British Columbia is Taxing Global Digital Ad Spend

British Columbia has determined that many forms of digital advertising, including Amazon advertising, are now subject to 7% PST. The decision to tax all advertising, regardless of location, is one of the most aggressive in North America.

At first, charging PST on advertising may seem a nuanced decision with little implications for individual businesses affected by it, let alone the Provincial economy as a hold. However, as we outlined in a previous article regarding British Columbia's new Marketplace Facilitator Laws, this decision equates to roughly a 10% to 20% decrease in profits for most marketplace sellers and threatens the viability of other ancillary businesses such as digital marketing agencies.

Advertising and Pay-Per-Click Advertising is Exempt but Province Says Amazon is Different

Advertising in British Columbia has historically been exempt from being charged PST. The Province also issued a bulletin re-iterating that Pay Per Click advertising (which constitutes the vast majority of Amazon advertising) is also exempt. According to the Bulletin from July 2022:

“You are a marketplace seller located in B.C. and you advertise your goods through an online marketplace. You pay a service charge to the marketplace facilitator to have your listing higher in search results. The advertising service does not have any strong or substantial factors connecting it to B.C. You do not pay PST on this charge as it does not relate to the sale of goods for use or consumption in B.C. and the service is not considered to be provided in B.C.”

Initial appeals from businesses to have PST that Amazon was charging on advertising refunded was initially granted by auditors. However, subsequently the Province has backtracked and reversed its decision (and also demanded repayment of previously refunded money).

Province auditors have now determined the Amazon advertising is different from other Pay Per Click models due to language in the Amazon Advertising services agreement which states “This Amazon Advertising Agreement (“Agreement”), formerly known as the Sponsored Ads Agreement, governs Customer’s access to and use of the Ad Services, including the Advertising Console…”. Because of the use of the word “advertising console” the Province has deemed Amazon sellers are not, in fact, paying for advertising but are paying for the use of the advertising console.

Is Use of Amazon Sponsored Ads Actually Software?

The Province's argument that advertising on Amazon represents use of software and differs from the language above which specifically states Pay-Per-Click advertising is exempt is unclear and we've been unable to get a consistent answer from either the Ministry of Finance or Provincial auditors. The argument appears to rest on the fact that there is some degree of telecommunications services/software bundled with the ad sales (more on this shortly).

