My 2017 Predictions for China, Private Labeling, Amazon, and More

We’ve just brought in 2017 (unless you're Chinese in which case the New Year isn't for a couple more weeks). And what would a new year be without resolutions and predictions? So I've put together a list of some of my predictions for 2017 for private labelers and importers from China. In this post I'll cover my predictions regarding product costs, increased competition on Amazon, and the new Trump administration.

More Competition On All Fronts Means Lower Margins

The private labeling fad is hot right now as evidenced by the number of blogs, books , and courses out there promoting private labeling (by the way, did I mention that you should check out my course?). And the fad isn't hot just among entrepreneurs living in the West. It's hot among big brands and Chinese as well. Emphasizing this popularity, I have a colleague selling a course on starting on FBA marketed just to Chinese speakers. He's selling over $10,000 worth of courses many months!

What this means is that private labelers are facing competition on all fronts. There's more small companies and entrepreneurs selling identical products with little changes aside from a logo and slightly re-written product description. Big brands are now selling their products direct to consumers (especially on Amazon) and foregoing wholesalers and distributors. And Chinese manufacturers are skipping all of the above and selling direct on Amazon by either shipping from China or physically shipping the goods to the U.S.

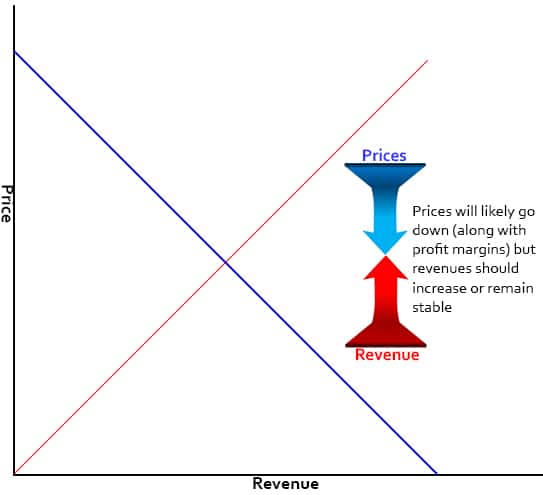

This competition means that there's theoretically a smaller piece of the pie for everyone, although the size of the pie is increasing thanks to overall ecommerce growth, as I'll get to shortly. I think overall, the increased competition will be mostly offset by a bigger market, but there'll be an adverse affect on profit margins. I think a 10%+ decrease in margins is a reasonable prediction.

Continued Growth of Ecommerce and Amazon Prime Means Lots of Opportunity

U.S. ecommerce sales in Q4 in 2016 increased 16% from 2015. Anyone who thinks that ecommerce is a fully matured industry couldn't be more wrong. This means that there's over 16% more fruit on the tree for picking. Furthermore, Amazon Prime membership is estimated to have increased in July 2016 to an estimated 63 million members world wide, up from just 19 million in June of 2016.

As any Prime member knows, Prime members purchase Prime eligible products (re: FBA) almost exclusively. And yet, it is still shocking how many products there are on Amazon not fulfilled by Amazon. The Amazon FBA train may be slowly starting its engine, but if you haven't yet boarded it, it has in no way left the station yet.

Rising Raw Material Prices, Steady Wages, and Higher Freight Means Moderately Higher Product Costs

At the end of 2017 we began to receive notifications from Chinese vendors about significant increases in the price of raw materials such as aluminum. Other colleagues have reported receiving similar warnings from suppliers. Raw material prices had been very low for quite some time thanks to a fragile world economy but prices seem to be rising across the board now.

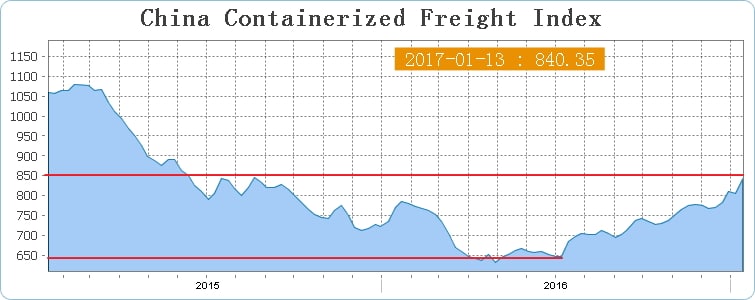

Sea Freight rates have also been rising very rapidly, up almost 30% from June. The bankruptcy of Hanjin didn't help things but rates were already abnormally low even before this so some increases were to be expected.

