Amazon Posts Highest Retail Quarterly Growth in Years [Q2 2025 Earnings]

Amazon just released its Q2 2025 earnings, and the results have some interesting and important revelations for sellers.

With the full effect of the United States' new tariffs now in place, what was the impact on Amazon's performance?

Amazon Posts Strongest Retail Growth in Years

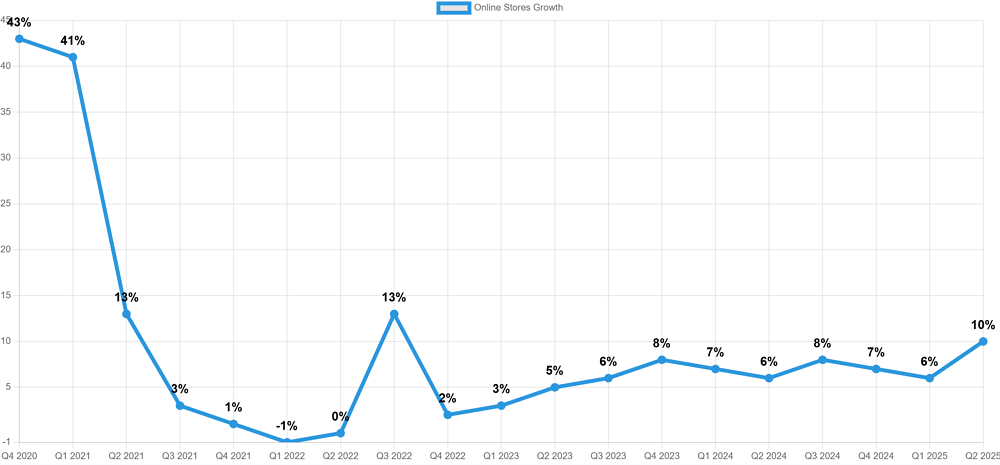

In one of the biggest surprises of the earnings call, Amazon posted 10% growth for “online store revenue” (essentially website sales).

Amazon's online store revenue growth reaches its highest level since Q3 2022.

This is Amazon's highest quarterly growth for online store revenue since Q3 2022.

This massive gain in online store growth surprised investors, as overall revenue from Amazon far exceeded expectations: $167.7 billion vs. $162.09 billion expected.

Amazon Advertising Up 23%

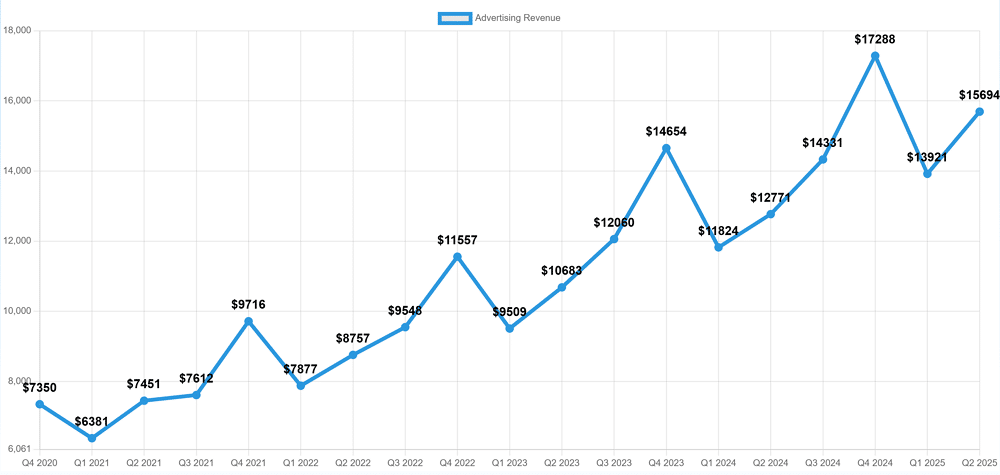

Unfortunately for sellers, revenue from advertising continued to grow rapidly as well, with revenue growth up 23%. This is higher than Q1's advertising growth of 19%.

Amazon's advertising revenue growth accelerates to 23% in Q2 2025.

As the chart above shows, advertising revenue has been growing at a staggering rate for Amazon. The growth is a result of both increased advertising CPC and CPM costs, as well as an increase in the number of sponsored products in search results and other locations on Amazon.

FBA Fee Growth Continues to Stay Steady

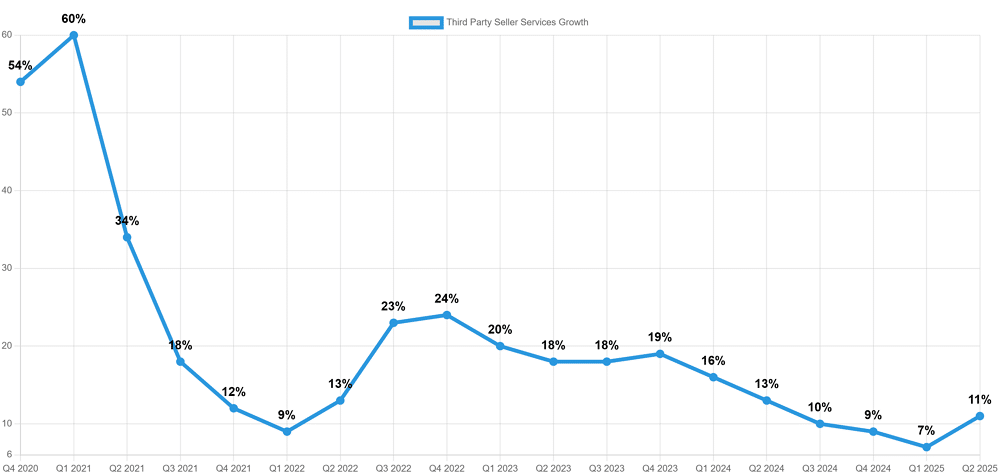

Third-party seller services (which largely capture FBA fees) grew 11% for the quarter.

FBA fees grew by 11% in Q2 2025.

This more or less matched overall online store revenue growth. This means that for many sellers, FBA fees as a percentage of revenue were unchanged from previous quarters.

Slower Growth Forecasted as Stock Tumbles

Despite performing well above expectations for Q2, Amazon's stock tumbled up to 7% in after-hours trading due to a poor forecast for Q3, especially regarding operating income.

For the current quarter (Q3), Amazon said it expects operating income to be between $15.5 billion and $20.5 billion. Analysts were looking for $19.48 billion, according to StreetAccounting.

Amazon also, for the first time, listed fears of a recession as one of its major risks going forward, in addition to tariff uncertainty.