I Sold Anchoring.com for $867,000 (2016)

On October 27, 2016 I sold my private label/ecommerce company which I had run for nearly 8 years for $867,000.

In this article I want to give a detailed account of the entire sales process of selling an ecommerce and private label company. There's a huge lack of information available on this subject. In fact, if it wasn't for a blog post three years ago from Andrew Youderian (who has since become a friend of mine) on selling his business TrollingMotors.net, I would have never had any idea on how to sell an ecommerce company. I hope this article is of help to others out there selling their ecommerce businesses.

In this article describe my decision to sell, how I sold the company, and how you can sell your ecommerce/private label company as well.

The Story of My Company

Let me bore you with some history about my company. If you want the nitty gritty of the business sale you can skip this section.

I had originally started my company in 2008. I started off selling boat anchors. Yes, boat anchors, those big heavy things that go on the bottom of the ocean. Out of respect to the new owners of the company, I won't publicly disclose the URL of the company, but I do share it in the private importing course I offer.

My first purchase order from China was for about $150 for a 50 lbs boat anchor. I quickly sold the anchor for over $300 and I was absolutely stoked! The $300 didn't even begin to pay for my sea freight fees from China but I could see the opportunity to scale my business.

Over the next 8 years I slowly grew my company. In the first couple of years I ran the company as a part time gig while finishing up my business degree at Simon Fraser University. Whenever I would receive a phone call from a customer while in a class, I would run out of the classroom, make my voice deep, and answer it like I was in a huge corporate headquarters in some fancy office. I would use similar tactics when I first traveled to China to meet Suppliers. I could only afford to stay in hostels, but when a Supplier would come to pick me up I would tell him to meet me in the lobby of the nearest Hilton and I would quickly rush there from my hostel.

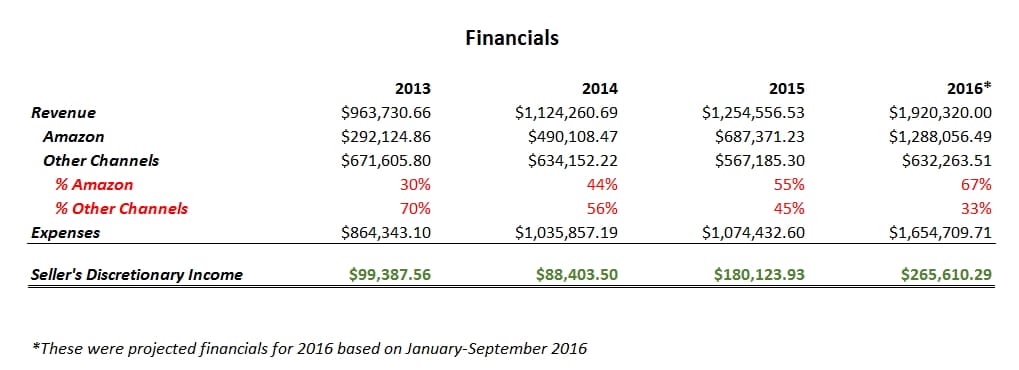

By my second year in business I had grown the company to doing $50,000 in revenues a year. Over the next several years I slowly grew the company year after year. By 2016, we were on pace to do just under $2million a year in revenues selling all types of boating products (over 300 different branded SKUs). We were earning over $250,000 a year in Seller's Discretionary Income (I'll describe what this means a little later) and I was finally able to stay in actual hotels while in China.

Why I Sold my Company

The second most common question I've gotten since selling my company is “Why did you sell?” (the most common is “What are you going to do now?”). As you can see from the financials above, I had a very profitable company and I sold for what equates, more or less, to a 2.65 year's worth (referred to as a multiple) of Seller's Discretionary Income. There were a few major reasons why I sold:

- I wanted the accomplishment of ‘selling a company' – deep down inside I wouldn't feel like a real entrepreneur until I had

- I'm deadly afraid of my business failing and wanted to take some money off the table for security

- It makes me nervous that Amazon had slowly become the source of over 50% of our revenues

- The exchange rate in my country, Canada, has plummeted recently and I got about a 35% bonus by selling my company in U.S. dollars

I've been the prototypical entrepreneur my entire life starting in Grade 2 by selling homework answers for $0.25 per answer. For better or worse, “entrepreneur” is the way I define myself. And to truly be an entrepreneur I felt I needed to sell a company. Sort of like how a hockey player never truly feels success until he makes it to the NHL.

