From Checking Out to Checkout: What Makes Amazon Customers Buy?

This study explores the different factors that come into play when Amazon customers make buying decisions. It gives insights to third-party sellers about what American customers prefer and how they respond to changes in product listings

This 2023 report also compares our results from the previous study to show how much customers’ preferences changed over the year.

Key Insights

61%

Majority of respondents said they have doubts about buying a product because of its authenticity.

50.77%

Last year, 62% of customers checked if a searched product was sponsored before clicking. This year, the number shrunk to 50.77%.

70.77%

Most of the respondents are more likely to purchase from Amazon than a third-party seller in 2023, a small drop off from 74% in 2022.

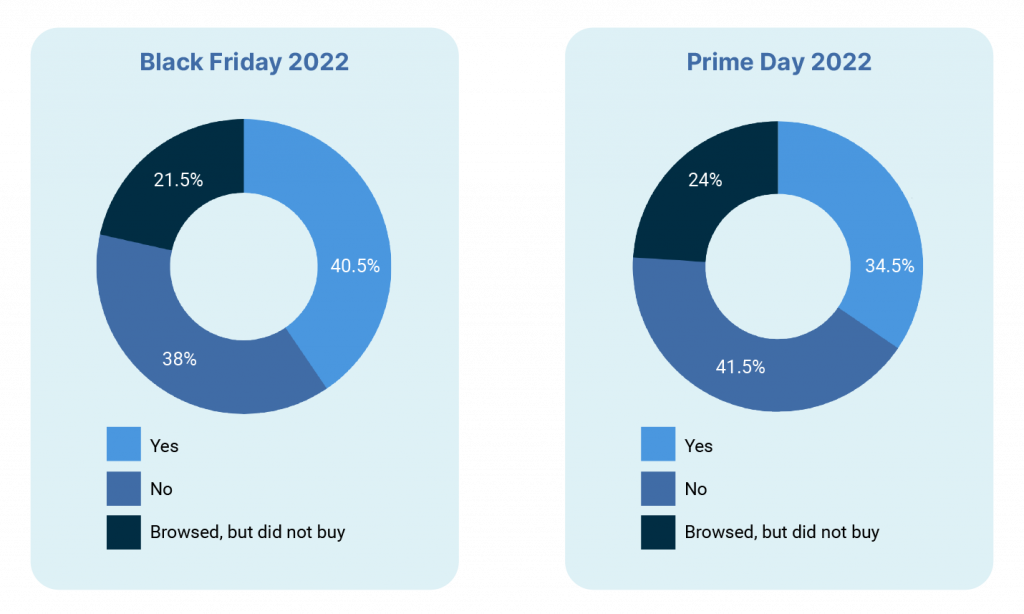

More customers shopped during Black Friday compared to Prime day.

Forty percent of people reported buying something during Black Friday 2022 while 35% reportedbuying something during Prime Day 2022.

In the previous year's report, we inquired about which event consumers spent significantly more. 59% indicated spending more on Black Friday compared to Prime Day (29%).

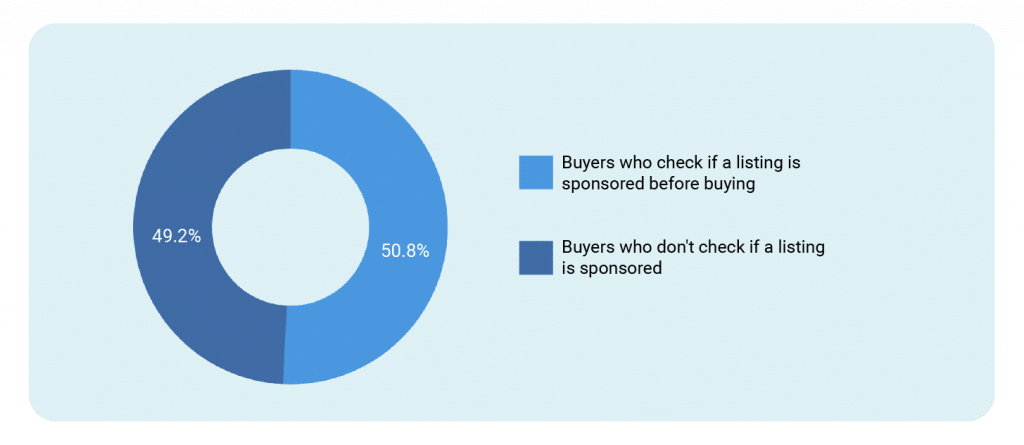

Majority of Amazon customers check if a listing is sponsored

The survey results indicate a mixed response regarding consumers checking for sponsored products on the search results page. While a majority of respondents (50.77%) do consider sponsorship, a notable portion does not.

In the previous year's report, it was found that a higher number of buyers (62%) verify whether a listing is sponsored.

