Interview with DutyCalculator.com

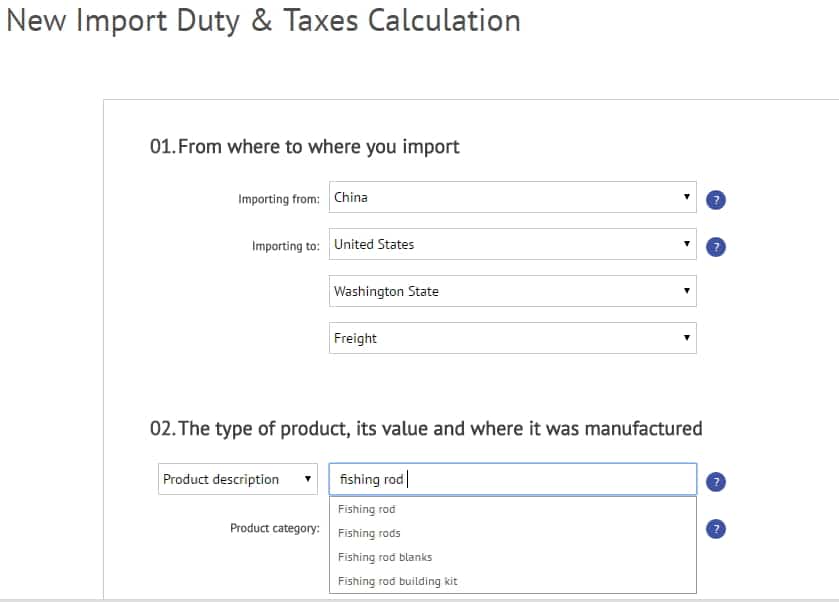

If there's one tool that you'll hear importers and private labelers recommend most often, it is DutyCalculator.com. DutyCalculator allows you to quickly and easily look up the duty rates by typing in a simple description of the product. Before importing any product you need to visit DutyCalculator.

DutyCalculator was recently acquired by Pitney Bowes. I recently had the opportunity to interview Luisella Basso, Vice President of International Trade and Customs Compliance for Pitney Bowes, to learn more about DutyCalculator as well as some more broad questions regarding customs clearance and tariffs.

Dave (EcomCrew): DutyCalculator has become one of THE must use tools for importers. It was recently acquired by Pitney Bowes. What exactly does Pitney Bowes do and how does DutyCalculator fit within its vision?

Luisella (Pitney Bowes): Let me start with Pitney Bowes, since many people may be unaware of what we do. Pitney Bowes is a global technology company that enables physical and digital transactions that power commerce. Think about how what gets ordered online (digitally) usually needs a physical product to get there. We have experience across the end-to-end process. What we do in our Global Ecommerce business is provide brands, retailers and online marketplaces with technology and services to deliver that rich, end-to-end, cross-border shopping experience for international consumers.

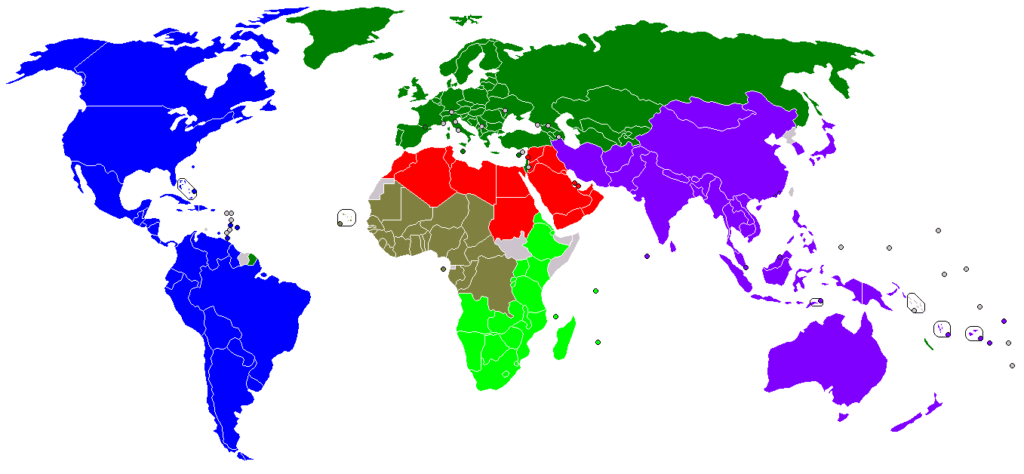

Regarding our Global Trade Solutions (formerly called DutyCalculator) we provide the tools to easily access and use the broad range of data, rules and regulations needed for cross-border trade in over 140 countries and territories. This offering is an integral part of the recently-launched Pitney Bowes Commerce Cloud, a commerce enabler, providing access to solutions, analytics and APIs across the full commerce continuum with speed and agility to help clients identify customers, locate opportunities, enable communications, power shipping from anywhere to everywhere and manage payments.

Dave: How many people are working for Duty Calculator and where are you based?

Luisella: So while Pitney Bowes is headquartered in Stamford, Connecticut, we have hundreds of employees who work on our Global Ecommerce business around the world in Canada, UK, the US, and throughout Continental Europe and the Asia-Pac region.

Dave: When was the site founded? Did it have the proverbial beginnings in the founder’s parent’s basement or did it always have a large team behind it?

