Amazon Q1 2025 Earnings – Advertising Up 19%, Slower Growth Predicted

Amazon just released its Q1 2025 earnings, and the results have some interesting and important revelations for sellers.

This was one of the most anticipated tech earnings reports of the year as Amazon, potentially more than any other large company, is sensitive to the impact of tariffs.

Advertising Up 19%, Online Store Revenue Up 7%

There are two metrics sellers should care about in Amazon's earnings report: Advertising Revenue and Third-Party Seller Fees Revenue (essentially referral and FBA fees). You can find all of the historical figures in previous quarters at the EcomCrew Amazon Stock Tracker.

If advertising and third-party seller revenue growth were more or less consistent with overall “online retail sales” growth, then sellers are paying roughly the same as in previous quarters. If growth for either of those two fees outpaced online retail sales, then sellers are, more or less, paying more for those two things.

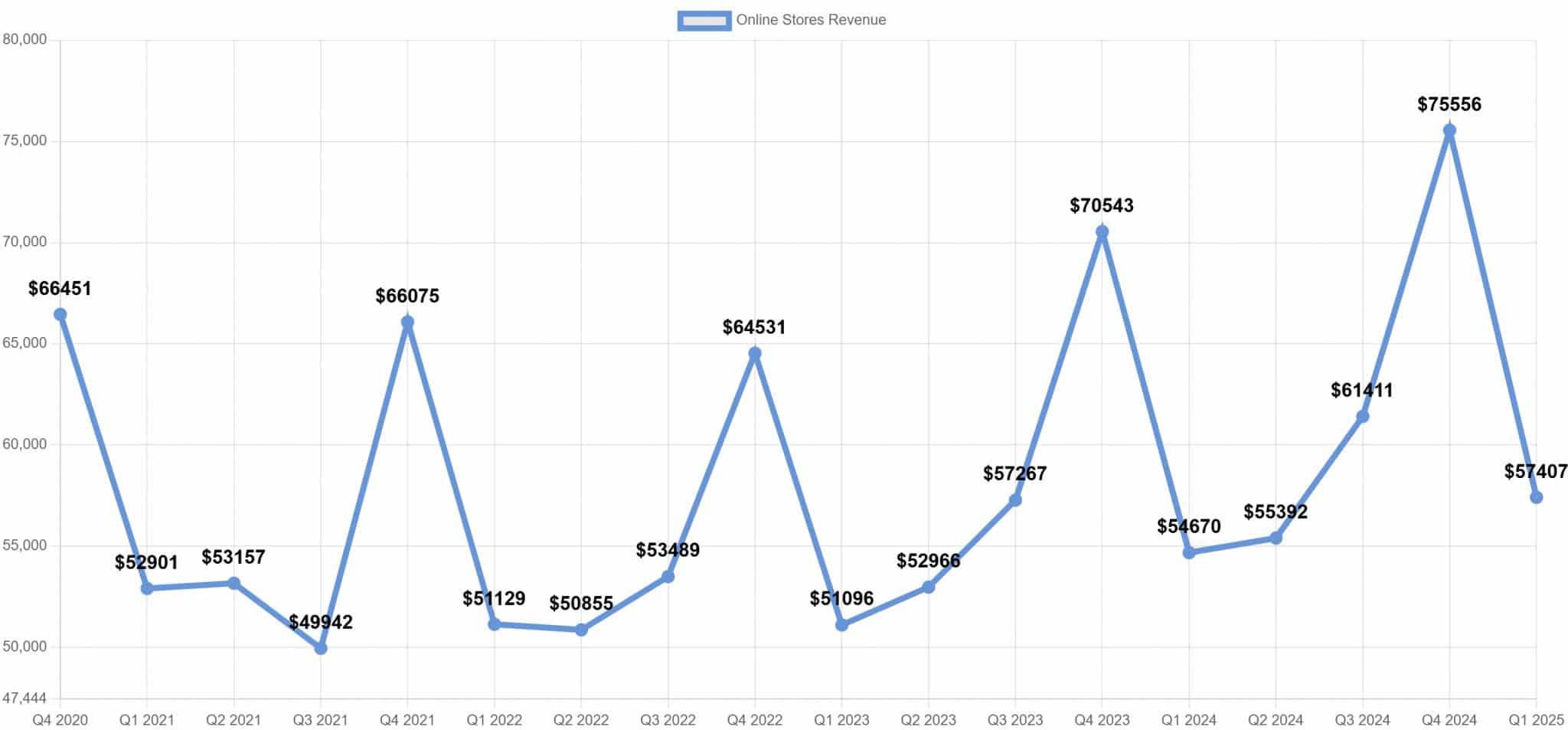

Online store revenue was up 6% in Q1 2025 (compared to Q1 2024). It was $57.40B in Q1 2025 compared to $54.67B in Q1 2024. Online store revenue takes into account only 1P sales (i.e., items shipped from and sold by Amazon) but is one of the best indicators of overall revenue growth, as Amazon doesn't account for gross sales of third-party sellers.