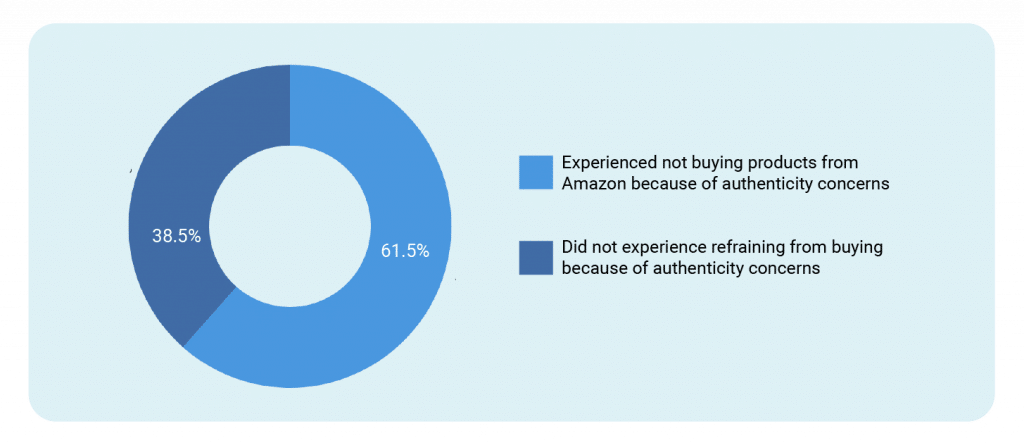

Consumers Fear Falling Victim to Fake Products.

More than half (61%) of people said they refrained from buying something on Amazon because they were concerned the products might not be authentic. Amazon reported that it has been working proactively to eliminate counterfeit products on the platform, but the majority of consumers are still apprehensive about the items’ authenticity.

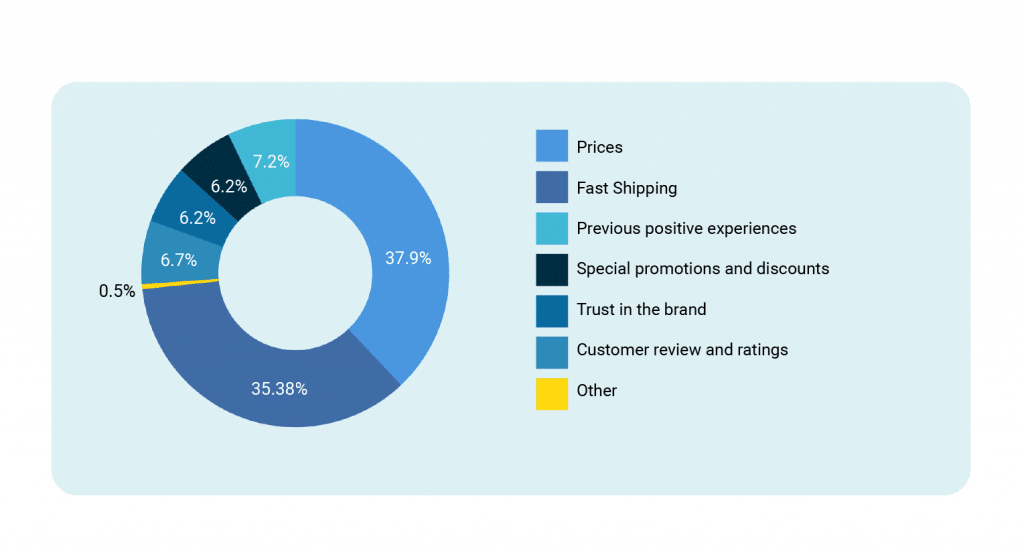

Price is still the primary consideration for Amazon buyers.

Prices still reign supreme, with 65.5% of the surveyed individuals considered prices as the main determining factor. This is higher than last year’s number, where only 52% of the respondents said that a good price influences their buying decision most.

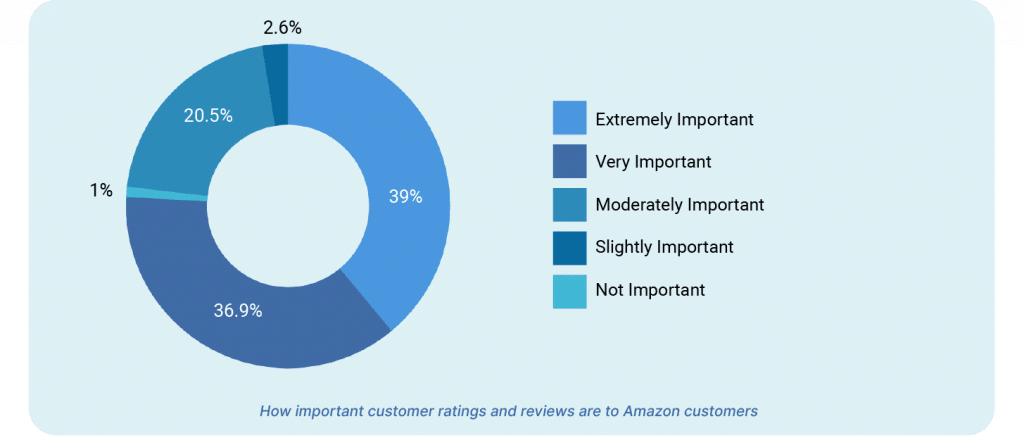

Customer Ratings and Reviews are extremely important to Amazon customers.

The results demonstrate that a majority of consumers value and rely on these reviews when making their purchasing decisions.

According to the results, an overwhelming 38.97% of respondents indicated that customer ratings and reviews are extremely important to them. This suggests that a significant portion of consumers heavily consider the experiences and opinions shared by other shoppers before finalizing their purchases.

However, in last year’s report, when consumers were asked what is the biggest factor in their buying decision, only 12% answered the number of reviews.

