What is NARF (Amazon North America Remote Fulfillment Program)?

Want to increase your sales from 5 to 25% from Amazon.ca and Amazon.com.mx by doing almost no extra work?

This might sound too good to be true, but North America Remote Fulfillment (NARF) from Amazon will allow you to do this with a click of a button.

In this article I'll discuss how to enable NARF in your Amazon account. I'll also discuss the one thing that most people forget to setup after enabling NARF that can dramatically increase their sales.

What Is NARF (Amazon’s North America Remote Fulfillment Program)?

NARF might sound like a seal sneezing but is actually an acronym for North American Remote Fulfillment program that will make it easier for sellers on Amazon’s U.S. marketplace to also sell in Canada and Mexico (you know, the other countries that make up the continent of North America!).

Related Listening: E348: 4 Amazon Advertising Methods and How Much You Should Spend on Them

NARF allows sellers to display their inventory stored in U.S. FBA warehouses on Amazon’s Canadian (amazon.ca) and Mexican (amazon.mx) marketplaces without having to ship and store inventory in either of those countries.

Your U.S. inventory basically becomes a centralized cache. So if you have 300 units available in the U.S., those 300 units will automatically become available to customers using .ca and .mx.

Amazon makes this possible by using a single global SKU for your product.

So unlike right now, where you need a different FNSKU on your product for all three marketplaces even though you’re selling the exact same product, your product will now only need one FNSKU.

And that also means you only need to create one listing.

By the way, check out how we use NARF to improve conversion rates here.

How Do You Enroll in Amazon’s NARF Program?

To enroll in NARF visit this page (you must be logged into Seller Central).

From that link, registration is as simple as a couple of clicks of your mouse.

In the meantime, if you haven’t been invited to NARF but are thinking about expanding into Canada, you can learn everything you need to know about selling on Amazon.ca in this EcomCrew article.

