Amazon Gets 54% of ChatGPT E-Commerce Referrals

Early data and hands-on testing suggest that conversational AI may be concentrating shopping traffic around the same platforms that already dominate online retail.

ChatGPT e-commerce referrals is still small. Let’s get that out of the way.

Google, ads, and marketplaces are still doing most of the heavy lifting. But something interesting is happening at the edges.

According to recent reporting, referrals from ChatGPT to retail apps jumped 28% year over year during Black Friday. That doesn’t mean AI is taking over e-commerce. However, it does show people are starting to ask AI where to buy things.

And once people start asking, defaults matter.

What Data Shows About AI Shopping Traffic

The headline numbers come from mobile analytics firm Apptopia, which tracked AI-driven shopping behavior during Black Friday weekend. Their definition of a “referral” was simple: if a user opened a retail app within 30 seconds of closing ChatGPT, Apptopia counted that as AI-influenced traffic.

Apptopia is clear that these are estimates based on a U.S. mobile panel, not direct access to OpenAI’s data. Still, it’s one of the clearest signals we have right now for how AI usage translates into real shopping activity .

And the pattern was hard to miss.

ChatGPT-driven referrals to retail apps increased 28% year over year. Of that traffic, Amazon captured 54%, up from about 40.5% the year before. Walmart followed with a sharp jump, climbing from 2.7% to 14.9%.

Together, those two retailers accounted for nearly 70% of all ChatGPT-driven retail app opens, leaving the rest of the field to divide what remained.

AI Was Supposed to Open Things Up. It Didn’t.

There has been a quiet assumption that conversational AI would make product discovery more even-handed. The idea was simple: ask a question, get the best answer, and let quality rise to the top.

In practice, AI behaves less like a neutral referee and more like a cautious recommender. When the prompt is vague, the response tends to favor options that feel familiar and broadly acceptable.

Large retailers fit that profile extremely well. Smaller retailers usually do not.

How We Tested ChatGPT e-Commerce Referrals

Rather than speculate about how this works in theory, we ran a small spot-check test to see how AI systems behaved in practice.

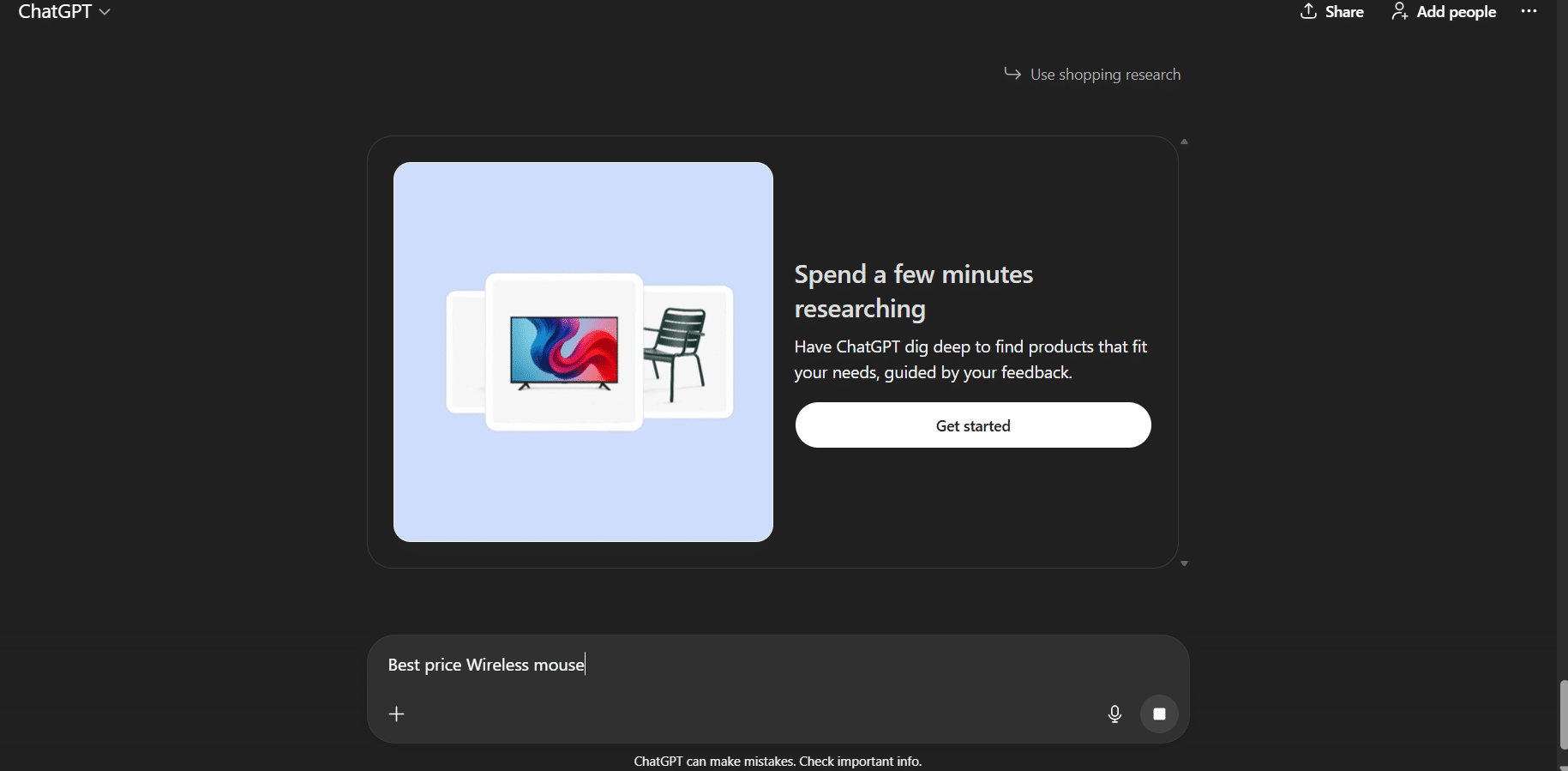

We selected ten everyday consumer products. For each product, we asked the same question:

“Best price [product]”

We first ran these queries in the standard AI chat without enabling any shopping tools—how most users naturally ask shopping-related questions.

