How Non-Americans Can Sell Their Products on Amazon FBA

This blog tends to attract a lot of international readers, and one of the most common questions I get is from non-Americans asking how they can sell their imported and private label products in the United States. Readers are eager to access the more than 330 million consumers in the states, and understandably so—the American ecommerce market is huge.

This happens to be a question I am well versed in answering as I live in Vancouver, Canada, and the vast majority of our company's sales are in the US. Almost all of the products we import are warehoused in the US. And no, I do not have a US corporation or some other fancy legal workaround. However, this article will give you a great start on the basics you need to know to start selling in the United States.

Also, let me give the necessary disclaimer and say that I am not a lawyer or a customs broker, so please consult these professionals before relying on the information I outline here.

Common Misconceptions

To begin, let me address a few common misconceptions about non-Americans importing into America.

FALSE: I need to open a US company to ship and sell my goods from the United States

If you are simply shipping your goods to the United States to have another company fulfill them (e.g., Amazon FBA), you do not need to have a US company. Lobbing your goods into some US warehouse to be shipped to Americans is easy. The need to have a US company becomes an issue when you start wanting to work in the United States or employ people there.

If you're Canadian check out our article on the best business structure for Canadian ecommerce businesses.

FALSE: I need an EIN (or W-EIN) to import into the United States

To make a formal entry into the United States (a shipment over $2,500) you need either a Social Insurance Number, EIN, W-EIN, OR a Customs Assigned Number. Thus, there's no need for an EIN or W-EIN if you have the Customs Assigned Number.

The Customs Assigned Number is for people who don't have a social insurance number or EIN. You can fill out this form or, if you're using a customs broker, they will get this assigned number for you and charge you nothing or very little to get it for you. Again, if your shipment is under $2500, you do not have to worry about this.

FALSE: I need to pay US income tax if I sell my goods in the United States

Simply selling your goods in the United States does not normally require you to pay US income tax. There's something called ETBUS (Engaged in Foreign Trade or Business in the US). To be considered ETBUS, you need to meet the following requirements:

- Have at least one dependent agent in the United States. A dependent agent is one who works so closely with you that his or her actions can be considered yours.

- That dependent agent should be furthering your business in the United States, i.e., the job is not limited to admin tasks).

You will be required to pay US income tax if you are ETBUS. But if you have no employees, you're almost certainly not ETBUS.

You will, however, have to pay sales tax in any state your products are stored (which would be 0% if you store them in a state like Oregon with no sales tax) and you can easily register, even as a foreigner, to pay sales tax with local state authorities.

How to Ship Your Goods to Amazon

So once you have your product that you want to sell, how do you get them to Amaozn fulfillment centers?

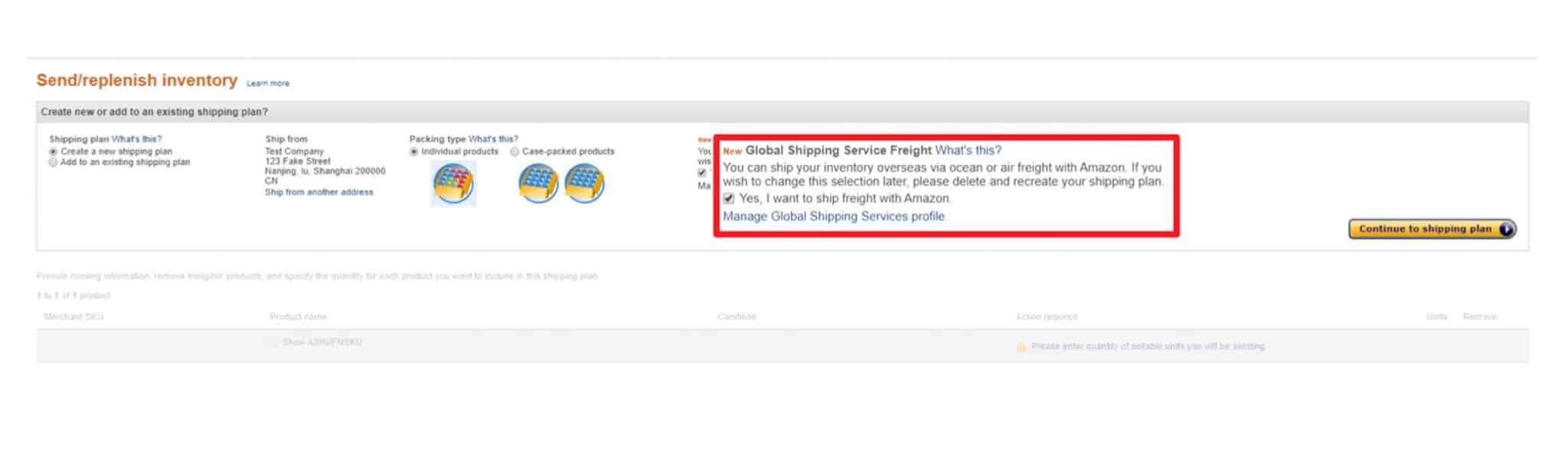

If you're shipping your goods from China to Amazon fulfillment centers in the U.S. the easiest way is through Amazon's freight forwarder (a fancy word for shipping company) called Amazon Global Logistics. See our article on how to use Amazon Global Logistics. With Amazon global logistics, Amazon will handle the sea freight (or air freight) along with customs brokerage. Customs brokerage just means the company that arranges to pay the duties you owe when you import something into the United States. Typically these duties are 0% to 50%.

Amazon Global Logistics really only works if you're importing from China. If you're purchasing your products from somewhere else, for example, if you're purchasing products from Canada and sending them into Amazon.com warehouses, then you'll need to arrange your own shipping. Amazon can't help you.

You either need to use a freight forwarder if you're shipping lots of stuff (Freightos.com is a good choice) or via a ‘small parcel carrier' like UPS, FedEx, Canada Post, etc.

No matter how you ship your products, the big key is to ensure that you ship them to Amazon with all duties paid. For example, if you've ever bought something from another country and had it shipped to you then you know that often you'll get a bill for any outstanding taxes and duties. You don't get the product until you pay those duties. Well, if you ship to Amazon and they get a bill, guess what? They ain't gonna pay it for you. The technical term for this is you're shipping to Delivery Duty Paid (DDP).

If you're shipping via UPS or FedEx you need to make sure you select this option to have the duties paid to you and not Amazon. This is pretty tricky to figure out but it is possible to do. There is good news though – as long as the goods are under $800 in value, there shouldn't be any duties or taxes. If they're over $800 there will be. This is called the ‘de minimis threshold‘. Remember that $800 number. It's very important.

How to See How Much Your Competitors Are Importing from China

Want to see how much your competitors are importing from China?