On top of wanting to have the accomplishment of selling a company, fear was a very important contributing factor. I was scared of my business failing and not being able to support my family (and/or having to get a real job!). As I'll get to below, I had a scary year or so where the health of the business was not very good. Although my business had never been healthier, I think this fear of failure is in the back of every entrepreneur's mind. By taking some money off the table I also feel like I'm able to take some bigger bets with my next company.

Contributing to this fear, however, was the fact that every year I was watching Amazon's percentage of our sales creep up. It had moved from 30% of our sales in 2013 to 67% of our sales in 2016. If Amazon ever failed as a channel for us (re: suspension), it wouldn't just hurt my company, it would destroy it. The likelihood of this ever happening was slim, but it was enough to scare the crap out of me by thinking about it.

Finally, I am Canadian but sold my company in U.S. dollars. The U.S. dollar is currently very strong and it allowed me to sell my company for a 35% bonus (I sold the company for $867,000US which equated to $1,170,000 Canadian Dollars). For the past several years the exchange rate had more or less been par (1:1).

The Decision to Sell

At the end of 2014 I made the decision to sell my company. 2014 was a rough year for my company. We were in cash flow hell, I had rushed into a couple of decisions that significantly added to our overhead, and we lost a lot of money. The company overall was negative $60,000 on the balance sheet. You might ask how a company that had Seller's Discretionary Income of $88,000 is negative on the balance sheet The answer is easy: by the naive owner paying himself too much. Compounding everything, in October 2014 me and my wife had found out she was pregnant with our first child. As any parent knows, when you first find out you're about to become a parent, your anxiety is through the roof. That anxiety coupled with having probably the worst year in business of my life resulted in my anxiety being through the roof and on its way to space.

I would have listed my company for sale right then and there if I could have but there was a problem – my seller's discretionary income was only about $88,000. From my research I knew that Ecommerce businesses typically sold for about 2.5-3x seller's discretionary earnings (SDI). This meant my business had a value of approximately $220,000-$264,000USD. This was before taxes and fees AND the currency exchange rate was about par at the time. In Vancouver, where a 2 bedroom apartment is upwards of $800,000CDN, it simply wouldn't be worth it for me to sell at this point. So I made a decision to spend all of 2015 increasing our profits.

Using 2015 to Maximize Our Profits

In 2015 I made some really hard decisions in order to increase our profit. I'll never forget the point where I resolved I needed to make some changes – we were exhibiting at the Toronto Boat Show in January. The show wasn't going as well as I hoped and I could see the company was going to be in serious trouble within the next few months. I had been lying in bed a couple of hours, unable to sleep with the stress, and finally took out my iPhone and wrote down the changes I needed to make:

- Get rid of our office and have me and my 2 employees work remotely

- Take a nearly 40% cut in my salary which allowed us more money to buy products

- Determine the true costs of each product by taking into account ALL costs including product costs, shipping costs, pick and pack costs, return rates, duties, sea freight, etc.

- I set a target margin for all of our products and raised prices – if a product couldn't be sold at the new higher prices we discontinued them

- I negotiated on nearly every cost we had including credit card processing fees, internet bills, 3PL fees, and Supplier costs

- I severely cut back on our Google Adwords spend (in the last couple of years many of our campaigns had become unprofitable)

The two hardest decisions I made were to cut back my salary by 40% and to get rid of our company office. Reducing my salary had no direct impact on the sale price of our company as the owner's salary typically gets added back to the earnings in an ecommerce sale. However, what it did was to free up cash flow for us to buy more inventory and create more revenue. I also got rid of our office that we had rented for 3 years. The office was a great escape from home (my ‘man-cave' I would call it) but it had almost zero functional use for our company as it was strictly office space with no warehouse. Me and our 2 employees started to work from home but also met twice a week at my condo to get some face to face meeting time.

