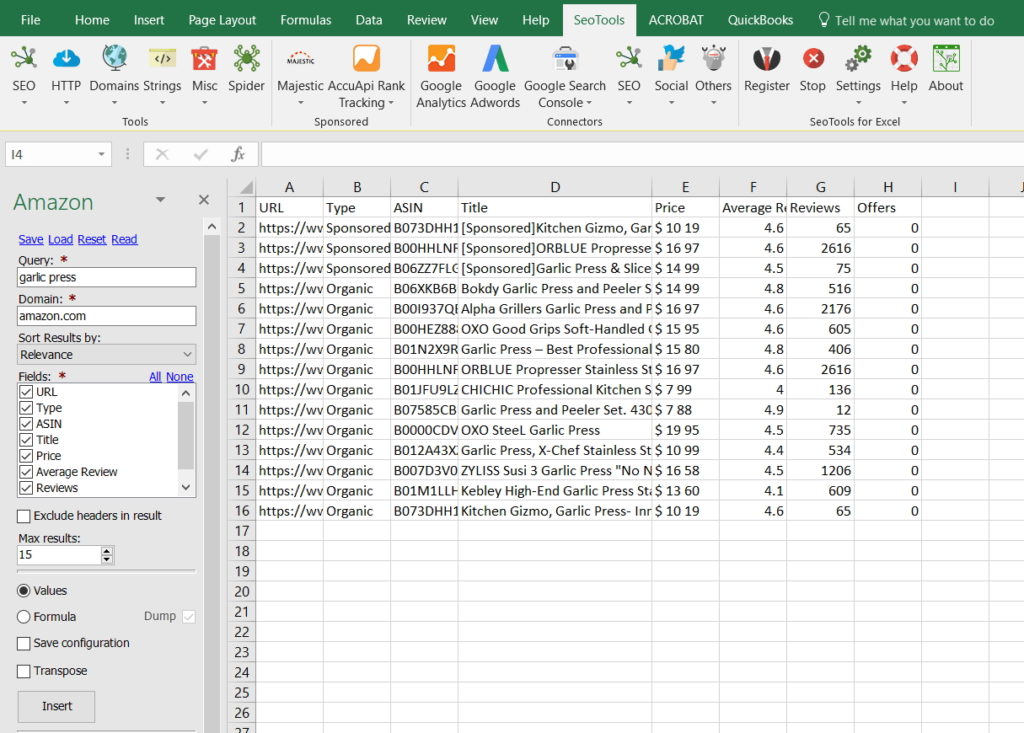

I used the incredibly useful SEO Tools for Excel. If you've never used SEO Tools before and you care anything about search engine optimization then you've been missing out. SEO Tools allows you to use Microsoft Excel to scrape data from a huge number of websites including Amazon. The Amazon extension is paid but you can get a free trial (no credit card required).

I looked at the top 100 listings for 15 different product keyphrases (see the searches I used below). I tried to pick keyword phrases where I thought there was clear user intent (i.e. not exploratory searchers). There's bound to be some bias in the keyword phrases I picked (opposed to something more random) but it should have a negligible effect on the results.

How Amazon Displays Search Results

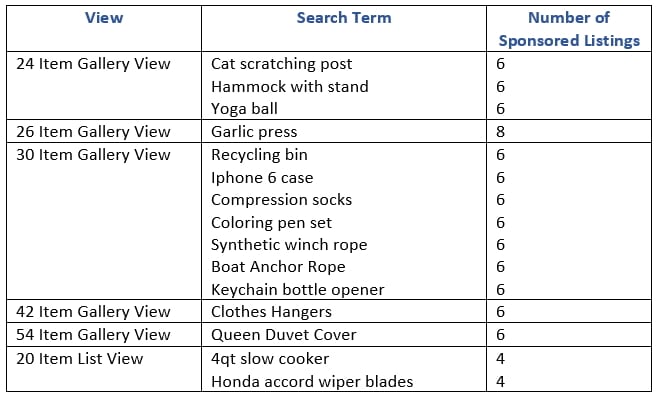

The first thing to understand is that Amazon displays search results in a lot of different ways that are dictated largely by search term, product, and category. There were 6 total views returned for my sample set of items and there are actually more views available on Amazon desktop than this (and way more if you consider mobile and resolutions). Amazon is not like Google where a first page ranking always means the same. Sometimes a first page ranking can mean being in the top 24 and sometimes it can mean being in the top 54. If you're targeting a keyword, determine what search results view is being used for your keyword/phrase.