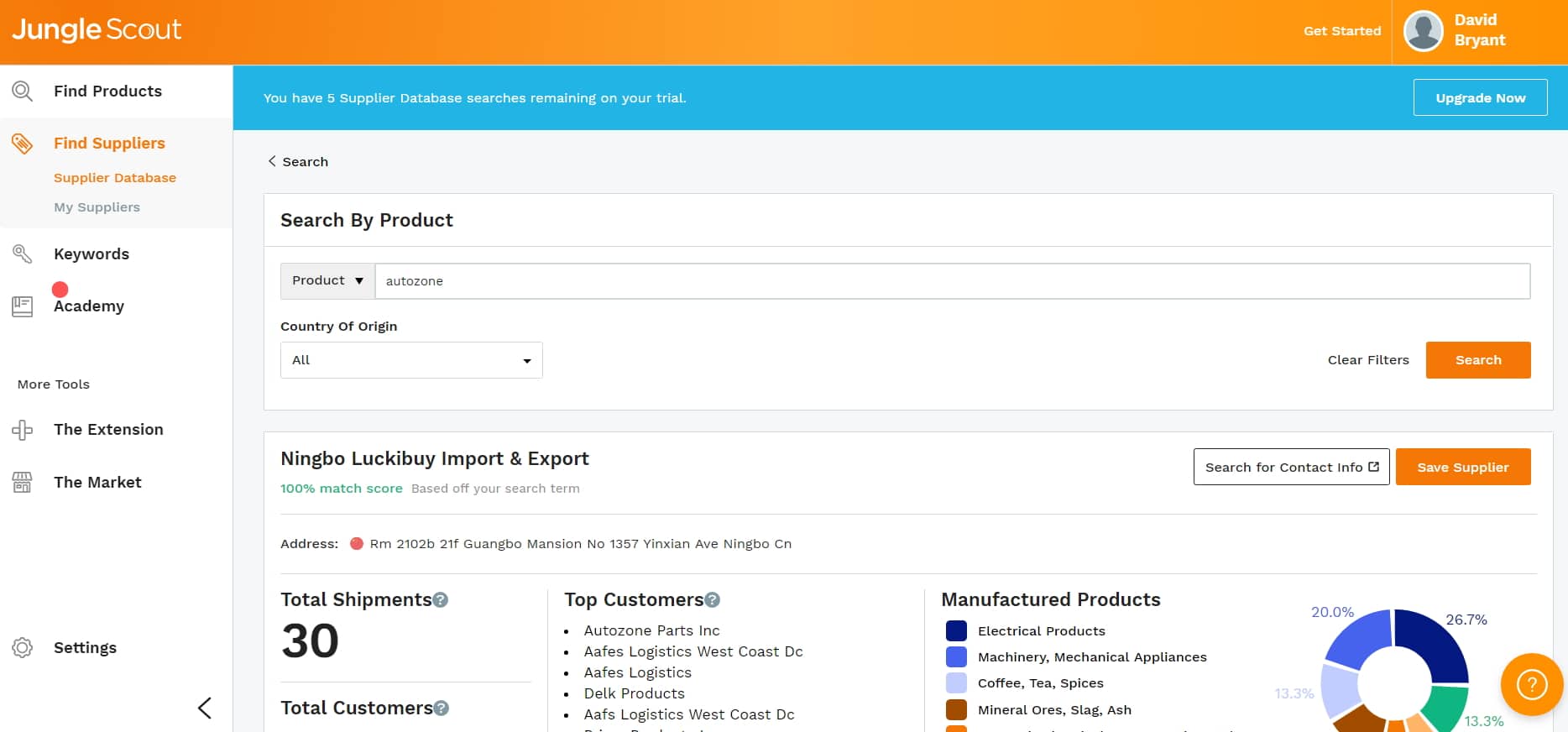

Custom import records are public information in the United States and there are multiple tools that allow you to simply search for a company name and see exactly how much these companies are importing from China.

My favorite tool for this is Jungle Scout's Supplier Database tool which costs less than $50 a month (other more expensive options include Import Genius and Panjiva). These tools will neatly summarize all of the information included on a particular company's Bill of Lading information such as product type, quantity, and supplier name/address.

If you're shipping via sea freight, you're going to need to setup a customs broker account regardless which will make sure you get billed the duties. If you're using Amazon Global Logistics they'll set this up for you automatically. If you're using someone like Freightos.com they'll give you the option to setup a Customs Broker account when you create your account.

A Sneaky Hack for Canadians to Get U.S. UPS & USPS Rates

This one only applies to Canadians. You know that, thanks to the border, shipping anything to the US is ridiculously expensive. However, there are a number of cross-border carriers that will ship your goods from Canada to the US at the domestic United States USPS or UPS rates (plus a small handling fee of $1 to $5). These carriers will pick up your packages in Canada and then drop them off at a postal facility across the border. An example of one of these carriers is Stallion Express.

However, note that this only applies to orders under $800, and this service is restricted to regions geographically close to the US (Vancouver, Toronto, and Montreal all have these services).

Taxes, Legal Requirements, and Money

The biggest headache for sellers used to be Sales Tax as technically you, the seller, would be responsible for collecting sales tax in 40+ states.

Over the last few years, this has all changed and Amazon is the one collecting and remitting sales tax in almost all states. There's exceptions, I'm not an accountant or lawyer, check with your CPA etc etc. but, for what it's worth, the vast majority of sellers do not collect/remit sales tax and leave it up to Amazon.

In terms of income tax, simply shipping your goods from a U.S. warehouse does not normally make you a U.S. company. Therefore, you should not have to pay any Federal Income Tax. Also, the United States has tax treaties with a lot of countries which will likely make you “exempt from U.S. taxes on certain items of income [you] receive from sources within the United States”. Technically, you should file a Form 1120-F with the IRS, which basically tells the IRS “Hey, I sold some stuff in the US. but I'm not paying tax because I'm a foreign corporation.” Again, like with FBA, a good portion of foreigners never file this, although when your revenues get to be substantially large (I'll leave it for an accountant to deem what he or she considers substantially large) you should consider filing such a form.

Money and US Bank Accounts

Amazon allows sellers from most countries to link their local bank account to their Seller Central account and get paid directly into that bank account. And no, it doesn't need to be a business bank account- Amazon will can be any personal bank account. There's good reasons to have a business bank account, but Amazon themselves do not care.

Note that Amazon will convert any money into your local currency. So if your bank account is based in Canada they will convert all of your U.S. sales to Canadian dollars. It does not matter if you have a “US dollar account” in your home country, Amazon will still convert the funds. You might wonder why this matters. It matters because if you have suppliers who you pay in U.S. dollars (i.e. Chinese suppliers) you lose a lot of money converting money from USD on Amazon to CAD in Canada back into USD in China (it's about 10% you'll lose in all the currency conversion fees you'll pay each time).

In this case, you ultimately need a bank account “in the United States”. Again, we are not talking a US Dollar account in Canada – the bank physically needs to be in America. Services like Wise.com can help. If you're Canadian, you can open up a US based bank account at TD/RBC/BMO through one of their subsidiaries and normally online. For other countries, it's a little more complicated but there are options.

Conclusion

One of the strengths of the American economy is how easy they make it for both its citizens and foreigners to do business in their country. For importers looking to sell into the largest economy in the world, this article should give you a good starting point for selling in the United States.

Are you a foreigner selling in the United States? What have your experiences been? Please comment below.

Hi Dave, I was wondering if you could recommend a good US broker that would have the EIN tax numbers for the various FPA Amazon warehouses, I’ve tried several brokers and none of them have this particular information and also I’ve tried to contact Amazon for their EIM/tax numbers and I’ve got no reply. Any help would be a greatly greatly appreciate it… Thanks.

Dave, some good information. Trying to figure out – we’re in Canada, but want to have inventory at a 3PL warehouse in the USA. What would be the declared value of the unsold goods, the FOB price used to import into Canada or possible sales price when we do sell it? Sales price will vary – we sell wholesale.

Hello DAVE,

Would like to ask you about something as an amazon seller.

Iam based in Egypt, and registered my seller account to sell on Amazon US.

Can i do that by FBM, or im compelled to sell through FBA.

Awaiting your kind reply.

Regards

Sayyad

I am based in the UK and want to sell goods to the USA market. I don’t have a physical warehouse, nor do I reside in the USA, the products are shipped by American retailers, so I am like an affiliate. Do I need to pay sales tax in the USA?

Hello David, great article with very helpful insights. We ship globally from Panama and are currently using the Panamanian Post and are considering using a warehouse in Florida.

I contacted Moss Adams for help, the closest location they have to Florida is Houston Texas. When I called, they told me their minimum retainer is $5,000, regardless of what you ask them to do. They have 4,000 associates and I was hoping you would be able to provide me with a direct contact at Moss Adams that is already familiar with this subject and a bit more reasonable in their billing. $1,000 to $2,000 is fine, $5,000 to start talking seems steep.

Thx!

Hello. I got some precious information about starting business in US from this article but my case is a little different. I making handmade items and want to directly sell it to US customers from my website. I am not gonna use any 3PL services or fulfillments, therefore I want to send parcels directly to customers from my country when they placed and paid the order. I plan to using post service and suppose it will be air delivery.

I am struggling with these moments:

As far as I understood the Ultimate Consignee is my customer and I had to specify customer’s tax ID (TIN?).

From American’s buyer perspective does it look like to share “sensitive information” or it is common practice when sellers or companies ask TIN at order? May I avoid this step?

How technically pay US taxes?

For example: My customer living in Arizona and as a seller I should pay 5.6%. I am not an US citizen nor living there, I specified me and my address in the Importer of Record. Also I am not gonna use US banks and will be using billing service from my bank in my country. Customer just paid for the order and I sent parcel.

How and when should I pay US taxes and how customs track it?

How will be distinct steps from this article? Thanks!

Hey Team,

I am in need of some help regarding FBA for United States. We are an Australian Business that sells wild cranberry super powder. It is a wholefood derived product that is not FDA or TGA approved and we make no claims for its ‘health benefits’.

I did two succesfull shipments to United States FBA that were cleared through customs of about 30 x units each. I then did a third shipment of 50 x units. Unfortunatley this did not make it through and it was flagged by customs as they were requesting our FFR (foreign food facility number) # and Manufacturing Address . I was not able to supply them with and FFR # as the product is manufactured in Australia and this number does not exist here in Aus. I was able to give them the manufacturing address though.

