How to Sell on Amazon FBA Canada (Amazon.ca) in 2024

Are you looking to start selling on Amazon.ca (otherwise known as FBA Canada)? If you're a Canadian, Amazon.ca is arguably the best marketplace to start with. And if you're from America or anywhere else who's already selling on Amazon.com, Amazon.ca is an easy way to boost your sales by 10 to 20%.

In this guide, I'll show you how to start selling on Amazon.ca including things you need to know about business requirements, taxations, and logistics. This guide will talk about physically sending your inventory into Canada and not just using Amazon North America Remote Fulfillment.

Related Reading: How to Sell on Amazon.co.uk

Check Out Our FBA for Canadians Facebook Group

Are you a Canadian selling on Amazon? Check out our exclusive Facebook group for Canadian Amazon sellers.

Why Should You Sell on Amazon.ca?

First thing's first, this guide is about sending your inventory physically into Canada NOT using Amazon North America Remote Fulfillment (NARF). NARF is a far inferior alternative then what we're discussing here.

Maybe you're wondering if selling on Amazon.ca is worth it. Canada has a population of 40 million compared to 330 million for America. So why go through all that hassle of shipping your products directly into Canada? Well there's some very important reasons why:

- Get WAY more sales than just using North America Remote Fulfillment (NARF) and get about 10-20% of the sales of Amazon.com

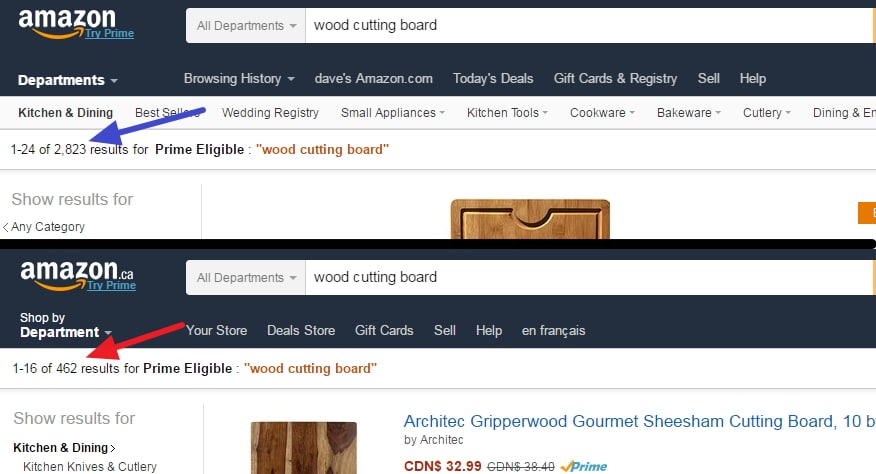

- Much less competition compared to Amazon.com

- Lower PPC costs

- Allows you to ship products from Canada to Canadians from non-Amazon sources

Canada has about 10% of the population of the US so by this but you'll likely see much more than a 10% gain. Why? Because competition is much less fierce in Canada. In general, I tell people to expect up to a 20% gain in sales from selling directly on Amazon.ca.

On Amazon.ca, the cost of advertising is also much cheaper than on Amazon.com. Typically, our ACoS on Amazon.ca is about half (or less) of what it is on Amazon.com.

One of the other benefits of selling on Amazon.ca is that you can use multi-channel fulfillment to ship Canadian orders from your website to Canadians direct from Canada (you cannot use MCF for international orders). This avoids duties and long transit times and is a big positive for Canadians.

Why North America Remote Fulfillment (NARF) Isn't Really Selling in Canada

In 2019, Amazon rolled out something called North America Remote Fulfillment, otherwise known as NARF.

With NARF, you simply click a button within Amazon.com and voila, all of your inventory is available for purchase in Canada…well, kind of.

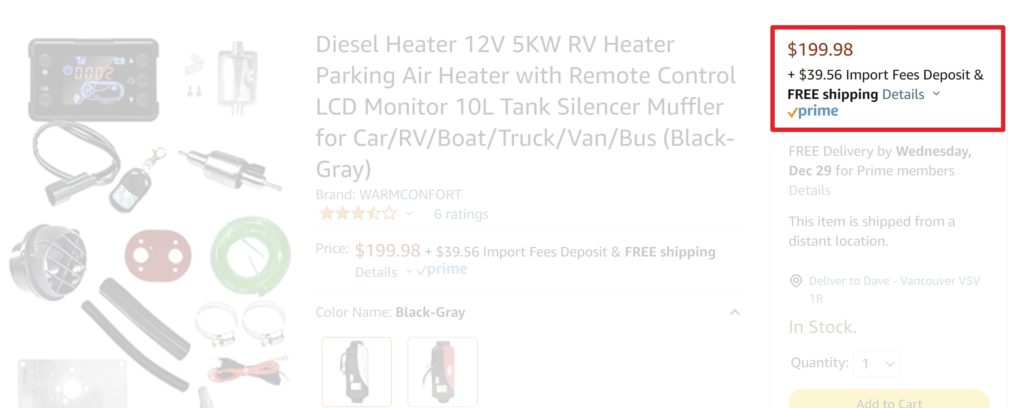

When you using NARF, your items are simply being shipped from Amazon USA warehouses to Canadians. This means Canadians pay expensive shipping fees, duties, and incur long transit times for NARF lists.

Yes, NARF is better than nothing but if you're serious about expanding to Canada it's not a replacement for sending your inventory physically into Canada.

Read more about Amazon's NARF program.