Our 15 products were displayed as seen below. The 30 item gallery view was the most popular, being displayed nearly 50% of the time.

What search results view is returned can also reveal a lot about product competition. Why would Amazon display more results on some pages and less on the others? We can rationally surmise the following: items that show more results require more selection for consumers to make a buying decision; items that show less results require less selection.

Pricing

We all know that price is a very important buying decision for people, but just how important is it?

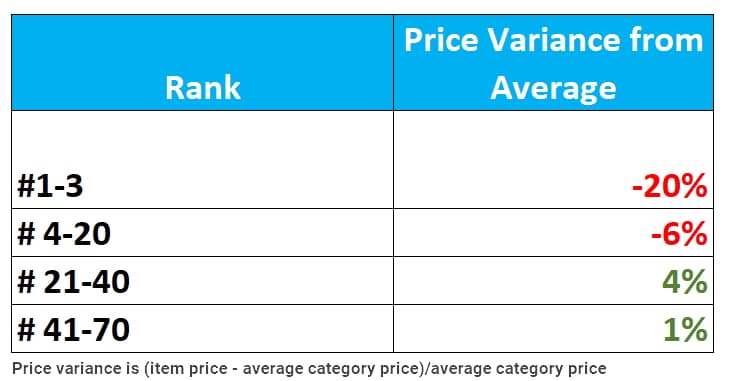

I looked at the average of the prices of the top 75 items for a search term and compared the prices of the top three listings to this average. Overall, the top 3 listings had prices 20% lower than the overall average of the top 75 products.

Listings #4-20 were still lower than average but just 6% lower. Listings higher than #20 were 1-4% more expensive than the average. There were many instances when the top ranked items were more expensive (for example, the top two rankings for clothes hangers were 2% more expensive than the average) but the overall trend is clear: lower prices mean higher rankings.

What this means for sellers: We all know how important pricing is on Amazon but this data shows how important it is. Unless you have an extremely differentiated product, if you want to rank high you most likely need to have a significantly below average price.

Titles

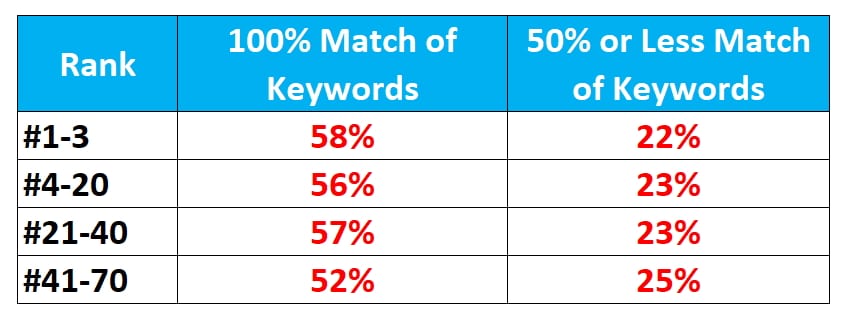

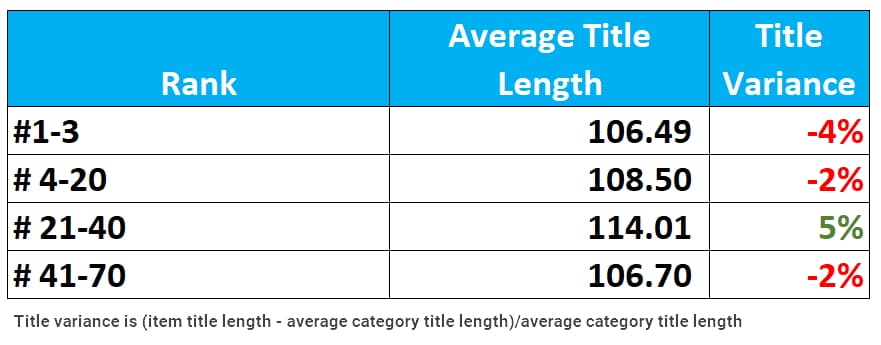

I also looked at the number of keywords that were in an item's title. My question was: does having all the keywords in a title make it more likely to rank in a top 3 listing?

