Do New Amazon Fees Hide the True Cost of Being a Seller?

Starting this week (May 1, 2024), Amazon will begin charging sellers a Low Inventory Fee followed by a Returns Processing Fee that rolls out on June 1, 2024. Both of these have been preceded by the Inbound-Placement fee introduced earlier in the year.

In recent memory, nothing seems to have irked Amazon sellers more than the introduction of these new fee categories. However, this continues the trend of Amazon raising fees through increasingly complex and difficult-to-calculate fee structures rather than general rate increases.

In this article, I'll detail the complexity of the fee changes that Amazon has introduced in recent times and how complex fee schedules make determining profitability difficult while maintaining Amazon's low prices for customers.

Amazon Increases Fees 30% Over 3 Years

In Q4 2023, Amazon's ecommerce revenue grew by 9.3%. But the amount of third-party seller fees it collected increased 19.8%. In other words, the amount of fees sellers are paying increased more than 2x the pace of the expected revenue growth.

| Source | Q4 2021 Revenue | Q4 2022 Revenue | Q4 2023 Revenue |

|---|---|---|---|

| Online Stores (ecommerce) | $66.075B | $64.531B | $70.543B |

| Third-party seller services (FBA Fees) | $30.320B | $36.339B | $43.559 |

| Advertising Services | $9.716B | $11.557B | $14.654B |

| FBA Fees as Percentage of Revenue | 45.9% | 56.3% | 61.7% |

| Advertising as a Percentage of Revenue | 14.7% | 17.9% | 20.7% |

To give you even more perspective, Amazon collected 43.7% more fees from Q4 2021 to Q4 2023 despite ecommerce revenue growing just 6.7% over those 2 years (2022 actually saw a revenue dip from 2021).

Keep in mind, Amazon's significant fee increases between 2021 and 2023 shown above are before the introduction of the inventory placement fees, low inventory fees, and returns processing fees (which we'll tackle later).

So where exactly has Amazon made those gains in seller service fees? Part of the answer is simply inflation as well as the increase in popularity of valuable services like Amazon Global Logistics (Amazon's freight forwarding division).

However, another important part of how Amazon increases fees is in the introduction of an increasing number of complex seller fees which are often difficult to determine and even harder to predict.

