The eCommerce Guide to Chargeback Management

For those who are not already familiar, a chargeback is a credit or debit card charge that is forcibly reversed by the issuing bank.

The chargeback system was introduced as a way for card users to recover funds in cases of fraud or abuse. The idea was to safeguard consumers who fall victim to criminal losses, but who can’t resolve the situation directly with the merchant. In a worst-case scenario, cardholders would have a fallback option for recovering their money, assuming the loss wasn’t their fault.

As a consumer protection mechanism, chargebacks worked fine for decades. However, that was before the internet completely upended the way we work, communicate, and shop. We have to remember that the system was put into place almost fifty years ago; long before eCommerce was even a consideration.

The way consumers shop has changed, but chargebacks have remained largely stuck in the past. While there have been some recent positive developments, the lag is still causing issues.

Chargebacks are a serious threat for all retailers. However, the impact falls most heavily on eCommerce sellers. The good news is that chargebacks can be managed… but first, you need to understand them.

A Good Idea That Got Hijacked

According to Mastercard, cardholders now file 615 million chargebacks globally each year. Given an average chargeback cost of $191, that means buyers will have disputed more than $117 billion worth of credit and debit card purchases this year alone.

The chargeback system was designed to make shoppers feel confident that credit cards were safe to use. In the internet age, however, people have figured out that nearly any eCommerce purchase can be disputed simply by claiming the transaction was fraudulent. Whether done with innocent or malicious intent, more and more cardholders are using invalid chargebacks to obtain refunds without involving the merchant.

The direct result has been a meteoric rise in chargebacks, many of them unwarranted. Responding to this threat is the core purpose of chargeback management.

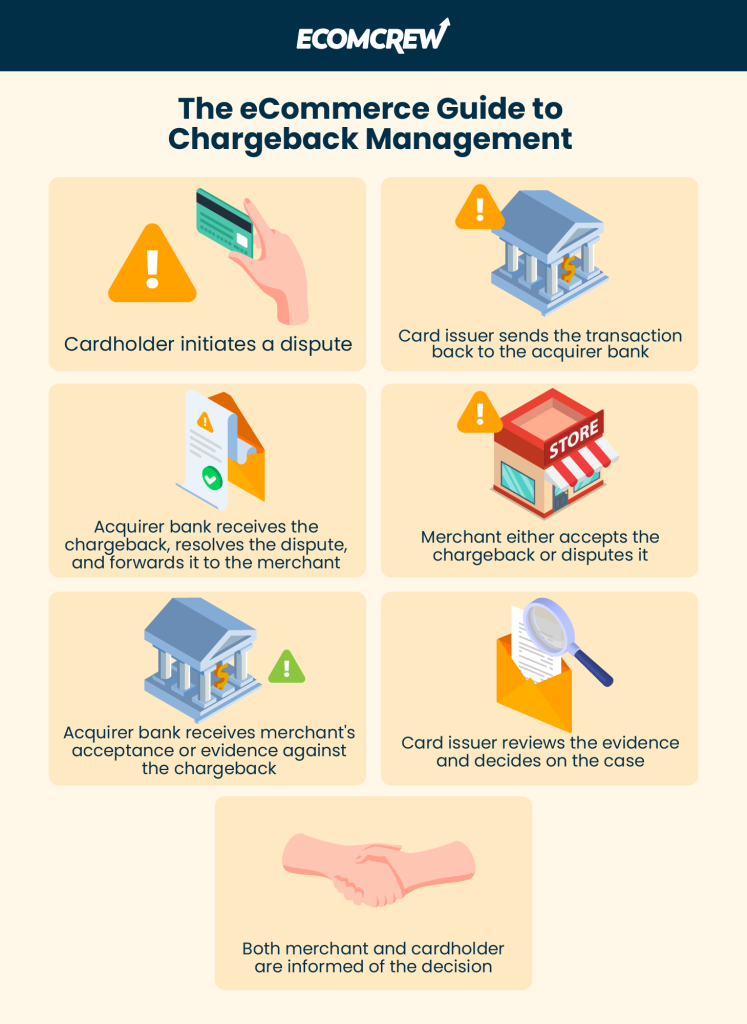

Successfully creating and implementing an effective chargeback system can be challenging, though. The chargeback process is complicated; there are multiple parties involved, as well as tight deadlines and evolving regulations. In many cases, shoppers have no idea that their claims are even invalid. Your strategy must take all of this into account.

Why Do Chargebacks Happen?