Unfortunately, it still did not make it through customs and was sent back to us.

I am wondering if you have any further information or advice on what we should do for our product to be able to get through customs and sell on amazon US.

If you wanted to have a look at our products our website is http://www.mtwilderberries.com.au

Thanks so much

That’s a tricky one and beyond my expertise :( Contact a customs broker here, i.e. PCBUSA.com, and they should be able to help though.

Hi Dave, thanks for the great article. I have a question and a piece of advice for other sellers.

1. Advice: Wise (wise.com) is an online multi-currency bank which recently changed their USD accounts to actually be an official US-based bank. Before we had to have a physical US bank to accept payouts for example from a US-based Shopify store, but as of this development it is no longer necessary. Amazon will also pay out into it in USD, no issue. The account is free, you do not need to open it in person, and it has saved us countless thousands per year on exchange rates, I can highly recommend it!

2. Question:

a. I am a US citizen living in Europe and own an ecommerce business here. You article is about non-Americans, does the same apply?

b. Does all of this apply even if I do not use an official fulfilment center? I have a friend in the US who is willing to store the products at her house and take care of fulfilling orders (paid obviously).

Thanks so much!

1. Thanks! Love Wise as well :)

2. a. Most of it will apply (some variables of course).

b. Depends what aspects you mean.

Hi Dave

I am a small business owner just starting out and I have my own website where I sell lip balms in Canada and the US. I’m a home based company in Ontario and I’ve sent a few shipments to the US through Canada Post, but I’m concerned about the State tax issue. At this point I have not charged my US customers any tax, I had a business associate who said it might be best to withhold tax if your not sure about the amount each State charges. Each of my shipments is approx $20-60 in value which certainly isn’t much money. Is there something I need to do, paperwork I need to file with the US to ensure that I’m not breaking any laws with the IRS? I have scoured the internet for this information but most of the posts I’m finding is about larger companies selling to the States or to Amazon. I’d appreciate any help you could provide me as I’m very concerned about the IRS coming after me regarding the State tax issue.

Hey Dave,

I reside in the US and currently want to start selling at Amazon. I intend to import some clothing item via ups from Africa which will be under $800. Is there any restriction or any other duties or tax i must fiile?

Don’t know about any restrictions (probably not) and no there shouldn’t be any duty.

Hello Dave, this article is really helpful and I thank you for taking the time to respond to everyone’s questions. My question is this: my company is based in Canada and sells fairly high-end product online to customers in the US. Some of this product is manufactured in China. Currently, all of our product is warehoused and shipped from Canada. Some orders of Chinese-made product are under $800 so make it to their US destination without tariffs or duties being assessed. If the shipment is over $800 it is attracting the 25% China tariff which is cost-prohibitive for our customers so we have been paying it but as you can imagine, this eats hugely into our profit margin. I understand that US-based companies are at an advantage when it comes to importing Chinese goods with a shipment value over $800 as the 25% tariff is assessed on their purchase price. To address this (as well as other logistical issues) I have started looking into shipping unsold Chinese-made product to a US-based 3PL but the advice from my customs broker is that the 25% tariff will still be assessed at the price we plan to sell the goods for and not the price paid to our Chinese supplier. Have you any insight as to how can address this tariff issue beyond setting up a US-based business?

Hi Dave,

This article is so helpful.

We have an Australian incorporated ecommerce company which sells womens swimsuits and we are shipping our goods to Arizona for Distribution across the US.

The goods are being manufactured in Indonesia.

Any benefit for for us to open a US company?

Thanks for all the info Dave – great read! Any chance you have worked (or heard of) any other 3PL warehouses besides Amazon that will agree to be the Ultimate Consignee? In speaking with ShipBob, they will not. Ideally would like to store inventory in Oregon like you said.

Thanks

Mike

Ours will be ultimate consignee. I’ve never heard of it being an issue. I’m surprised ShipBob is refusing to be.

Awesome information, summary and to the point. After searching Google on few points for Canadians I finally got answers here, so thank you very much. Great job.

Hi, very interesting article. My situation is this:

Hi, I have read your very useful “13 typical questions”. Question #4 is exact my case:

I am a UE citizen, I live in EU and I do all my work from EU. I do not have office/agents/warehouse in USA. I do have an LLC in NYC (lived here 20 years) and I use my LLC to purchases goods from EU and resell it to my clients in USA.

Is this legal? Can the LLC invoices my clients? Can the LLC be managed by a non-resident living abroad?

Thanks

Hi Dave,

Thanks for the very helpful article! It’s great to come across someone who actually knows what they are talking about.

I am filling in a commercial invoice to send my first shipment of inventory from Canada to an FBA warehouse in the US. I’m using UPS for shipping and brokerage. Do I need to designate a particular entity in the “Sold to” section of the commercial invoice? UPS uses the “Ship to” info by default, but Amazon does not want to be listed as the buyer. Also, what should be the “Reason for export”? The commercial invoice template does not include a “for resale” option.

Thanks for any help you can provide.

Wow. This was super helpful.

I’m just at point where I’m considering a fulfillment centre in US.

I think I just found a way I won’t need to. If I get a fulfillment centre in Van., I’ll just get that service to pick up. I had never*** heard of these solutions. OMG–thanks so much Dave. Wow! How’d I even find this article….I am so thankful. Sincerely, Faith Chipman

Glad it helped, Faith!

Hi Dave, soon a US webshop will be open to sell clothing, I am having a delay on my price tag, is it possible I can sell online products and deliver without the price tag? Of course, price will be on the webshop and also in the invoice. Appreciated your help!

Hi Dave, very interesting post, and exactly what I was looking for. I still have some questions, pretty much just for a condensed conclusion:

I am having a business in Canada, doing e-commerce and ship stuff around the world. Currently, I ship most orders from our small warehouse and some from FBA Canada, but I want to expand to FBA USA as soon as possible. I thought it would be enough to rent a small warehouse in US close to the border where my supplier shipments from China can be received for me, and once or twice a month I cross the border myself for a day or 2 and repackage and label everything for FBA, and then ship it to Amazon from US soil without having my products crossing the Canadian border at all. Can I legally do this with just having an address in the USA, without any other requirements? Because when I read your article it sound just like that – almost too good to be true.

I can’t speak to your situation directly and your circumstances may be different, but it’s what we do :)

Hi Dave,

Need some professional advice for shipping machinery to the USA from China as a DDP shipment being a Canadian company. I am in Vancouver, BC and it would be best if I could directly talk to you over the phone or meet you in person.

Sorry! The only ‘private consulting’ I’m doing right now is for our Premium members. If you can post something publicly here that I can answer concisely I’m happy to take a look.

Hi Dave,

If we are a Canadian company importing frozen food into the US (Using our foreign address as Importer of Record), delivering straight to our customers warehouse (product sold DDP), who should we declare the FSVP importer? Technically we should be the FSVP importer, however FDA is very clear that it needs to be a physical US address. Our customer’s cannot be the FSVP importer as they do not do the full Supplier evaluation..

Thanks!

Hi Dave…your Blog is awesome! I am a new Canadian Importer to Canada and USA for Amazon Canada and USA respectively. My products have yet to come, but will be coming so shortly. I saw your note about the EIN. Recently my Clearing and Forwarding Agent asked me to call Amazon and ask them for “their” EIN number? I saw that in the blog under the heading “I Need a EIN (or W-EIN) to Import Into the United States” you had a link to a form. I had filled it out and had noticed the “Social Security Number” field but didn’t input my SIN there.

Qs1: Am I supposed to input my SIN in there?

Qs2: Shall I call and ask Amazon for their EIN number? I didn’t ask my CF agent what was the need for it? So before I upset the Seller Central Agent, I thought I’d ask you if that’s even needed?

BTW, your blog is AWESOME! It has amazing “life saving” info for a startup. Bless you man!

Enjoyed reading this blog post. Licensed US customs broker since late 80’s here. Launched my own business last year. I have a National permit too. US Customs is increasing enforcement on e-commerce transactions this coming year.

Hi Dave,

If I understand correctly from your post above, reseller certificate is only required for the state you store the products in, would that be the state of your prep centre?

In case of FBA products can be stored on any state as per Amazo’s will, would resellers certificate in one state be sufficient?

Thanks

A reseller certificate isn’t required and only allows you to do things like purchase tax free in that state (if for business purposes). Most of the time you don’t need one, especially if importing from China.