One of the biggest mistakes I see with ecommerce owners who have grown quickly is they do not understand their actual costs on a product by product basis. When you're small and you only have a few products, you see every cost coming in and you intuitively know if a product is profitable or not. However, when you grow to several hundred or several thousand SKUs it's very easy to lose grip with what products are profitable and which are not. I went through months of cost reports to calculate what our true profit margins were on a product and discovered we were actually selling many products at a lost. We either scrapped those products or priced them higher.

I also negotiated price discounts for nearly every expense we had. Simply asking for a discount (and ideally name dropping one of the vendor's competitors) often results in a very easy discount.

Finally, I severely cutback our Google Adwords spend. Over the years, advertising costs with Google have consistently crept up to the point that previously profitable campaigns were no longer profitable. Why I didn't pause these campaigns earlier was sheer laziness.

How Ecommerce Companies Are Valued: A Multiple of Seller's Discretionary Income

By this point you've heard me mention Seller's Discretionary Income (SDI) multiple times. For all intents and purposes, SDI is the only thing that will be used to value your business. Growth and some other factors might affect what range of a multiple you get, but ultimately it comes to SDI. Don't make the mistake I made before in thinking that revenues has any impact on the value of your business. It has almost none. It's all about profit.

So what is SDI? To derive SDI you simply take your profit and then add back your salary and any discretionary expenses- things like car leases, cell phones, meals, trips to Hawaii, etc..

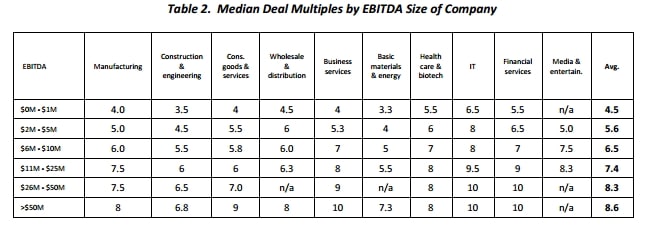

As I mentioned before, businesses typically sell for 2.5-3x SDI- Seller's Discretionary Income for the last 12 months. This means you take the profits from your company for the year and then add back your salary and any discretionary expenses- things like car leases, cell phones, trips to Hawaii, etc.. Below are the average industry multiples. You'll notice that the bigger your company, the higher the multiple you can get.

Also, when you sell your business it's normally a multiple of your Seller's Discretionary Income PLUS the cost of inventory. So if you list your business for sale for $100,000 and you have $20,000 in inventory, the final price is $120,000. I'll get into this more later on.

How to Find Someone to Buy Your Business – Do It Yourself or a Business Broker?

In the beginning of 2016 I decided to list the company for sale. You basically have two options when trying to sell your company: try and go at it alone or use a business broker.

If you decide to self-list you would normally list the site on a place like flippa.com or bizbuysell.com. The obvious advantage is you save on brokerage fees which are typically 10% of the total sale price (it's a lot!).

I've never sold a business before so, as much as anything else, I wanted to use the sale of my business as a learning experience. I felt using a broker would help maximize the learning. Here are some advantages to using a broker:

- The broker should have a Rolodex (email list) of buying leads

- The broker knows the process in and out – selling a business is way more complex than selling a house

- It's easier to negotiate through a broker and you can play good cop bad cop

- The broker keeps the process moving forward through due diligence

- The broker can provided document templates including Letters of Intent, Asset Purchase Agreements, and so on

There are basically two main business brokers for ecommerce companies selling in the mid 6 figures to low 7 figures, Quiet Light Brokerage and AcquisitionsDirect. Other options included EmpireFlippers, which tends to be lower 6 figure ecommerce sites, and Flippa, which is typically more geared towards non-ecommerce companies (i.e. affiliate and advertising based websites). Don't even consider using a local business broker – they specialize in selling local businesses like restaurants and laundry mats.

