Using Amazon FBA for Your Imported Products

Amazon FBA has become a critical part of many importers and private labelers. In this article I'll discuss the pros and cons of Amazon FBA, the real costs associated with using it, and how to have your Chinese Suppliers prepare your products for FBA.

There’s a good chance you’re already aware of what exactly Amazon FBA is, but for those who aren’t familiar, here is a quick overview. Amazon FBA is a third party fulfillment service provided by Amazon that allows you to send your products to Amazon warehouses and have Amazon ship the products to your customers for you. The main advantage, aside from the fact Amazon handles all aspects of shipping your packages, is that they also give you deeply discounted shipping rates and give FBA products preference in search results compared to non-FBA products. You can ship products that you warehoused at Amazon either for Amazon orders or non-Amazon orders with the latter having a small surcharge attached to such orders. This means that Amazon FBA is a fulfillment solution both for Amazon orders and other sales channels you may use like eBay and your own website.

Pros and Cons to Using Amazon FBA

Pros:

- Amazon Handles all of Your Fulfillment

- Deeply discounted shipping rates

- Boost in Amazon search rankings & higher conversions

Cons:

- You have to pay for your products to be shipped to Amazon

- You have to pay for Amazon storage fees

- You create sales tax liability in 13+ states

Pro: Amazon Handles All of Your Fulfillment

This doesn’t require a lot of elaboration. If you elect to use Amazon FBA they will handle all aspects of shipping your products. If you sell an item on Amazon, you literally have to do nothing except read the “Amazon.com has shipped the item you sold” email. If you sell an item on another channel, you simply have to fill in a small form to have your item shipped.

Pro: Deeply Discounted Shipping Rates

This is arguably the best part about Amazon FBA: the deeply discounted shipping rates they offer. As of this writing (2015) Amazon charges, for sales through Amazon.com, $1.00 per order + $1.04 Pick and Pack Fee + $0.63/pound. This means to ship a 3 pound package you will pay $3.93. This is a hard price to match anywhere else. Even better, Amazon’s express shipping rates are absolutely phenomenal, with the price for 2-Day shipping being just 10 cents more per pound.

Boost in Amazon Rankings

If your item is fulfilled by Amazon, you will see your items rank higher and your customers are more likely to purchase your item due to the added trust customers feel of having Amazon handle fulfillment. Most users of FBA report that their sales on Amazon increase by 200-300% when an item is converted to FBA (yes 300%!).

Con: You Have to Pay To Ship Your Items to Amazon

Unfortunately, with Amazon FBA you have to pay to have your items shipped to an Amazon Fulfillment center. These are sprinkled throughout the United States and you cannot choose which warehouse to send them to. Fortunately, Amazon gives you deeply discounted shipping rates via UPS to ship your products, so the shipping rates work out to be a fraction of the cost that they would have been without Amazon’s deeply discounted rates. More on the actual costs below.

Con: You Have to Pay to Have Amazon Storage Fees

As of 2015, Amazon charges $0.51 per cubic foot per month to store your products. This means an 18”x18”x24” box will cost you about $2.30 per month to have Amazon store it. With slow moving inventory, this can slowly start to add up.

Con: You Create Sales Tax Liability in 13+ States

The issue of sales tax and Amazon FBA is further reaching than this article can cover, but at the heart of the issue is that by using Amazon FBA you potentially create sales tax liability for yourself in each state Amazon has a warehouse in, which currently is more than a dozen states. This means that you technically need to file and remit sales tax in each of those states. The unofficial word is that 95%+ of Amazon FBA sellers do not currently do this and states have not been known to be going after FBA users for sales tax as of now. But it is a very real concern.

How Much Is It to Use Amazon FBA?

The first big consideration with Amazon FBA is how much exactly does it cost?

With Amazon FBA there's three main ways you're going to pay: freight to Amazon Warehouses, Storage Fees, and Fulfillment Fees. I'll break down these fees by pretending that we're selling a 10 pound item. If numbers bore you, feel free to skip over the breakdown here and go directly to the FBA Cost Summary below.

Inbound Freight to Amazon Warehouses

The largest single cost you're going to pay with Amazon FBA is the freight to get it to an Amazon warehouse. Annoyingly Amazon often will separate your shipment into many smaller shipments that you have to send to various states across the United States (unless you choose their inventory placement option which is extra money). So if you're sending 12 items to Amazon they'll request you send 4 to Indiana, 4 to Phoenix, and 4 to Guam (or some other absurd location).