FBA Fees Increased from 3 Tiers to 21 Tiers in 5 Years

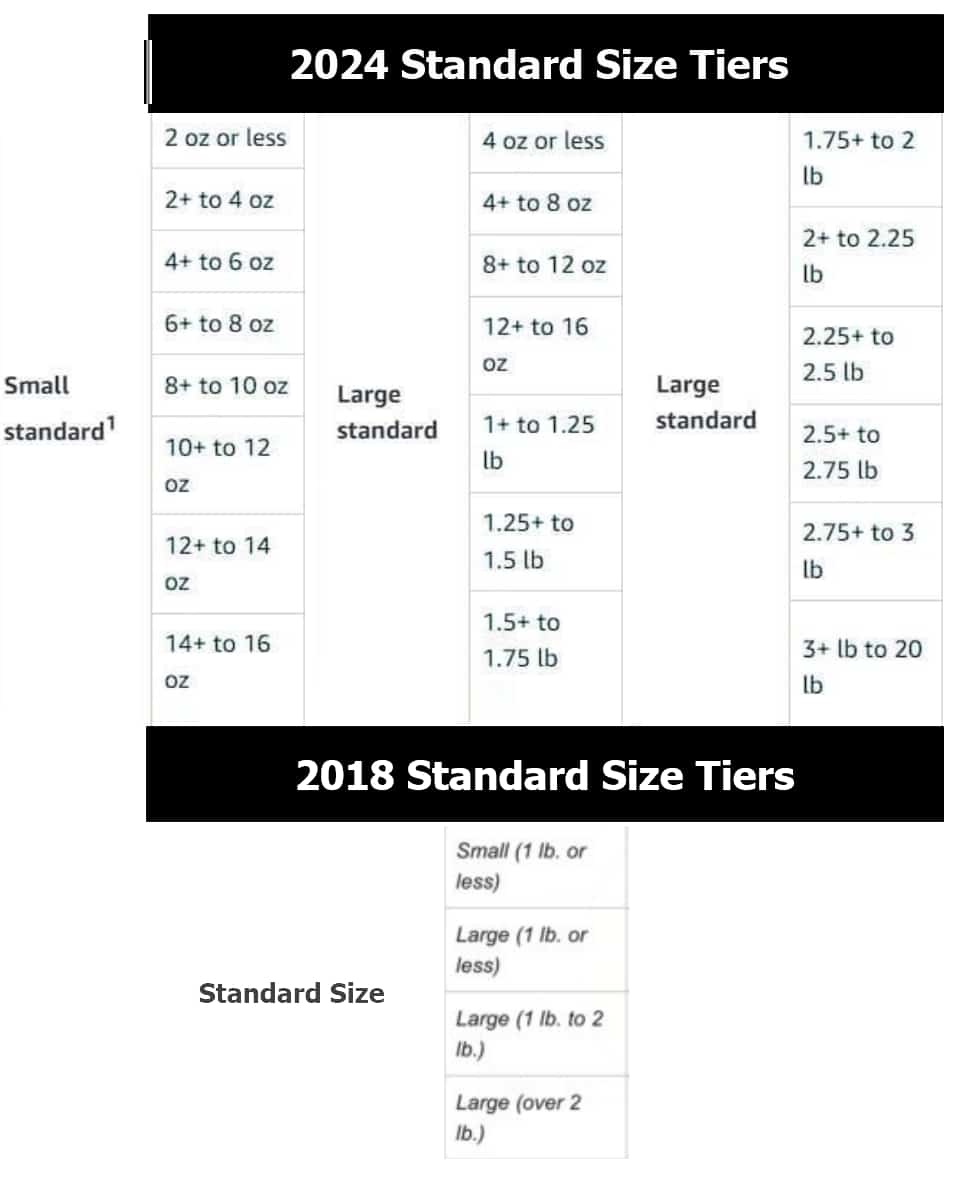

Possibly the biggest evidence of Amazon's increasing fee complexity is the base FBA fees it charges sellers for shipping a package to a customer.

In 2018, there were just 3 size tiers for “Standard Size” items (one of the most common size of items sold on Amazon). However, since then, the number of size tiers for Standard Size items has grown to 21 size tiers.

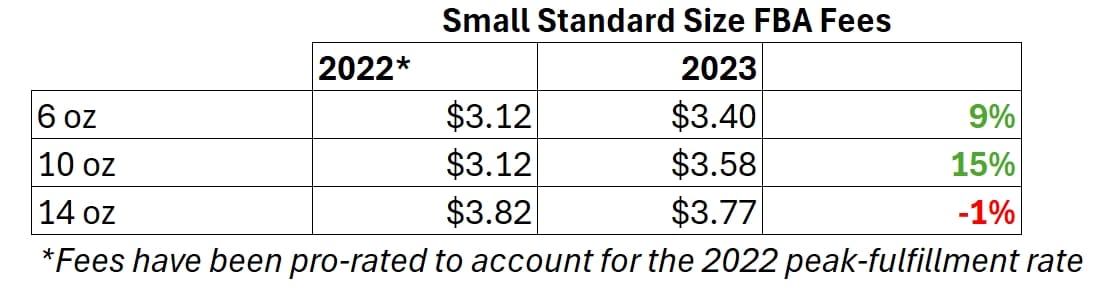

Here's a perfect example of the complexity of Amazon's fee increases. In 2023, Amazon introduced a new fee structure for FBA fees. At first glance, this new fee structure may appear to be an actual win for sellers as Amazon removed peak fulfillment fees (fees charged from October to December). Amazon maintained only one size category, 12+ to 16oz and fees actually decreased slightly in this one category.

However, for items smaller than 12 ounces, fees actually increased 9% to 15%, depending on the size.

Now cynical readers and Amazon itself would argue there's nothing deceptive occurring here. Amazon is simply introducing more granular pricing and you can easily calculate how much your fees will increase for your items. However, whether deliberate or not, continuously introducing new fee structures makes deciphering the true impact of fee increases nearly impossible and adds friction to sellers increasing prices to account for the new fees. Moreover, it also goes against norms of how fee increases are typically introduced within the logistics industry.