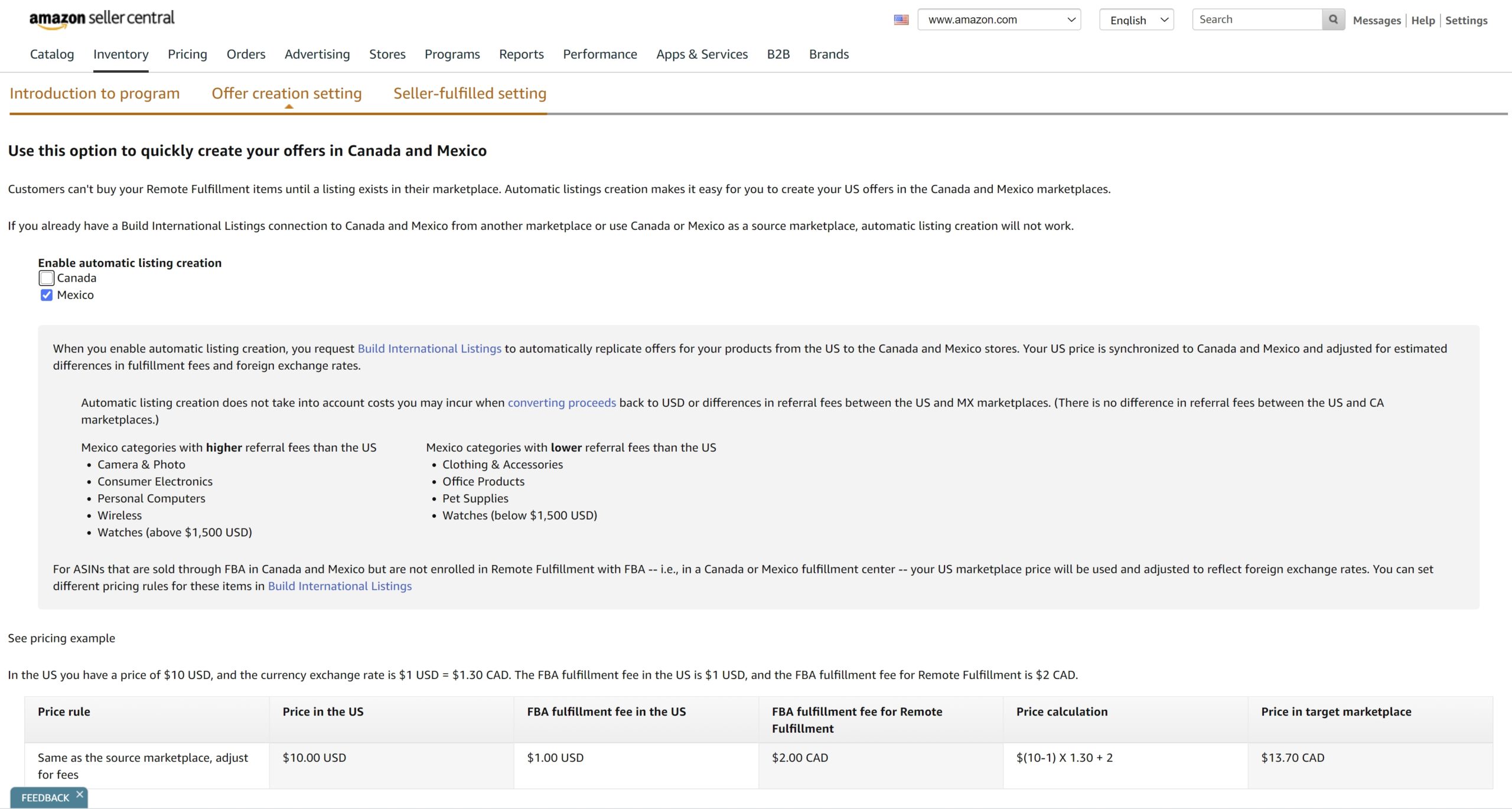

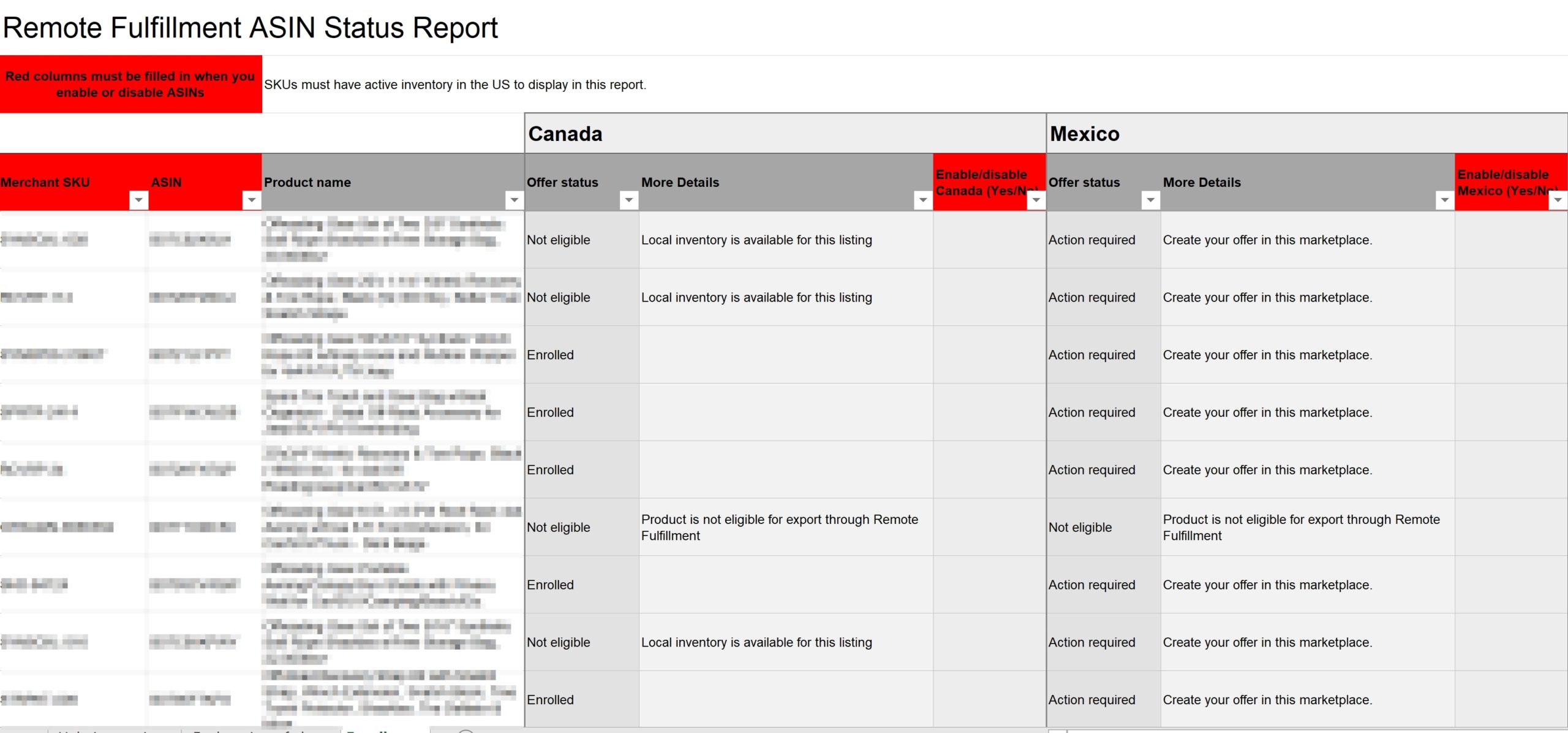

How Do You Enroll Products in NARF?