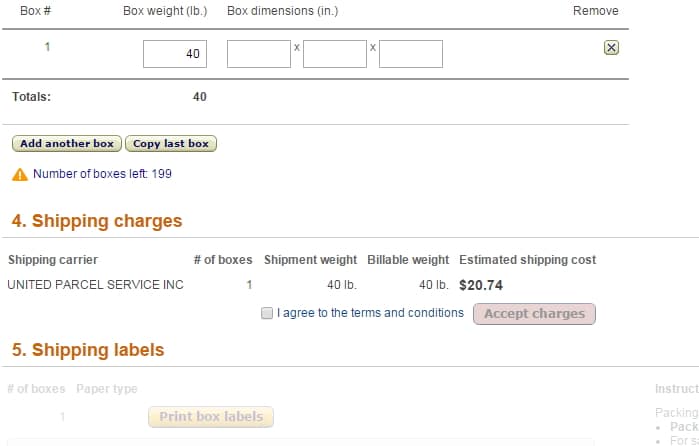

Thankfully, Amazon offers deep discounts with UPS for these smaller shipments. In a mock example I made with Amazon FBA, they charged me $20.04 to ship a 40 lbs box from Seattle to Whitestown Indiana. Assuming each item weighs 10 lbs, this works out to $5.01 per item. In general, you can assume freight to Amazon warehouses is going to cost you around $0.50 per pound.

Storage at Amazon

Storage at Amazon is $0.51 per cubic foot per month in non-peak seasons (i.e. not Christmas). Assuming our little 10 pound package measures 24″x18″x6″ this works to approximately $0.77 per unit per month. This is quite reasonable although you have to be careful not to get stuck with a large amount of slow moving inventory for months on end.

Fulfillment Fees to Your Customer

Amazon charges $1.04 in pick and pack fees and then $0.88 for the firs two pounds and $0.41 for anything above 2 pounds. In other words, our ten pound item is going to cost $6.08 to ship (assuming it is ordered on Amazon).

Amazon FBA Cost Summary

So the total cost for our 10 pound item works out to the following:

Inbound Freight: $5.01

Storage at Amazon: $0.77

Fulfillment Fees; $6.08

——-

Total Cost: $11.86

You will probably have a hard time shipping the a 10 pound item yourself using either UPS, USPS, or FedEx for that cost. So for $11.86 Amazon will ship your product and do all the dirty work. It's a great deal and one of the reasons Amazon FBA is thriving.

The Passive Way to Get Your Goods from China to Amazon FBA Warehouses

Does it sound like a lot of work to first receive your products from China and then break the products down into a lot of smaller shipments to send to various FBA warehouses? If so, it's possible to never actually touch your inventory. Here's how:

Step 1: Have Your Items Bar Coded in China

Whether you're using your own GS1 provided bar codes (you're probably not) or Amazon provided FNSKU bar codes you want to have your items bar coded in China. Almost all Suppliers will be happy to apply bar code stickers to all of your products free of cost.

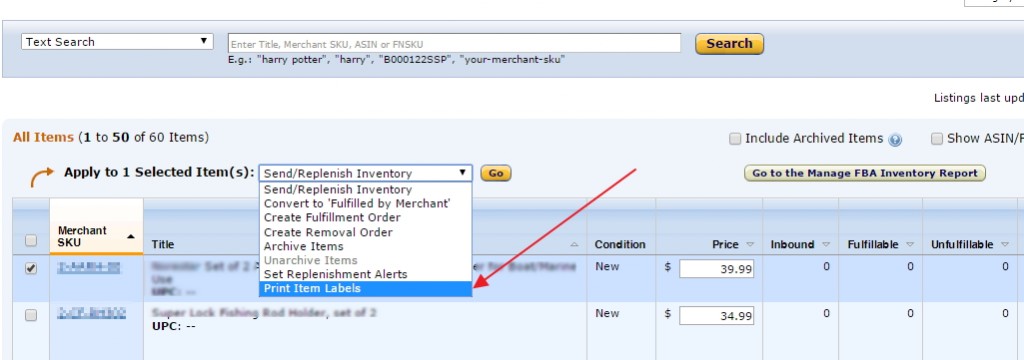

How do you get Amazon bar codes for you product?

- Add your product as a private label product to Amazon which will require an Amazon professional selling account.

- Convert the product to be fulfilled by Amazon.