We can see from the search results that there is almost no variation between the top rankings and the lower rankings.

Well, we can see from the statistics, that the top 3 results had all of the search terms in the title 58% of the time. 22% of the time they had half or less of the search terms. You can make your own judgments, but to me, if the titles were absolutely critical, I would expect to see a greater number than 58% of the listings with all of the keywords in the top 3.

Some categories are more optimized than others (aka they have more keyword stuffers). If we compare items relative to other items in that category, the top 3 ranked items were 4% shorter than the category average.

You can draw your own conclusions from this data. For me though, this tells me one thing: keywords in titles are a very poor ranking factor for Amazon.

What this means for sellers: This finding has one of the most serious implications. Titles should be written for humans, not Amazon, and used for conversion purposes, not ranking purposes. Keyword stuffed titles are not good for consumers and hurt your overall conversion rates and subsequently rankings. As we'll look at below, if you want to keyword stuff, do it in your bullet points.

Reviews

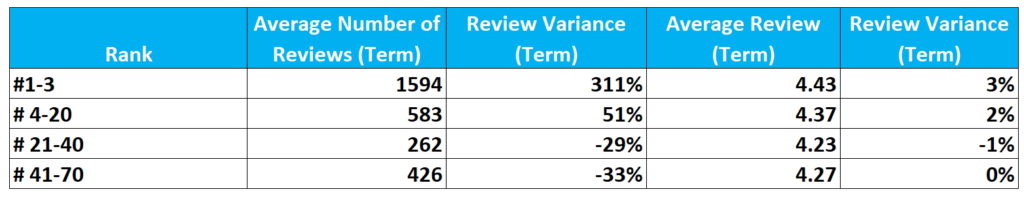

Ah! Everyone's favorite ranking factor: reviews. How do these correlate with search results?

If we look at the data below we can draw some easy conclusions. Again, I looked at the averages related to the search term as review quantity and average varies heavily by the search term/product set.

We can see a couple of things. First, the top rankings have way more reviews than the bottom rankings. However, this is likely simply a self-fulfilling prophecy in some regard: a higher ranking means more sales and more reviews.

What's more interesting is that there is almost no variation between the average review rating of the highest rank items and the lowest rank items. Having good reviews is your ticket to the party but doesn't mean you'll go home with the prince or princess. Without good reviews, it is very difficult to get a good ranking.

What this means for sellers: Quality of reviews is critical to even having a chance to rank. Having reviews that are below average appears to doom a product from ranking. Having good reviews, however, only seems to have a small correlation with ranking well.

Using a Small Sample Set to Reveal Product Opportunities

I wanted to apply some of the above statistics to a really small sample set to see if the trends we identified held true. A small sample set is easier to apply manual analysis to and is also easier to visually identify trends with.

