Your Ring Doorbell Cam, Your Privacy, & Amazon’s Ecommerce Monopoly

Did you get a Ring doorbell cam or other Ring accessories this Christmas? If you did, you weren't alone.

Ring doorbell cams have been one of the most popular products on Amazon all year. Unbeknownst to many, Ring is actually owned by Amazon. So if the thought of your Amazon Alexa listening in on your every word wasn't unnerving enough, you'll take little comfort in knowing that Amazon is actually watching you every time you enter and leave your home.

Governments are increasingly scrutinizing the potential monopolies of big tech giants like Google, Facebook, and, of course, Amazon. You may have also read our blog post on the Top 25 things Congress Forced out of Amazon during Congressional hearings.

In this article, I'll show how Amazon is utilizing its dominance of ecommerce, often in unethical, if not illegal, ways to monopolize home security and ensure they're the only company watching and listening to your every move.

Amazon Buys Ring in 2018

Amazon bought Ring in 2018 for just over $1billion. Analysts saw it as a natural fit for Amazon as they seek to eventually make in-home deliveries. It was also a perfect fit in one another way: Alexa provides the ears into your every whisper at home. Now, Ring provides the eyes to your every movement.

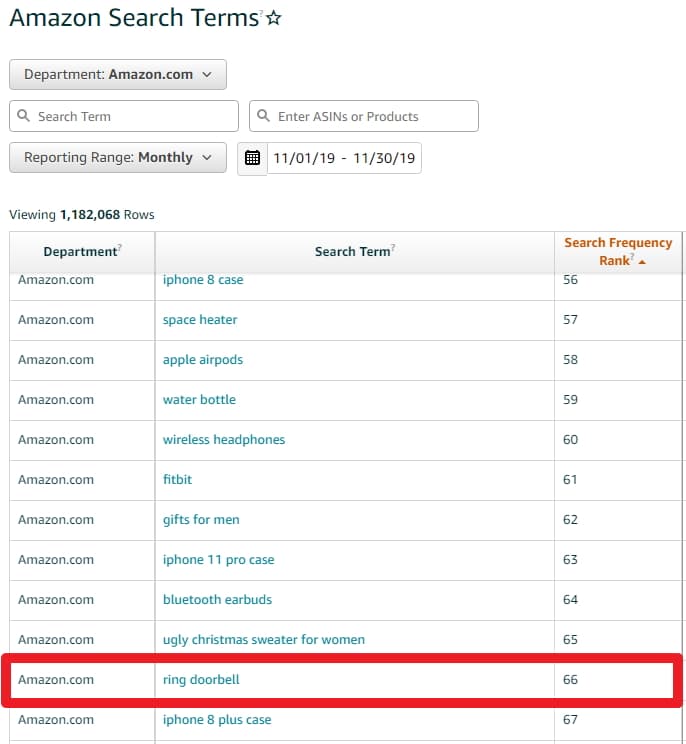

Since the acquisition of Ring, the popularity of its products on Amazon has been on a titanic rise. Ring Doorbell was the 66th most searched for keyword on Amazon in November. Right below Ugly Christmas Sweaters and right above iPhone cases.

Ring isn't the only in-house brand that Amazon owns. They own literally hundreds of brands for everything from dish detergent to energy bars. In fact, Amazon revealed that they own over 154,000 private label products. Yes – 154,000. Some of these you're aware of like the in-house Amazon Basics brand. Others, Amazon does a pretty good job of hiding the fact it owns like Mountain Falls and Happy Belly.

Now, of course, Amazon has the perfect platform to sell its own products like Ring doorbells. It controls somewhere between 37-47% of all U.S. ecommerce sales. Given those statistics, you might think Amazon is a large retailer in the U.S., just like The Home Depot. But you would be wrong.

Amazon – The Marketplace, not the Retailer

Regular readers of this blog know better, but most people think of Amazon as an online version of Walmart or other large retailers. The only problem is that the majority of Amazon is not a retailer. It's a marketplace like eBay (remember them?) where multiple sellers compete and sell the same products. In fact, for the first time in 2018 Amazon revealed that 58% of its sales come from third-party sellers. That percentage is growing year-over-year.

This marketplace dynamic of Amazon is why you love and use Amazon (probably) every single day. Multiple sellers (often dozens or even hundreds for a popular product) compete for the “Buy Box” on Amazon. The seller with the lowest price wins the Buy Box and nearly all of the sales for that item. Take for example this Coleman Steel Creek tent. There are over 50 sellers competing for the Buy Box.