Ultimately I decided to go with Joe Valley at Quiet Light Brokerage. After multiple calls with brokers and ultimately chose Quiet Light because of their reputation but also because Joe took the time to research and understand my business before we ever spoke. The agreed commission was 10% of the sale price (despite me trying to negotiate lower). Here are some things to keep in mind if you're choosing a broker:

- 10% is an average commission and 8% would be about as low as you can find.

- Make sure the commission is not taken on any inventory and only on the sale price of the company

- Ecommerce businesses are very in demand right now and brokers are hungry for listings

I List My Business for Sale at $597,000

Over the course of a month or so, me and Joe my broker prepared a marketing package for my company. The marketing package consisted of the financials and a lengthy question and answer document about the business. We decided on a list price of $597,000.

But now you say, “Dave, I thought you said you sold your business for $867,000?”. I did. But this is where the inventory part of the equation comes in. As you may recall, I said businesses sell for Seller's Discretionary Income PLUS the landed cost of inventory. We had $267,000 in inventory at the time of eventual sale. The amount of inventory you carry is always variable, so the final cost of the inventory isn't calculated until a few days before closing (it's typical in most cases for the buyer and the seller to go through a lengthy in-person inventory count, which we me and my buyer did do).

On February 23, 2016 the listing went live.

My broker Joe advised me the process generally follows a process somewhat like the following:

- The listing goes live – it gets posted to their website, emailed to their list, posted to several brokerage websites, emailed to other brokers, etc.

- Within a few weeks they expect to get 2-3 seriously interested buyers

- With those 2-3 seriously interested buyers you do 1-4 conference calls between yourself and the buyer. The buyer gets to ask anything they want. They also may ask for some very brief supporting documentation.

- If they like what they see, you negotiate a Letter of Intent (LOI) – essentially a price

- Once the LOI is signed by both parties the buyer gets to start due diligence where they will basically try to recreate everything you've reported in your Profit and Loss Statement. This normally takes 3-4 weeks.

- If the buyer is happy with what they see, you sign an Asset Purchase Agreement (APA) and within 2-4 weeks after, the deal closes.

All in all, Joe told me to expect about 2-3 months from the time the business got listed to the time it closed.

In March we had a lot of inquiries come in about the business but no serious buyers. By May, we had two conference calls with potential buyers but nothing materialized. Finally, 2 weeks before I was about to pull our listing and remove it from sale, the ex-CEO of a public company wanted to have a conference call to discuss my company. I was excited simply to be able to say I spoke to this ex-CEO but didn't expect the call to go anywhere.

The Offer & Letter of Intent

Me and the potential buyer (who ended up becoming the buyer) spoke on June 13 and by June 30 the buyer submitted an offer to purchase. The initial offer basically involved the following points:

- $550,000 purchase price ($50,000 less than asking)

- $100,000 seller financing for 3 years @ 6% interest

- The inventory was to be purchased on consignment (purchased as sold)

With any business sale, the actual sale price is often only part of the actual offer. The other big negotiating points are seller financing (along with the terms for it) and inventory price/financing. After that, there's even more legal jargon that is argued over by lawyers during the final agreement (and this jargon actually has some fairly serious implications). More on this later.

The seller financing is an interesting contingency on most deals. Most buyers want some seller financing for a couple of reasons. First, it's a relatively low-interest rate loan. And second, and even more importantly, it ensures the seller doesn't bail town the second the deal closes.

Ultimately after some extremely long back and forth (there were some family dynamics at play in the deal which complicated things) we agreed to the following:

- $600,000 purchase price (so plus $3000)

- $100,000 seller financing for 2 years @ 6% interested

- Inventory to be paid for over 8 months in equal monthly payments

They say if neither party is happy in a deal it's probably a good deal for everyone. This was probably the case for us. I think I “won” on the sale price along with some of the legal jargon but I ended up taking back more financing than I would have liked, specifically the financing of the inventory.