However, despite online store revenue being up only 6%, advertising revenue was up 19%.

As the chart below shows, advertising revenue has been growing at a staggering rate for Amazon, far eclipsing online store revenue growth. The growth is a result of both increased advertising CPC and CPM costs, as well as an increase in the number of sponsored products in search results and other locations on Amazon.

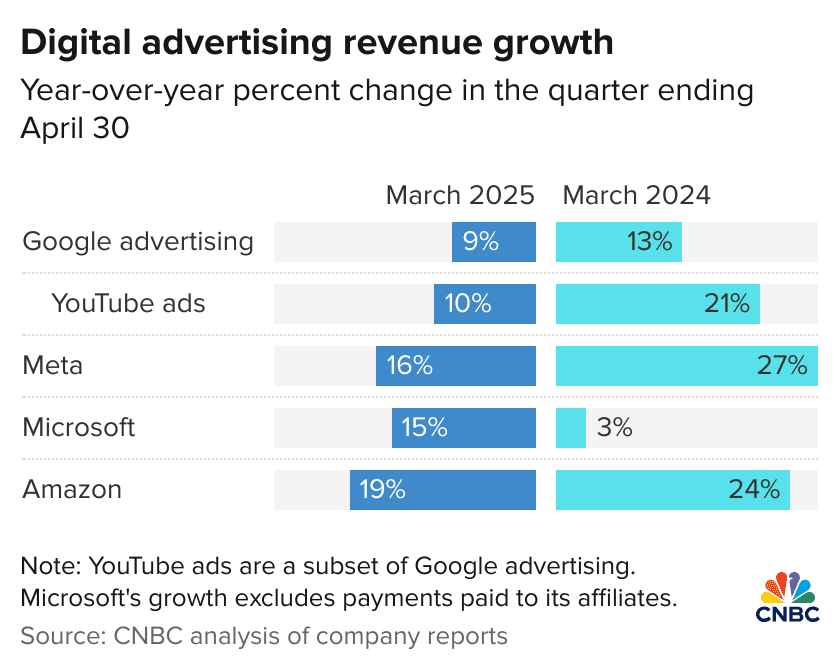

Amazon Has Fasted Growing Ad Business of Big 4

Amazon's ad business growth means that it also ranks number one in terms of overall growth for the last year compared to the other three major online advertising platforms (Meta, Alphabet and Microsoft)

Amazon's growth of 19% was higher than Microsoft (15%), Meta (16%) and Google/YouTube (9%/10%).

FBA Fee Growth Plateaus

If there was one potential bright spot, it was in regards to FBA Fees.

FBA fees ( which are reported as “third-party seller fees” and make up the majority of this category) were up 7% year-over-year.

With online store growth of 6%, it means that FBA fees increased more-or-less the same as actual online store revenue growth. In fact, it was the lowest FBA fee growth in over 5 years (and potentially much longer)

This news of limited FBA fee growth shouldn't be surprising as Amazon announced last year that there would be few FBA fee increases for the year.

Slower Growth Forecasted

Amazon also said that it expects second quarter operating income to be between $13 billion and $17.5 billion, below the $17.64 billion consensus forecast, according to CNBC.

The reason for the sluggish outlook was stated as “tariffs and trade policies” and “recessionary fears”.

Other News

Amazon also announced a number of other results and achievements for the quarter:

- Held deal events worldwide to help customers save over $500 million across Big Spring Sale in the U.S. and Canada, Spring Deal Days in Europe, and Ramadan/Eid Sale events in Egypt, Saudi Arabia, Türkiye, and UAE.

- Announced $4 billion investment through 2026 to expand Amazon’s rural delivery network to bring even faster delivery to customers in less densely populated areas across the U.S.

- Launched Amazon.ie in Ireland, offering over 200 million products with low prices, fast delivery, and local Prime membership.

Conclusion

The limited growth in FBA fees is good news for sellers. However, as demonstrated by Amazon's continued growth in advertising, it is also showing that it is becoming increasingly a ‘pay-to-play' platform. On top of this, the weak earnings forecast could spell trouble on the horizon for third party sellers.