How to Start Selling on Amazon.ca

Alright, let's get into the nitty gritty how to actually start selling on Amazon.a

Step 1 – Register for a Canadian Business Number

This is going to be the most time consuming step for most people (but it's not that hard)

Sellers located outside Canada who import goods for sale on Amazon.ca are considered non-resident importers by the Canada Border Services Agency (CBSA). Both the CBSA and the Canada Revenue Agency (CRA) require businesses to interact using business numbers. A non-resident importer must obtain a 15-digit Business Number (BN) from the CRA before importing goods into Canada.

The Business number is free and easy to get. You can get a business number by:

- You may obtain a business number by calling 1-800-959-5525.

- You may obtain a business number by registering online or by completing Form RC1.

- Having a customs broker get it for you

Many customs brokers can help you get your business number for you (such as Pacific Customs Brokers). I recommend just calling the number above to get your number though. It's easy.

A couple pro-tips if applying for a business number on your own: On the form when it asks for a social insurance number, simply leave this blank and when it asks for your estimated taxable sales in Canada it's smart to enter something below $100,000 as else you will be required to prepay half of your estimated GST (The Canadian Revenue Agency will determine in your second year if you need to prepay a percentage of your GST/HST).

Once you get this business number, everything is easy-peasy.

Step 2 – Send Inventory into Canadian Amazon Warehouses

The next thing to do is to actually send your inventory in Canadian warehouses. You cannot transfer inventory from Amazon.com to Amazon.ca and there is no partnered carrier from the U.S. to Canada (there is UPS partnered carrier within Canada though but only for small parcel, not LTL). This means you'll need to arrange for shipping yourself.

I'm going to assume you have your inventory in a 3PL or other warehouse in the U.S.. Again, you can't transfer inventory from a U.S. FBA warehouse to a Canadian FBA warehouse. The only way is to remove that inventory into a 3PL and ship it in to Canada.

If you're shipping from China to Canada directly, the process is nearly identical to how you would ship to the U.S. and you can use a freight forwarding service such as Freightos.com (note, there is no Amazon Global Logistics into Canada).

Shipping from the U.S. to Canada can be surprisingly expensive. Expect about $300-$500USD per pallet of goods (it'll be more expensive the further the Amazon.ca warehouse is from your warehouse).

Most freight forwarders can ship into Canada for you and directly into Amazon.ca warehouses. We use PCB Freight Forwarders.

Step 3 – Pay Your Duties & Taxes

You will need to clear customs into Canada.

If you have your business number, filing customs is very straight forwarder.

Tariff rates are generally lower now than they are in the U.S. because there is no additional 25% Tariff from China (and if your goods are made in North America, they're duty free).

There is one gotchya – when you import your goods into Canada you will get charged 5% in GST (a federal sales tax). Many sellers look at this as a 5% as similar to a tariff and just the cost of doing business in Canada but it is not. You can get this 5% back at the end of the year but you need to file for it (that's another topic but it's very easy to get this GST back). Almost every single Canadian business files to get back their GST at the end of the year and you should too.

Bonjour – What About Canadian French Labeling Requirements

Canada has a significant French population, particularly in Quebec. By law, all mandatory label information should be shown in English and French except the dealer's name and address. This normally includes the product name and net quantity/measurement information. Directions for use, and promotional/marketing statements do not have to appear in French.

This information is generally not checked upon import and, for better or worse, many private label sellers do not adhere to these labeling requirements.

For more information, see here: http://www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/01248.html

Step 4 – Setup & Market Your Canadian Products on Amazon.ca

Once your products get into Canadian FBA warehouses, your hard work is done and now you need to start marketing those products!

Here's a few steps to follow:

- Make sure your listings are active in Canada! You probably needed to do this before you sent your inventory into Canada but if you haven't already, now is the time.

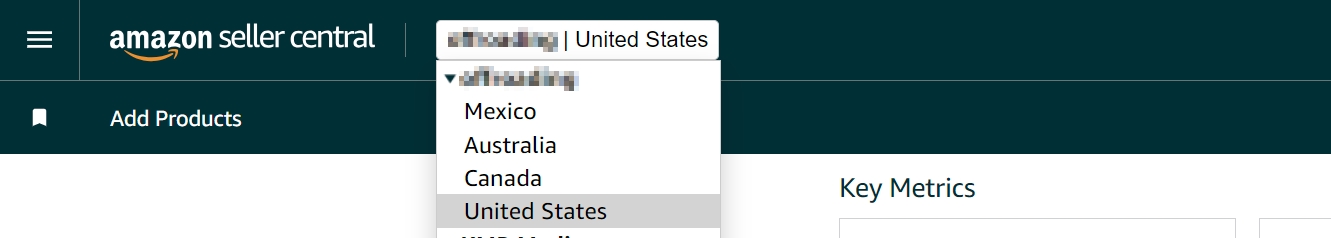

To get to your Canadian listings, switch to Canada in the menu at the top of Seller Central.

To get to your Canadian listings, switch to Canada in the menu at the top of Seller Central. - Turn on Sponsored Products advertising in Canada. Again, it'll be cheaper than the U.S..

- Monitor the exchange rate. If $1USD was worth $1.50CAD when you first started selling in Canada but all of a suddenly the exchange rate jumps to $1USD=$2CAD will guess what? You need to raise your prices in Canada!

And that's it! Once you follow those easy steps you should start seeing some sales in Canada almost immediately.