Due Diligence & Final Contracts

On July 13 we signed the Letter of Intent. This basically gave the buyer access to EVERYTHING about the business. They could ask for any report, any receipts, any tax filings, etc.. As I mentioned, they needed to confirm that everything I reported was 100% accurate.

This is one area that makes having an entirely online business a very good thing. Immediately I setup user accounts for our buyer with PayPal, Amazon, our Magento backend, Google Analytics, and Linnworks (our order management software). This took me about 15 minutes to do and the buyer never asked for a single other thing (often due diligence documentations requests can take hours upon hours). The buyer was able to easily replicate the main items on our Profit and Loss statement (specifically revenue and Costs of Goods Sold) and was able to confirm everything I reported was true. I've heard of many sellers trying to hide costs, inflate revenues, etc.. Don't do this – eventually the buyer will discover any erroneous information and if they do, it will most likely kill the deal.

Despite the buyer having little concern about the health of the business, it still took over 2 months for the buyer to finally draft an Asset Purchase Agreement (basically the final contract to purchase the business). This was apparently the second longest due diligence time in Quiet Light's history. There were several reasons for the delays but ultimately I think it came down two reasons. First, no matter how rich you are, hundreds of thousands of dollars is a lot of money to anyone. The buyer was extremely rich (more than I'll ever be) but everyone is worried about losing this amount of money on a bad bet. Second, it wasn't until October (keep in mind the offer to buy the business was made in June) that I finally met the buyer when he came up to the Vancouver area to count our inventory. I truly think if we met sooner the deal would have closed within weeks instead of months. If you're selling your company, meet the buyer face to face as soon as possible to build rapport and trust.

After the buyer submitted their Asset Purchase Agreement, my lawyer had to review it and make revisions (I used Alexander Holburn in Vancouver – Loren Mallett was incredible). The lawyers typically go through 2-3 rounds of revisions. They argue on things you would never even think of. Things like indemnities and jurisdiction locations, along with other things like non-compete clauses. A couple of important things that were included in the final contract:

- A non-compete clause not to sell boating products online for 3 years

- A promise to help the company transition for 40 hours over 3 months

Expect to pay $5000-7000 in legal fees for nearly any business sale which is one of the rare times I've used a lawyer and felt like my money was well used.

The Business is Sold!

On October 27, the business officially sold. The buyer transferred $500,000USD (remember, there's a financing component) to his lawyer's bank. Once his lawyer provided proof of this we began the actual transfer of assets to the buyer.

Me and my two (former) employees spent all day transferring the assets of the company, things like Amazon accounts, domains, web hosting packages, and SaaS products. This is an important note to make: when someone buys your company they are almost always buying the assets in the company NOT the actual company. The buyer doesn't want the liabilities your LLC or corporation has incurred (such as taxes) but it does want the good stuff like domain names and customer lists. So when I say that I sold my company this is actually not true. My company still exists (including bank accounts and almost everything else financially related to it) but it has no assets with which to speak.

I expected when I sold the company to feel bitter-sweet, almost like when you break up with a girlfriend or boyfriend. Surprisingly, I didn't feel any of that, at least initially. More than anything, I felt a huge sense of accomplishment. As an entrepreneur, you can never truly win while you're in the process of running your company. You always want more growth and more profits. Only when you ultimately exit that company does it really feel like a victory.