We then repeated the same queries using ChatGPT’s shopping research mode, which is designed to surface retailer links and comparisons.

All searches used consistent wording and were conducted in the same session. We tracked which retailers were mentioned or shown in the responses, without attempting to estimate clicks, conversions, or downstream impact.

What ChatGPT Does With Casual Questions

In standard chat mode, ChatGPT did not present retailer links. Instead, it offered a short product list followed by a “Where to Buy” line.

Across multiple responses, Amazon frequently appeared as one of the first retailers named, often alongside Walmart. Even when both were listed, the ordering framed Amazon as the obvious option rather than one choice among many.

Other retailers and brand-owned sites did appear, especially for direct-to-consumer products. However, those mentions tended to feel conditional, while Amazon and Walmart felt assumed.

What Changes When You Use Shopping Research Mode

Shopping research mode behaves differently, but only if the user explicitly asks for it. Including language like “shopping research” before the product query activates this mode.

Once enabled, the structure of the response changes. Retailers are shown as links and the list of options widens to include more competitors and brand-owned sites.

That shift weakens the sense of a single default destination. Prices, availability, and product details share more equal footing, which reduces the influence of ordering alone.

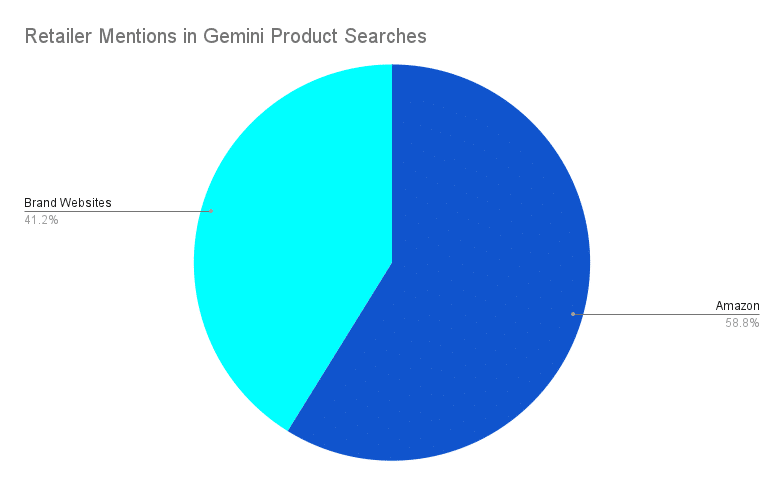

Google Gemini Shows Similar AI Shopping Patterns

To see whether this behavior was specific to ChatGPT, we ran the same conversational prompts in Google Gemini.

Amazon appeared in 10 out of 10 searches. That consistency stood out immediately.

Gemini did attempt to diversify. In 7 out of 10 searches, it also linked to the product’s original brand website.

Still, Amazon remained the anchor every time. Brand sites appeared as supporting options, not substitutes. Even when AI systems attempt to broaden the answer, they tend to organize it around the same marketplace gravity that dominates traditional e-commerce.

Why Defaults Matter More Than AI Shopping Features

On paper, AI shopping tools look strong. Comparison modes exist, retailer links are available, and alternatives are there for anyone who wants them.

In practice, most people don’t use those features. They ask short, vague questions and accept the first reasonable answer. AI responds in kind, favoring options that feel safe and familiar.

Amazon doesn’t need to dominate every AI shopping flow to benefit; it only needs to dominate the default one, because that’s where most interactions remain.

Why Smaller Retailers Struggle With AI Product Discovery

AI systems prioritize clarity and predictability when generating responses.

Large retailers make that easy. They offer broad inventory, familiar pricing, clear delivery expectations, and straightforward returns. All of that is easy to summarize quickly.

Smaller retailers often require context. Better pricing, better quality, or niche advantages take explanation. Unless users ask very specific follow-up questions, AI systems tend to skip that complexity.

The result is structural. Discovery defaults to what is easiest to explain, not necessarily what is best.

How Retailers Appear in AI Shopping Recommendations

You’ll hear a lot of different terms used to describe visibility inside AI systems, including AI SEO, GEO, or AEO. The labels vary, but the underlying idea is the same: brands want to appear in AI-generated answers, not just traditional search results.

What matters for this article is that there is no settled playbook yet.

Based on what we can observe, AI systems lean on signals they can trust quickly. Brand recognition matters. Clear product information matters. Availability and consistency across the web matter. These signals help AI answer confidently, especially when the question itself is broad or loosely defined.

Large marketplaces already perform well on these signals. Smaller retailers can still appear, but doing so often requires more context or more specific prompting from the user. That difference shows up clearly in default AI shopping behavior, even before any deliberate optimization comes into play.

What Early ChatGPT Shopping Traffic Signals for E-Commerce

AI-driven shopping traffic is still early, and that makes it tempting to ignore. The clearer takeaway is not about scale today, but about direction.

Across reported data, hands-on testing, and behavior across multiple AI models, the same pattern keeps showing up. Defaults shape outcomes. Familiarity shapes defaults. And familiarity favors the largest platforms.

That does not mean the outcome is fixed. It does mean the forces shaping it are already visible.

By the time AI shopping traffic feels large enough to demand attention, many of the paths users follow will already feel natural. Defaults in discovery have a way of turning into habits long before anyone agrees they exist.