Pattern Group, Seller Turned Service-Provider, Files to Go Public

Pattern Group has filed for an IPO under the ticker symbol PTRN on the Nasdaq Global Select Market.

Pattern is routinely one of the largest sellers on Amazon but has a relatively unique business model compared to many sellers. Specifically, it positions itself as a global “retail-as-a-service” provider.

They revealed significant growth numbers in its S-1 filing. But behind the impressive revenue climb are some key risks and dependencies worth examining.

One of Amazon's Largest Sellers

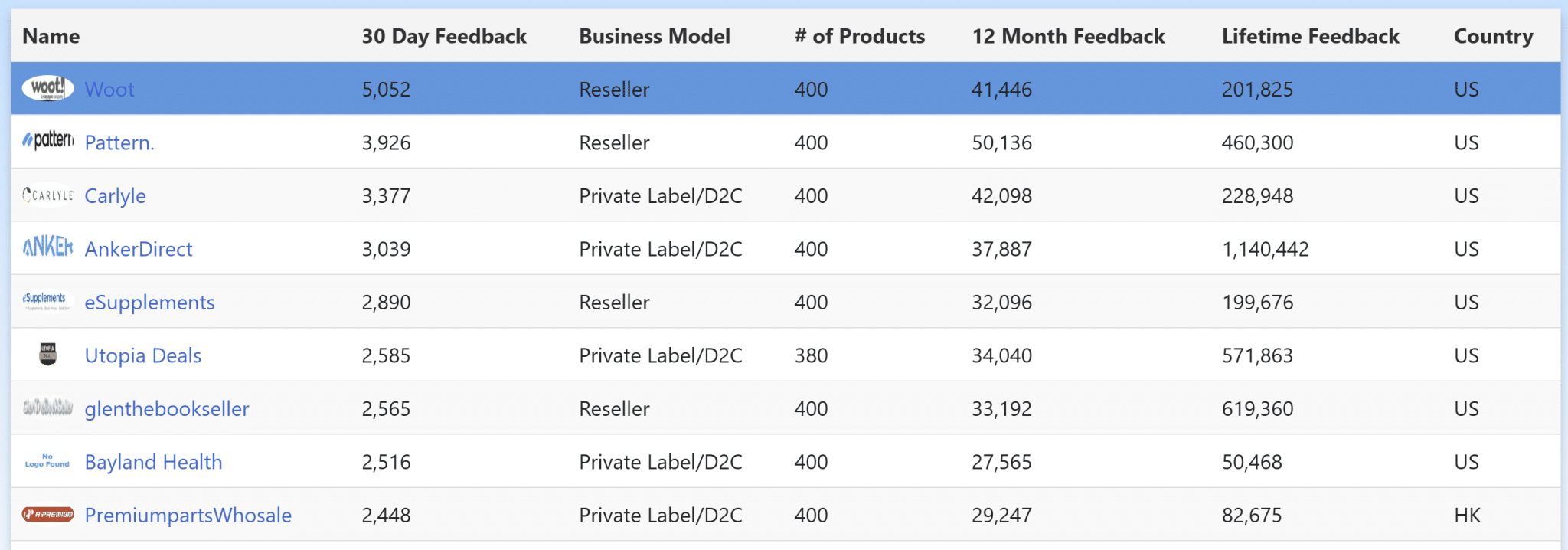

Pattern is regularly one of the largest sellers on Amazon. According to SellerSnooper.com, it is the #2 largest seller according to feedback (just behind Amazon-owned Woot).

Pattern’s model, however, is very different than most sellers on Amazon.

They buy inventory from brand partners and resell it across dozens of global e-commerce platforms, primarily Amazon. This means they take ownership of the product while becoming the exclusive online distributor for the products. This also means they manage all aspects of the sale, from logistics to marketing.

The company touts its proprietary technology and AI-driven insights as a differentiator, claiming it can optimize pricing, advertising, and logistics better than traditional third-party sellers.

In addition to its retail operations, Pattern offers software tools like Product Experience Management (PXM) and influencer management platforms. Still, the overwhelming bulk of its revenue comes from marketplace reselling, not SaaS subscriptions.

Revenue Growth

Pattern’s revenues have surged in recent years. Below is a snapshot of its reported revenues:

| Year / Period | Revenue (USD) | Growth vs. Prior Year |

|---|---|---|

| 2022 | $990.5 million | — |

| 2023 | $1.37 billion | +38% |

| 2024 | $1.80 billion | +31.5% |

| TTM (to June 30, 2025) | $2.09 billion | — |

| H1 2025 | $1.14 billion | +35% YoY |

Most of the Sales Come from Amazon.com (U.S.) and Long Term Clients

Despite the broad marketing spin around being “global” and “multi-platform,” this isn't quite the case.

94% of Pattern's revenue comes from Amazon and 88% of that comes from the U.S. marketplace.

Pattern does not disclose the exact number of brand partners it works with. However, it highlights that 87% of 2024 revenue came from existing partners, and nearly half of revenue was tied to partners of five years or more. This indicates strong retention, but also dependency on a relatively concentrated set of clients. Losing just a few large partners could dent growth significantly.

Moreover, Pattern does have an impressive list of clients it works with, including Pandora, TUMI, BOSCH, Panasonic. However, many large brands choose to self-manage selling on Amazon or simply sell to Amazon as a vendor. It's uncertain the business model of being the sole online distributor for large brands is sustainable.

Increasingly Crowded Space

The agency and exclusive-brand-representative model, especially for Amazon, is becoming increasingly crowded.

For example, in a recent Crew Review newsletter we profiled Front Row Group who also made the shift from sellers to service-providers several years ago and now has a similar business model to Pattern.

In addition, many FBA aggregators have also shift to agency-like business models after the FBA aggregator crash several years ago.

Profitability and RSU Dilution

On paper, Pattern is profitable. In the first half of 2025, it reported $47 million in net income compared to $35 million the year before. But profitability is thin relative to revenue, and heavy reliance on stock-based compensation looms in the background. The filing outlines substantial restricted stock unit (RSU) grants tied to IPO and post-IPO performance milestones, which could dilute shareholders if the stock performs well.

Final Thoughts

Pattern wants to be seen as a high-tech global e-commerce accelerator, but its S-1 suggests it is still primarily an Amazon reseller with tech-enabled logistics. For potential investors, the question isn’t whether Pattern can grow—it has. The real question is whether it can sustain that growth while diversifying away from Amazon and maintaining profitability without excessive dilution.