- Go to Manage FBA Inventory and print a PDF sheet of your bar codes (most Suppliers prefer 30-up, i.e. 30 bar codes on a sheet.

Step 2: Send Your Shipment from China to a Third Party Logistics Company Familiar with Amazon FBA

The next step is to simply send your products to a third party logistics company (sometimes called 3PL or a ‘pick and packer') who can break your shipment down for you into smaller packages and label them as required for FBA (all shipments going to FBA require an Amazon provided carton label on the outside of the box).

Almost every port city and every border city (and any medium-large city for that matter) has countless numbers of these logistics companies who can handle this. FBA Inspection based in California is one such company but again, there's countless of these companies (in the Seattle area alone, there's well over a dozen such companies). Keyword phrases to search for are “third party logistics FBA YOUR-CITY” or “Pick and pack FBA YOUR-CITY”. Just call or email a couple of different companies and make sure they're familiar with FBA. Most should be.

Remember, Amazon is Not the Only Third Party Fulfillment Option

As great as Amazon FBA is, it is not the only third party fulfillment option available. There are thousands of such companies which offer similar services, ranging from huge companies to smaller companies. The biggest advantages other third party fulfillment and logistics companies can offer is more bespoke service. With Amazon, you're just another spoke in the wheel, but with smaller fulfillment companies, they will actually learn about you, your company, and your products. Did you royally screw up a customer's order and want a special hand written note inserted into their package apologizing? Good luck getting someone at Amazon FBA to do this, but a smaller fulfillment company may be happy to oblige. But of course, such companies can't match Amazon's size, scale, efficiency, and/or pricing.

Conclusion

Amazon FBA has been one of the most fundamental changes in ecommerce in the past several years. It offers the every day Joe the opportunity to provide Amazon-level logistics and shipping to his customers. Although there's a ten thousand pound elephant in the room called “sales tax nexus”, local authorities seem to be turning a blind eye to it for the time being.

Have you personally used Amazon FBA for your products? Were there any hidden surprises you encountered along the way? Please share your experiences with Amazon FBA in the comments section below.

This is really interesting and comprehensive David.

This is the most detailed post I’ve read ever since I started hearing about this Amazon FBA stuff and I’m very happy to have discovered your site.

However, I’m assuming that this is not a business for an average guy with a lean budget. I think it’ll cost an arm to start this business because I don’t think its something you can start with a couple hundreds of dollars.

Finally, can you please give me a rough estimate to the minimum investment an average guy is expected to lay down on this starting from manufacturing to shipping? Just assuming you want to test the water first?

Thanks for sharing Dav.

BTW: I enjoyed your post at Niche Pursuit, keep on flying the flag.

Hi Theodore,

A couple hundred dollars may be a stretch (although I’ve known people to import a few hundred dollars worth of small widgets and do OK), but a couple thousand dollars (and even less) is a totally acceptable budget.

One of my first orders was for $350 worth of products, I managed to get the Supplier to pay for the sea freight, I paid $75 to the freight forwarder for admin fees, $50 in dock fees when I picked up my products, and I cleared customs myself and picked up the goods myself at a local warehouse. It was a lot of work doing this all myself, but all in all, it was under $500 and I think I sold those products locally for well over $1000. So definitely you can do it on the cheap if needed.

That’s so cool Dav,

I’m very happy to hear that. That means that if I have like $1000, I should be able to start it?

What are the basic requirements? Or do you have any guide or walkthrough or even a checklist that one can follow?;

I know how important it is to follow someone who has walked the talk before and I’m indeed very glad to have connected with you Dav because, you’re the only person that is really telling me the truth about this business. Thank you

However, what can you charge me so I could stand on your shoulder while doing this things from research to the end?

Please sir, I’m really willing to learn from you.

Thanks a lot for responding to my comment. I’m going to tell everyone about you.

Have a lovely weekend sir

Hi Theodore,

Yes, $1000 can get you a small shipment of lower priced items from China. Some Suppliers might reject a smaller shipment like this but you’ll find one if you contact a half dozen or so I’m sure :)

The eBook available here has a really good walk through and that’s a good starting point.

As for consulting, I’m not in that business just yet but there are sourcing agents out there who will be happy to give you more hands on advice like this.

Hi Dave,

My name is Nick. My business parter/friend and I just ordered our first overseas shipment from India. We just had a few questions regarding the delivery of the shipment.