What I Learned and Advice to Potential Sellers

As I mentioned before, I viewed the entire process of selling this business as a learning experience. I'm 32 and I feel like there'll be at least a couple of more exits in my life. I think this experience will be invaluable for starting and selling any future businesses. Here are a few points of advice I can give to anybody considering selling their company:

- Build and manage your company like it will be sold tomorrow

- Recognize that there is a market for your ecommerce business

- Revenues are vanity, profits are sanity, especially when selling your company

- Aim to sell your company for under $100,000 or over $1,000,000 (avoid in between like I did)

- During the entire sales process, assume until the very last day that the deal will fall through

The second you start your business, build it as though you are going to sell it. Do things like keeping clean financials and having clear Standard Operating Procedures (SOPs) so that anyone can take over. Also, once you get past a certain size (approximately $1million in revenues) having employees will really help with the sale of your company. The buyer will find peace of mind in knowing that there's other people who have some idea of how the company is run besides you. Basically, make it so that your business can survive without you because if it can't, no one will want to buy it.

Also recognize that assuming you have a profitable and tidy business, there is a market of people who want to buy your business, especially for ecommerce businesses which are hot right now. I was skeptical there would be a market of people with $800,000+ who would want to buy my company, but there is. There are a lot of people in the world with a lot of money and they want to buy ecommerce companies like yours and mine.

For the first few years of my company, I thought the revenues we were generating had some bearing on the value of my company. I aimlessly grew revenues and ignored profit. A business generating $250,000 in sales and $125,000 in profit will generate a lot more than a company generating $2,500,000 in revenues and generating $50,000 in profit.

In hindsight, when I sold my company I fell into a bit of no man's land. The company was too big and expensive for an avereage joe, but it was too small to be of interest to serious buyers. I was lucky to find the perfect buyer but going forward, I will look at the potential sweet spot of a business price to be either under $100,000 or over $1,000,000.

Finally, when selling your business, assume until the day you get your money that your business will not be sold. I don't care if you have the most interested buyer in the world or a signed Letter of Intent, assume your business will not be sold and continue to operate it that way. Once you start to check out of your business, it puts you at an extreme disadvantage during the sales and negotiation process.

Conclusion

It has been over two months since I sold the company. While there has been occasional second guessing of my decision to sell my company, those second guesses have been surprisingly rare. I've been enjoying the last two or so months with complete freedom of the day to day worries of running a 7 figure business. It has also allowed me the freedom to concentrate on other projects, including this blog as well as another ecommerce site which I hope to share the progress of in the near future.

I hope this article helps someone who is considering selling their company or someone just starting a company but who would eventually like to have an exit. If anyone has any questions about selling a company, please post your comments below and I'll try to help the best that I can.

Can you add social media share button?

Just a few lines of code.

Thanks!

We had it but ditched it due to lack of use :-(

Awesome article!!! Thanks for sharing your experience. It’s

Thanks John.

Thanks for this great article taht I discovered today along with others on your site. I’m interested because I have a business not doing well at all here in France. It’s an inherited family business and I guess there are multiple personal and relationship problems between the heirs to blame for to start with. Unfortunately I lack the proper business culture (and studies) to support my dear wish to fix it all. Cooming to the point: to see what it takes to sell a sound business written in your simple words gives me a better view of where we are standing. Nothing is worse than uncertainty.

It’s an interesting position to be in – if you can fix a broken business, even marginally, you can get very big returns for your efforts. Adding an extra $10,000 of profit a year would likely make you $25,000-$45,000 extra in a sale, depending on your industry multiple. On the other hand, there’s the uncertainty in knowing whether you can actually fix it or if you might break it more.

Congratulations on the sale! I can indeed relate to the fact that deep inside you wouldn’t feel like a real entrepreneur until you have sold your business.

Funny you mentioned Joe from Quiet Light Brokerage. Last year I did a call with him. I wanted to know from Joe what I could do to increase my sale price, if I decide to sell my company a couple of years from now.

He mentioned 4 things to keep in mind:

– Collecting and paying sales tax.

– Use accounting software like QuickBooks or Xero. He said “you can sell your business without using accounting software, but it’s going to make things a lot more difficult. Plus you won’t get the same value for your business.”