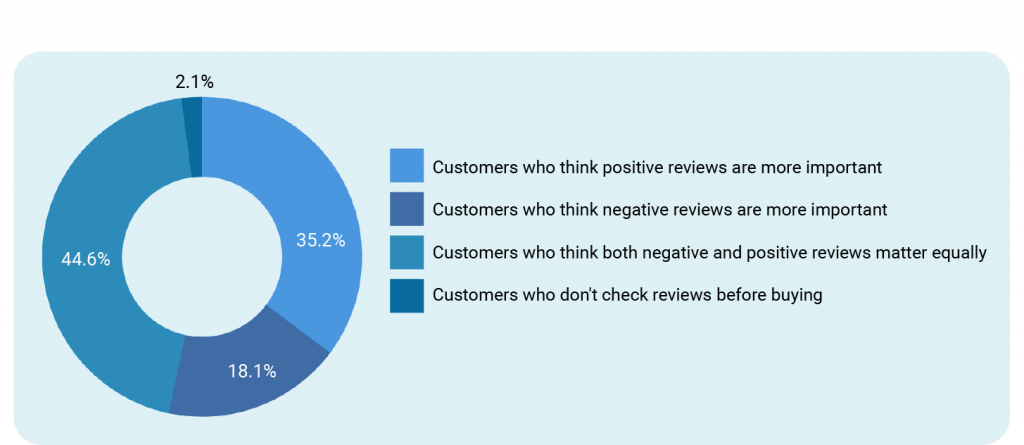

Most Amazon customers think positive and negative reviews matter equally.

When asked about the impact of product reviews on purchasing decisions, the survey revealed interesting insights. Among the respondents, 35.23% indicated that positive reviews have a greater influence on their buying decisions.

However, a greater percentage, 44.56%, said that positive and negative reviews are equally important to them. This means that they like to see a mix of positive and negative feedback to get a better overall idea of the product before deciding to buy it.

According to the previous year's report, 47% of respondents stated that positive reviews have an impact on their purchasing decisions. Additionally, 32% indicated that positive and negative reviews hold equal weight in influencing their decision-making process.

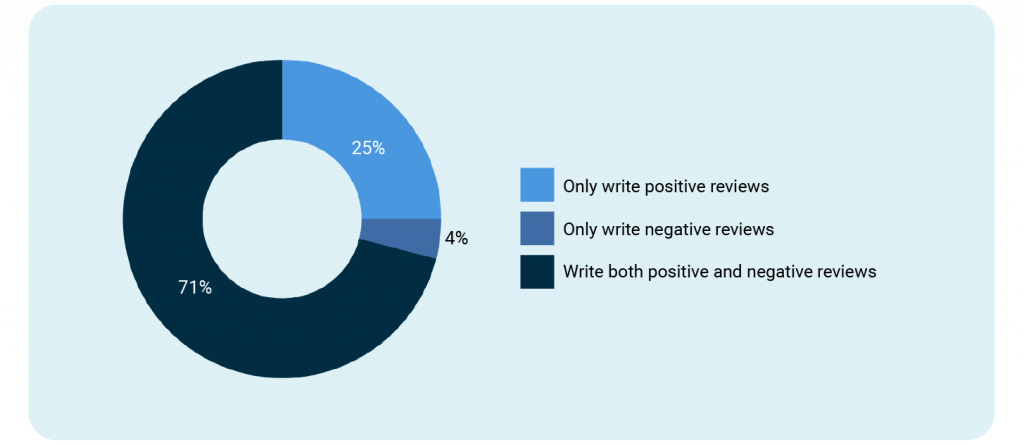

Most Amazon customers write both positive and negative reviews on Amazon.

When we asked about the kind of reviews they usually write, the majority (70.97%) of the respondents said they write both positive and negative ones. They're not afraid to share both positive and negative experiences with the products they buy on Amazon.

A quarter of the survey takers mentioned they only write positive reviews, but a few (4.03%) admitted they write only negative reviews.

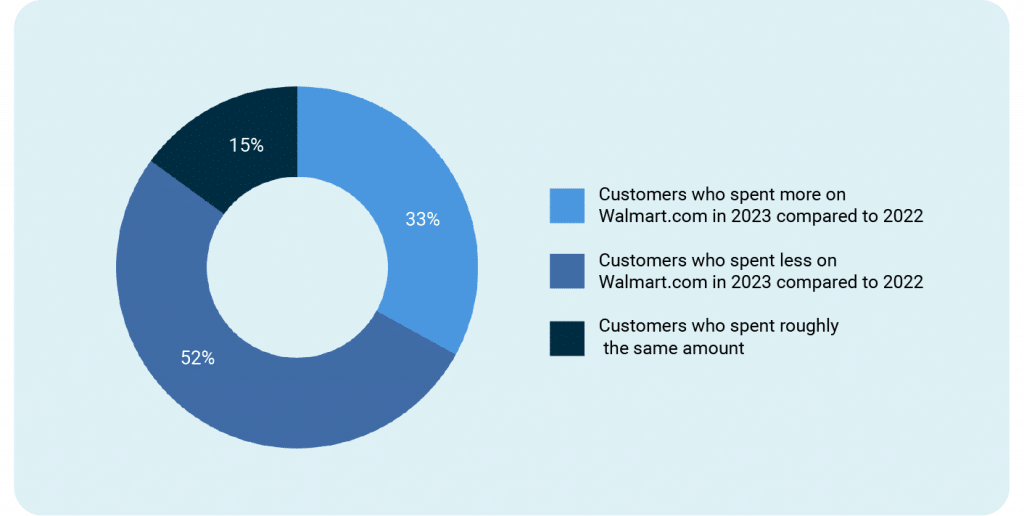

More than half of consumers admit to not increasing purchases compared to last year.