1. Do we absolutely need a freight forwarder? How will we be contacted about where to pick up the shipment if we do not?

2. Our shipment is arriving in Oakland, CA. The port of discharge is in New York. How does it get to the final destination? Is anything required on our part after the shipment arrives at the port of discharge?

3. What documents are required to claim the shipment from the warehouse?

Thank you for taking the time to answer these questions. I am sure you a very busy and your time is much appreciated!

Hi Nick,

1. Who arranged shipping? The Supplier? If so, the Supplier has a freight forwarder, and their agent in your country will contact you at some point (look for the phone call!). That agent could just be one person working from a home office in Oakland or New York.

2. It’s like being moved via rail to New York. You shouldn’t have to do anything extra. You can confirm with the Freight Forwarder though.

3. The shipment will need to be released to you, so your Supplier can either send you a copy of the Original Bill of Lading which you need to give to the Freight Forwarder, or you can ask the Supplier to Telex Release the shipment to you (the much easier option- the Supplier simply says to the Freight Forwarder “nick has paid for this shipment, release it to him).

Hey David,

Spoke to you before about the idea of buying a container of 20 or 30 units of several SKUs from a supplier.

You mentioned to work your way up to a container however I am finding trouble avoiding this when the products I am interested in are a little larger and more expensive ( > $100 and > 5 pounds) . To ship air in most cases would be way too expensive and might as well get a container of product if air cost is so high. If I got a container I of course would have a third party inspection in China before shipping goods.

My question is how would you go about testing/validating heavier or more expensive items in North America since small quantity purchases can be very expensive when sourcing from China and just buying one sample and selling would not validate the product?

Would you source a similar product domestically and test? OR maybe throw up a listing and see if it gets sales to test demand then cancel orders since you don’t actually have product? Just some thoughts.

Thanks!

Michael

Hi Michael,

If it was me I would just import 2-5 of these units via sea and try my luck. Remember, you don’t need an entire container to import something via air. I’ve had things as very small pallet shipped via sea.

thank you David for sharing your experiences and knowledge! I am just getting started and hearing you on nichepursuits podcast really inspired me!

Thanks Stephanie!

When you ship upc labels or anything to china and it is used on your product and shipped back to the United states. You must declare this in the cost of the product. 10 years later they will be knocking at your door to pay for the added cost plus penalty fees. Which will become costly. Same with molds you have a Chinese factory make. This has to be declared in your cost.

Hi Gary,

That’s a good point you make about the molds. As for the UPC labels, for us those are normally incorporated into the packaging, which we do declare. But you’re right, it’s one of those things to be aware of when doing your customs entry.

I’ve been reading your site and a few others for a while now but I have a specific problem that I’d like help on. What I’m trying to do is import products into amazon FBA and sell on Amazon of course. But the products seem hugely competitive for instance on amazon you have Product by “” and Sold by “”. Most of these products have around 20 or so people selling the same thing so does that mean the sales volume is shared between all of them? Or is it just the seller who appears first when you find the product that gets all the sales? And if there are people all selling the same thing is it best to create your own listing rather than compete with all of them. A lot of them seem to have such low prices it looks impossible to make a profit with shipping and fba costs included. Whats a typical margin you’d look to have before even proceeding with a product? I know that’s a lot of questions but any help greatly appreciated

Hi Matt,

The majority of the sales, probably 90%+ go to the seller who wins the buy box.

If you’re importing a product, you technically will need to create a new product. This product is your and your company’s brand so there can be no one else selling it.

You need to differentiate your product some how, even if it’s just through a superior description and photos. If you piggy back on another listing you can’t do that.

Gross margins should always be 50%+. For net margins, i.e. after shipping, amazon fees, etc. I always like to be 20%+.

Hi David,

I came across your article and thought it was very informative. Thank you! I have a couple questions I hope you can answer. I’m brand new to this and would like to start importing from China or elsewhere and sell on Amazon and Ebay. The questions I have are:

Looking at cost prices from suppliers and sales prices on Amazon there seems to be good profit on lots of products. My concern is calculating the cost per unit to arrive to the Amazon warehouse or my house. I can find very little info on import fees, and shipping fees to get the product. Any knowledge you have on import methods would be great. Most often it seems like getting the product will be the most expensive part. Does the supplier deal with customs and doc and import fees or do i?

Also is it bad to use a home address with supliers?

What would another option be if I didn’t want to use a home address?

Thank you for your help.

