Sea Freight Rates Have Soared 300%. Here’s Why.

Sea freight is currently a mess! One that’s pretty much summed up by the giant container ship that got wedged in the Suez Canal, holding up billions of dollars in global trade every day before it was refloated.

But even before that whole blockade issue, chances are you’ve already been paying more in sea freight to ship your products out of China and into Amazon FBA. A lot more.

In this article, we’ll look into why sea freight rates have soared in 2021 and what you can do to keep your business afloat (pun intended).

Related Listening: E165: Shipping from China Made Easy with Freightos

How Much Have Sea Freight Rates Increased?

The Freightos Baltic Index pegs the market rate for a single 40’ container at a little over $4,000—nearly quadruple what it was a year ago.

This unprecedented spike in container prices have caused delays for online retailers trying to import high-demand goods from China.

It’s doubly worrisome because about 60% of all global goods are shipped by container.

Of course, this whole price hike affects all industries that ship goods, but some analysts say that ecommerce and Western consumers may bear the brunt of it, mainly because most ecommerce sellers in North America and Europe deal with Chinese suppliers.

Why are Sea Freight Rates so High in 2021?

Surprise, surprise. The pandemic that brought entire economies to their knees has a hand in this fiasco. But it’s actually more of a confluence of factors that COVID kicked off.

Here are a few of our culprits:

- Lockdown restrictions slowing down global trade

- Trade imbalance between China and the West

- Trade tensions between China and the US

- Lack of manpower due to the pandemic

- Big shipping firms taking advantage

How COVID-19 has Changed Consumer Behavior

Health concerns and lockdown restrictions caused the market to depend heavily on ecommerce. Online retail activity increased immensely, and it led to a much higher demand for retail goods. People are setting up home offices, buying fitness equipment to work out at home, and even ordering food and essentials strictly online.

While a lot of consumers took to shopping online to comply with stay-at-home rules and avoid exposure to the virus, average savings actually went up and a lot of people became more cautious on their purchases.

According to a McKinsey survey, as lockdowns have eased up and vaccines are rolling out, these savings translate to pent-up demand waiting to be unleashed in what we can call revenge shopping. Categories like apparel, beauty, and electronics will are eating up a huge chunk of that post-pandemic discretionary spending.

Depending on the item category you are selling in, you’ve either had a really bad year or a really good one. But the increased demand for certain goods comes with a price, that price being soaring sea freight costs.

China’s Trade Surplus

Picture this: China sends three containers filled to the brim with iPhones to the United States. In turn, those containers get carried by trucks inland to be filled with soybeans. Those soybean-filled containers then get shipped back to China.

The problem arises when China does not really need three full containers of soybeans back.

This is called a trade deficit, or when a country’s exports exceed its imports (or vice versa). At the time of writing, the Port of LA receives around three and a half containers from China for every one it sends out.

A trade imbalance is nothing new (especially between China and the US), but global Chinese exports soared 60.6 percent over the first two months of 2021, when a lot of Western economies started to recover from the pandemic and demand for Chinese goods skyrocketed.

China's global trade surplus reached 103.25 billion early on in 2021, whereas it recorded a deficit of $7.21 the past year.

So, you have a pandemic-induced increase in ecommerce, plus lockdown restrictions forcing idle ships and empty containers just sitting at port, plus China being among the first economies to recover from COVID, hence sending in a lot more products into Western markets than it is shipping in.

To boot, the soaring demand for Chinese exports means that shipping companies are finding it a lot more profitable to just send empty containers back to China than have them go the entire trip inland to pick up imports.

Combine all that with the fact that Chinese exports are usually high-value products, while US exports are relatively lower-value agricultural produce like wheat and soybeans.

The result: Competition over containers (when Western economies bounced back) drove prices through the roof.