Hi David, thanks for this great article.

I`m Strale from EU, a Non-US citizen. My plan is to ship products from China to FBA US. As I don`t have a company anywhere in the world, am I able to import goods in US or I need to set up a company? When say “to import” I mean to arrange 3pl to do all that stuff on my behalf.

If this is possible, could you recommend any company who does things like this?

Thank you in advance.

Strale

Check out https://www.ecomcrew.com/the-ultimate-guide-to-finding-and-choosing-a-third-party-logistics-company-or-3pl/. Most international sellers don’t setup a U.S. company.

As an foreign importer, is it possible to import food products into us ? After some searching, noted that we will need an agent to communicate with FDA. Understand that the agent must be a local registered company but not sure if works for foreigner importer.

Hi Dave, I am a new drop shipper and am having a hard time finding any definite information on if i should charge sales tax in the US. I am Canadian living in Winnipeg. All of my products are shipping from Ali Express to either Canada or the US. My Shopify account has set up proper taxes for Canada based on the different provinces however nothing is showing up for the US. Therefore, i am confused as i am assuming i do need to charge sales tax as well for the US? I am reading conflicting info on this. Some posts say yes you do, some say only if you have Nexus set up in a particular state. However, in my situation nothing is being stored at a warehouse anywhere as everything is shipping directly from China to the customer either in Canada or the US. Do sales tax in the US still apply? If so, how do i know what to charge since each state is different? I want to ensure i do everything from a taxation standpoint from the beginning.

Also, if my products are under $100, will i be charged custom duties?

Last question, since i am drop shipping directly from China to the customer should i still open a bank account in the US?

Thanks so much for your input! I can’t find this info anywhere and have no idea where to go.

Hi David, thanks for this informative article. I’m a Canadian living in Toronto. I’m in the process of getting my first product ready to be sold in Amazon USA. I know that we have to include a business address on my physical product. I signed up Seller Central as an individual because I don’t have a business set up yet. Should I include my Canadian address on my product or does the business address have to be a US address? Do I have to include the full address like street number? Or City, Province and Country are enough? Is there an alternative? If I use a virtual mailing address in the US, would I have to provide utility bills and other proofs to Amazon to be approved?

Please advise.

Thank you,

Jean

Packaging markings vary by country but normally city and postal code of the official business address are sufficient. This is something rarely checked by customs *knock on wood*

Does the address of the distributor has to be in the US only or it can also be outside de US? For example: Distributed by CompanyX in Australia?

Hello,

Great article. I have 2 questions.

1) Do you need to get your Customs Assigned Number once or everytime you ship goods into USA?

2) Above 2500 usd you need a Customs Assigned Number and Custom bond. Is this the case for both sea and airfreight shipments?

Gr Marco

Hi Dave,

Thank you for the super informative post.

I currently own a business in Canada where our products (mainly clothing) are imported from China. The items are typically shipped to us by air via DHL and we pay duties upon arrival in Canada.

As we are expanding our business into the USA, I am wondering if you can provide me with some insight on the overall workings of that.

We are planning to still import the items into Canada so that we can do an in-house quality check before repacking and sending them out to our American clients. Do you know if we or the client will have to pay duties again? I read that we do not have to report the Export if the “goods that were imported into Canada and are exported from Canada after being transported in transit through Canada en route to a non-Canadian destination;”. Is there a limit for the overall value that we can send at once? Will we have to charge sales tax on the products? Will I need a customs broker?

Thank you in advance for taking the time to read my questions! I’ve been trying to find this information online and it’s been very confusing.

Generally you’ll pay duties for both Canada and the U.S. but can technically claim them back. You can generally send $800 to the U.S. without anyone paying duties. The sales tax question is above my pay grade :)

Hi Dave,

Thank you for the response! Is there a link/source that I can go through regarding claiming back duties? Thank you.

Its pretty formal paperwork as far as I know.

Hi, thank you for your article!

My question is: i’m Using Shopify. Payment will be with PayPal. I registered my business in Germany since i’m German and i’m Not allowed to open a business here in the states. My payment will be with PayPal (German account). I wanted to use transfer wise but it doesn’t work. Having an bank account in the states doesn’t make it easy to get the money to Germany. How will it work with the taxes? What exactly do I have to pay to my country since it’s only registered there but i’m Dropshipping from China to the states? I’m not importing or exporting anything to or out of Europe.

I can not find anything what makes it clear, thank you so much Jenny

Too complicated of a tax question unfortunately to answer here :(

Hi Jenny,

Your situation and mine are very similar. Would love to hear if you’ve made strides towards answering it!

Thank you,

Hi,

I am a Canadian thinking of getting product shipped from China to USA directly. I wanted to mail out orders once received thru our website from our USA place which is just a storage unit. What is the correct way of doing this, Is a work visa required? Will be only doing this once or twice a week ,couple hours per visit. My office is at home in Canada.

Thanks

Really depends on the border guard. There’s no concrete rule here. You’re probably OK but could run into a border agent having a bad day. You’ll need to pay a ‘user fee’ (<$20) each time regardless.

Hi David,

First of all, I would like to thank you for all the great content you have on your blog! I’m so glad to have found it!

I have a question I was hoping you could help me with.

I’m based in Europe and I’m looking to import items into the US to sell to US customers (not through amazon – but through other platforms and my own website). Thanks to your post, I’ve figured out I don’t need to be a registered business in the US to be able to import the items – I just need to ship everything DDP.

My question is about the Ultimate Consignee. Do I have to work with a fulfillment center for this? Or can I have a friend / relative help me with the pick and pack + shipping process for free? What are the liabilities of the ultimate consignee? I believe nothing if I’m the one paying for import taxes and duties in advanced. Do you have any advice?

And the last question: do I need to pay any taxes in the US? or would I just pay the income taxes in my home country? I’m aware there are tax trade agreements between the EU and US, so there should be no need to pay double taxes in both countries. But any advice would be appreciated :)

Thank you in advance for taking the time to read my comment! :)

Regards,

Sofia

Hi Sofia,

TBH, I’m not totally sure the implications of the Ultimate Consignee but I do not believe there are many as Amazon is willing to be it (and they’re very risk adverse when it comes to these types of things). Check with a customs broker to be sure.

I don’t want to give tax advice, but IF you don’t have income tax requirements you will, at the very least, have reporting requirements. And this doesn’t even get into sales tax.

Hi Dave,

All great information! I have, what I hope, is a very basic questions.

A specialized Canadian produce company has approached me to assist them in importing to the United States. They are asking that I assist by signing their import permit, as I am a US resident, and help facilitate their entry into this market by entering into business with them.

The company is making it sound like a very simple task, but I am concerned about liability (legal, tax, etc) of having my name of the permit. Are these issues I should be concerned about? Is this process that simple or is there more to it that the company is missing?

Additionally, after reading this blog it does not sound like they may need to utilize a US resident. They already produce some items within the US.

Thanks for any guidance.

It depends what you mean by import permit. If they are asking you to be the importer of record, then yes it can have fairly deep consequences. I believe it only extends as far as duties (and remember, CBP can audit and go after back-duties just like the IRS can for taxes) but it may go deeper than that. I’m not totally sure how far the liability goes.

Hi Dave,

Thank you very much for your post.

I want to bring clothes from Brazil to sell in US stores (not Amazon). Do you know what I need to pay here as taxes, fees, etc.? Do I need to open a company? I doing some research but not finding any help.

Thank you!

Great post. I have a thriving company in Perú and now i want to start selling in the US. I’m planning on sending a partner there (which is not an american resident, nor a citizen, but is in the process of becoming one) so he can distribute our products there. Which way do you recommend as to go, working with Amazon, getting another Warehouse, or maybe distribute them personally. Will i need a bank account in the US? Or payments can be made through our web via Paypal without any issue. Thanks.

Hi Sebastian,

You can sell on Amazon without any presence in the U.S.. A foreign company and foreign bank account normally suffices (assuming Peru is one of the permitted countries according to Amazon).

For Canadians, RBC has a cross boarder account, I’m assuming that should work for this purpose too? But it does cost $40CAD / year.

https://www.rbcbank.com/cross-border/us-bank-accounts.html#new

Yes, it works, although they will force you to get a business account once your transaction volume gets too big.

Hi Dave,

I just incorporated in Canada, and so I am looking into opening a Business checking account with BMO Harris. However I see all their Business Checking accounts have a foreign transaction fee of 2.8%. My suppliers are in China. If you pay by PayPal, Transferwise, it will show the merchant location to the bank, so if applicable, they will charge the fees. It is a bit confusing though, it seems it may only be charged if a debit card is used or for ATM use, but it also says “remotely from the US”.