The survey results show that 52% of consumers didn't increase their purchases on Walmart.com compared to last year. It's a signal for Walmart.com to dig deeper and make adjustments to stay competitive in the online retail world.

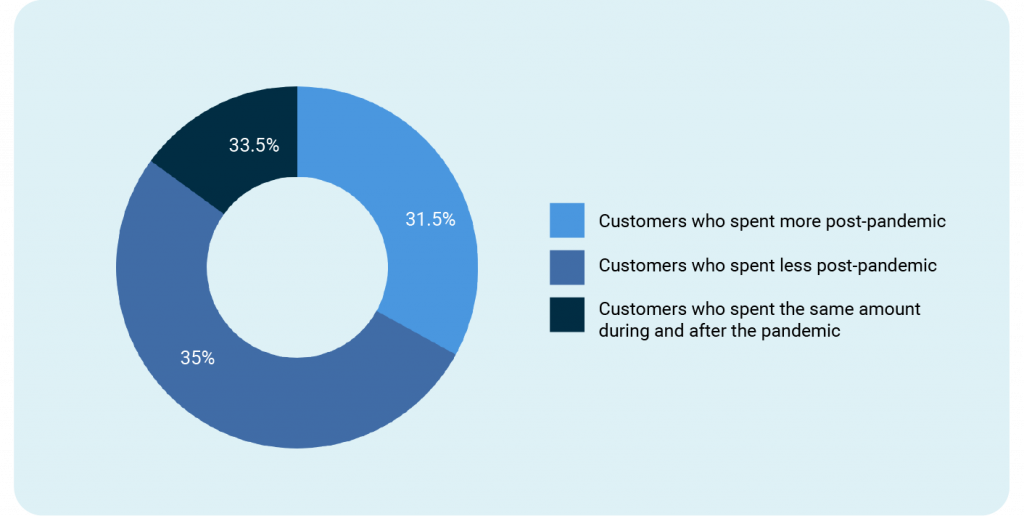

Post-COVID impact on Amazon purchases.

The survey results show a range of responses regarding changes in spending on Amazon after the COVID pandemic, with 31.50% spending more, 35.00% spending less, and 33.50% maintaining their pre-pandemic spending levels.

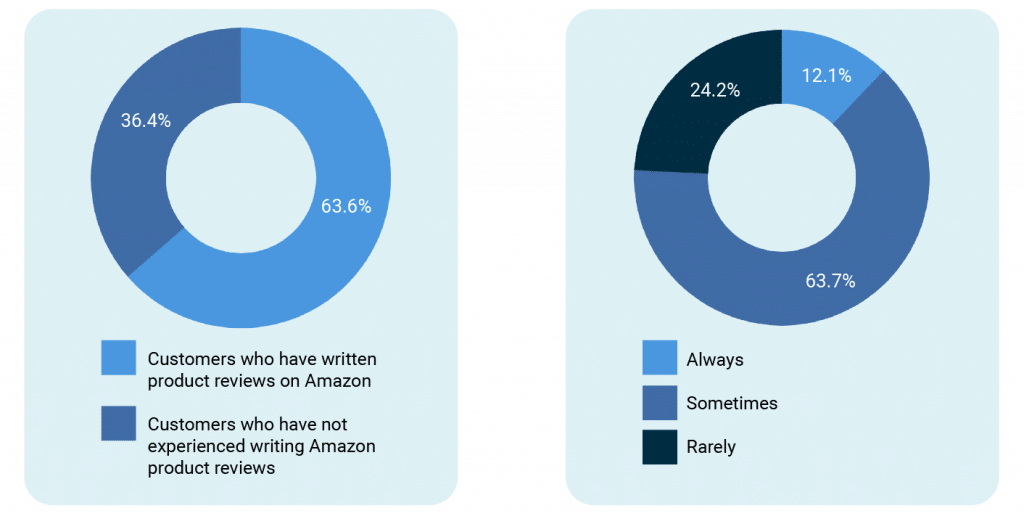

Most customers have written reviews on Amazon.

Findings show that a big chunk of consumers (63.59%) have already written product reviews on Amazon. Of those who have, only 12.10% say they always write reviews.

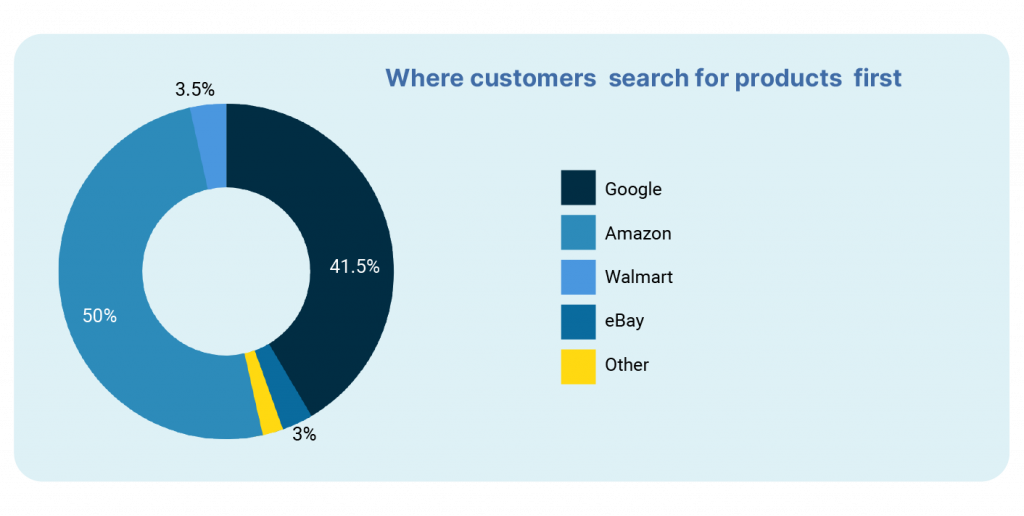

Amazon is still the no. 1 shopping search engine.