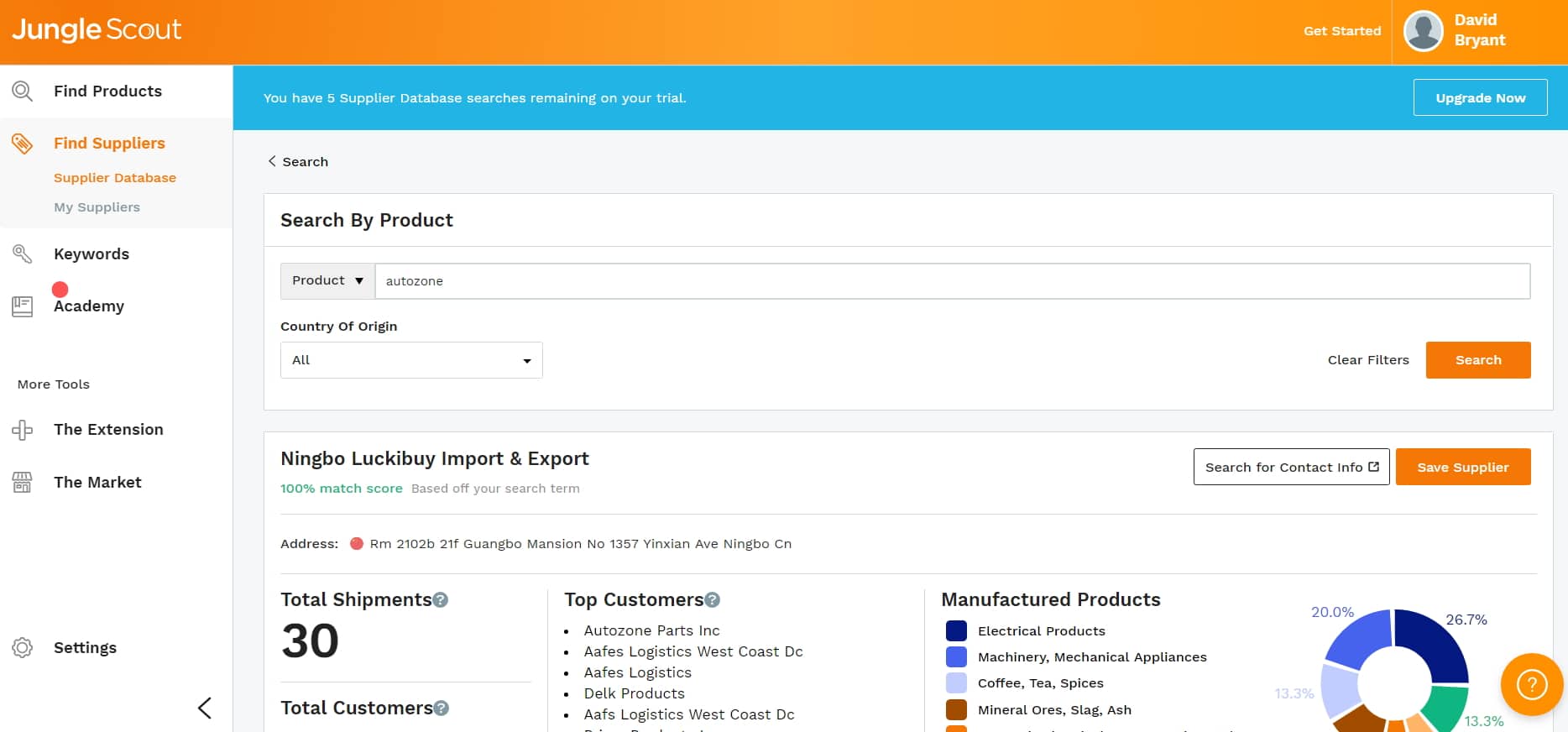

How to See How Much Your Competitors Are Importing from China

Want to see how much your competitors are importing from China?

Custom import records are public information in the United States and there are multiple tools that allow you to simply search for a company name and see exactly how much these companies are importing from China.

My favorite tool for this is Jungle Scout's Supplier Database tool which costs less than $50 a month (other more expensive options include Import Genius and Panjiva). These tools will neatly summarize all of the information included on a particular company's Bill of Lading information such as product type, quantity, and supplier name/address.

US-China Trade War

Another key factor is the ongoing trade war between China and the US, which we touched on when we talked about the best countries to source private label products from.

Even with the recent change in administration, the uncertainty surrounding tariffs has caused a lot of Chinese exporters to rush their goods into the US before new tariff schedules take effect, which has caused freight charges to increase over the past year.

Is There a Chinese Container Mafia?

Reuters has also reported some sort of mafia activity in China’s shipping industry.

Seeing the money to be made in all this, big private firms have stockpiled containers and are making them available to the highest bidders, making sea freight even more of a pay-to-play situation.