However, while raw material prices may be increasing, wages seem to be relatively stagnant in China in part due to the slowed growth there and the Yuan is also devaluing against the U.S. dollar.

In 2016, many product prices actually decreased and in 2015 many product prices increased very significantly. My expectation is that overall product costs will increase moderately in 2017 (higher increases than in 2016 but lower than 2015).

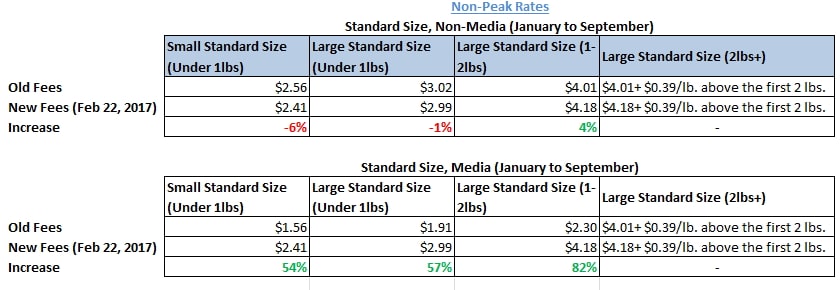

Increasing Amazon Fees, More Seller Fulfilled Prime, and More Restrictive FBA

I recently summarized the significant fee increases from Amazon. Amazon warehouses are bursting at the seams, they're having to open more warehouses to meet demand, and they're having to hire more people to fill that demand (or worse, pay heavy over time wages). IMO, Amazon will not be able to keep up with this demand and they will have to start more drastic measures to stop the dam from collapsing. Some things they could potentially do:

- Increase fees more dramatically in Q4 2017

- Encourage more seller fulfilled prime

- Put more restrictions on new sellers sending products to FBA

- Eliminate non-Amazon fulfillment orders

Overall, I'd expect big changes from the FBA program over the next 1-2 years. I think anyone relying exclusively on FBA for fulfillment should start to look into having a backup 3PL ready in case the FBA does turn for the worse against FBA sellers.

Donald Trump Will Do Nothing Substantial Regarding Chinese Imports

If you read my post on Donald Trump's impact on importers, you are already aware of my predictions on what a Donald Trump presidency will mean. I think that, for the most part, his direct impact on importers will be very minimal. What may be of more consequence to us though is the impact he will have on the overall economy. If the market and economy responds favorably to him and there is strong economic growth both in the U.S. and globally, it should in theory mean more sales for all of us. In regards to my predictions for his direct impact though, here they are:

First, Trump will declare China a currency manipulator. The U.S. and China will enter into some negotiations, Beijing will allow some very little appreciation of its currency in return for some other concession from the U.S.

Second, Trump will open a few cases against China with the WTO for certain products. He’ll likely target products relatively inconsequential to China and China will do the same in return but they’ll avoid an all out trade war. Trump will be able to declare that he opened up more cases against China than any other U.S. president but the consequences will be negligible.

Third, Trump will not pull out of the WTO. U.S. markets have received a considerable ‘Trump Bump’ since his election. If he pulled the U.S. out of the WTO the U.S. could flirt with another recession.

Fourth, Trump will renegotiate other free trade deals like NAFTA but China has none. Opening existing trade deals is a much easier task than dealing with the WTO and the limits it imposes. Countries with free trade agreements with the U.S., specifically NAFTA, are at considerable risk but China, for better or worse, has no free trade deal with the U.S.

Conclusion

There you have it. These are my predictions for 2017 for importers and private labelers. Overall, I think 2017 will bring relative stability for importers and I think it should be a great year for all of us. Yes product costs will rise somewhat and there'll be more product competition in nearly every industry. But the ecommerce market is still growing incredibly quickly, the U.S. economy is strong, and despite all the Donald Trump doom and gloom, his impact will likely be minimal.

What do you think will be the major changes in 2017 for private labelers and importers? Do you have any bold predictions for the new year that I haven't mentioned?

Interesting insights David. I found myself agreeing with you as I read through your speculation on Trump.

The profit squeeze on sellers happened in a similar way on EBay so it makes sense that the same will occur on Amazon once enough people figure out how to find products for FBA.

It’s amazing how much Amazon feels like eBay from a few years ago, albeit with fulfillment integrated.