Brand Report – February 2022 ($621,816)

Welcome to the February edition of the Brand Report! Each month, we'll break down our monthly revenue so you can see what's working and what's not.

We'll give you aggregated numbers across the eight brands we either own or have significant equity in.

In our exclusive Secret Sauce Brand Report, you'll get our numbers broken down brand by brand. We'll also give you a 60-minute class each month detailing one particular thing we're working on right now that you can use to start and grow your own business.

Our next class is on March 16. It's all about how we identify the initial 3 to 5 products we'll develop. Get the Secret Sauce for your brand.

Revenue for February 2022

Our revenue for February 2022 was $621,816, which is roughly equal to that of January.

IceWraps continued its resurgence and was up nearly 50% compared to February 2021. This is in part due to the fact 2021 was a terrible year for that brand (largely due to supply chain issues) but also thanks to a new homerun product that wasn't a part of February 2021's catalog.

Offroading Gear and BTG continued to have dismal months due to being out of stock of most items and January and February being the slowest months by far.

Typically, there is a fairly massive surge beginning in the second half of March as people start to crawl out of their winter hibernation and start to look toward spring and summer. Generally, March is close to 3x February numbers, but we will see in a month if that trend continues.

Our other brands were fairly comparable to last year, seeing 10% dips or gains.

What We Worked on This Month

Here are some of the things we worked on in February:

- Expanding Instagram Influencer Outreach. We've been pretty heavy in working with YouTube influencers for our Offroading brand. Influencers work well in this niche, and there are a lot of micro-influencers who often will work just for free products. Given this success, we've now expanded to working with Instagram influencers. We've got our products into the hands of a few influencers already, and we'll see in a few months how this pans out.

- Continuing to Raise Prices. Inflation is here. Freight rates are up. Supplier prices are up. And Amazon fees went up their usual 3-5% this year. In response, we've been strategically raising our prices all year. One of our Filipino employees keeps a spreadsheet of all of our ASINs and the BSR rank of that product. Week by week, we increase prices in 5% increments. If BSR drops (in a bad way), we put the price back to where it was. If BSR stays the same or improves, we bump the price again. In our Secret Sauce members' Brand Report, I'll give a screenshot of this spreadsheet we use, although the description above is a pretty good overview.

Two Wins for Our Brands in February

Here are a couple of things that worked for us in February:

- Amazon Global Logistics CHEAP LCL rates – AGL is Amazon's Freight Forwarding arm (shout out to EcomCrew Premium where we have an entire module on using it). I've had a love-hate relationship with AGL over the last couple of years. It was not price-competitive with other freight forwarders, but it's extremely fast. Last year, it became almost unusable due to inventory restrictions, and transit times were terrible. Over the last couple of months though, AGL's freight rates have become either decent or dirt cheap, in the case of LCL. 10CBM FOB China delivered into an Amazon warehouse is roughly USD1,300 – again, that's delivered directly into an Amazon FC.

- More negatives = lower ACOS. We continue to be working hard to lower our TACoS (Total ACOS). One of the easiest wins is to be prolific with negative keywords and ASINS. We have a great negative keywords list that you can check out. Amazon last year also made the change (finally) to allow negative matching of ASINs, something people don't do nearly enough.

Two Fails for Our Brands in February

Here are a couple of things that didn't work for our brands in February.

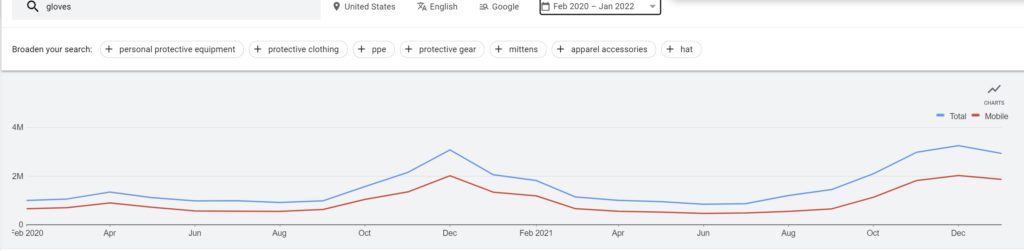

- Our Tactical Gloves sales have been significantly lower than last year – Last year, one of our surprise hits was a Tactical glove we sell. This year, sales have been down nearly 50%. One of our first thoughts was that there was a big Covid bump in search volume for gloves last year (see the traffic analysis from Google Ads below)

It turns out search volume has been pretty steady for the last year. Because of this, our next step will be a listing refresh to help give the listing a boost. In the Secret Sauce member's only Brand Report, I'll detail the steps we normally take to give new life to a stale listing. - Ordering 32 CBM worth of a product. We ordered a bunch of our truck covers late last year. We had calculated it was about 25 CBM, which would fit fine into a 20′ container (a 20′ container has roughly 27 CBM of space). Ordering a 20′ container doesn't really make sense right now as 40′ containers are basically the same cost as a 20′ container (alas, inventory limits). What makes even less sense is accidentally ordering 32 CBM instead of 25 CBM, which is exactly what we did, meaning it's too much for a 20′ container and leaves a 40′ container half empty. Of course, our supplier had a great solution – order some more stuff to fill the container (which is what we ultimately did, but I'm still annoyed our supplier didn't let us know about the silly order volume beforehand).

- (Bonus Loss) Something went viral – in a bad way. We're still wrestling with a bit of bad publicity at the moment, so I'm not going to disclose exactly what happened until later. In a nutshell though, one of our brands had something go very viral in that brand's community. I've experienced things going viral in small ways before, but never to this magnitude. To be continued…