Half of consumers surveyed prefer Amazon as their primary online shopping destination, while 41.50% opt for searching on Google products.

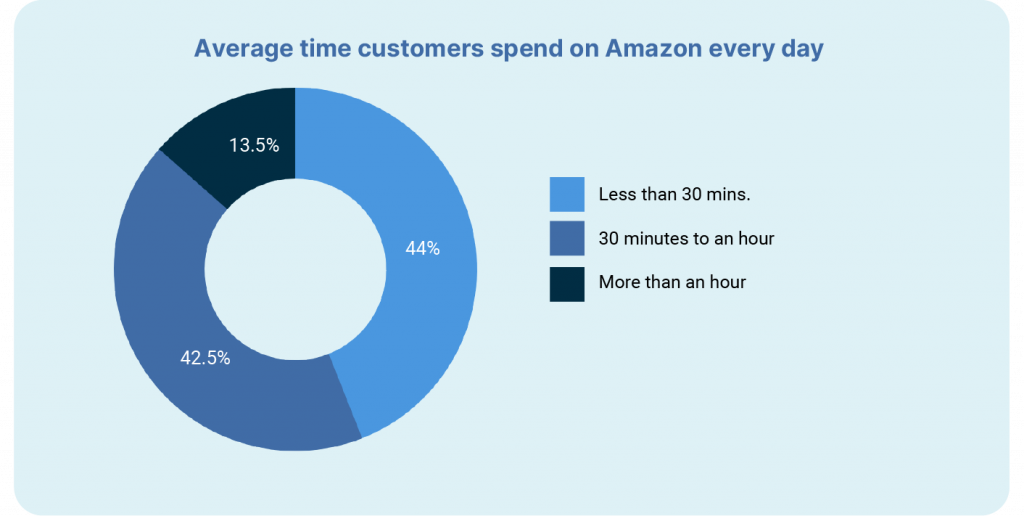

Most Amazon customers spend less than 30 minutes per day on the site.

Most of the customers surveyed (44%) spend less than half an hour each day on Amazon.com while 42.5% dive into a 30-minute to 1-hour search.

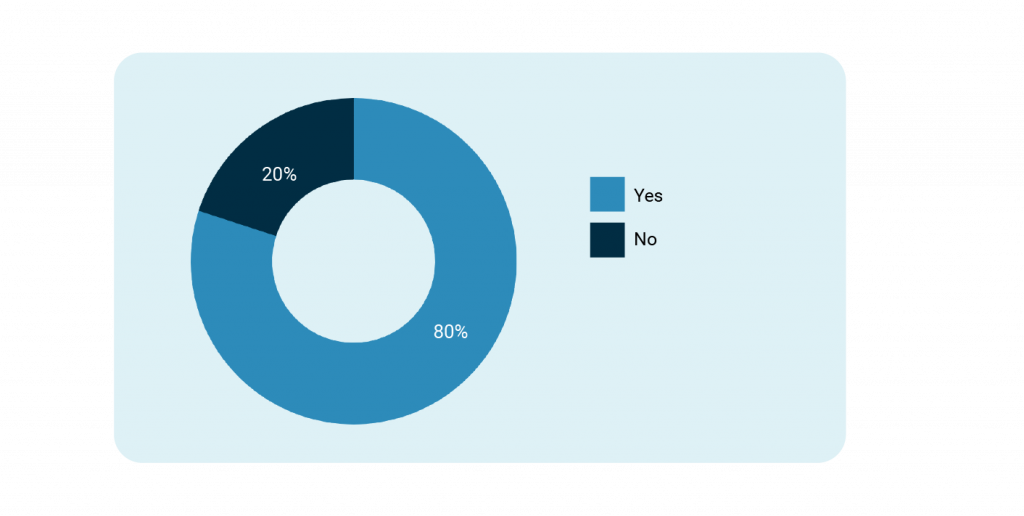

Majority of Amazon customers in the US are Prime members.

Despite the increase in the fee, 80% of those surveyed are Prime members.

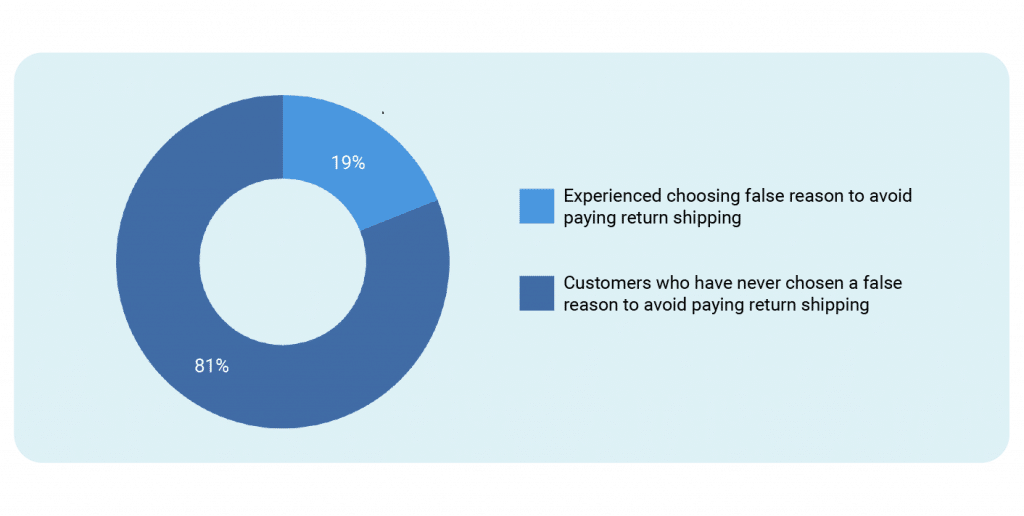

A few customers admit to selecting alternate reasons to justify returns.