Hi Joe,

It depends on the size of the order but generally freight/customs/brokerage are very substantial costs which you will almost always be entirely responsible for. If you’re ordering something via sea, your freight/customs/brokerage costs are likely going to be close to $1000, which often may come close to exceeding the product cost (that $1000 is relatively flat no matter the quantity). It’s possible to get something shipped all-in for ~$200 but it’s going to be a very small shipment. You can use your home address for an air shipment – a lot of people do and . Obviously it’s hard to pretend you’re a multibillion dollar company if you do though :)

Not to try and hard sell you and squeeze $10 out of you, but the ebook is a really good starting point for getting started :)

Can people from Australia ship stock to FBA Amazon?

What’s the process? Thanks!

Yes of course. But you have to make sure it arrives DDP, i.e. duties and taxes paid. I’ve had shipments rejected even though I was sure they were shipped DDP, so it’s advisable to ship a very small trial order first.

Hi David,

Thanks for writing such wonderful articles. I have been reading around the net for quite sometime and find your article the most comprehensive so far.

I’m from Malaysia and I wish to source from China and ship to FBA in US and UK. My current biggest concern is doing the quality inspection (for now I don’t think I can afford hiring a quality inspector) is it possible to ask 3rd party logistic company to do the inspection for me? And how much will these third-party logistic company cost?

Cheers,

Alex

Hi Alex,

Thank you.

I’ve never heard of anyone using a 3PL for a quality inspection and even if they did I’m sure it would be close to or greater than the $300 you pay through AsiaInspection.com or elsewhere for an inspection.

Thanks for the site! I’ll look into it. By the way, anyway to get an email notification when you reply us?

Didn’t even notice I had a reply if I didn’t come back your site to check!

Hi David,

Are you currently only using Amazon FBA to sell your products? I believe relying only on Amazon is risky as they can change their algorithm anytime, suddenly terminate our Seller Central account, etc…?

Or do you also have your own (Shopify) stores?

Cheers!

Hi Frank,

Yes, we sell across many channels, but Amazon is becoming a bigger and bigger piece of the pie.

What other channels do you use, other than Amazon?

Hi Frank,

The most important for us are eBay, Website (and then there’s a lot of ways to drive traffic to your website), trade shows, and wholesale.

Hey David.

I have a question regarding the legal aspect of the business. I live outside of the US and I would like to ship a test order to FBA, 200 pieces via air using a carrier, total value under $1000. As I saw from your previous replies, the shipment should be DDP. I don’t have a company in my home country at the moment because I would like to test the waters first. The question is: do I need to incorporate a company in my home country to have the goods clear customs, or I can have the import done as a private individual? Do I need to complete some forms with US customs prior to sending the shipment? Thanks!

Whether or not you need to have a business in your home country I can’t answer. For the U.S.. As far as clearing the goods into the U.S. you should be able to do that as an individual, although please speak to a customs broker before taking any of my advice to heart.

Hi. I am moving along with my manufacturer, we have already sorted out product, packaging, and price. I am waiting for my sample before I place order. I was planning on having it shipped directly to FBA but I am not sure what I need to do to clear customs for a smooth arrival in U.S. My manufacturer told me that they will put my UPC barcode on my items as well. I was under the impression I only needed 1 UPC barcode that goes on all of my items since they are 500 of the same item. But you are showing printing 30 at a time? Can you please clairify the UPC? And if air shipping what do I need to do before it ships. I am not planning on having it inspected in US first as they are sending me pictures after completion, sending me 10 units separately to my house for photography, and it is an unbreakable item. Thanks so much!

Hi Nicole,

This is a lot of questions and more than I can answer here and a lot of the Amazon questions are probably better directed to the Amazon forums. But as for the barcodes, you should only need one barcode, be it your UPC or an Amazon FNSKU. I’m not sure where 30 is shown, but that might have just been printed 30 per page (and they would be cut down individually after that)

Hi David,

Thanks for a such an informative article. I learnt stuff that I didn’t know about. David, this business doesn’t seem to be as profitable to me now as it appeared to be when I started research on it. There are just so many costs associated with it. It looks like that anything I want to sell for $20 will cost me atleast $4 buying from the supplier. Lets say I import 500 of such items weighing a total of 200 pounds. From your experience, can you please give me a rough idea of the following costs that I have broken down into? I have given my estimate for some of them:

Supplier Cost (500 x 4) = 2000

Shipping from China to US = ?