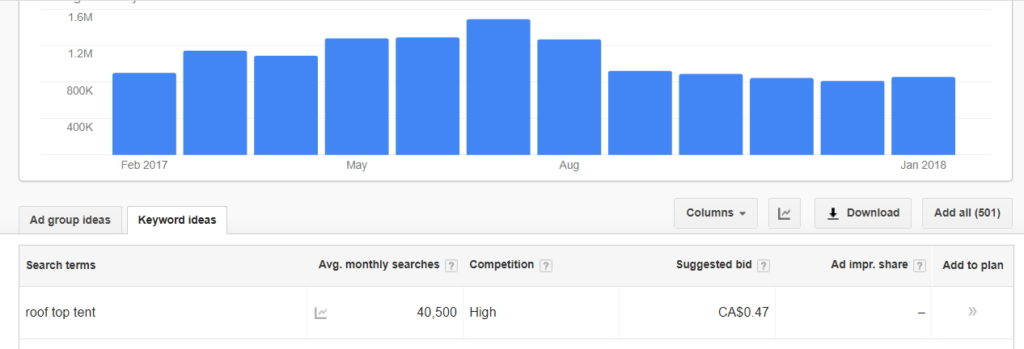

I considered the key phrase rooftop tent. This keyphrase only has 179 results. I went through all 179 listings and I ranked everything on a 1-5 scale of relevance, with 5 being exact matches. There were only 14 exact matches (i.e. there are only 14 rooftop tents on Amazon). I didn't want to consider non-exact product matches because we normally only ever compete against highly relevant and comparable products.

Now the question is: What are highly relevant and higher ranked products doing better than highly relevant but lower ranked products? Below are the search results.

This extremely small sample set, while not necessarily as reliable as our larger sample set, shows some interesting trends:

- Items that have good verified reviews almost always rank better than prime enabled listings with no reviews even if they're priced above average. Good reviews trump price and prime.

- All other things equal, though higher ranked items have lower prices

In this limited competition category, it would be very easy to get a top 10 ranking. Start importing a Rooftop Tent, send it to Amazon FBA, price it at around $1000 or lower, and get just a single 5-star review (which of course would be completely authentic and not simply your mom buying the item and leaving a review…).

This example shows the amount of opportunity still available on Amazon. This product is not some infinitely small demand item either. It has over 30,000 monthly searches for rooftop tent on Google.

Limitations and Future Analysis

The research here is far from perfect. The most serious limitation is that it only looks at search result data and not product listing data. Ideally it would also have analyzed bullet points, product descriptions, and media. Unfortunately scraping product listing data from Amazon is much more difficult than scraping search data.

Above all, this data ignores product specific variables. Product brand is an important variable for many products and next to impossible to measure. The Amazon ranking unicorn that is product velocity is also not taken into account.

Summary: How to Rank Well on Amazon

In summary we can conclude a few things:

- The top 3 products for search terms are generally 20% lower than other products for that search term. Products generally get more expensive the worse they rank.

- Keywords in titles do not appear to correlate heavily with ranking which is some indication that titles should be used for conversion purposes and not for ranking.

- There is almost no variation between the average review rating for higher ranked items and lower ranked items. Having good reviews is critical for getting a ranking, but not necessarily guarantee a good ranking.

Through all of this, there's one very important factor we haven't addressed: buying behavior. Whether you call it buying behavior, sales velocity, sales, or conversions, what product people ultimately buy the most is what is going to rank the best on Amazon (they are ultimately a retail store after all). We've all seen a product with bad reviews, terrible photographs, and non-existent descriptions ranking well for one reason: they're selling lots.

If I had to summarize the most important ranking factors on Amazon it would be as follows:

None of this is likely to be ground breaking news for experienced sellers but it does reinforce suspicions and also adds context and depth to our hunches.

Conclusion

Do you agree with the findings here? Do they support your experiences selling on Amazon or have your experiences differed significantly? In your opinion, outside of price, titles, and reviews, what are the most important ranking factors on Amazon? Share your thoughts below.

While touched on, I think conversion from search is the key. When people search for a keyword and then buy something that drives ranking more than any other variable.

I would go so far as to say everything else just supports that.

For high competition keywords I’d agree that is definitely the case, especially for the top rankings. Ultimately buying behavior trumps all.

Dave, great analysis! Very useful. Interesting results too, especially around keywords and descriptions.

How would see a 1- star review on an otherwise great listing ( i.e. a bunch of 5 stars) affect ranking?

I’ve relaunched an ASIN I had some QC issues with in the last couple of weeks and sales dropped off a cliff. I don’t know whether there’s been any algo changes of late but it’s keeping me up nights!

From an algorithm standpoint, I don’t think one one star review will affect your rankings if it is does not affect your average review in any significant way. If this one star review is hyper critical it could affect things from a conversion stand point (which would then hurt your rankings).

Yes, tend to agree. Conversions were reasonable even with that pesky 1 star, then come March 8 …zilch.

Do you guys have first aid kits?! :-)

Lol, not yet but that’s a great idea!