So I am wondering if you have been hit with such fees, and if not, does your schedule of fees mention the 2.8% foreign transaction fee?

Hey Dave

I am a canadian Citizen and wanna import my books to USA from Iran.I arranged with tranportation company and broker in Sanfrancisco!But she told me you should put some one name here who has social security number and I

Thought to put my friend’s name who is American for delivering my books under his name!

Do you think this is fine ?! Or US will tax him for my books?

I opened a new RBC US account which I received my bisa debit and my credit card for US to use here!

Just plz let me know about putting my friend’s name for US Sanfrancisco airport costumes ?

Also after I sold my books,should I only declare that to Canada as my income ? Or USA ?!

As I might get my Green card here around end of 2019 fall ,but I am not sure yet!

Thanks for helping me

Pa

The importer of record (i.e. your friend in this case) will be liable for any unpaid duties. This is a sensitive area importing from Iran due to sanctions so I want to be careful what I tell you one way or the other.

The taxation issue is beyond what I can answer in this comment :)

Thank you so much for this information. It clarifies so many doubts. Just to be clear, I would like to ask you a few questions, for which ill give you background. I´m a young entrepreneur looking to build an FBA business from Venezuela (Im aware of the fact that Im not on an approved country, but I do have a US address and bank account so its ok). Now my questions are, and thank you in advance:

1) Once I pay the manufacturer, do I need a freight forwarder to complete my customs duties and such or can I just pay FedEx or UPS to send them directly to the Amazon warehouse? (My orders will be less than 2.500$)

2) If I set up my seller account with a U.S address, but put my Venezuelan address on the Importer record, will that get me any legal trouble?

3) Should I pay a China to US freight forwarder to do the procedure? If so, which would you recommend?.

Once again, thank you so much for all the help!.

Best regards,

Marco.

Hi Marco,

Sorry for the late reply.

1. Yes, FedEx and UPS can normally handle it under $2500.

2. They’ll either reject or accept you Venezuelan address as the Import of Record when you submit customs. Having a customs broker (NOT UPS or FedEx) eliminates any issues here. Amazon though doesn’tcare.

3. A freight forwarder is one relationship you should develop early…they’re cheap and will save you a lot of trouble. Try PCBUSA.com (and let them know ecomcrew referred you :)

Thank you so much for providing such detailed information!

Even worth more than the ebook I’ve bought!

Thank you :)

Dave,

Amazon says they may be listed as the Ultimate Consignee but only if the if the name of the Amazon entity is followed by “in care of FBA” on the shipping documentation.

Do you know what shipping docs they’re referring to and do you do this yourself?

Thank you.

This is normally your customs import documentation that will be done by your customs broker.

Hi Dave,

Very good article. What If you don’t need a warehouse in the US, and simply just want to sell and ship your products directly to US consumers from the country your business is based?

Do you still need to worry about sales tax then? Or is imports/customs only the “barrier”?

Best,

Johan

I don’t know what each individuals state tax rules are (they could be different) but I know often it’s the individual’s responsibility to self report in these cases (which of course no one does lol).

Hi David,

Thanks for putting out quality information on a rarely touched topic.

As we approach 2018, is PCB still your recommended freight forwarder/customs broker? Any opinions/experience with a company called Flexport or any other freight forwarders?

Also, did you complete a power of attorney form for your broker to act on your behalf? Should one be mindful of anything when completing a POA form for this purpose?

Do you use your Amazon seller (display) name or your company legal name for shipping paperwork (IOR, BOL, POA)?

Thank you.

Yes PCB is still very good. I’ve heard good things about Flexport but never used them myself. POA is pretty standard – I’m not aware of any issues. As far as I know, BOL and POA have to be your company name not Amazon seller name.

Flexport is very good (you need to attend their webinar to get your account setup) — have used them several times and the customer service is great also. Prior to going with Flexport, I heard good things about PCB so I emailed PCB several times with general inquiries to test how quickly they would respond; unfortunately, I never received any response from them on numerous attempts for simple, straightforward questions.

Thanks Victor – that’s disappointing to hear about PCB and thanks for the review about Flexport! PCB has always been very responsive to me but perhaps you got the wrong person. I’ll keep my eyes/ears open for any other similar comments in the future to see if you were the exception or the rule for new customer service.

Hi There!

Great article, thank you for that. I am a US citizen and would like to sell goods from India (I visit there a lot and have some supplies for clothing that I want to import into the US and sell there here). Can you let me know if the process is simliar and what would the differences be?

Can’t speak from experience, but there shouldn’t be any differences.

Hi Dave,

Thank you for writing up this article, it definitely touches on some concerns I have. I’m also in Vancouver, I have had a e-commerce business in Canada for about 2 years now. I recently started shipping my products to a US warehouse (not FBA) to expand my reach. I’ve been importing a bunch of goods into Canada and then repackage them in smaller shipments and ship them to US from Vancouver. What I want to do next is shipping directly from my Chinese suppliers to the US. Most shipments go by either DHL or UPS air. If I read your article right, it doesn’t matter where I ship from, if it’s under $800 or $2500, I should be able to clear customs without an EIN, is that correct? Currently I’m using the supplier’s DHL and UPS account, should I be using my own DHL and UPS account in case I get hit with duties and taxes? I currently use their brokerage service to import to Canada. Can I use the same one to import to the US?

Thank you in advance !

You don’t need an EIN regardless – there’s non-resident import numbers you can get either on your own or through a customs broker like PCB.ca. But yes, the $800 number is important to avoid duties and needing formal clearance into the U.S. (that $800 ‘de minimis’ number is only $20 in Canada). If your Supplier trusts you they can ship “ddp” and simply have all the taxes/duties billed to them and then they’ll charge you for them but if the goods are under $800 this doesn’t matter.

Awesome post! I’m actually going through this process right now, I’ve been reading for hours upon hours on this subject. I’ve hit a large roadblock right now. I’m Canadian and I’m looking to import from Hong Kong to the US, and in to a fulfillment center. I requested the fulfillment centers US Tax ID but they will not issue it for use on my import. I contacted 4 other fulfillment centers, and none of them will allow me to use their Tax ID also. I’m not looking to create a US corporation, as I already have one in Canada. Any suggestions? Thanks!

Hi Dan,

That is bizarre – I’ve never had a problem with any 3PL providing this. Even Amazon will provide theirs. I suspect there’s some miscommunication happening. Make sure you mention you want them to be the ultimate consignee, not the importer of record.

Hi David,

Such a blessing that I get accross your article! I want to ask, Amazon is requiring sellers now to have an EIN and sign the W8BEN if you are a foreign seller who wish to sign up with them. From what I read, W8BEN means that you are claiming excemptions or deductions if treaty is existing for your country. I am from Philippines and lives as an expat in Singapore. I am planning to dropship items from China to USA FBA. The thing is, Philippines has a treaty with USA and I can claim tax deduction of 15% (which is a relief). In addition, I also don’t have to pay PH tax because my income is not sourced from PH. Where should I file the other 15% due for US? Will amazon be witholding it for me (directly deduct from my gross profit) thus I need to submit another form to them? Or do I even have to pay income tax at all? I want to set things right from the beginning to ensure to troubles in the future. I know that the best course of action is to seek advice from an accountant. But I am just an individual (not a business yet) trying to get into this thing.

Thanks in advance for the help!

I could be wrong, but I believe Amazon requires an EIN OR to sign the W8BEN (not both). I have no idea about the Philippines tax/treaty law, but you need to pay tax to someone. This is why tax treaties exist. If the Philippines is like Canada you would normally pay tax in the Philippines. Although you’re not selling the products in the Philippines, all of your work (which is the main cause of your profit) is based in the Philippines.

I accidentally found your blog as I have been frantically trying to find some solution to my slightly unique problem. I apologize in advance for being so detailed. I could not make it short as I must explain the situation in detail to get the full view of my confusion.

Background:

I am a US citizen from Seattle. I have been in India for some time researching on sustainable products that I could sell in the US market. I am now designing and developing samples for organic cotton infant clothing line.

As I have a resident status here in India, my initial plan was to design and manufacture in India and export to my buyers in the US. I would take samples every season to the US, get orders, return to India, have them manufactured and ship to the buyer. I registered as a sole proprietor company India with this plan in mind.