Your products should be automatically enrolled in NARF, but not always.

When you go to the page above, there will be a link to an XML file (open in Excel or Sheets).

From here you can see which products have been automatically enrolled and which products have not been.

What Are The Pros And Cons Of Amazon NARF Program?

Pros Of Using Amazon NARF Program:

- Risk-free market testing – In the past, if you wanted to know if Canadians would love, and buy, your musical toilet seats as much as your American Amazon customers did, there was time and money involved. You’d have to buy a new UPC, set up a new listing, ship inventory from your supplier to Canada (probably via the U.S. because it’s hard to find a freight-forwarder that will ship direct. Which meant you paid customs duty twice). And don’t even get me started on dealing with country-specific sales tax laws. All of that cost and effort, only to find they didn’t want to listen to the star-spangled banner as they went number 2. With NARF, you get to avoid all those headaches. Simply add your listing to each marketplace, sit back and wait to see if they buy.

- No additional FBA inventory storage costs – Because every sale you make in .mx and .ca ships from your U.S. inventory, and you’re already paying storage fees for that, there’s no additional cost.

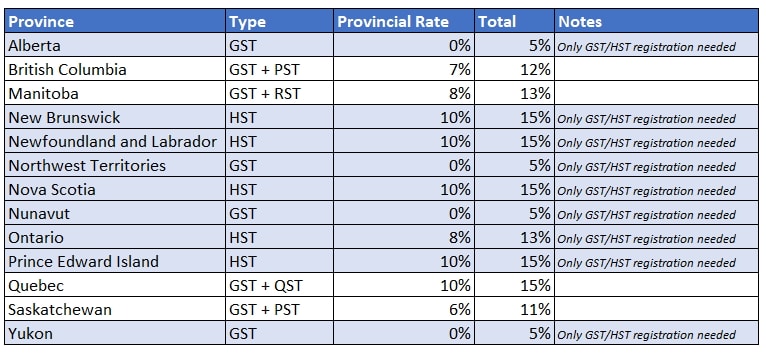

- No local tax regulation headaches – I already mentioned this in point 1, but it’s worth mentioning again. As soon as you import inventory to sell into a country, you open a whole new black hole of tax regulation specific to that country. On top of import-duties, you’ll need to become knowledgeable on local sales tax laws (or pay someone to do it for you $$$) in order to avoid any tax-dodging penalties. Take Canada. They have GST (good and services tax) which is a 5% federal tax added to most purchases. But in some provinces, GST is combined with provincial sales tax to create a harmonized sales tax (HST). And HST rates vary by province. And now I have a headache.

NARF allows you to dodge these headaches because you’re not importing or storing any inventory in either Canada or Mexico. And Amazon deals with the sales tax on the other end.

Cons Of Using Amazon NARF Program:

After that list of pros, you’re probably wondering what the cons could possibly be. It turns out there are a couple.

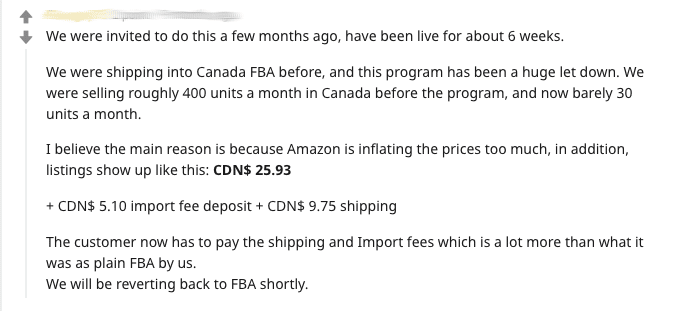

1. If you already sell on .ca or .mx, NARF may not be worth it – This Reddit post from an Amazon seller who was already selling on .ca before they were invited to participate in NARF highlights one unforeseen con.

As you can see, from 400 units a month to barely 30 units is a huge drop.

Whatever the reason for that is, if you’re already successfully selling on .ca or .mx, you may want to think carefully about using NARF.

2. You have to keep on top of exchange rates – Although your inventory is unified across all 3 marketplaces, you still have to set your price in all three separately. This is because customers buy in their local currency. That means you have to constantly monitor exchange rates to ensure rate changes don't leave a big dent in your profits.

Alternatives For Selling Globally From U.S. Seller Central

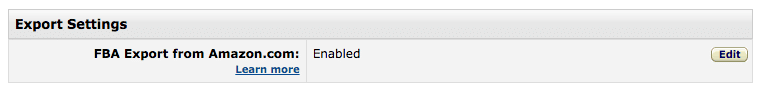

While it doesn’t let you list your products on other Amazon marketplaces, another simple option to make your products available to customers from around the world is to enable FBA Export in your Seller Central account.