– Multiple streams of revenue

– Tracking your inventory on a monthly basis. Apparently this is called “Accrual Accounting for Inventory”: [(Beginning Inventory – Ending Inventory)+Purchases)] for EVERY MONTH.

* Did you do all these 4 things in your own business?

* In hindsight, were there other things you would have done differently (for example things that could have increased the sale price)?

Thanks!

Hi Hans,

Yes, I did all of those things. Some of these are more important than others. 1) For sales tax – this one is a bit odd as most of the businesses on Quiet Light have some portion of sales coming through Amazon and very few of them are collecting tax in all of the states they should (12+) but you should be collecting tax in your home state at least, 2) Yes, definitely use some type of accounting software ,preferably quickbooks or xero like Joe mentioned. With most online accounts such as Amazon and PayPal you can easily give another third party access to your reporting so it’s not 110% essential like it used to be, but I would still say it’s 99.9% essential :) 3) This will help your multiple for sure, but there’s many 100% amazon businesses sold, 4) Yes this helps. You can estimate what your monthly COGS was using ratios after the fact, but if you’re not basing your last 12 months of financials on your year end (i.e. you’re basing it on July-June revenues instead of Jan -Dec), then you pretty much need monthly COGS.

Thank you! Looking back, were there other things you would have done differently (for example things that could have increased the sale price)?

In terms of running the business, probably not. I may have tried to grow the company for an extra year to get a higher sale value, but I think there was a limited market for my company so I may not have been able to sell it then. In terms of the actual sale, I’ll know in the future that the sale price is only a small part of the deal – specifically seller financing (probably not doing it) and inventory value (I would have been more aggressive in how I declared landed value, i.e. including ALL freight and handling costs).

Hello,

Thank you for sharing your experience about the whole process. You added several missing pieces to the puzzle in my perception of building and selling my business. I also would had sold my business if I was in your position in a heart beat. If I may, you put yourself in a much better position-you already have the knowledge, but now you have the capital to expand your potential even farther. Plus, you are such a young man. Congratulations Man! I hope to be you in a couple of years:-)

Thank you for your positive comments! I definitely think the whole experience will allow my next adventure to be even bigger :)

thanks for sharing David. Very detailed and step by step.

Hi David,

Great post! I am also from Vancouver and a student of your course. May I know if you provide one-on-one coaching? I live in Vancouver as well and would love to hear about your coaching service. Looking forward to hear back from you. Thanks!!

Hi Ansh,

I’m not doing any coaching right now but feel free to email me any time :)

Can you share some ideas as to where we can start looking for buyers once our company has met our “for sale goal”? Thank you

I highly recommend you to use a broker like Quiet Light Brokerage. It’s very tough to find a buyer cold IMO. You might try a site like bizbuysell but again, I’d recommend a brokerage.

Good stuff David – thanks for bearing it all. I particularly like your comment about being prepared to sell from Day One (keeping all records in good order).

Thanks John. Being prepared to sell also helps if you ever need to sell in a bind (many people need to sell quickly because of duress, i.e. illness) but it also will help your business be a better oiled machine even if you don’t sell.

Great article David and congratulations on your sale. I too recently sold an ecommerce business and I wish there was something like this written before I did – I ended up paying 15% commission including on the inventory! Maybe it was because mine was in the low 6 figures but still, it would have been something to have been aware of that I could have negotiated on. Again, great article for people looking to sell their first ecommerce business.

Hi Jacquie – sorry to keep your comment in moderation – it slipped by me. Who did you sell through, out of curiosity?

David sorry, I thought I had already replied. I used FE International.

Really interesting David. Thank you for bearing it all in such a detailed post. It’s a good reminder that the headline figure of a sale for a business is quite possible composed of elements like the inventory sold over a period of time and some vendor financing rather than what people might imagine is that a cheque with lots of zeros arrives in the mail and you bank it and you’re done!

And then on top of the financing, there’s the normal obligatory transition period. And when the cheque arrives, be prepared to lose a big chunk of that in taxes. All things that are good to know for the person potentially selling their company.