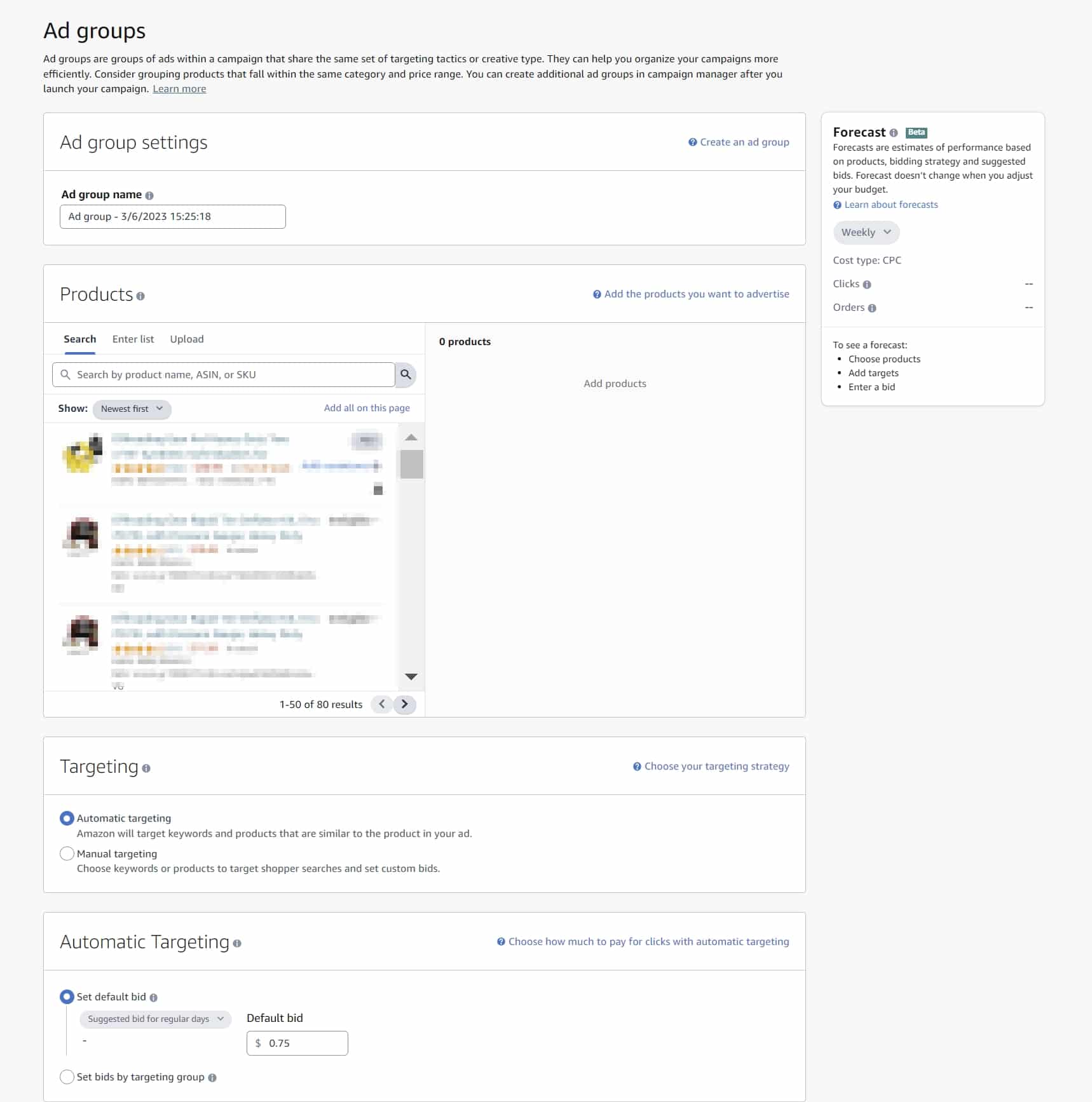

Part of argument from the Province is the argument that because (they believe, although incorrectly) that businesses can create video or image ads within the Advertising Console it represents use of software similar to Adobe Photoshop or Premier. The confusion likely arises in the fact that the Ministry of Finance auditors may not fully understand how ad creation happens on Amazon. However, as Amazon sellers know, almost all ad creation on Amazon is actually far more rudimentary than even Google (or Facebook) and simply involves selecting products and setting a bid amount.

The Provinces Stance on “Bundling” of Services

The idea that some degree of software is bundled within a business' ad spend seems unfounded but the Province has clearly rules regarding this very scenario in its Telecommunications Bulletin. Essentially, a fair market value needs to be determined for the bundled service. According to the bulletin:

“If you sell taxable and non-taxable goods or services together for a single price, you are making a bundled sale. The general rule for charging PST on a bundled sale is that you charge PST only on the fair market value of the taxable portion. The fair market value is the price that a good or service would normally sell for in the open market.”

If we entertain the idea that the Advertising Console is being bundled with other Amazon Advertising Fees (which is a stretch to say the least) then the fair market value would clearly be one of two values:

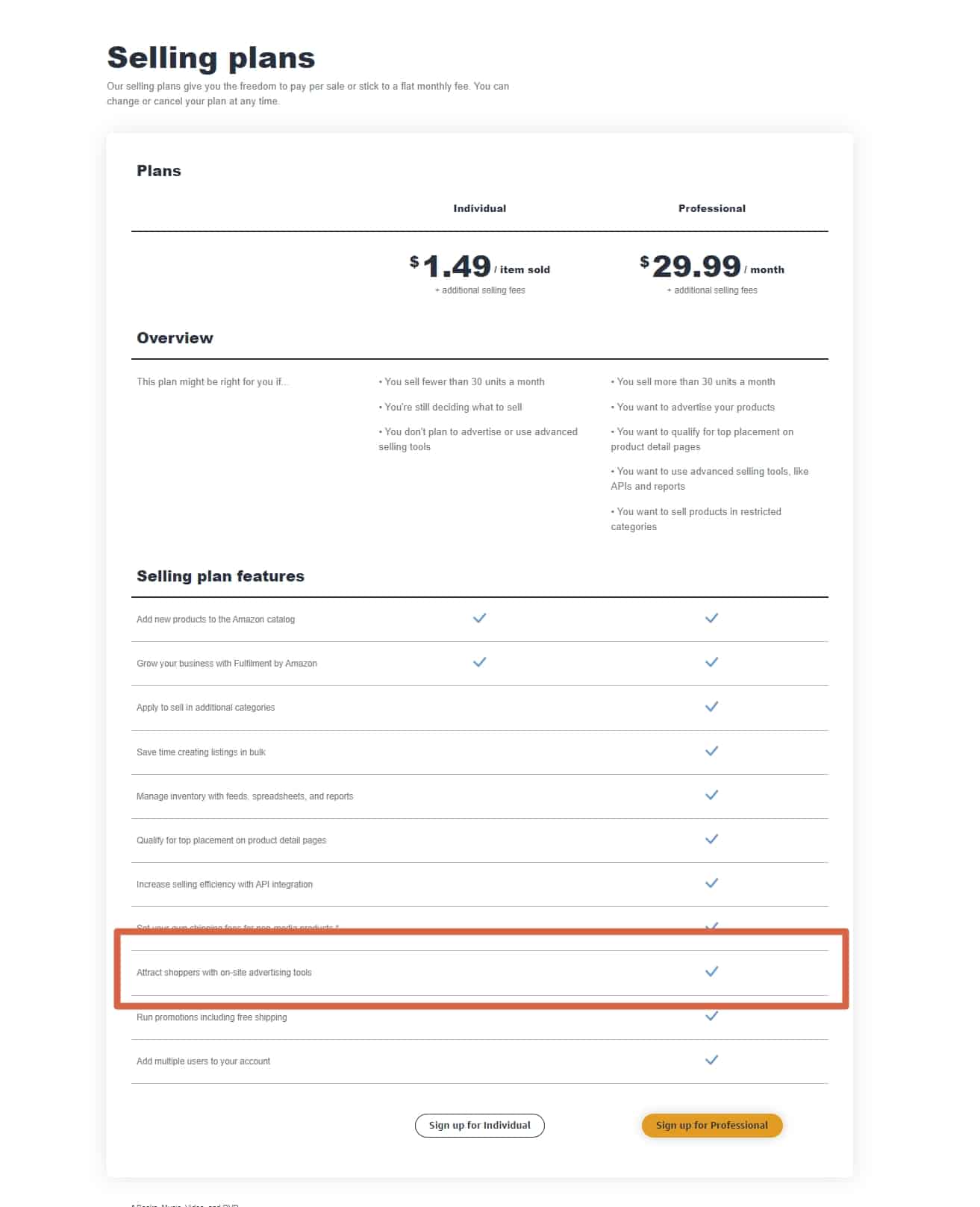

- $0 as businesses can access the advertising console and all of its tools without paying any additional fees. Paying for advertising does not allow access to any additional tools.

- $29.99 – the price of a Professional Seller account which gives access to the Advertising Console.

What About Other Forms of Digital Advertising like Facebook and Google?

Currently, Amazon is the only major online ad platform charging PST on ad spend. Google and Facebook currently do not. The Ministry of Finance has also stated though that these ads should also be subject to PST. In written communication with the Ministry of Finance they said the following:

“If you use software and telecommunication services (e.g., video, music) to create advertisements with electronic devices ordinarily situated in BC, you are required to pay PST. This applies to any platform that provides users the tools and software to create the advertisement. Therefore, PST will apply when Google, Facebook or any other social media networking site provides customers access to taxable software and/or taxable telecommunication services to create advertisements.”

The Province's Stance Threatens All Digital Business in British Columbia and Favors Foreign Owned Businesses

At first, the implications of the provinces stance on digital advertising seems nuanced. However, as we outlined in our previous article on this subject, advertising equates to more than 10% of gross revenue for most sellers meaning a 7% non-recoverable tax on this works out to roughly 1% to 2% of overall revenues. In a low-margin industry such as ecommerce, this will make operating an ecommerce business in British Columbia impractical for many.

I spoke to one large agritech ecommerce business with revenues of over $10million who has already re-located their offices into Alberta to avoid the tax. I've spoken to many others who are either in the process of moving their businesses out of the province or are contemplating it because of the law. Personally, I am also looking at selling the majority of our brands because of the application of the law.

However, the trickle-down effects go beyond just ecommerce businesses. Dann Ilicic, who runs a Yaletown based marketing agency, told me “The way the law is written makes running any digital marketing agency in the Province effectively impossible.”

The worst part of all regarding the law is that it explicitly advantages foreign businesses, especially Chinese businesses. Currently, PST is only applied to B.C.-based businesses even if a foreign company is advertising in British Columbia. With Chinese based businesses making up over 60% of all Amazon sellers, the law disadvantages B.C. sellers and benefits foreign based sellers.

There is a glimmer of hope as the Ministry of Finance wrote back to us in late February 2023 with the following response, “Since the introduction of the new rules on the tax collection, remittance, and reporting obligations of online marketplace facilitators and on online marketplace services, the Ministry of Finance has received feedback and suggestions from various stakeholders such as yourself on these changes in order to make the changes more simple, clear, and consistent.” Unfortunately, it is uncertain how much more clear the current bulletins can be and it remains to be seen if future bulletins will affect anything.

If you're a B.C. based seller and think this law is unfair, I'd like to ask you to please write to the Ministry of Finance (FIN.Minister@gov.bc.ca) as well as signing our Change.org petition.

We are a seller in the exact same situation. Any idea why the change.org petition won’t load. Looking to get in touch with Grant, how can we email you?

I’m not sure why it’s not loading, but sorry to hear you’re in the same situation. Contact your MLA and MOF if you can!

Good article. I have written email to the Ministry of Finance. But I don’t expect any changes recently.

Great – every voice matters :)

Nice blog

Thank you!