Sales Tax in Canada

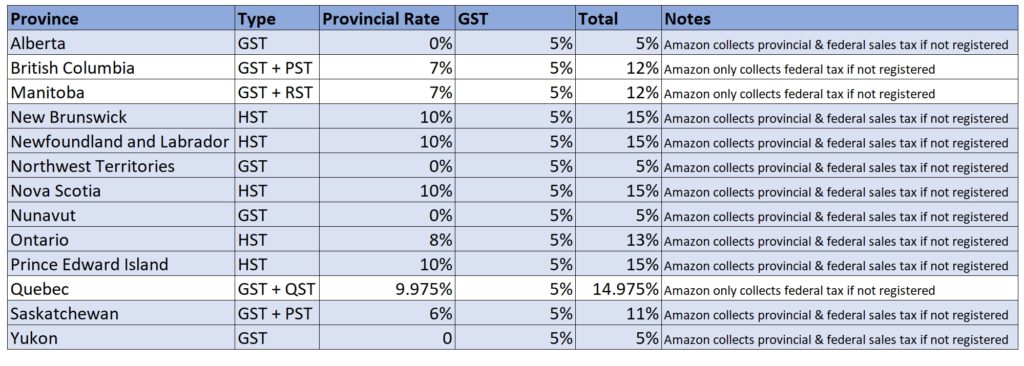

There is a federal sales tax in Canada (meaning everything in Canada gets charged a 5% tax rate) and also some provincial sales tax in most provinces. Most provinces blend the provincial and federal sales tax together called HST.

On July 1, 2021 collecting sales tax for non-Americans got even simpler as Canada rolled out marketplace tax collection (MTC) rules which means Amazon will collect and remit GST/HST for any seller who is not registered for GST/HST.

There's a few provinces where you technically need to collect and file sales tax for, specifically British Columbia, Quebec, and Manitoba. These provinces may have thresholds you must meet before being required to file. Check with an accountant to know your obligations.

Popular Misconceptions About Americans Doing Business in Canada

Here are some of the things people mistakenly think about Americans selling to Canadians:

- You will have to pay Canadian income tax.

- Product regulations are different and more complex in Canada than in the United States.

- You will need to set up a Canadian bank account.

- Americans can work in Canada without a visa.

We are not accountants, but normally, the income you make in Canada will be exempt via tax treaty (assuming you have no permanent establishment in Canada). The reverse is true for Canadians doing business in the US. Check with an accountant to be sure of your tax liabilities though. However, you will definitely be subject to a sales tax liability once you surpass a certain sales threshold.

As for product safety requirements, labeling, etc., they are normally very similar to the US (as opposed to, for example, Europe, where they are much different). As always, though, check with a customs broker to be aware of any potential importing requirements before importing.

Canadian has a different currency than the U.S. but Amazon will be happy to convert Canadian dollars into U.S. dollars and send it to you that way. Amazon will also give you a very poor exchange rate when it does this. Eventually you should get a Canadian bank account such as one through Wise.

Conclusion

Hopefully, this article has outlined my arguments for why you should be selling on Amazon.ca (as well as who shouldn't be) and also how to get up and rolling. Since late 2015, Amazon.ca has been a significant driver of growth for my company and I think it can do the same for a lot of other companies seeking 10-20% sales growth.

Have you had any experience selling on Amazon.ca or other Amazon marketplaces? Do you have any questions about selling on Amazon.ca? If so, comment below.

I don’t know much about this, but you explained well in this blog.

Thank you for the article. I have 3 questions which are below.

1) How to start by creating the account to finnding it.

2) is it too hard to start it

3) What is the easiest way to start

I am asking as i am working in paying starting fee or $29.99.

Thanks

Abrar

Thanks for the summary, Dave. When shipping from the US to Amazon FBA CA via Fedex Ground, what unit value do we place on the commercial invoice? When selling to retailers in CA, we list the wholesale value but as I’m sending it to the FBA warehouse and not a CA retailer do I have to list the full retail value?

Thanks for the info, Dave, great stuff. I don’t really understand the role of customs brokers and you don’t mention them.

I applied for BN + NRI (RM) for US LLC with CRA. I won’t touch GST/HST registration until there’s annual $30K in Canada.

1. I’m confused about the next steps. Do I just register an account with US UPS and ship DDP through them (US 3PL to Canada FBA)? And pay the duty through my CBSA account and send proof to UPS?

2. I talking to a shipping company/agent that says after NRI registration is done I need to apply for a Canadian Brokerage Account ($250). At the same time, they mention that UPS will act as a customer clearance broker (I don’t understand what that means and if that is different from a customs broker). I am lost, so what exactly do I need this shipping agent for, when the UPS will be the broker. Is the broker just paying the CBSA and submitting commercial invoice on my behalf? Do I need some kind of a broker other than UPS for this kind of situation (US 3PL to Canada FBA via UPS)?

3. Since Amazon is collecting and remitting GST/HST on our behalf now, do I even need to deal with GST/HST registration after $30K is crossed? I mean I probably want to do that when there’s a revenue of a couple of $100K, but what if it’s like $50-200K.

Thank you and have a great day

Hello Dave

Thank you for the great article which helped me to process FBA Shipments for Canada.

Couple of questions that I like to ask to make sure.

1- Do I need to make Commercial Invoice for FBA Shipment to Canada? If so, is there a certain format that I need to follow?

2- Since I can’t use the Amazon Partnered Labels other than UPS Labels, when I write down the receiver’s address, is it okay for me to list my contact number since I can’t find the Amazon Warehouse number?

Hope to receive the answer from you soon and have a great one.

1. Any format is really fine. Just find any invoice template and it should be fine as long as it shows the item totals and overall total.

2. Yes

Hi Dave, thanks so much for the rich content and article. Very helpful!

My team has some more questions on the topic of bi-lingual product regulations.

Context: we are a large US personal care brand (soap, shampoos, etc.) selling mostly DTC & Amzn US. We’ve launched our Canadian DTC business ~14 months ago and doing well. Our products only have English packaging at this time.