In traditional retailing terms, you can think of the Buy Box as a shelf space at your supermarket. If you're one of thirteen brands of ketchup being sold at your local Safeway, you want to be eye-level. Except on Amazon, there's only one shelf with space for one item.

This model is at the expense of sellers, but the benefit of consumers. It drives prices down to ridiculously low levels. Free-market capitalists love this!

Amazon loves to paint itself as a marketplace in other situations when it's convenient for them, with two of the most popular examples being in terms of sales tax and product liability.

In terms of sales tax, Amazon has traditionally argued they're a marketplace and therefore not the ones responsible for collecting sales tax for sellers. States, in turn, have passed “marketplace sales tax” laws to requiring “marketplaces” like Amazon to collect sales tax.

In terms of product liability, Amazon has argued they're a marketplace and, once again, not liable for any injuries or harm resulting from the use of products purchased on Amazon.

For a company like eBay there has been very little controversy that they are in fact a marketplace. They do not warehouse inventory like Amazon and, more importantly, they do have in-house brands that they can promote ahead of competitors like Amazon does with Ring and their other brands.

Amazon Manipulates Search Results to Favor Its Brands

Most customers on Amazon find their products through search.

There exist paid ads on Amazon, specifically in search results. These ads are very similar to how they exist on Google and most other major search engines. In fact, the top search results are almost always paid search results.

Again, like most search engines, advertising on Amazon is based on an auction format. Sellers enter their top bid on a particular keyword. If Seller A and Seller B are both competing for the keyword “frying pan” and Seller B has a higher maximum price he's willing to pay each time a customer clicks their listing, then, all other things equal, Seller B's ad will show.

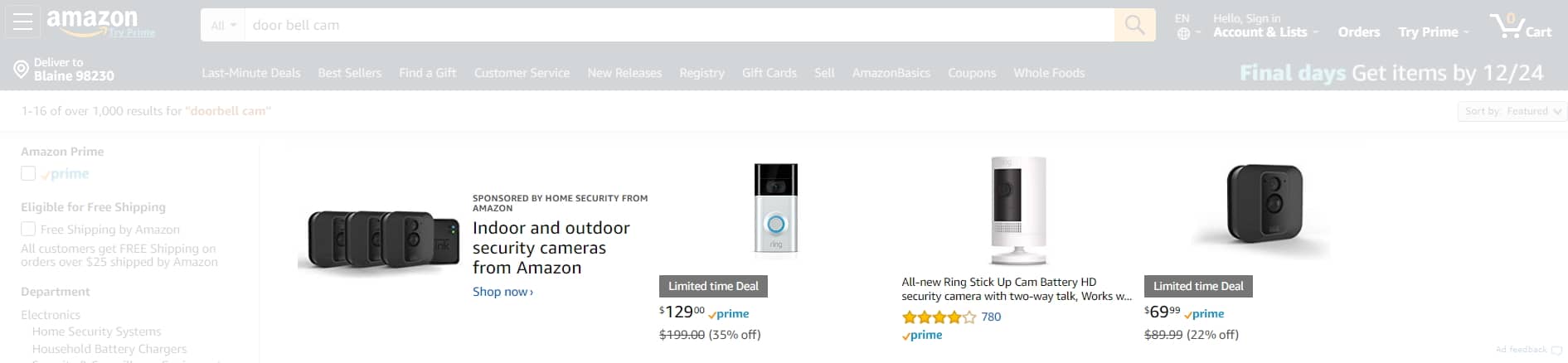

Do you want to guess whose ads display on every single page when you search for doorbell cam?

Amazon, during Congressional hearings, admitted they promote their own brands in paid search results “Consistent with the value proposition for private brands generally…like other retailers, Amazon highlights its private brands in promotions and marketing in the Amazon store when Amazon thinks they will be of interest to customers.”

In brick-and-mortar terms, this ‘top-of-page' area is the equivalent of eye-level shelf space at your supermarket. Amazon is essentially relegating every single competitor to the very bottom of every shelf that very few people ever look at. Worse, Amazon controls 38% of ALL ecommerce shelf space. It's basically the same as if Walmart, Kroger, Costco, Albertsons/Safeway, and Sam's Club (roughly the same market share in U.S. grocery as Amazon has in ecommerce) all got together and refused to allow any competitors to display anywhere but the bottom of shelves.