Being brand new, I know that I won’t get huge bulk order yet and later I found out that no Us compliant and certified manufacturer was interested in smaller MOQs. Also, they refuse to sell it to any domestic company like mine due to export drawback subsidy incentive given to exporters by Indian govt. So I have now decided to make a larger sample order at the sampling rate and have them export to the US. I could just sell them over the counter with minimum margins to the boutiques and stores so they can try a smaller order. This will get me an initial foot in the door orders.

Question:

Here’s my question and confusion: If my factory wants to be the exporter from India, how can I be an importer in the US without registering a company in the US? As a Us citizen can i import it without a business tax

identification number? I can be present in the US when my shipment arrives so will be able to receive my goods and not send it to warehouse or fulfillment center? I can have it stored in my cousin’s garage for a short period of my stay in the US – as it will be a limited stock quantity (about 3000 pieces of tiny infant clothing).

Lastly, can I sell to the boutiques over the counter with the invoice from my Indian company? Will there be a sales tax? I don’t want to register another company in the US just yet. It will cause double tax for me and delay in setting up while I am in India. I could miss the season. If I can work around it and still be able to import and sell in the US as an Indian company, that would be great.

As per this blog, foreign importers in the US are able to send the goods to fulfillment centers. My story is slightly different as I am a US citizen with a registered foreign company and I want my products to be imported in the US and be send to me so I can sell them under the invoice of my Indian company. How does all this work? Please advise.

Thank you so much.

Hi Reshma,

Far too many questions unfortunately to answer in one go and way beyond the expertise of this blog. Yes you can import as a non-resident importer – you get whats referred to as a Customs Assigned Number. Your Indian corporation is an entirely different entity than you so whether you’re American or Martian should be irrelevant. Don’t quote me. I’d speak to http://www.pcbusa.com and they can help you with all the nuances. The tax questions are getting way beyond the focus of this blog – you’ll need to speak to an accountant, mossadams.com specializes in this type of thing. Expect to pay about $400/hour though.

Thanks a bunch Dave. Apologies to have many questions there. Appreciate your reply despite the long read

Hi David,

Thank you for the great article, I was able to find lots of info I was looking for.

I have been selling on Amazon FBA Canada for a year now and would like to expand to .COM

I am still trying to complete the puzzle and still confused with regards to the EIN account and sale tax.

When exactly an EIN account would be needed? Would I need one if I will use DHL/UPS to ship DDP to Amazon FBA small boxes (10Kg and 100 items)?What exactly determines the value of the shipment? IS it the inbound shipping oder created on Amazon or the supplier invoice when I receive it in Canada?

With regards to sale tax, will Amazon add the sale tax automatically for the items sold in those states? I am still under 30k anual sales and not charging sale tax in Canada. How do you file the sale tax in USA?

EIN you should not need – you’re a non-resident importer. The supplier invoice determines invoice value. Amazon can charge sales tax but it will not remit it- that’s up to you. That involves reporting to each state authority (like you would for PST or GST for example) and way too big of a topic to answer here.

Hi David, I’m a Canadian that recently incorporated a company federally in Canada for the purpose of starting an Amazon.com FBA business. Does your ebooks address how to set up an Amazon FBA business for a Canadian corporation? Ideally I’m trying to do everything through the corporation but I’m hitting two bumps in the road: i) to set up an Amazon Seller’s account requires a credit card which my newly created company doesn’t have so is it okay to use personal credit card or should I investigate how to open a business credit card?; ii) I too didn’t like the exchange fees incurred on switching back and forth between USD and CAD so I’m following your guidance and I’m working on opening up an account with BMO Harris. Correct me if I am mistaken but it sounds like you opened a personal checking account from BMO Harris, so is it advisable to use a personal checking account from BMO Harris for my Amazon Sellers Account? I’m trying to request a business checking account for my Canadian Corporation but the bank is asking for an EIN. I apologize for throwing a lot out there and I deeply thank you for the valuable information you’re provided on this website to help entrepreneurs import products from China.

Tai

The ebook doesn’t go into detail about this. With that being said, don’t get hung up on opening business bank accounts/credit cards/etc. until you have some real revenue being generated. Use your personal accounts. Especially on the U.S. side of things, it’s very difficult to get U.S. business bank accounts/credit cards, especially until you have an EIN.

Just read that the state of Virginia does not consider consider the practice of storing product in warehouses as creating ‘nexus’. If this is true, I presume no sales tax requirements. Can anyone confirm this?

Hi Mike,

Can you share where you read this?

Hi David,

I have an EIN linked to a sole proprietor business outside the US. I want to ship goods from China to my US address (NOT AMAZON FBA).

Can I use my EIN for this? (Ultimate Consignee)

How will this affect my tax obligations?

Will this be seen as working and receiving income in the US by IRS?

I’m not sure but most 3pl’s are happy to give you their tax id and be the ultimate consignee (in fact I believe Amazon will be this as well). I’m not 100% certain but I do not believe this will have any impact on your notes states income tax liabilities.

Hi David,

First and foremost, thank you for the great article. I found it very informative and put me at ease as I am looking to get into selling through Amazon FBA and I live in Toronto.

From what I’ve read above, it’s clear that on the US end, all I’ve got to worry about is sales tax in the states where my product will be stored (if that). My question is, now when filing income tax on the Canadian side what are the types of things I should keep an eye on? Are profits made in selling products in US on Amazon considered capital gains for my Canadian income tax? I’d appreciate your insight on this.

Thank you in advance,

Marcin

Hi marcin,

If you’re based in Canada then your profits/losses in America are part of your company profits in Canada.

Hi David,

Great article and on a side note fantastic book (Importing from China is Easy), read it on Amazon kindle, that’s how I found your website.

I had a question regarding paying for customs duty via air express (DHL, UPS etc). It’s something that’s worried and confused me for a while. I live in the UK and plan to ship goods from a manufacturer in China to Amazon fba warehouse in the US. If I understand correctly the Importer of record responsible for duties cannot be Amazon and will need to be me (my name and UK address on the form).

Now when I pay the Chinese supplier the agreed price for the manufactured products and the shipping fee quoted, am I right in saying customs duty will need to be paid once the consignment physically reaches the US and not before (i.e in the air)?

And If so how do I, in the UK, pay/be billed? Am I paying the courier or customs directly? As the only information they have is name and address, will they send me a letter? (which would mean I would incur holding fees?). Would they give me a phone call? (although I could not see an option for telephone in the IOR section in your image). I’m about to pump a large portion of my savings into this, so I’m nervous of my goods being rejected, thus incurring costs I cannot afford?

Thanks and sorry for all the questions.

Osman

Hi Osman,

You need to make sure the goods are delivered DDP (delivered duty paid) which you can request with DHL/UPS/etc. essentially meaning they’ll bill you and not the addressee (aka Amazon). Make sure your Supplier truly understands what you mean when you say DDP, other wise call DHL and setup an account and they’ll walk you through how to do a DDP shipment.

Hi David, thanks for the reply.

I spoke to DHL (UK) this morning. They called me after I registered an interest in setting up an express account. I spoke to their Small Business Export Advisor and told them I’d be shipping private label products from China to the US for the Amazon.com marketplace. I explained the shipping terms would have to be DDP and I would be the IOR (Importer of record) as Amazon cannot be the IOR and rejects shipments if duties & taxes haven’t been paid. I asked them how I would go about paying customs duty since I’m in the UK and the shipment is being sent door-to-door (China to the US).

They told me this is called 3rd country shipping, which they don’t do. And because you can only open an account in the country you’re based in, I couldn’t open an account with DHL (US) as I wasn’t a resident. I was told the only work around would have to be sending the shipment to the UK from China, then onto the US. I’m so confused since I’m obviously not the first non-US resident to be selling into the amazon.com marketplace.

Thanks.

Osman

Hi Osman,

Thank you for the detailed response! I must confess, our company has a Canadian and us ups account (we’re registered in both countries) and I wasn’t aware of the issues in shipping to a third country like you mentioned. I guess in that case you would need to have your supplier arrange shipping or use a third party freight broker. The other option would be air freight and formally clear customs into the us yourself through a customs broker, but this would cost more for smaller shipments.