Questions:

1) We understand there is a risk of product takedowns in the case of ample customer complaints. However, do you know the process of how this would work? Specifically, how many customer complaints would it take? Would we likely get fair warnings before Amzn forced delisting? Would we have the chance to pause all of .CA to not risk the US listings/business?

2) Are there known precedents for this occurring? (i.e., examples of this in the past you’ve seen)

3) Is there a way to suppress sales and/or ad spend in Quebec province to mitigate this risk further? Basically we disallow sales to Quebec at checkout or some other mechanism?

Thanks so much for the help!

I’ve never heard of products getting suspended for bi-lingual issues. You’re right that hypothetically a bunch of customer complaints could trigger it, but this doesn’t seem to be a ‘thing’ that customers complain about often (I’ve personally never seen such a complaint). There’s no way to exclude certain regions for sale on Amazon unfortunately.

Hi David, this is a really helpful article. Question for you. You wrote: “Furthermore, on July 1, 2021 things got even simpler as Canada rolled out marketplace tax collection (MTC) rules which mean Amazon will collect and remit GST/HST for any seller who is NOT registered for GST/HST.”

This sounds great, because I don’t think I’d have the bandwidth to do sales tax filings and remittance myself.

What confused me is that, later in the article, you wrote that the 5th step in getting started is to “Register for GST/HST”. Don’t I want to *avoid* registering for GST/HST, because NOT being registered for GST/HST is what will allow me to have Amazon file and pay sales tax to the Canadian government on my behalf? Thanks for any clarification.

If you meet the legal threshold for having to register to collect GST/HST you still have to do it. Canada knows many sellers won’t, so they put the burden on Amazon to collect if the seller doesn’t. There’s also often tax advantages to registering for GST/HST (i.e. you get back most GST/HST paid during the year)

Hi Dave,

Thank you very much, it is indeed very informative and encouraging. Three questions:

1) With regards to the MCT rule, do I need to apply with Amazon in any way for Amazon to collect the tax on my behalf? Or I just list the product, and Amazon will deduct the FBA fees + taxes + etc automatically every time I sell a unit?

2) Also, for my product, there is really no instructions or anything really.. It’s just a wooden box, wrapped in bubble wrap and packed in a kraft box, and the supplier in China helped me print the FNSKU and shipping labels.. I think that’s about it. So do I still need to do the French labelling thing?

3) If I send10 cartons which has 4 units each (total 40 units), by sea shipping, do you reckon I can get away without a Canadian business number just yet?

Thanks a lot Dave.

1. Too complex for me to answer here.

2. Legally, probably. There’s certain elements that are required to be bilingual. See the link in the article.

3. Value will be more contingent the the number. As long as you can get someone (i.e. the 3PL) to pay the duties on arrival for you and forward you the invoice, you should be OK.

Hi Dave, great article, wish I found this a couple years ago. I’ve been selling a few products on Amazon.ca (I am Canadian). I noticed only one of my items is Prime eligible – I have four products which are very similar variations, and all four are in stock at Canadian fulfillment centers. Prices range from $26 – $35. It’s the $35 one that has the Prime eligible sticker on the listing. Any idea why this would be?? Thanks very much!

Check what address you have entered in Amazon. Could be Canadian location dependent.

Hi Dave

I want to start selling on amazon.ca. I may have a silly question, please bear with me :). But this is what i want to do. Order a small quantity, say about 20 units of a product from ali baba.com to get started . Get it shipped to an FBA warehouse in Vancouver (delta). Set up my listing and hope this product sells. Question 1) will ali baba ship directly from china to the warehouse here in vancouver? and if i choose DDP, will all the costs be included in that. Just regarding bringing the shipment over, what else should i be thinking about?

Don’t have it shipped directly from China to FBA. Your supplier most likely won’t actually ship it DDP and a bunch of other issues can occur (especially in Canada where our de minimis is so low) – ship it to yourself and then ship it in with partnered carrier.

Dear David,

I want to sell a product on Amazon Canada. I am residing in Canada as Permanent Resident but My potential manufacturer is from Philippines. I plan to sell some food seasoning.

1. Is this product possible to sell on Amazon Canada?

2. Do I need to get Business Number first and any tax forms that I should know about and submit first?

3. And since its food item, does it need permit from FDA even though it already is registered product in Philippines?

Still doing some research but it seems difficult

For me

Hi Dave, thank you for this article. I am a single-member LLC in the USA – when filling out the Canadian Business Number form, I have to choose one of the following: individual, partnership, trust, corporation, other. Would I choose “other” as none of the other options really match the entity of a LLC here in the US? Or does Canada consider a LLC a corporation?

Hi Dave, thank you for the post.

I am Canadian living in Canada and recently opened a US bank account to start FBA on Amazon.com. Given the current situation with COVID-19 and Amazon accepting limited FBA inventory in the US and the uncertainty ahead, I am also now thinking of starting on Amazon.ca first since I can do either FBA and MFN here controlling the process easier. When I open a professional selling plan for $29.99 CAD here, do I need to open another separate professional selling plan for $39.99 US when selling on Amazon.com? Is there any advantage to opening the Amazon.com account first before amazon.ca or vica versa? Thank you very much for the reply. – Michael

Hi Dave,

great article, thanks so much for the info. I am a US seller and finally going forward with Canada FBA. I tried to ship a pallet and it looks like I can’t do it without a Canada FBA phone number since the freight company actually needs to call and make a delivery appointment. I can’t seem to find this information anywhere and filing a ticket gets me no where. Any idea which number I need to provide to the Shipper to call?

Thanks so much,

Ed

You probably should find a different forwarder. Most forwarders/shippers now know the entire process of getting into FBA through and through.