Of those surveyed, 18.97% of respondents acknowledged selecting alternative reasons, such as product defects or late arrivals, in order to avoid paying return shipping fees.

However, this percentage is significantly lower than in the previous year's report, where it was revealed that 54% of consumers admitted to providing false reasons for returning products ordered on Amazon in order to avoid paying return shipping charges.

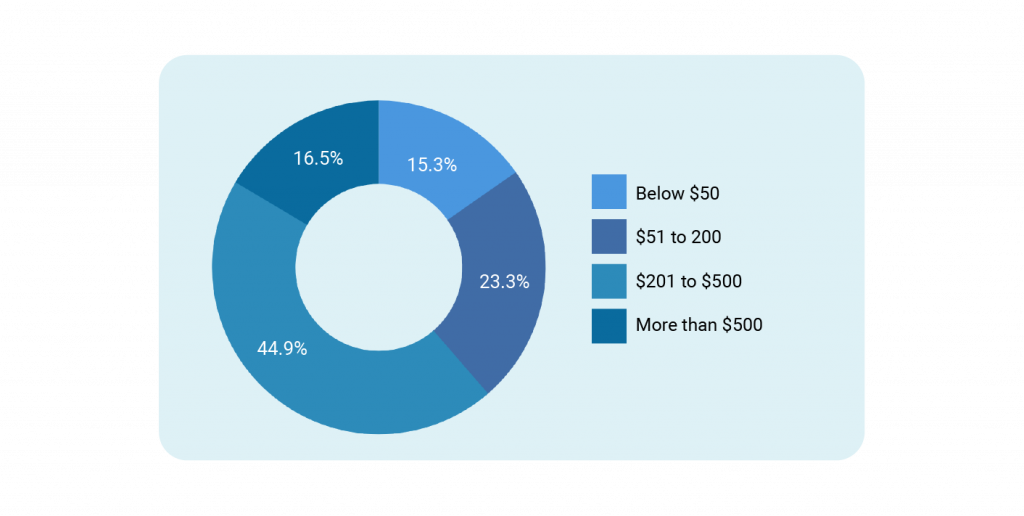

More than half of the respondents spend between $51 and $200 each month on Amazon.

On average, most customers (58.46%) spend between $51 and $200 per month on Amazon while 25.64% spend less. Only a small percentage (1.54%) spend more than $500 shopping on the platform.

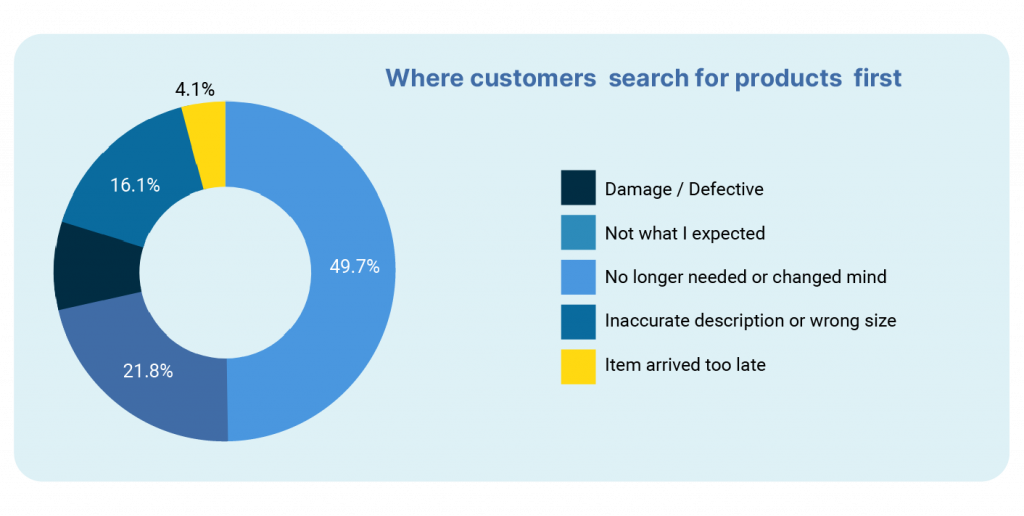

Damaged or defective products is the leading cause of Amazon returns.

A significant majority of consumers (50.26%) cited receiving damaged or defective products as the most common reason for returning their Amazon orders. This emphasizes the importance of product quality and the need for improved packaging and quality control measures. Addressing this issue is vital for Amazon to enhance customer satisfaction and maintain a positive brand image.

More than half of the respondents spend between $51 and $200 each month on Amazon.

The survey results indicate that 37.95% of the respondents consider prices as the key factor, while 35.38% prioritize fast shipping.