UPS & FedEx Use Annual General Rate Increases

UPS, FedEx and most other carriers annually announce a flat General Rate Increase (GRI). For example, in 2024, each increased rates identically by 5.9%. This is an across the board fee increase. So if in 2023, you paid $10 to ship a package from Seattle to Los Angeles, then in 2024, you would pay $10.59. It's an easy-to-understand fee increase, and merchants can easily predict their fee increases and adjust prices accordingly.

Now to be fair, neither UPS, FedEx or other carriers are innocent of introducing questionable surcharges and zone-realignments to raise prices. However, these carriers exist in a competitive marketplace where each carrier is, more or less, kept in check by others. For Amazon though, there essentially exists no other competition in the “ecommerce marketplace and logistics provider” arena.

Amazon Has a Long History of Introducing Opaque Fee Increases

Amazon introducing a few new size tiers isn't the crux of the problem. It's the fact that rather than introducing a so-called General Rate Increase, they've introduced a complexity of new fees over several years that make deciphering fee increases difficult.

Let's take a look at some of them:

- From 2018 to 2023, Amazon increased the number of size tiers for standard size items from 3 to 21.

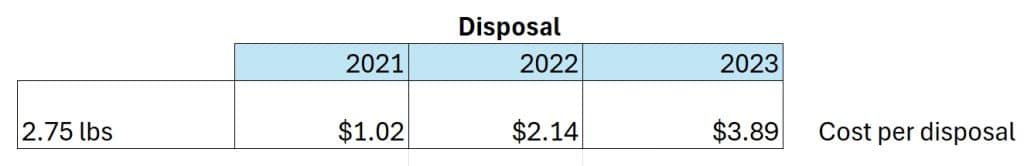

- From 2021 to 2023, Amazon increased disposal fees 380%.

- In 2023, Amazon replaces the Small & Light program with the Low Price FBA program (resulting in lower minimum price requirements and higher fulfillment fees in most cases).

