Shein Faces Lawsuits vs. Temu and Fashion Designers

A war between two Chinese fast-fashion rivals are in a standoff in US courts as Shein faces lawsuits vs. Temu.

Temu recently filed an antitrust lawsuit, accusing Shein of using “unlawful exclusionary tactics” to squeeze its competitor out of the US market and prevent Temu’s manufacturing and growth as an ecommerce platform.

Shein Faces Lawsuits From Temu?

According to the complaint from Temu, Shein has undertaken a scheme to protect and expand its power in the United States fashion market instead of offering better prices and quality to its customers.

“For a long time, we have exercised significant restraint and refrained from pursuing legal actions. However, Shein’s escalating attacks leave us no choice but to take legal measures to defend our rights,” Temu said in a statement.

Temu alleges that Shein has engaged in anti-competitive strategies to maintain its top position in the “ultra-fast fashion” market by forcing Chinese apparel manufacturers into exclusive relationships. These tactics have allegedly blocked direct price competition and hindered Temu's sales.

According to a Shein spokesperson in an article by Reuters, they claim the lawsuit by Temu is without merit and that they will vigorously defend themselves.

How Did Shein and Temu Get to This Point?

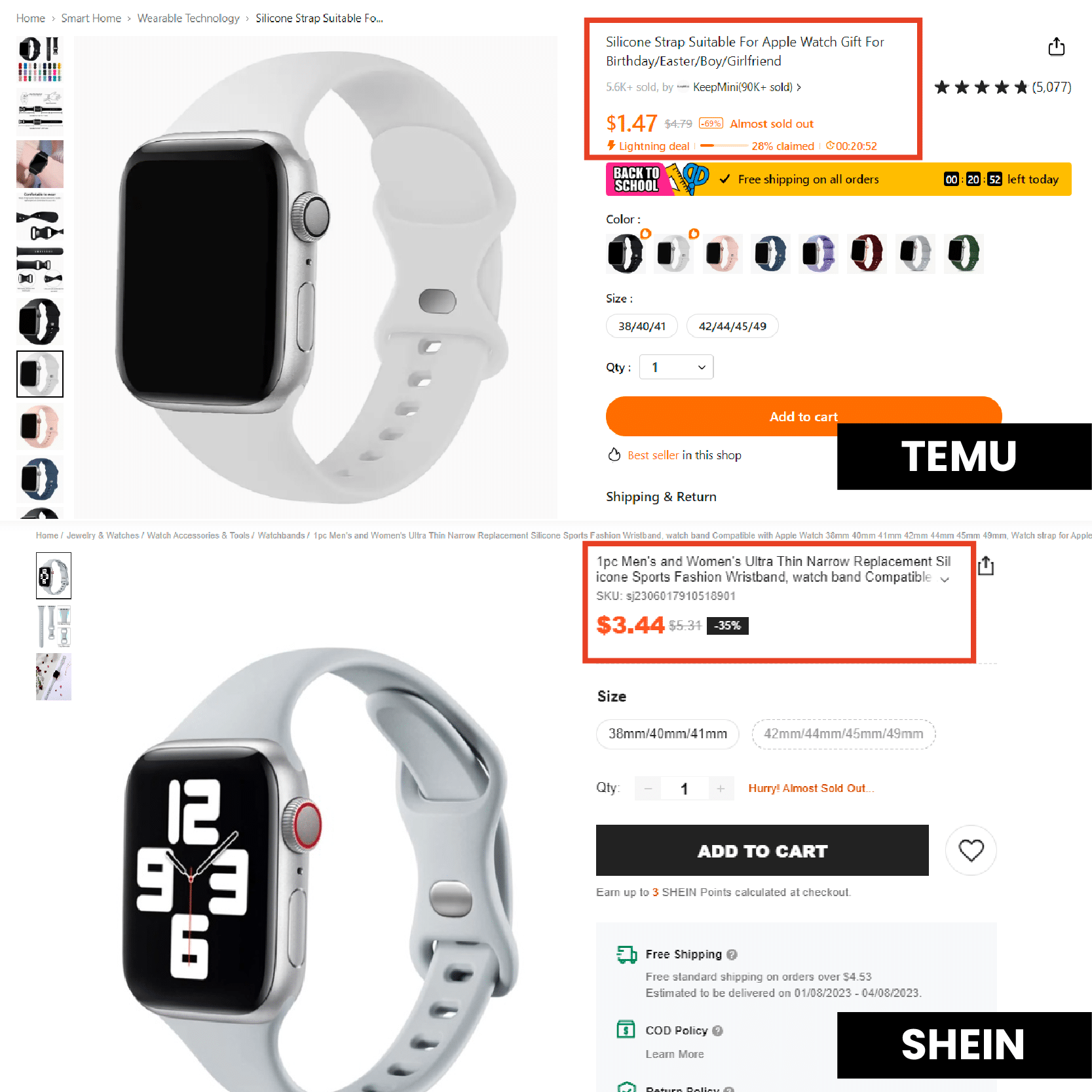

Both companies have gained popularity across the globe due to their low prices.

Temu, a newer player in the clothing scene, was launched by Chinese e-commerce company Pinduoduo in the latter part of 2022. The idea of launching another clothing app stemmed from using Shein’s business model of selling apparel at cheap prices. And as per Harvard Business School, Shein is likely the first made-in-China, sold-beyond-China retailer that uses data and software to match consumer demand for designs.

The biggest secret to their early success has been their willingness to spend on marketing campaigns. For example, in their now famous Super Bowl ad, the company reportedly spent $14 million to have their 30-second commercial shown twice during the game.

As of last April, Temu’s Gross Merchandise Value (GMV) in the United States alone was estimated to be around $400 million.

On the other hand, Shein was founded in Nanjing over a decade ago and has achieved immense success since its launch. Its popular app revolutionized the fast-fashion industry by offering heavily discounted designs to millennials in the US and Europe, leading to an estimated $30 billion in sales for 2022 surpassing established brands like H&M and Gap.