Hi David, Great article, whish I had read it sooner! I live in the US and ship some products to Amazon.ca ( FBM and FBA ) Looks like the “easier” way is to just keep it at FBM as the customer will pay the taxes. However FMA in Canada sells much faster for me. Importing cases of products into Canada with UPS paying the fees does this relieve me of the GST and HST tax that the customer pays when I fulfill by FBM? Thank you for your help! Ron

If you’re sending individual shipments across the border to customers, then UPS should bill the customer for all applicable taxes. If you’re sending in cartons to Amazon for FBA, then no, no one is collecting tax for the customers.

Hi Dave,

excellent article!

I’m just trying to confirm one thing.

I’m a US seller and I would like to send a small shipment to Canada just for a test run. (about 100 items)

I will send via DDP (probably UPS or FedEx) but I don’t quite understand the Tax requirements.

As this is a test run. Do I need to register for Taxes in Canada or can I just send the first shipment, see how it goes and then go thru all the of that?

Thanks

Yes, you shouldn’t meet the sales tax threshold.

Hello Dave,

I am a seller in amazon canada who is GST registered and I was wondering if I can set up pricing that can automate Gst/Hst/Pst for different province. My listing price is 20.99 and it gets taxed between 5% – 15% per sale for different province. Is there a way I can set up the pricing adding the specific GST/HST for the specific province? For example, listing price is 20.99, if a customer purchases my product from a province that taxes 15%, listed price changes for that province.

GST/HST is generally added after the sale (not within the sale price like Europe). This is pretty standard functionality in most shopping carts and Amazon. If you want a GST included price that differs, you’re really complicating your life.

Hi Dave,

This week I received the Canadian Business number for my company along with the Import – Export account and a Corporation Income Tax Account which I didn’t request. I’ve been calling Canada Revenue and they insist that even though I have a U.S. coporation I need to have Corporation Income Tax account and the obligation to file an income tax return once a year, is this the case with you? I only requested a GST/HST and an Import-Export account when I requested my business number but they automatically enrolled me in the Corporation Income Tax as well which I think is not correct.

I’m not an accountant but I wouldn’t be surprise that you have to file a tax return, even if null. Again – filing and having tax due are two different things. I’m not sure which boat you fall into. You’d be best to talk to an accountant in Canada about this (there’s a link to a good one here).

Hi Dave,

Thanks for the great article!

Maybe I’m not understanding this correctly but what if I’m buying from Amazon.com FBA and selling the same product to buyers on Amazon.ca,

1. I would need a brokerage company to bring the product over correct?

2. is the product still fulfilled by Amazon?

3. Would the product still be under warranty?

1. If you’re shipping to FBA in Canada, and not shipping it directly to the customers in Canada.

2. If you ship it to FBA in Canada.

3. Not sure – depends on the product’s warranty.

Hi Dave,

Is the dave at smallbizpro.com right email address? I of course changed the at to @ and took out the space. But the email was bounced back to me.

Thank you!

Thank you for the heads up !! It should be smallbizpro.ca (not .com). I’ll correct the article.

Hi Dave,

Our company is currently selling on the .com site in the US and we are a US LLC. We are thinking of selling on the .ca site but have no idea how to approach this which is why we really appreciate this article and may even reach out to the Canadian accountant you listed. We don’t have a high volume of sales yet in the US so I’m a little skeptical about creating listing on the .ca site for all the other expenses that we will have to incur. I had a few questions about using .ca FBA:

1) Do most companies that do CA FBA use an accountant to handle all the GST/HST and provincial tax filings? Is that were David comes in?

2) Does getting a BN for our US company create nexus there where we have to file Canadian income tax returns?

3) How does this affect the partners of our US LLC…would that income flow down to them that would require them to file Canadian tax returns too?

Thanks for the help! Any advice would be appreciated!

Best,

Darrell

1. Yes most people would use an accountant at least for registration (remitting is very simple). Registration is simple though and can definitely be done on your own.

2. Not my expertise but normally tax treaties avoid you being double taxed.

3. Ha- Now you’re really over-estimating my taxation knowledge :-)

Hi Dave,

Great article and great podcast!

Do you have a general rule of thumb on how much to increase the US price of a product when listing it for sale on Amazon.ca?

In your podcast you mention the HST tax, duty fees to import into Canada, customs fees, currency conversion fees, the difference in currency exchange rates and the higher cost of shipping. Is there a ballpark percentage that can be used to add to the current US price to get close to what you should be charging in Canadian dollars?

Thank you.

Increasing them 50% is a safe bet. It’s going to vary though depending on the duty rate of the item and the currency exchange at that point in time.

HI Dave,

I am thinking of sending my goods directly to Canada to a 3PL warehouse and from there into Amazon. Do you have any recommendations for Canadian 3PL who are familiar with Amazon prep and processes?

Hi Charlotte – most 3PLs are familiar now with Amazon. Try http://www.integratedfulfillment.com though – they’re good people.

Great article, Dave, thank you for sharing. We are looking to expand to Amazon.ca (currently .com) but are trying to decide on FBA or FBM. Anything you can suggest to help us decide/what is best for tax purposes? Our product is made in the USA so we don’t have int’l suppliers to ship directly to CA, all products come directly from us. We use FedEx and will continue to. Is any of the info. in the article different than if we chose FBM (as it relates to paying GST/HST)?

If you do FBM from the U.S. to Canada you don’t have to worry about collecting GST/HST. If you fulfill from within Canada, whether or not you use FBA, you’ll still have to pay GST/HST on all orders so there’s not a significant difference.

Dear Dave,

You are a wonderful resource!!