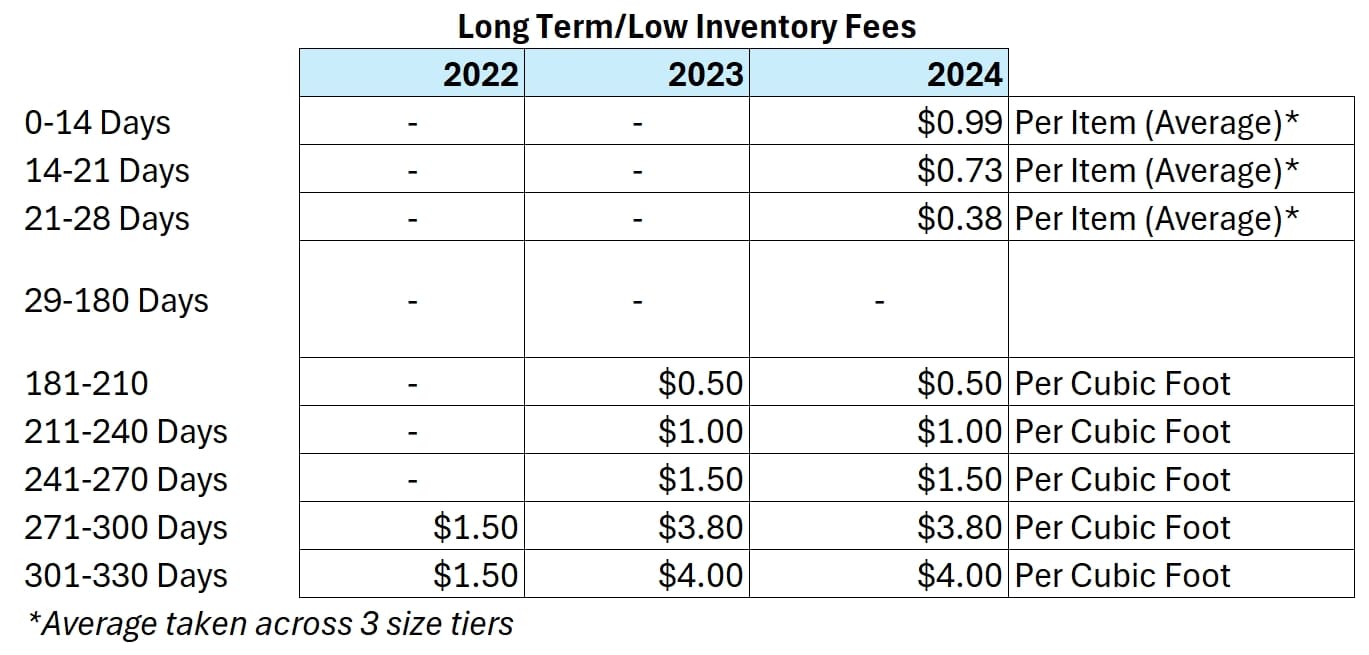

- In 2023, long term storage fees were applied starting at day 181 opposed to day 271.

- In 2024, Amazon introduced Inventory Placement Fees, Low Inventory fees, and Return Service charges.

This is just a short summary of some of the fee changes to occur over the last couple of years years.

Now one could argue that these are just typical revisions to fee tables common in industry and not a deliberate attempt to obfuscate fee increases. However, starting in 2024, making this argument becomes significantly harder.

Amazon Introduces Three New Fee Structures for 2024

We now turn our attention the three new fee structures Amazon has introduced for 2024: inbound placement fees, low inventory fees, and returns processing fees.

You could argue with many of the other fees Amazon has introduced prior to 2024, such as new size tiers, that sellers can easily predict their selling fees for selling any product on the platform. However, the new fees introduced in 2024 are either impossible to independently estimate without the use of an Amazon API/Seller Central or are performance-based on obscure metrics. Here's a look at these new fees.

Inbound Placement Fees (2024)