Luisella: Our Global Trade Solutions business, formerly DutyCalculator, was founded in 2009 by Andre Schmidt, an entrepreneur, who started it from his home. Andre continues to run our Global Trade Solutions business at Pitney Bowes.

Dave: This is kind of a geeky question, but how does DutyCalculator get its data for the dozens of countries it provides data for? My experience with tariffs and duties is a 10,000 page book provided by U.S. customs consisting of millions of products! Does each country really provide some nice API or is there a building full of people manually entering data somewhere?

Luisella: All customs duties and taxes within Pitney Bowes Global Trade Solutions have been carefully researched, selected and updated by professional customs experts to ensure they are aligned with the rates published in tariff schedules or equivalent journals throughout the countries we cover. We use up-to-date duty and tax rates set by customs agencies and revenue authorities around the world.

Dave: It seems that the “Private Labeling” and “Importing” business model seems to be growing exponentially. Would that confirm your experience as well? How many searches is Duty Calculator getting a day for product classifications?

Luisella: The private label retail market is continuing to grow.

We can’t release statistics on the specific number of searches we receive each day for product classifications. But what I can tell you is that our Global Trade Solutions cover hundreds of thousands of products for 143,720 users. For more background, please visit: http://www.pitneybowes.com/us/global-ecommerce/international-retail-delivery/global-trade-solutions-for-import-export.html.

Dave: What exactly is an HS Code?

Luisella: The Harmonized Commodity Description and Coding System (HS) is an international product nomenclature developed by the World Customs Organization to facilitate the collection of trade-related statistics and tariffs. Traded products are assigned internationally standardised HS codes and commodity descriptions.

Having the correct HS code is one example of the complexity of cross-border trade. More consumers from more countries are shopping the globe. However, duties, taxes and restrictions vary by country and territories. To be successful, merchants need to create a transparent experience, including accurate final costs for the end customer.

Dave: Do all countries use HS Codes to classify items?

Luisella: Countries that belong to the World Customs Organization (WCO) all use HS Codes. The HS code is comprised of 6 digits, which designate the chapter, heading and subheading to which a commodity belongs. However, member countries of the WCO are allowed to further subdivide the HS nomenclature beyond 6 digits, and to set their own rates of duty at the level they classify goods.

Dave: What happens for a brand new product on the market that may not have an HS Code? For example “Hoverboards” would presumably not have an HS Code (or at least not until very recently). How does one classify a ‘new to market’ product?

Luisella: Every product – even if new to the market – will have an HS code, as the code is determined by the characteristics of the product, not assigned to each individual product as it is released. Sometimes the nomenclature will change to represent a new technology, but until that time, new products will be covered more generally. The classification depends on the product, its composition and its characteristics. The tariff schedule has notes and rules of interpretation for its chapters, headings and subheadings. These can be followed to find the correct classification of any products. For more complex products, a retailer may want to work with an expert such as a Customs broker or lawyer who can help.

Dave: In my experience of importing into both Canada and the United States, it seems that the United States has very low duty rates compared to Canada. In your experience, does the United States tend to have low duty rates compared to most other nations?

Luisella: On average, the United States does tend to have lower duty rates than other countries. However, it is important to note that duty rates depend on the product. For example, textiles and apparel tend to have higher rates while diamonds and electronics are duty-free.

Dave: Are there any countries which are guilty of having particularly high duty rates which might surprise readers?

Luisella: Many countries have high duty rates. For example, the BRIC countries tend to have higher rates. Additionally, in many countries the cost of importing increases due to additional import taxes at the national and state level.

Dave: You’re advertising a “Guaranteed DDP” service which as many readers may know is very important when shipping to Amazon FBA from outside of the United States. Why does someone need to use your “Guaranteed DDP”service? Can’t I just ship via UPS or FedEx with DDP shipment terms?

Luisella: As the opportunity for global cross-border trade expands, so does the complexity. More consumers from more countries are shopping the globe, however duties, taxes and restrictions vary by country and territory. To be successful, merchants need to create a transparent experience, including accurate final costs for the end customer.

Our guaranteed Delivered Duty Paid (DDP) service offers a platform for users to ship internationally, along with the calculation of import duty and taxes, lookup of full digit HS codes and import restrictions. Users can prepay duties and taxes, with the benefit that we will guarantee the duty and tax amount and handle the remittance for them. This can help eliminate unforeseen importation costs so there are no surprises for sellers or buyers when items are delivered. Our guaranteed DDP service also includes managing the remittance for certain carriers so the customer pre-pays duties and taxes to the global ecommerce provider and the carrier bills us.

Dave: To be honest, up until this interview I only knew DutyCalculator as “the website to quickly look up product classifications”. I was surprised to find a lot of other hidden treasures like your plugins for eBay and Magento! Are there any other products and services you offer that might be of interest to readers?

Luisella: I am glad that you did some exploring. There are three ways clients can tap into our Global Trade Solutions:

- Web tools to: calculate import duty and taxes; lookup HS codes, duty and tax rates and import restrictions; and access resources for country import/export guides, denied party screening and Guaranteed DDP.

- APIs that can be embedded seamlessly in business processes, for example to enable a merchant to charge accurate import duty and taxes at checkout, and to offer a total landed cost to their international customers. The APIs allow merchants to classify their product catalog, charge accurate import duty and taxes at checkout and create required documentation (commercial invoice, packing list), including 10-digit HS codes for the country of destination.

- Product classification services — whether for a single product or for an entire catalog — with a choice of human classification by trade experts or machine classification.”