The high percentage of respondents who prioritize prices suggests that competitive pricing still plays a crucial role in attracting customers to shop on Amazon.

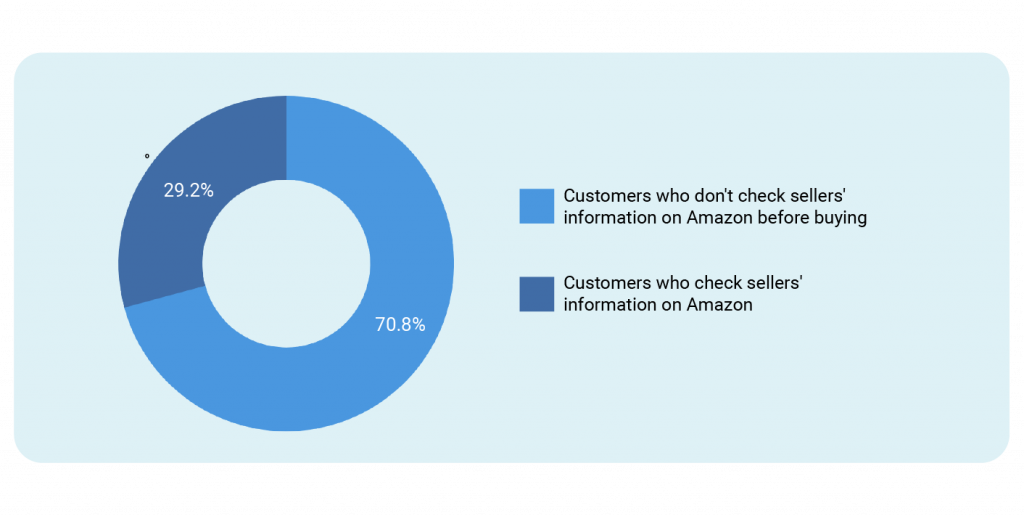

Majority of consumers check the seller's information before purchasing.

Results reveal that a significant majority of consumers (70.77%) actively check the seller's information before purchasing on Amazon.

According to last year's report, 72% of consumers said that they check detailed seller information and examine details such as location or nationality when considering purchasing products on Amazon.

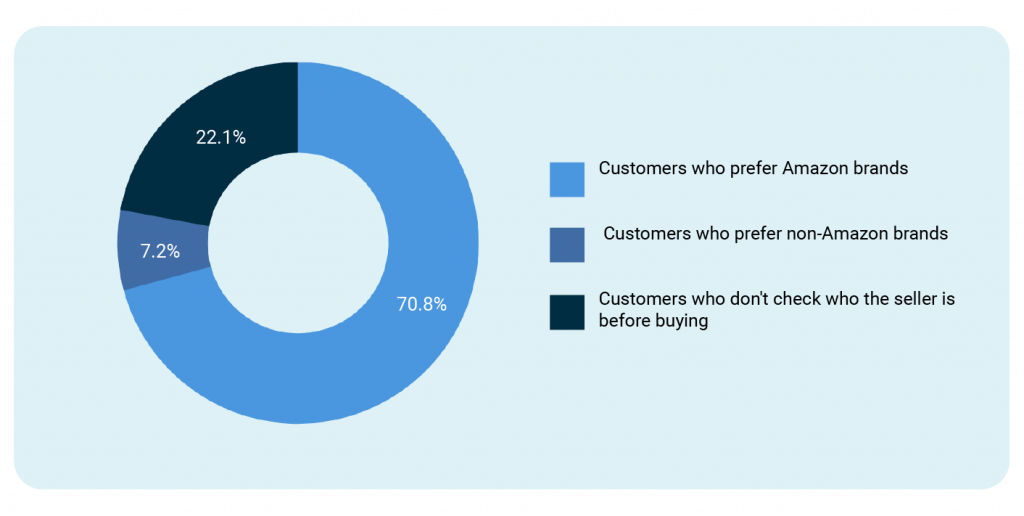

Customers still prefer Amazon brands over third-party sellers.

The survey reveals that a significant majority of consumers (70.77%) prefer purchasing products from Amazon's brand, such as Amazon Basics, rather than opting for third-party sellers.

Last year, when consumers were asked a similar question, 74% said they prefer products labeled as “Ships from Amazon” and “Sold by Amazon” as opposed to products sold by third-party marketplace sellers.

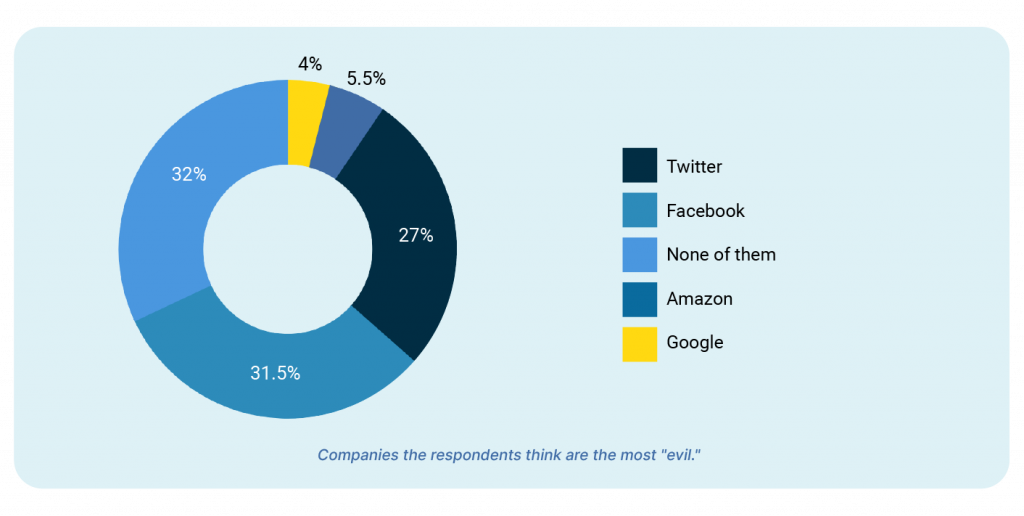

Facebook is considered as the most evil among Big Tech.