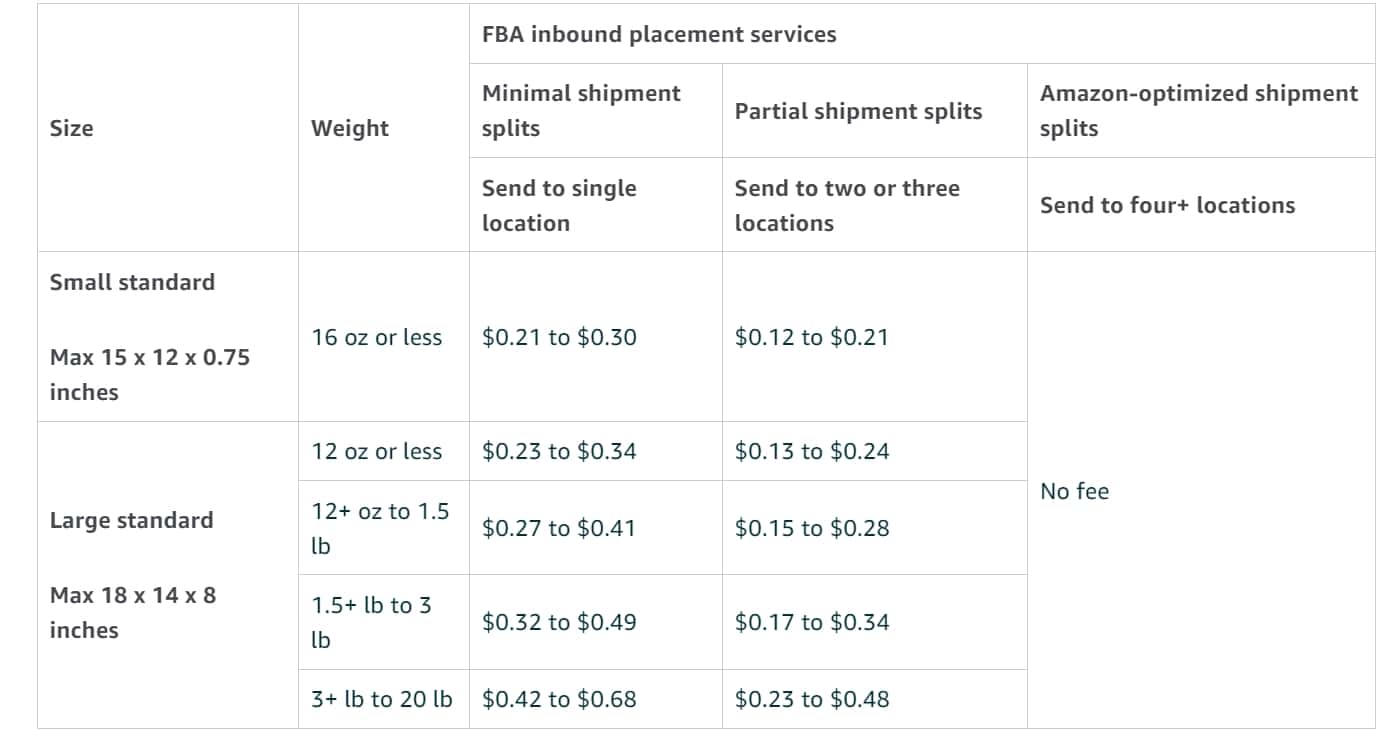

Starting in early 2024, Amazon introduced Inventory Placement Fees which charge sellers to ship to fewer fulfillment centers.

Personally, as a seller, I've never seen so much discussion of a fee increase from Amazon. The major reason for this discussion has been the uncertainty of how much inventory placement fees will cost them.

Amazon's fee structure gives a range of prices. According to Amazon, “The fee range will vary by inbound location.” How do you determine what that price will be? You have to generate an estimate within Amazon Seller Central or using their API.

This brings up a very legitimate concern from sellers: if a seller can't accurately predict what placement fees will be before they sell an item, how do they determine the impact to profit margins and how much prices need to increase by to account for new fees?

Low-Inventory Level Fee (2024)

This May 2024, Amazon is set to introduce a Low Inventory fee, a fee charged if historical inventory levels are below 28 days. The low inventory fee is slightly different than a Long Term Storage fee in that it's charged on a per item basis.

One of the biggest issues with this fee is its complexity. It is calculated based on the historical supply of a product over the last 30 days or 90 days. Is this historical number impossible to calculate? No, but it is very difficult to (especially without logging into Amazon Seller Central) and even harder to predict.

And maybe because they realized that sellers are uneasy about the impact of the new fees, Amazon actually delayed the implementation of the fees for one month.