What You Can Do to Protect Your Business

Again, ecommerce sellers may bear the brunt of the increased sea freight costs, and perhaps some of it could be passed on to consumers. Either way, it’s bad for business.

Here’s a few things you can do to protect your business:

- Plan out your procurement process

- Work with a reliable freight forwarder

- Consider alternatives if it makes sense

Plan Your Shipments Early

With freight costs going through the roof, it’s more important than ever to book your cargo early and have a well-planned procurement process. Consider booking your shipments weeks or even months ahead.

Avoid booking shipments during peak seasons and holidays.

Also, make a solid shipping plan so you are always on top of your inventory and never run out of stock.

Work With a Reliable Freight Forwarder

Admit it or not, it’s not so much what you can do, but what your freight forwarding company can do for you.

Be sure to work with a reliable forwarding company. Large and established freight forwarders can deal on your behalf more effectively than smaller companies, and they have much more resources at their disposal.

Also make sure to work with companies that communicate with you and are transparent about your shipments.

US shipping regulators have also started looking into disadvantageous shipping practices to reduce bottlenecks, complexity in shipping, and costs relative to the recent price surge.

Consider Your Alternatives

As of this writing, there is only a marginal price difference between a 20’ containers and a 40’ container. If you can, order more products and ship a 40’ to lower your per unit costs. LCL in fact is becoming a more viable option for items less than 25 CBM.

Even with the high cost of sea freight, air shipping is still much more expensive than sea freight. However, the gap between air shipping and sea shipping has narrowed slightly, and there may be more times when air shipping is viable, such as optimizing cash flow and reducing stock outages.

When Will Sea Freight Rates Go Back to Normal?

The short answer is nobody knows. Matter of fact, no one is sure if it will normalize at all.

Some reports say that there may be no easing until Q2, which could sound like ages if you're in ecommerce, especially if you're shipping fast-moving products that are in high demand due to the pandemic.

Others say that the container shortage will likely last longer into 2021, despite a lot of carriers recently placing new orders for containers.

Conclusion

This whole sea freight rate fiasco doesn’t seem to be going away any time soon, and we are all on the same boat.

Understanding why sea freight has become more expensive and a lot more complex will help you prepare and plan out your procurement more effectively.

Where do you think sea freight goes from here? Let us know in the comments down below.

Have been bringing boxes from Japan since 1994, normal rate for a 40ft HQ is $2650. 2 months ago was charged $8,800, this week have been charged $19,800.

That’s taken a big chunk of the profit from that cargo, and denied the UK government of the tax that they would have got from that profit as well.

We need governments to just tell the lines that they won’t allow the ships to re-fuel unless normal rates are charged. That’ll stop this robbery dead in its tracks.

Some intervention definitely could help! Although governments hate to interfere with market pricing.

I’m an importer for more than 20 years now. Early this year I was paying $6,300 for a 40-45’ HQ. Now it’s between $12,000-$19,000. I quote customers first, then 60 days production in China and another 30 days on the water. My profits have almost dried up because of this. If rates don’t lower soon, I’ll be closing the business. I bring in 150 containers a year and still seen as small. Was about to ship product from Indonesia and have a rate of $24,000. Can’t afford it. Sad this is how it is but someone is profiting big time! Pure extortion in my book!!!

Yep – it’s terrible :(

Hello,

Since the writing of this article sea freight as increased even further :( Now around 10K for a 40′ container.. I have a FCL load worth of product being manufactured in China. However, I am considering to just warehouse it in China for a couple months since it would be a new product launch so no worry about running out of stock. What do you think? Should I just bite the bullet and pay the massive shipment cost (still will be profitable but big hit to margins) or delay my product launch? They are oversized items so logistical costs matter more.

Unfortunately it’s not likely to get better until next year (and could get worse before then) so you’ll have to decide if you want to delay it that long.

Good morning! I could not find any better analysis and explanation, until now, referring to the crazy soaring shipping freights I am personally experiencing as Export Manager. Keep on!

Good morning! I could not find any better analysis and explanation, until now, referring to the crazy soaring shipping freights I am personally experiencing as Export Manager. I will also subscribe to Yr. weekly blog. Thanks.

Giovanni, Milano, Italy

Thanks for subscribing, Giovanni! Glad you like our blog :)

Love this blog!

Thanks, Julie! Glad to hear you enjoy our blog.