We are a small 501(c) 3 church-owned publishing company (Bibles, Prayer Books, Hymnals, etc). We import these from Asia printers. We understand about becoming an Non Resident Importer, the 5% Federal tax, and Provincial taxes. (We believe that books are exempt from Provincial taxes.)

If we use a fulfillment service in Canada to receive the imported books and sell them in e-commerce to our denomination’s Canadian churches and members, will we have to pay Canadian Income Tax on the money the fulfillment service remits to us in the US?

Can’t find the answer elsewhere, so your help will be much appreciated!

Thanks,

Ron

I

I can’t say for sure but normally if your country has a tax treaty with Canada it will make a lot of it null. I’ll give the obligatory- talk to a tax professional.

Hi Dave,

I am located in Canada and getting ready to place my first order from China which will be shipped directly to the FBA warehouse in Canada. I would like to get the first order shipped via air express so I don’t have to worry about finding a trustworthy freight forwarder right now. Is there a general rule of thumb for when it makes sense to ship air express instead of air freight or sea freight? The order weight is approx. 248kg (16 boxes) and my supplier has quoted me about $6.4/kg which seems pretty good to me. Can you provide any insights or thoughts on this? Also, am I correct in thinking that the shipping terms have to be DDP not FOB with air express to make sure there are no charges billed to Amazon upon delivery?

Your help and expertise is much appreciated.

Thank you,

Nicole

General rule of thumb is right around that 250kg mark sea freight starts to make more sense. You’re right at that limit so both rates are probably going to be pretty comparable. Yes $6.4/kg seems pretty good but sometimes the devils are in the details (i.e. surprise fees). I also assume that is to a local airport – keep in mind someone will still need to pick these goods up from the airport warehouse (it is NOT door to door delivery) and a customs broker will need to be used to clear customs for you.

Hi Dave,

Thanks for replying. Wouldn’t it be door-to-door delivery if it’s shipped via UPS Express Courier? Wouldn’t UPS handle the customs clearance for the order?

Thanks,

Nicole

Sorry I was just thinking it was air freight. If it’s going UPS it is normally quoted door to door and that rate is very good. And yes, they should handle the customs (but they’ll be charging you for it).

No problem, thanks Dave!

Hi Dave,

Thank you for your informative articles. I am a Canadian seller looking to launch my first product on Amazon.ca. Ideally, I’d like to get my first trial order shipped via air express (air courier) to avoid the hassle of finding a reputable freight forwarder and customs broker, plus avoid any hidden costs. I should say that the order will be shipped from my supplier directly to the FBA warehouse in Canada. As far as I know, all air express orders need to be shipped with DDP terms, is that correct? I just got a very expensive quote for air express from my supplier and I’m trying to make sense of it. Typically air express is about $7/kg but the quote she’s given me is a little over $12.5/kg. Can you provide any insight into why this would be so high? Is it because of the DDP terms?

I can provide additional information if you need it, but I would really appreciate your feedback and expertise because it can be a bit daunting and overwhelming trying to figure everything out myself.

Thank you so much and please keep up the good work!

Nicole

$7/kg is on the low end. $12.5/kg isn’t astronomically higher so it could be any number of factors, it’s a peak season, documentation and other fees are included. Suppliers generally don’t gauge on the shipping but they also do not shop around for the best rates so keep that in mind.

Hi Dave, great article. I was wondering if I can get your thoughts on a couple of things:

I have an existing Amazon Seller Account in .com have been selling a few private products for about 4 years, doing okay.

My wife has a new Amazon Seller Account in .ca and would like to import and sell my .com products. Separate bank account and company name from the .com account. The Canadian Company is incorporated with Business Number and GST Number.

I have a couple of questions.

1. Do you foresee any problems with this?

2. Should we create a totally new listing? It will use the same labels and UPC code though.

Or should we just list the products from existing ASIN’s in .com

Thanks for your help.

1. You should probably technically get approval for this from Amazon. If you use the same IP to login they’ll probably flag and/or suspend one of your accounts pretty quick. 2. You’ll have to upload it as a new listing regardless (although 99% of the information will be the same like UPCs)

Good Day,

We are a amazon fba seller based in US. Based on my understanding, in order to sell on fba Canada, we need to register our business with Canada govertment, and register for import/export, then GST, and business income tax(unsure about this)

Do you have referal for any company for the follwing service?

1. help us to setup all IOR so we can import into amazon fba Canada warehouse(or if there is any way we can use third party IOR to import?

2. any sort of virtual mailbox service so we can receive legal letters from govertment

3. bookeeping and tax accountant, for us to pay/claim GST, and clarification on business income tax in Canada.

Thank you and have a great day!

David T

Hi,

Try david@smallbizpro.ca. For the mailbox, check out our list of third party logistics companies here: https://www.ecomcrew.com/the-ultimate-guide-to-finding-and-choosing-a-third-party-logistics-company-or-3pl/

Hi Dave – was reading through your article as I am searching for more information about American’s sell on Amazon.ca (hard to come by so thanks for posting)

I am currently helping a US Corporate client move through getting tax and business accounts set up.

The one item I feel you may not be accurate on is that there are 5 sales taxes sellers may have to remit. HST/GST, BC Sales Tax, Saskatchewan Sales Tax, Quebec Sales Tax, and Manitoba Sales tax. So a warning – If you sell in those provinces you need to collect those sales taxes in addition the GST/HST. I believe Amazon.ca allows you to exclude selling in specific provinces (not absolutely certain).

Also just an FYI in response to some of the comments I read that may prove to be helpful for readers.