However, this year, Shein’s sales declined from $100 billion to approximately $64 billion mostly due to a tech downturn. An analysis of identical products that were offered both on Shein and Temu found that the prices on Temu were usually 10-40% less than those on Shein.

Shein Faces Lawsuit from Fashion Designers

Despite all the buzz coming from Temu’s lawsuit, Shein is also in the midst of another legal battle.

In another filing, three fashion designers have sued Shein for breaching the Racketeer Influenced and Corrupt Organizations Act (RICO).

The lawsuit claims that Shein engaged in intellectual property theft from the designers, stating that Shein stole and sold exact copies of their work without consent and has been doing so since their launch. It took this long to discover what Shein has been doing since they employed a “byzantine shell game of a corporate structure” to evade legal repercussions effectively.

Will This Affect Amazon Sellers?

To try and regain the money they've lost, Shein has slowly begun its transition from being a cheap but slow delivery retailer to a broad category retailer and hybrid marketplace. One of their projects is to have a physical presence in the US by inviting Amazon sellers to its platform.

“The final piece is to find both suppliers who make and manufacture Shein clothing, but also third-party sellers who are interested in coming alongside us and reaching our customer base in these local geographies,” said Peter Pernot-Day, Shein's head of strategy, in an appearance on the Modern Retail podcast.

Since Shein is still an invite-only platform, the only way they can add third-party sellers is by reaching out to sellers via email. However, since the emails were basically a carbon copy from one to the next, some sellers immediately marked it as spam.

As per one of Marketplace Pulse's blogs, Shein's email template looks something like this:

“With how successful [brand] has been on Amazon, I am reaching out to you today with the opportunity to bring [brand] to SHEIN Marketplace.”

Conclusion

As Shein faces lawsuits, a decision regarding either of Shein's lawsuits has yet to be made in court, but with all the criticism surrounding them in recent months, it’s hard to tell what the future holds for one of the world’s leading B2C fast fashion companies.