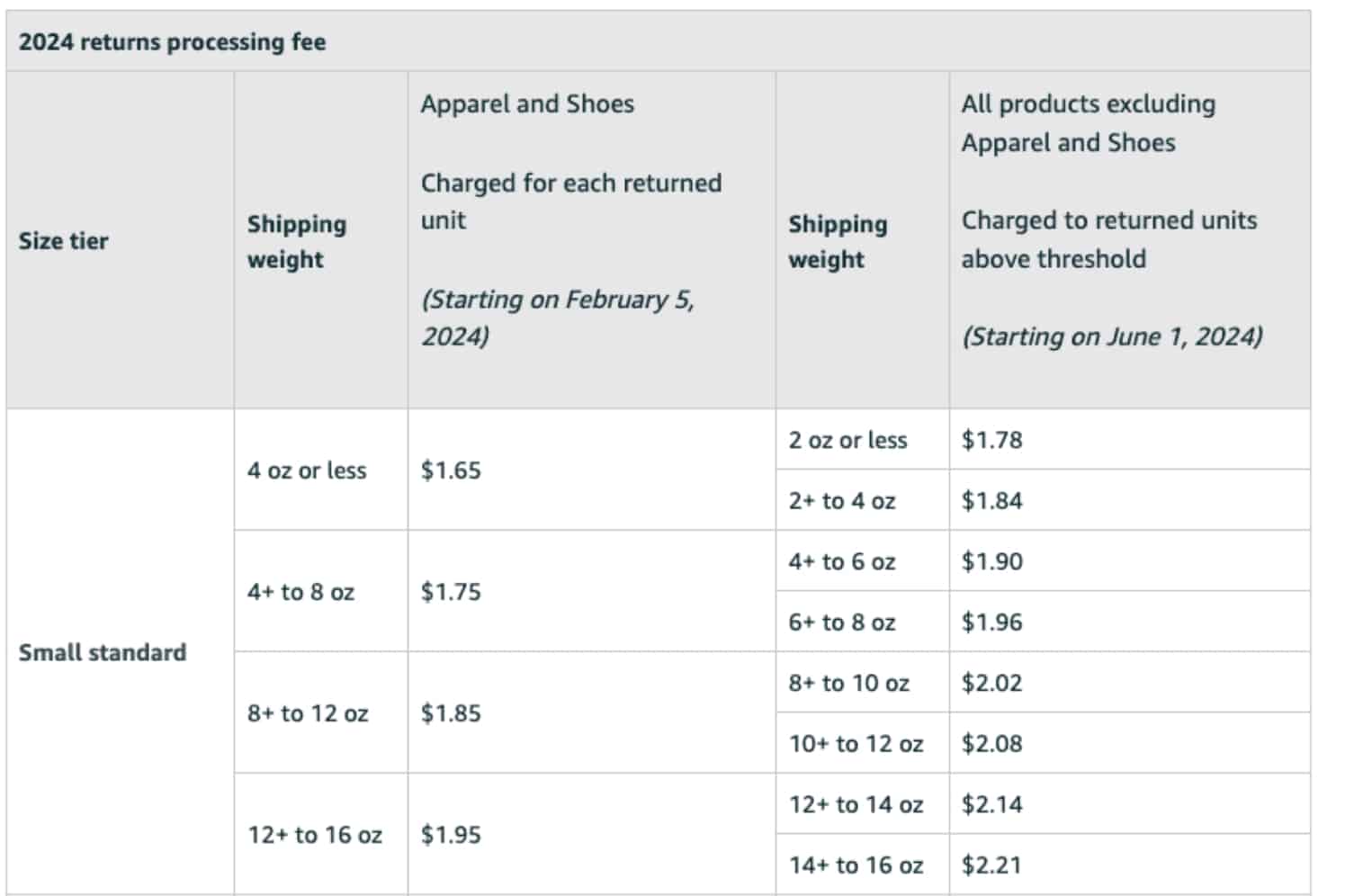

Returns Processing Fee (2024)

Finally, Amazon is set to introduce a Returns Processing fee on June 1, 2024. According to Amazon, “The fee will only apply to products that have return rates above a threshold specific to each category.”

The returns processing would appear to have a fairly concrete fee schedule. However, what is unclear is what the “returns threshold” for a particular category and how frequently it will change. Amazon is also somewhat in control of return rates overall, based on their leniency or strictness in allowing customer-returns (Amazon does not disclose return rates for the entire platform but the National Retail Federation estimates holiday return rates for ecommerce overall to be 21%)

Is Amazon Creating Opaque Pricing to Resist Product Price Increases?

So why has Amazon chosen to introduce a complicated mix of new fees rather than simply increasing the rates of previous fees?

One argument is that these new fees allow Amazon to granularly price their services and reward sellers who have excellent operational metrics. In other words, they are performance-based fees. One could argue that as long as sellers maintain their inventory levels within Amazon's thresholds and also minimize return rates by offering excellent products with accurate product descriptions, these fees won't hurt them. In other words, they reward ‘good sellers' and harm ‘poor sellers.'

Now here's a more insidious argument: it's in Amazon's interests to obfuscate fees as much as possible to hide the true cost of selling on Amazon. Doing so can create a false sense of profitability, especially relative to other platforms such as eBay and Etsy. This, in turn, creates friction for sellers to determine the necessary price increases needed to maintain margins.

Is this last argument a stretch? The FTC doesn't think so, and it's part of their lawsuit against Amazon for illegally maintaining its monopoly power. According to the lawsuit, Amazon “…extracts enormous monopoly rents from everyone within its reach…[by]…Charging costly fees on the hundreds of thousands of sellers that currently have no choice but to rely on Amazon to stay in business. These fees range from a monthly fee sellers must pay for each item sold, to advertising fees that have become virtually necessary for sellers to do business. Combined, all of these fees force many sellers to pay close to 50% of their total revenues to Amazon.”

Regardless of what you think Amazon's intentions are for the introduction of several new fees in 2024, the end result is that sellers are likely going to pay significantly more in fees this year.