When an American individual or corporation applies for a CRA Business Number I would also note that at the same time they can apply for the GST/HST and Importer numbers – this is on the RC1-17e. Check boxes for each one.

American’s must collect HST/GST once their worldwide sales go over $30,000 (not just their Canadian Sales) and the threshold for Provinces that have sales tax is different or non-existent. So what this means for the vast majority of sellers is you should have your taxes accounts set up before you start selling on amazon.ca because you should be charging tax right away.

Apparently amazon.ca has told sellers from the US to just build the tax into their price until they get set up with tax accounts. Doesn’t seem the smart way to do things.

You will also be required to provide a security payment to Revenue Canada if you expect your Canadian Sales to be over $100,000. There is an exemption to this that can be signed off on.

It can take over a month to get all the provincial sales tax accounts set up. Each process is cumbersome, and different.

Thanks again for posting this blog, very helpful.

Thank you David for the excellent follow up. I will modify some of the information to reflect this. In regards to the different provincial sales taxes, I’ll clarify this regarding the provinces. I believe Saskatchewan has voluntary remittance for out of province sellers. BC and Quebec are the biggest provinces people should be aware of. Manitoba has a fairly negligible population and one has to weight the costs of selling there.

Hi Dave,

We are planning on starting international shipping for both our website and on Amazon after reading your article. Thanks for writing it, and for providing all of the helpful information. We think 10-20% growth is very achievable and appreciate you getting us motivated.

We would really appreciate it if you could help us with a couple questions.

Has FBA Export removed the need for shipping product into Canada for sale on Amazon.ca? If not, what are the pro’s and con’s of each method (FBA Export vs. Amazon.ca)?

Also, any recommendations for shipping to Europe? Australia? New Zealand?

Thanks so much for any help.

John

FBA export just ships from USA to Canada which can in no one compare to shipping from within Canada. They don’t get prime, pay a ton for shipping, have slow shipping times, and unpredictable duties and taxes. See our article on selling in the UK here: https://www.ecomcrew.com/how-non-europeans-can-sell-on-amazon-co-uk/

Hi Dave, thanks for this great article it has helped us jump start our planning. For this one point we were wondering if there is anything that you would recommend us do to avoid the bad exchange rates at any given time:

To sell on Amazon.ca, you can continue to use your American bank account and Amazon will simply convert the funds into US Dollars, albeit with a terrible exchange rate (Amazon will take about a 3.5% commission). There’s no need to setup a Canadian bank account.

Would you recommend a bank account that transacts in CAD?

I would suggest looking into TransferWise’s crossborder bank accounts- you’ll get a much better rate when exchanging.

Thank you!

Hi Dave

Thanks for reply.As i want to add amazon.ca to my current amazon.com ,Amazon does lot of scrutiny and that my affect my current account.Some seller mention horror storey on seller forum about suspension of account.My account Health is very good.Is it easy to add amazon.ca

Thanks

Sam Jariwala

I’ve never heard of adding Amazon.ca adding more scrutiny to your .com. Maybe things have changed though.

HI David

Thanks for reply.One more question.My product has 18% custom duty in Canada and 5% gst to add.My other company sell to my NRI company at $10 per peace.Mean i have to pre pay duty $2.30 per peace in advance considering 22% total tax.Now when i sell through amazon.ca at $30 per peace,then after one year filling tax i have to pay tax 22% on $30 sell and credit for advance already paid at my cost of purchase at $10.This is correct.I have to pay income tax in Canada or only in USA .

Thanks

Sam Jariwala

Yes, paying the GST in advance sucks but you ultimately get it back. The duties are normally higher in Canada but this is because the U.S. is abnormally low not that Canada is abnormally high. Just price all of this in to your pricing in Canada and aim for the same margins you have in the U.S. – Canadians will pay for it :)

Hi David Incredible Article very articulate and 1st I have seen that gives details from start to finish on amazon CA.

One question: I did UPS around 2 months ago from US to Canada via fba and the warehouse in Canada did not take the inventory UPS had to return it back to me.

How do I send it from my location in U.S. to amazon canada warehouse?

Yes, I had the same thing happen to me. You need to make sure the freight is going “DDP” aka all of the charges get billed to you and not Amazon.

David, thank you very much for all your efforts and support! We are planning to start doing business with Amazon.ca FBA.

Are the prices displayed on Amazon.ca including the taxes or are they net and the taxes are added once the customer has provided a delivery address?

The issue is how to calculate the price per item send to Amazon.

Thank you very much.

Sorry for the late reply. Tax is charged ON TOP of the purchase price.

Hi Dave,

Do you have the ideal number (in CAD$) you should purchase your products for from suppliers?

I know Amazon.com ideally your product cost should be around $5 per piece.

Thanks!

There’s no idea for .com or .ca. There’s lots of paddle board sellers making a ton of money on Amazon and their cost of goods is around $250 :)

Hi David

i am selling my brand products since one year from amazon.com usa FBA. My sell volume reach $100 k per month.I am importing from China to my warehouse.i want to start sell through amazon.ca

do you advice me ?

Thanks

Sam jariwala

Easy – follow the steps here :)

Hi David

Thanks.I got BN number 15 digit as per your advice.Now should i apply GST/HST number and thenafter contact my freight forwarder to ship amazon warehouse in Canada? or i can apply GST/HST letter stage.I am confident to sell$100 k in one year to Canada

Thanks

Sam Jariwala

Business number and GST/HST number are more or less the same and I believe a business number is all you should need to clear into Canada. I’d contact pcb.ca and tell them what you’re trying to do. They can do your customs paperwork for you and also make sure you have everything you need.

David, this is very helpful and I didn’t have to go through a CPA who would charge at least $500 for tax issues in Canada. I thank you for your kind explanation for starting business in Canada via Amazon.ca.