If your products are eligible, by enabling FBA Export people from all over the world will be able to buy your products from Amazon’s .com marketplace (they’ll simply have to cover the additional cost of shipping to wherever they live).

To enable FBA Export, simply go to settings in the top right of your seller central account, select Fulfilled By Amazon from the drop-down menu and then scroll down until you see Export Settings and hit edit to enable it.

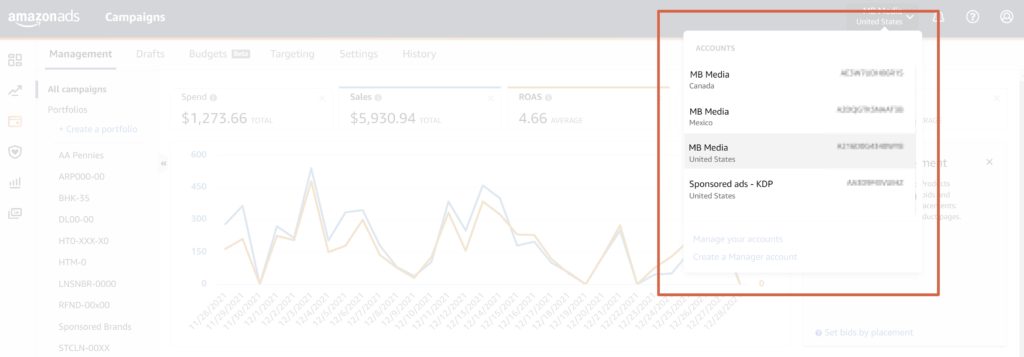

Advertising on Amazon.ca and Amazon.com.mx with NARF

You wouldn't sell a product on Amazon.com without enabling some advertising for it (at least I hope you wouldn't), so why would you skip adverting your products that you now have live on Amazon.ca and Amazon.com.mx?

Go to your advertising console and navigate to either your Mexico or Canada advertising account (see the graphic above) and start copying your most profitable advertising campaigns from Amazon.com into these marketplaces. Conversion rates will be lower than Amazon.com (given that you don't physically have inventory in these marketplaces) but advertising rates will also likely be lower. Make sure to monitor your campaigns after you set them up.

Conclusion

Assuming you get an invite, and you’re not already selling in either Canada or Mexico, testing your products on both marketplaces using NARF seems like a no-brainer.

It could generate extra sales at essentially no cost to you, and with minimal headaches (I say minimal because, Amazon).

Using that free-market testing, you could then make an educated decision about whether you want to actually import and sell in either or both of Amazon’s other North American marketplaces.

Hi John, thank you very much for the great article. Can you please verify if Amazon will handle Sales Taxes for NARF orders? (“And Amazon deals with the sales tax on the other end.”). According to other articles I’ve read, it seems the seller is still obligated to take care of Sales Tax.

Amazon should be taking care of sales tax AFAIK.

HI can you please provide information what happens if the customer returns the item if the sellar will be charged any fees (shipping….) ore its like amazon.com with no fees

thanks

Hi there,

Can you advise how returns are handle, I have heard that returns are extremely expensive for the seller.

Thank you.

I have also had this issue, I had to shut down my listing once already in NARF to prevent issues in the future

Hi,

Is there any way to activate NARF only on specific items and not all my items that are in US?

Yes, there’s the option to upload a spreadsheet.

I heard that many accounts are getting suspended as a result of NARF because labelling/packaging requirements are not met. What exactly are the requirements for packaging/labelling for NARF program? Thanks

Haven’t heard of it. It’s possible Amazon is enforcing bi-lingual packaging requirements in Canada and suspending those products from NARF. Don’t think it would affect them in the U.S. though I’m not sure.

Hello,

Fantastic article! We just started using NARF and it was very simple to set up! We’ve already seen some sales and are hoping for a bit more however we ran into an issue. We had quite a few products that are not eligible due to import restrictions. These products are the exact same, just available in a different scent, as ones that were approved and are already selling in Canada. I’ve been told there’s nothing we can do about this and just have to wait for things to be reviewed.

Is there anything that can be done in cases like these?

Thank you!

If you have a NARF listing live and then send the product up to CA to have CA AZ distribute the product from there – is it against policy to have the NARF SKU and the CA SKU both live at the same time? Similar to having 2 FBA skus/listings of the same product being against policy. Contrary to having an FBA and FBM listing of the same product/listing NOT being against policy. So which is it of the two options?

Thanks!

Hi!

We are trying to set the prices for the individual products we are going to sell through NARF and Seller Central provides only two options for setting NARF prices:

– % above the source Marketplace

– fixed amount above the source Marketplace

Really frustrating thing is that these options can be applied on Account Level only which means it will add the same % or $ amount to all US product prices.

Is there any way to set NARF prices individually. Hope it makes sense.

Thanks!