Hi David,

Does the below make sense to you in terms of importing from China to the USA as a Canadian as a possible option:

I’m Canadian. Going to ship product from China to US (California) directly to my fulfillment company (not FBA). The fulfillment company will pick the product from the master carton and ship to the customer. I will be incorporating federally in Canada and then setting up a foreign c corp entity in the state I create nexus in (California). I want to avoid the hassles and do it right by setting up an EIN number since it appears to be easier to have one in the long run. I will be setting up a virtual mail address locally in Canada to be used as my corporations address. I will also be using a registered agent service as it is a requirement in California for all legal docs and state notifications. I will consult with an accountant but I know that I will be entitled to a foreign tax credit from CRA against the corporate taxes paid in California. Also learned that if setting up as an LLC (which I’m not) as pass through, CRA will still treat it as a separate entity and therefore you will not be entitled to the same dividend treatment as Canadian Dividends when divends is paid out. I will be collecting sales tax from California customers only and remitting to the state. I will also be shipping a smaller portion of product from china to my home in Canada so I can have stock ready for Cdn customers which I will manually ship in the beginning.

I will also be using a customs broker and freight forwarder or courier depending on final weight of shipment which is TBD. I will setup a US Bank business account and have all money deposited in there from sales of the product. All US expenses will be paid by that account as well. All cdn expenses will come out of my Canadian corp business account such as accounting fees, or CDN customers. If I need to transfer money from us bank account to Canadian account I will write a cheque or wire money or transfer to a US dollar account if it’s the same institution. I.e. TD.

If I need to use fba in the future then I will need to consider shipping to a 3pl in California preferably and then to Fba.

This is the approach I am thinking of pursuing. Does it make sense? I plan on having my non fba for product that is sold from my site and fba for all Amazon purchased product. I could in theory have the product shipped to a Canadian address first in bond and then prepped for Amazon, take some product off the pallet and then send the rest to fba and my fulfillment but it sounds so much more complicated that way.

Trying to find the simplest method.

Hi,

Way too much detail for me to analyze in a comments section but you’ve clearly given it way more thought than 99% of other people which is either good or bad. Make sure you don’t get stuck in paralysis by analysis and make sure you’re spending the VAST majority of your time on selling products and not all the legal and accounting mumbo jumbo which creates 0 revenue for you.

Im actually a Canadian selling products in the US for the past few years as well, great article you have here, I wish I would have saw this blog when I first started out years ago haha.

Im now starting to get approved for wholesale accounts from big brands and one of the things that some of them ask is a resale certificate, whats this certificate do and can you easily get one in the US as a Canadian company?

Thanks!

resale certificate in most cases is basically to make the sale sales tax exempt. If you’re shipping from Canada you can just say you don’t have one. If shipping from the U.S. you would need to register for a tax ID in the state your goods are stored – if you don’t want to do that try just telling them you don’t have one.

Hi David, this is great and concise info, thanks! I’m looking to dropship from China and was trying to find any info if as a non US citizen/resident I needed to open an LLC in the US (WY or DE), but I saw some info that led me to believe I didn’t have, and your article seems to confirm it. The IRS allows for foreign entities to apply for an EIN for banking purposes. Is this the route you went? Also, did you have a mailing address in the US (even if it’s a mail forwarding service) to use as your US-domestic address when signing up for Amazon, Paypal, banks, etc?

You can sign up for personal bank accounts in the U.S. no problem without an EIN. I’d have to have someone confirm but I believe you may even be able to get a corporate account, but I could be wrong. Either way, Paypal and Amazon can both withdraw to a Canadian bank account although they have to convert your US dollars to local currency.

am just wondering if President Trump of the United States does what he stated in his campaign…adding a 45 percent tax or tariff on imported goods that it would make importing from china to the united states futile and other distribution points like Canada would be an option..the question i guess really is if american consumers would continue to purchase chinese imports regardless of the distribution point and how that is all tracked to levy the tax.

If you mean importing from China into Canada and then redistributing to USA, it wouldn’t make a difference. The goods are still considered made in China (and NAFTA DOES NOT apply). With that being said, it’d be very difficult for Trump to single out China due to the WTO (he could pretty easily impose across the board increases though to all countries).

Hi David,

Thanks for the valuable information.

I am from Winnipeg Canada, i found very little information about i can i start an amazon fba business in US from Canada. But your article is very informative and valuable.

I would like to know if i start my Amazon FBA business from amazon.ca, do i need an import license to get my products in Canadian Fba warehouse from China?

Thanks

If you have a Canadian business, your business number is the same number you use to import. You can technically import your goods personally without ever getting a business number but as you’re importing them for commercial reasons, you officially need a business number. Regardless, you should get a business number as it costs next to nothing to get and you will need it at some point in your business career :)

Hi David,

I was hoping you could help me with any information you might have or to assist with pointing me in the right direction to find it. I’m actually trying to research this for a friend of mine who currently runs a business in Canada and would like to bring a team from Canada to sell his products in the US at certain events. How would he go about doing this? Does he need to obtain a work permit for himself and each member of his team? I tried to look into this but I couldn’t find one that applied to his situation as an entrepreneur. In which case, would he need to incorporate his company in the USA in order to be able to sell his products in the USA?

I’ve spent countless hours trying to obtain more information so any help would be most appreciated.

Thank you.

Hi Michelle,

Unfortunately there’s no easy way for a canadian to sell products at a u.s. trade show. You can accept purchase orders at a show (and then process the payment back in Canada) but not sell products for immediate payment.

Thank you for getting back to me on this. I appreciate your input. By the way the title of your post “NI HAO DONALD TRUMP – THE IMPACT OF TRUMP’S ELECTION ON IMPORTERS FROM CHINA” totally cracked me up! I barely speak or understand Chinese myself (even though I am Chinese, I think you are probably more Chinese than me) but I did understand “NI HAO” and thought it was hilarious!!!

Thanks again!

Hi David,

Wonderful article, thanks for writing it!

I’m wondering if you have had any experience dealing with DHL or FedEx or UPS as a complete supply chain solution?

I am based in Australia and I am looking to import goods straight from my manufacturer in China to the US. The goods will already be pre-sold, so as soon as they arrive to the US, they will be sent straight out to customers, without being put into storage. There will be quite a few items, a 40ft container load. Have you dealt with any of the aforementioned delivery services whereby they assist you from the time the goods arrive in the US, including customs clearance, unpacking from the container, processing the individual items, and then distributing around the US to the individual consumers who have pre-purchased the items?

Because the items will be sent straight to the customer, it seems that using a designated 3PL warehouse is a waste of money.

Your thoughts are highly appreciated.

Regards,

Jordan

Hi Jordan,

If you need someone to basically help you get a container of goods from China to your customer in the U.S. a freight forwarder is going to be your better solution than UPS/FedEx/etc. simply for the fact they’ll be able to offer more bespoke service to you (good looking having one rep be your point of contact for you with UPS).

Keep in mind, no matter who you’re using, most likely you are basically going to be using a 3PL (whether that 3PL is owned by the freight forwarder or not) and you’re going to be charged appropriately so. However, what you’re trying to do is very common (especially with FBA sellers nowadays) however, normally people use a freight forwarder to get the goods to the 3PL and then have the 3PL handle all of the shipping on to your customers (cross-docking).

Hello David,

I have a question. I am from Bangladesh and I want to export product to USA from China. I want to use PCB as you suggested before, but the problem is I can’t find their rates. Can you help?

Thanks

Kawsar

Hi Kawsar,

They’ll have to answer that themselves, but brokerage normally costs about $200-$300 per shipment plus duties.

Hi David

Thanks so much for this article, very eye opening.

I was just wondering if you could shed some light on my situation and hopefully help point me in a right direction as I am quite worried about my situation and thank you for your time as I hope to not be too long in my message:

I signed up for Amazon FBA as an International Seller last year May. I am a South African living in China. I signed the famous W8BEN form, then was allowed to start sending goods to FBA and start selling in the US. I immediately started to send goods and start selling. I contacted Amazon Seller Support a few times to confirm that I don’t need to file for any form of tax and they kept reassuring me that I didn’t need to (I guess they thought i was just listing and drop shipping from China and not using FBA).

I am not registered as a business anywhere in the world and have been selling individually. I have a “business” partner who is an American Citizen and its his bank account that we have been using to get the disbursements from Amazon.

Over the course of the year we have sold over $200 000 in sales and just under $100 000 in estimated profit.

The other day we found out that actually we are liable for paying all sorts of tax.

So my question was, what is the best course of action here do you think? Should my business partner and I register a business in the US, open a US bank account, file for EIN and then pay all the outstanding Tax?

OR

Is there a easier way to handle dealing with all this?

Thanks so much for your time

Kind Regards

Richard D

Hi,

I’m not an accountant, but a couple of things: 1) where are you paying income tax on the $100k of profit? If you’re not paying any income tax, then you’re evading tax somewhere :) If you are paying it, the chances are good that that country has a tax treaty with the U.S. and you’re not required to PAY U.S. income tax (but you are required to claim the treaty benefits). In terms of sales tax, you have a lot of obligations in various states to file u.s. sales tax. With that being said, the VASTTTTT majority of FBA sellers (u.s. or international) never pay this. You be the judge if you want to file or not.