You’re welcome – you can forward that $500 to Ecomcrew ;)

Hi Dave,

Another great article as always.

Fellow Vancouverite here, I would really appreciate your input as I’m very stressed out:

I am a full-time gradute student just starting to import from China and selling on amazon via FBA.

As a trial, I just placed my first order on Alibaba for 120 bracelets worth of a total $98 being shipped by DHL/FedEx to Vancouver. I neither have a import/export account nor a registered business. Am I allowed to import as an indivisual with no business affiliations for resale? I am concerned this would be against the law.

Your answer is highly appreciated, thanks in advance.

You should probably be entering this as a commercial entry and have a business number. If it was me though I would do exactly as you’re doing and try to validate my product first and then worry about all the business stuff. You’re life is going to be a million times easier by spend the hour and a couple hundred bucks and getting a business number. Worst at worst, you won’t be able to clear the goods into Canada. I suspect the RCMP and CRA has better things to do than go after you $98 smuggling :)

Hey Dave,

Great article, thanks!

A couple questions:

1) Like many US sellers, we have drop shippers selling our products on Amazon.ca. The ASIN in the same, they are I guess using our same UPC etc. That means that I will need to take over their listings when going to Canada rather than creating new, correct? Have you ever heard of anyone having issues with this?

2) What is the status of Brand Registry in Canada? I would want it to lock off my listings from these drop shippers

3) This is a bit of an accounting question, but you touched on it so I will ask:) If I am a company registered in someplace overseas & I’m not American, do I need to pay profits tax to the CRA? I am getting conflicting feedback on this but if so it kind of kills all my eagerness.

Thanks a lot! Keep writing more great articles:)

1) You can try to take over the SKU, which will be messy, or just sell from the pre-existing sku. 2) I’m not sure actually. 3) I’m not a tax expert but I believe it will depend if the country you’re registered in has a tax treaty with Canada. If so (which most developed countries do) you would only need to pay sales tax.

David Such a uselful article. We are selling in Uk Europe since lat 7 years and in USA we setup FBA since last 4 years.

As a british citizien i formed a inc company in USA. We want to expand our business on Amazon.ca with FBA.

What do you suggest. Our volume is always high and we can easily go up to 100k in a year.

Please suggest

Short term you can ship in via Air Courier without really needing to do anything else. Long term you will need to setup a business number – a customs broker like pcb.ca can help with that.

Hi there great article! I have a question. On Amazon certain products like books can piggy back through a listing already made. Is that possible with Amazon CA?

Yes, you can piggy back on any existing listing on Amazon.ca as long as you’re selling that exact product.

Am I understanding it right: If i’ll send from China to Canada 1-2 boxes of 150 total units as a trial, I can avoid paying any taxes, correct?

Or should I still pay duties? If so: How do I get billed if shipment (Fedex, UPS) is made by China supplier?

Thanks.

I’m not sure where the $150 figure came from but Canada’s ‘de minimis’ threshold is $20 (meaning anything above this gets tax charged on ). Fedex/UPS will give you a bill upon delivery for the taxes/duties/brokerage.

David,

Any advise for Merchant Fulfilled shipping? We don’t use FBA and would like to ship directly into Canada. Our items are low weight( under 1 lb) low $, (6-10) and small.

thank you. Ann

Do you mean shipping from the U.S. to customers in Canada? USPS is normally the cheapest.

Thanks David,

That is what I thought. I think I need to investigate. The whole tax situation by province and how I handle that. Plus whatever US customs needs me to include. Plus an import dues.

thank you.

Ann

Hi David, I’m Canadian and want to sell on both .com and .ca. Do I have to set up Seller Central acccount in both or can I set up a .com account only and use for both?

You can use one seller central account for Canada, the U.S., and mexico.

Hi David,

Thanks for a great article. I’ll be listing in Canada next month.

What about bilingual packaging? This seems like a legal requirement but seldom enforced?

Chris

I’m not 100% sure what the rules are around the Canadian bi-lingual packaging laws (and most of the visitors here aren’t Canadian so it’s irrelevant to them). I could be wrong, but I do not think this is something CBSA enforces at the time of import and other agencies enforce it when an item actually is for retail sale. Again, I could wrong though

Great article David. When shipping from your suppliers do you tend to send first to Canada or the USA and then split the shipment, sending a portion to the other country? Is there an advantage to shipping to Canada over the USA, or vice versa?

I tend to send to the U.S. first. Ideally if I can justify it, I’ll have a small LCL shipment shipped from China to Canada, although often I end up having to ship from the U.S. back up into Canada. The major downside to doing it the latter way is that you pay duties twice – in the u.s. and in Canada.

I am curious, my company is planning selling our items on amazon.ca FBA. However what will become of the HST when we get a Canadian Business Number, I understand we will collect it from our sales, but we ship our item via Fedex so we will pay it when it come into the county. Will we get a refund for the second time paying the HST on the goods or just have to pay the HST effectively twice and only collect it once?

You mean the HST you pay for goods that you import into Canada? This is an input credit that you get back when you file your HST so you don’t pay HST twice.

Hi David,

Great info.

I’m just getting started in white labeling products. Do you think starting with Amazon.ca makes sense? I thought it might make sense since Amazon.com seems saturated.

Yes, if you’re Canadian.

Hi Dave. How do you gauge demand on Amazon.ca? Since reviews are so low I feel like it’s not the best metric. Do you use any Jungle Scout style tools like ASINspector?

Hi Danny,

The best way IMO is to divide the U.S.sales by 10 (or slightly lower like 8). You’re right – the reviews are really misleading.