Chargebacks can be initiated for a variety of “official” reasons. Credit card networks attach a reason code to each case so merchants will know why the claim was allegedly filed. These labels rarely tell the whole story, though.

The key to understanding chargebacks is knowing that, ultimately, all of them stem from one of three fundamental sources:

- Third-Party Fraud: Third-party (or “criminal”) fraud covers any unauthorized transaction made with stolen or spoofed payment card information.

- Merchant Error: This refers to a list of seemingly minor missteps that can trigger chargebacks, like unclear policies, processing shortcuts, and simple oversights.

- First-Party Fraud: First-party (or “friendly”) fraud describes first-party misuse (either deliberate or unintentional) of the chargeback process by cardholders.

That’s it. No matter what the cardholder’s claim or the card brand’s reason code, the baseline cause of a chargeback can always be traced to one of the three triggers above.

For management purposes, each requires a unique strategy featuring the right combination of tools and tactics. To avoid wasting resources by fighting the wrong problem, you need to clearly identify what is actually causing your chargebacks. And unfortunately, tracking down the true source of each claim isn’t as easy as it sounds.

The Trouble With Chargeback Source Detection

As we alluded to before, reason codes are not reliable indicators of chargeback sources. This is because friendly fraud is predicated on the reason code attached to a claim being false. Looking only at reason codes means you may end up addressing symptoms, but never really touching on the true problems.

For example, let’s say a buyer doesn’t want to pay for an item ordered by another member of the household. Because someone else made the purchase, the cardholder may consider it fraud and dispute the charge. In other cases, a buyer may mistakenly think that chargebacks and refunds are the same thing. Feeling that chargebacks are more convenient, and believing that it doesn’t matter either way, they dispute the charge before bothering to contact the merchant.

In both examples outlined above, the merchant could end up using criminal fraud tools to try and fight what are, in reality, first-party issues. There’s good news, though; once you have isolated the true reasoning behind each transaction dispute, you can start fine-tuning your process to prevent more disputes.

How to Fight Chargeback Criminal Fraud

Most merchants focus their efforts on fighting criminal fraud because they overestimate the amount of third-party fraud they actually experience.

As we’ve seen, many disputes identified as criminal fraud are actually mislabeled cases of friendly fraud. That said, potential criminal activity is definitely a threat. Merchants need to be diligent about deploying fraud detection solutions as part of a multilayer strategy.

Once you’ve identified the extent of the problem, you can start building a strategy using card network verification tools, internal manual review processes, and fraud detection solutions. Think about fraud detection like a net; the finer the mesh, the more fraud you can intercept without inhibiting valid customers.

How to Fight Merchant Error

As with criminal fraud, most (if not all) merchant error chargebacks are preventable. It’s mostly a matter of locating the errors responsible.

This requires an in-depth, end-to-end evaluation of your business. You must be willing to review and rewrite policies and practices as necessary. Every phase of the sales process must be checked for chargeback triggers, including fulfillment, customer service, product pages, and more.

Unfortunately, the typical merchant is too close to their business to do an unbiased analysis. First-hand knowledge of your operation can actually blind you to missteps an outside observer would catch. That’s why outsourcing the job is almost always more effective.

How to Fight First-Party Fraud

Addressing friendly fraud is the real challenge here. Because friendly fraud happens post-transaction, managing this threat is largely a reactive matter. It’s hard to stop fraud when it takes weeks or months before you even know it happened.

That’s not to say it’s impossible, though. Chargeback alerts, as well as tools like Order Insight for Visa transactions or Consumer Clarity for Mastercard, provide notifications of pending disputes. They let merchants avoid a chargeback by refunding the order or providing additional transaction details.

Still, for most online retailers, the best option is to challenge illegitimate claims through chargeback representment. If you’re experiencing a high number of friendly fraud cases, representment is the best way to, at least, try to manage your losses. The process can be complicated and time-consuming, though. Again, this is an area in which outsourcing is usually the most cost-effective option.

eCommerce Chargeback Management

There are dozens of specific practices that merchants can implement to mitigate both short- and long-term chargeback risk. Getting the most from your efforts, however, is dependent on whether you deploy the right tools to manage actual threats. That means understanding the three chargeback sources we outlined above.

Taking a stand against illicit chargebacks can be a huge undertaking. It often requires outside help to do this effectively. In the end, though, the recovery of revenue, a more sustainable business, and a stronger reputation with both banks and customers make it worth the investment.