Hi David,

Thanks for the extensive detail of dealing with US business as a Canadian based company.

Couple questions if you don’t mind helping me with:

1) I’m based in Toronto Ontario with a warehouse in Dallas Texas selling wholesale shoes in the US. I do have some store owner asking me for my Tax ID…How would I deal with this?

2) How did you open BMO US account?

Thanks

1) Tell them you don’t have one :)

2) You want to open it at BMO Harris.

Hi David,

Great article from someone who’s been doing this a while! Have you ever personally driven stuff across the border or know someone who has? I have to a meeting at my fulfilment center regardless and thought I might bring down a load of goods in my truck, but am not sure how to set up the duties on that.

Hi Jerry,

Never going to the U.S. but plenty of times going to Canada. Just declare it to the border guards. I believe if it is below $800 they may just let you bring it down duty free. Worst at worst they’ll make you fill out a bunch of paperwork- might take a while but someone will help you with it.

I lived in MN, US now. And I am an amazon third part seller but all of my items were shipped directly from China to the buyers in US by Fedex. I only work at home (a small town in Minnesota) with clicking on my personal computer from collecting the orders’ info from Amazon to making order in China online. I have no office, no representative, no storehouse in US. I am pretty confused whether I have a Nexus in US. And whether I need to collect the sales tax from my buyers on amazon? Most of my buyers are in California and New York. Thanks!

BTW: My annual orders this year is over 2000. And the total money will be received from amazon (including my cost and profit) is over $100,000 this year.

From a Canadian perspective, if you are shipping directly from China to end customers, you would have no nexus. I suspect the U.S. is the same. It’s the job of border officials to decide whether to collect any tax/duties. Again, I only have experience with this in Canada so don’t take my word as gospel.

Hi David, I’m so happy to have stumbled on your website. I have been doing tons of research on how to sell on amazon but the more information I get, the more confused and overwhelmed I am, especially when it comes to the logistics involved with shipping the product from China to the fulfilment centres.

I am still doing product research and buying samples from China. I’m about to place my first order but I’m still confused as to how the entire process works. I want to buy your ebook but was wondering if the cost is in Canadian or US dollars (I live in Canada). You also mentioned on the article on how to choose the right product that it shouldn’t be a product that would sell for less than $50(if I’m not mistaken). For someone like me starting out with just a little over $1000CND, is it even possible to start an amazon business shipping from China with all the costs involved?

Hi,

Yes, it is possible but it’s going to take a lot longer to grow your business. Ultimately $1000 is a very small budget to work with for any business. However, I would try to get some ‘small wins’ importing small products from China and selling them on various marketplaces (remember, you don’t need to use FBA to sell on Amazon so you can simply have the goods from China shipped to your home). Once you have these wins, I’d recommend saving a bit more, to $2000-$3000 :)

I too am Canadian and take my goods to the US. I have used a shipping center over the line for 6 months now who do my fulfillment. Recently i was stopped at board by customs as they just dont seem to like how i am taking my goods and having it fullfiled. I clear the enteries myself but questions of who collects taxes and who collects fees have come up. Do you have any advice on how to clear this up with customs so i dont have problems when i do an entry. I currently just use a cbp form 7523 and all of my shipments are less then 2500 usd.

Hi Ken,

It’s a huge issue crossing the border and IMO you’re never going to get away from scrutiny. IMO the scrutiny likely isn’t from your clearing customs for your own goods (there’s a million people doing that) the scrutiny comes from a very grey area you’re in terms of doing business in the United States. Are you potentially working in the United States in a way that violates the terms of the business visa you’re technically entering on? Are you liable for any state sales tax? Are you liable for any federal or state income tax? etc etc.. The solution: Have a freight forwarder and/or customs broker do all of it :)

This question of crossing the border came up for me once when I had goods manufactured in Florida for delivery to a customer in California. I wanted to inspect the goods before shipment (they were worth many thousands). US immigration stopped me and wanted to know what tool I would use to inspect! They said a tape measure was okay, anyone can use a tape measure, but if I needed to use a micrometer I was working in the US without a work permit and depriving an American from work!

In my experience, how much hassle you get will often depend on the temperament of the officer questioning you. As you mentioned, describing your activities in such a way that the border officer will in no way feel as though you are endangering a U.S. job is the best approach. You don’t need to lie, but you also needn’t volunteer more information than is necessary.

Hi David…

As a Canadian company I am exporting goods>$2500 to my fulfillment warehouse in Texas and I am being told I need to list my company as the USPPI (US Principle Party of Interest) and to do so I need a Federal Tax ID Number. I am also being told I cannot list my fulfillment warehouse as the Consignee. Can you please comment on this?

I’m not sure what the USPPI is. I’ve never been asked for it. I’ve always used our 3PL’s federal tax ID number. I would push your customs broker a little harder on this – something doesn’t seem right.

sorry if I m not clear … I m about IRS and income reporting…. when I started my tax interview I was asked to certify “?The income to which this form relates is

(a) not effectively connected with the conduct of a trade or business in the AUnited States, ”

Should I issue an invoice for $200 myself for import to avoid questions?

Hi David! Thanks for your help! Could you be so kind as to advice more particular situation. I m Canadian corporation. I buy goods in EU and bring to the US… Amazon FBA/ My Invoice price let say $100? but then I sell at Amazon for $200. It looks like income in the US? Plz comment. BR, Alex

Hi Alex – as far as I know you have income in the u.s. but it should be protected under tax treaty depending on where you are.

Hello David,

Thank you very much for the great information in your post & in the comments…

I live in Los Angeles, I’m going to be bringing a pet nutritional supplement from the manufacture in Winnipeg, Manitoba Canada to Amazon US for FBA.

May I ask what you recommend as far as shipping to Amazon US for small, & medium shipments?

Thank you again!

btw I found you from a Google search.

All the best,

Jeremy.

Hi Jeremy – Sorry for the late reply.

It depends what you classify as small and medium. If it’s small, as in it fits in a box, UPS or any carrier that lets you ship DDP. If it’s a pallet or more, contact any freight forwarder. Unishippers is a good one.

Thank you, David…

Any suggestions, yet, David?

I just wish to say from the outset, great job in assisting foreign sellers who sell in the US. I am trying to start an online drop shipping business from a US based company. My problem, though, is trying to open an online account with FedEx, UPS or DHL, a requirement of the US drop shippnig company. The Online form to fill out is geared to US residents only. My country is not divided up into States and Zip codes like the US is, and those two fields are required. hence the problem. It is also virtually impossible to contact FedEx UPS etc by email or chat. The automated customer service rep does not respond to ones exact needs so it too is useless. How do I proceed?

Caswall, it’s late in the game but you can sign up for third party services that ‘give’ you a US address. Any mail you receive there can be forwarded to you, or they can open it and scan and email it to you as well.

Hi David! I appreciate your help, but would like to ask you a different question. I’m a Brazilian non-citizen studying in the US and want to import coffee from Brazil. Am I allowed to receive coffee shipments and sell them to coffee shops being a non-citizen? If not would it be better to ship directly to the coffee shop from our company in Brazil rather than going through me? Is there any permit I’d need to have if I want to sell these products in the US?

Hi Rafael,

There’s nothing to prevent you from selling the items to Americans. People do it all the time and you won’t be subject to any special taxation if all of you’re doing is shipping products to your vendors. Regulatory approval is a different question and you would want to check with a customs broker as I don’t know the nuances for coffee. If you’re shipping small quantities to vendors you can probably fly under the radar but it’s not a sustainable long term strategy.

Invaluable information to say the least thanks so much david.

I have a question for you ..you said Amazon FBA (Amazon in yhe states) will gladly give me their EIN number to use but this does come at a price right ? I believe it is $150.00AUSD everytime you need it please correct me if i am wrong.

I live in Toronto,i called the IRS and obtained my EIN number as an international applicant which was assigned to my canadian address can i just use my EIN number ?instead of paying to use Amazon FBA EIN everytime i import?

Thank you

Hi Francis – I had no idea about the fee Amazon charges- I can’t confirm or deny this. I’m not sure if this is the EIN you’ll use (we always use our 3PL’s) but any customs broker can confirm this or not.

What donyou mean your 3pls? Is this some form of importing number ?

Hi Francis,

It means 3rd party logistics.