Custom Broker = 200 (estimate)

Custom Bond (single entry) = 50

Duties = 400 (estimate)

Shipping from US port to Amazon centers= ?

Fulfillment Cost + Referral fee (500 x 10) = 5000 (estimate from FBA calculator)

Amazon monthly fees = 40

It will generate $10000 revenue selling at $20 each. It looks like that adding all the above costs and some other costs (return etc) will not leave me more than $1000-$1500 in the end. This is just 10-15% margin in the end. Please advise on how these costs can be minimized.

Hi Ahmad,

If you have it shipped via DHL or UPS you may be able to get the products landed, including customs, for around $1000-1500 (I’m purely estimating). You’ll save a lot on the customs broker and bond fee. Check out freighteo.com and get some estimates. For under 200 lbs you probably want to avoid sea.

All your other costs seem spot on. The duties seem very high. Normally duties are under 10% but maybe they’re higher for your particular item.

10-15% margins after everything is said and done is a LITTLE thin, but under 25% is definitely the norm. Anyone who tells you differently is probably exaggerating or doesn’t have their numbers down as well as you :) It sounds like your price may need to be closer to $25 though to get close to that 20%+ margin.

hello, in step, it says that you have to get your items bar-coded in China. Isn’t the Prep and Ship company in the US do this (instead of the Chinese supplier)

Hi.

Yes, you can get this done in the U.S. but you’ll pay for it (normally around 10-25 cents per bar code) whereas your Chinese Supplier will likely do this for free :)

Hello,

As a private individual (no corporation or LCC) I would like to import some items for personal use from a supplier in China (thin film clamps and mounting hardware for Solar Panels) via sea freight (due to lower cost of shipping).

Since I do not live near any sea port, the merchandise would have to come to me via cargo train, also since I am not associated with any cargo rail company to pick up the shipment (would need to have an ongoing contract with a major cargo train freight company) that is not an option. So, I would like to know whether or not one could have such shipment sent to an Amazon FBA warehouse in order to then have the items shipped directly to my address via USPS (postal office). Could my supplier/seller in China send the items (1 cubic meter box) to an Amazon warehouse in the USA in order to then have the shipment ultimately sent to me via regular mail through amazon (instead of having the the items individually sold at amazon whereby amazon would be acting and providing fulfillment services; so in my case amazon would simply forward the shipment to my address in the US) ?

Thanks for any insight,

tk3000

Hi,

I guess theoretically you could do this, but boyyyyy are you making this more complicated than it needs to be. Amazon is going expect you to conform to all of their unncessary requirements like bar coding, having a professional selling account, creating listings for items. Just use any of the million “pick and pack” companies and have them receive your shipment and send it you however you want. There’s literally thousands of these companies who will do this for you, https://fbainspection.com/ is one example. Or better yet, just talk to a freight forwarder and ask them to arrange for “door to door” service for you.

Thanks for the input! The supplier in China indicated that he have forwarder who would send the 1 cubic meter package (it can be 0.5*2*1 size wise, for instance) to a California sea port, and then from there it would take off by train to a train depot near me (I would pay $130 to the shipping cost). From that point, I can not simply go to the railroad station and pick up the package given that only a customer of the freight train company with a terminal,etc, could do that. So, would the forwarder in this case being retrieving the items for me from that train station?

The forwarder should have a local warehouse arranged that the goods are brought to, although double check with the forwarder.

When you get something shipped via sea that’s less than a container, the same thing happens – the item(s) go to a warehouse arranged from the forwarder, normally anywhere from 1-10 miles away from the port.

Thanks. I will follow your advice and not use a fba in this situation. Maybe my supplier in China is confused about the options.

The items should be shipped via sea freight from China with port of entry in California (LA), and last he indicated that the his forwarder/consolidator could have the items then sent to Columbus,OH, to one warehouse (I assume the whole container would be decontainerized in Columbus,OH). But the supplier indicated that the items in my order would have to clear customs in LA and that it would be a problem since I would have to be there to clear customs which does not make much sense. Couldn’t the forwarder clear the customs or maybe I could simply fill out a form and sent it electronically. Typically, does people pay any tariffs when they bring things from China? I know that for personal use there are no taxes or tariffs.

Hey, I think our agent in US will solve your problems, the agent will instead of you to pick up the goods from the port and then do the customs entry for your goods, then delivery the goods to your address, you can pay the tax and duty by yourself or our agent pay instead of you.