In an era marked by wealth accumulation and controversial labor practices, the question of which tech giant is perceived as the most “evil” stirs controversial debates.

When consumers were asked to identify the most “evil” among Google, Amazon, Twitter, Facebook, or none of them, the responses were diverse. Surprisingly, 32% of respondents chose “none of them.”

Facebook took the crown as the most evil, with 31.50% of the votes. Its controversies, ranging from privacy breaches and algorithmic manipulation to questions surrounding disinformation, may have significantly degraded its public image.

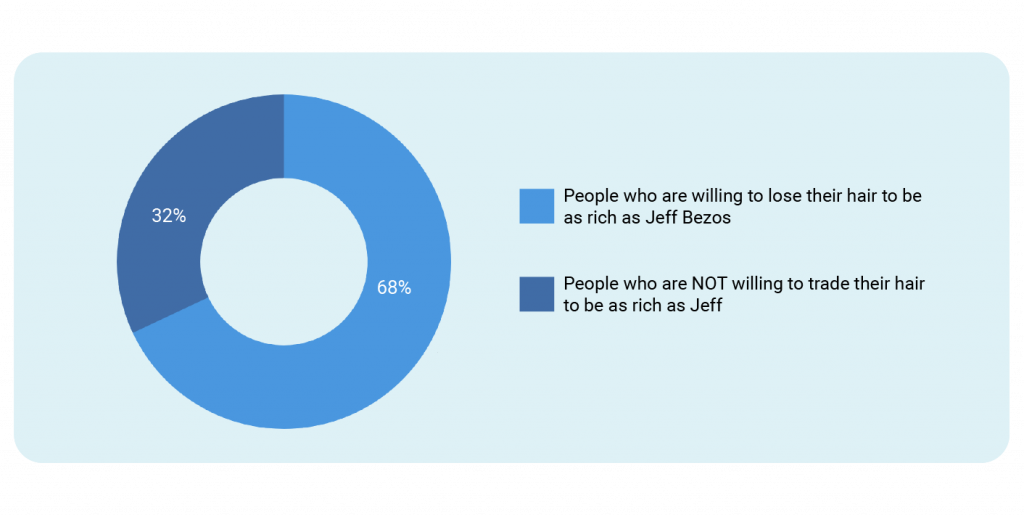

Hair over wealth: Most people are willing to go bald to be as rich as Jeff Bezos!

A whopping 68% of the people we asked in our survey said they'd totally give up their hair to be as rich as Jeff Bezos, Amazon's owner. This isn’t surprising since hair can grow back, but being as rich as the Amazon founder is a one-in-a-lifetime opportunity.

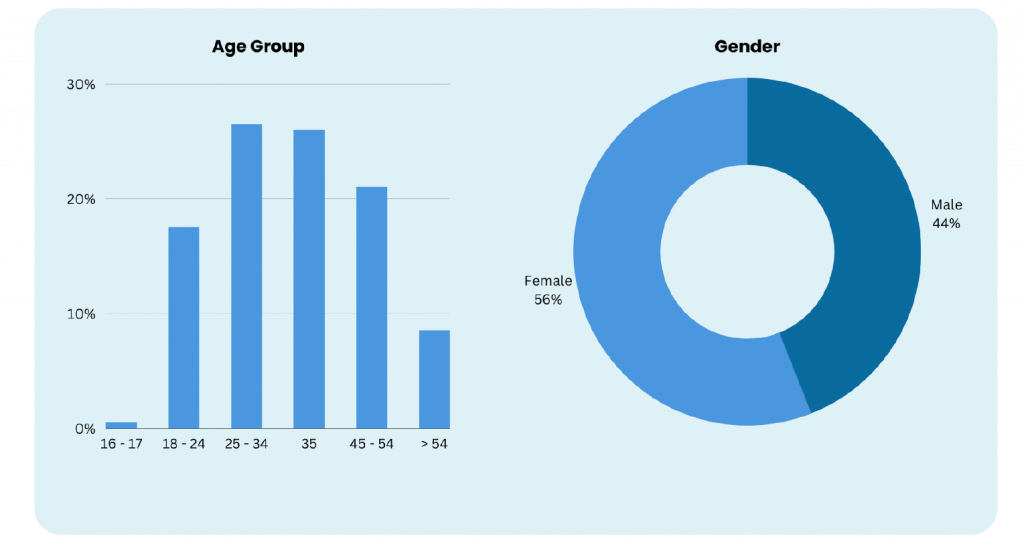

Respondents Demographics

Methodology

This study aims to gather data and generate insights about Amazon consumer behavior and preferences that sellers can use to improve their Amazon businesses. In particular, it aims to better understand how the average Amazon shopper views listings and ascertain which factors heavily influence their buying decisions. To obtain the data, we surveyed 200 Amazon shoppers from the United States using an online market research platform.