Amazon (Unfairly?) Controls the Price for Your Ring Doorbell

As I showed earlier, Amazon allows multiple sellers to sell the same product. It's a marketplace, remember? However, there is one particular group of products that Amazon does not allow any seller to sell: Ring doorbell cams and other Ring products.

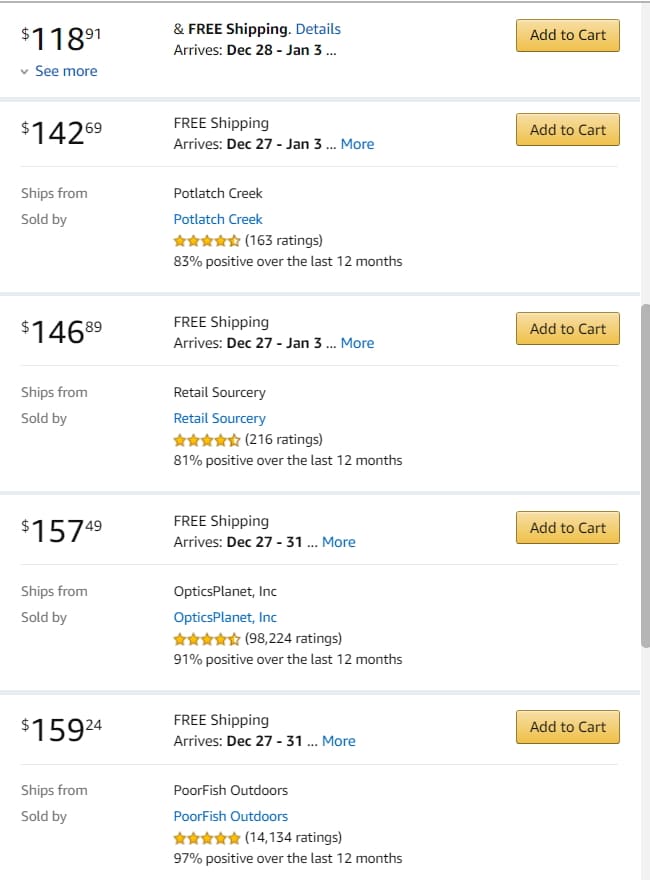

Technically, Amazon doesn't forbid other sellers from selling Ring products. Rather, it imposes a 45% “tax” on sellers who do. To give you some perspective, the highest duty percentage under Trump's trade war with China is 25%.

If the marketplace for Ring doorbells was allowed to “freely” compete, the price would likely be lower than what Amazon currently sells them for. When a product has considerable distribution like Ring does (it's sold in a variety of retailers like Best Buy, Home Depot, etc.) a “grey market” develops where resellers acquire the products outside of the manufacturer's normal distribution chain.

There's nothing illegal about the grey market and, in fact, one of the places the grey market thrives the most in is on Amazon. There's a whole cottage industry of what is called Retail Arbitrage. Sellers find products on the grey market, undercut other sellers on Amazon on price, and make a tidy living. Amazon doesn't allow this grey market to exist for Ring products though.

Who cares? It's Just a Doorbell Camera

At this junction you might be thinking “Who cares – Amazon spent a lot of money buying Ring and so it's just protecting its investment.”

The major concern is that Amazon is unfairly creating a dominance not just in doorbell cameras but also in home security and the “connected home”. Like I mentioned before, it wants to be the eyes and ears in your home. This is an industry with significant privacy concerns.

More disconcerting though is what it can mean for potential other industries that Amazon sets its eyes on. With Amazon's dominance in ecommerce, it can create an unfair advantage in nearly any product category it desires. Imagine, for example, that if Amazon all of a sudden sought to get into healthcare and produce drugs and other pharmaceuticals? It's one thing controlling the market and prices for home security devices, but imagine if Amazon was able to exert similar control over blood thinners and antibiotics?

Oh, by the way, Amazon for well over a year now has indeed been making active moves to get into healthcare.

Conclusion

Does Amazon have an ecommerce monopoly that's a threat to the well-being of the public? Even if we consider the high estimate of a 43% market share of ecommerce in the United States, it's difficult to necessarily call that a monopoly. The danger though is that Amazon's dominance is likely not dwindling and its tentacles are slowly spreading into more and more industries.

There has been fairly significant chatter about requiring big tech companies like Google, Facebook, and Amazon to break up. As a biased Amazon seller, I could certainly see merit in requiring, at a minimum, for Amazon's product brands to be separate from the “marketplace” Amazon.com. It would almost entirely eliminate many of the concerns addressed in this article.

What do you think – is Amazon too big and should it be broken up?