How to Sell Your Ecommerce Company for Top Dollar

Have an ecommerce company? Chances are you've thought about selling it at some point.

Both myself and Mike (your faithful podcast host) have been fortunate to both sell a brand in the last couple of years. I sold my boating brand in 2016 for just south of 7 figures and Mike sold his Adult Coloring brand in 2019 for just north of 7 figures (it still eats away at me that he “won”).

In this post I'll detail exactly how you can sell your ecommerce company for top dollar.

How Much Is Your Business Worth?

One of the best things about selling an ecommerce business is that there is a fairly liquid market for them and valuations are fairly standard.

Most ecommerce businesses are going to get roughly a 2.5-3x multiple of Seller's Discretionary Income (SBI). SBI is basically your company's net profit with discretionary expenses added back to the profit – things like your $1500/month car lease, that trip to the Dominican Republic for a ‘conference', and so on.

Your inventory cost will also get added back on to your selling price. So, for example, if you have a business that generated $225,000 in profit last year, you had $25,000 in discretionary expenses and $100,000 in inventory, your business would be worth as follows:

Seller's Discretionary Income = $250,000

Seller's Discretionary Income x 2.75 = $687,500

+Inventory Value = $100,000

Total selling price = $787,500

I put in a 2.75x multiple in the above example. Actual multiples may be slightly higher or lower. In reality though, as I'll discuss later, your true multiple will often be a lot lower after all costs are taken into consideration.

Also, buyers will pay you for your inventory cost (NOT retail value). They'll also likely want some type of discount on the inventory cost due to old and stale inventory which EVERY business has.

The Mythical 4x+ Multiple

How do you get something more than a 3x multiple? It's not easy.

To get this type of multiple you need to have profits well above $1 million a year. At this level you become attractive to private equity groups and/or as a strategic acquisition. Even then, getting above a 3x multiple is very rare. Most brokers I know have only ever sold a very small number of ecommerce businesses in the 4x multiples or above.

What Buyers Love and Hate When Buying an Ecommerce Company

First thing. It is definitively a SELLERS market right now for ecommerce businesses, especially FBA businesses. COVID has affected many ecommerce businesses positively and there's also a lot of cheap money being floated around for buyers. If you're thinking about selling your business, now is definitely a great time to sell.

However, not every business will fetch top dollar. Many, in fact, sell for closer to 2x and some can't even sell at all.

Buyers LOVE:

- Amazon FBA businesses

- Businesses with low inventory value and high turnover

- Aged businesses

- Obvious paths for profit growth

Buyers HATE:

- Difficult to relocate businesses

- Hero SKUs

- Lots of inventory and/or low turnover

- Messy accounting

Amazon FBA businesses are HOT right now. So hot that there's a cottage industry of ‘FBA rollups' (see the sidebar below). FBA businesses are simple to run and have a high growth trajectory.

Older businesses are also far more attractive than newer businesses, specifically very new businesses. Generally, buyers want to see at least 2 to 3 years of operations before paying a reasonable multiple.

Buyers also like it when your business isn't perfectly executed. Bloated staff, expensive 3PLs, exorbitant COGs – these all are ways that a buyer can potentially increase their profitability overnight.

In terms of what buyers dislike, difficult to relocate businesses are also a turnoff for many buyers. This can mean either warehouse and logistics operations that are difficult to relocate or key staff members unwilling to move.

Inventory is also a scary thing for many buyers. If the potential buyer of your business needs to have $500,000 in inventory to turn a $100,000 profit, that means his cash is not going to be used very efficiently. There is an opportunity cost of capital and capitalists need to determine where to best allocate their money. As Kevin O'Leary says, his money is an army and each day he wants his army to bring back more prisoners, instead of being killed in action. 10% of revenues for operating cash flow (i.e. inventory) is fairly typical.

Finally, buyers are also looking for a sweet spot in terms of the number of SKUs that your brand has. That means not having the majority of your sales in one ‘hero' SKU and not having a disproportionate number of SKUs.

Who's Going to Buy Your Business?

When you sell a business, you may be surprised to learn how many investors (both individuals and groups) there are with deep pockets willing to pay you a good chunk of change for your business. In fact, the vast majority of the time, you will never have heard of the (potential) buyer of your business.

Normally buyers are going to fall into one of the following categories:

- A group of investors who has an active portfolio of ecommerce businesses (often called an “FBA rollup” or “ecommerce rollup”).

- A wealthy individual making a career/business shift looking to run a lifestyle business

- An individual/group looking to flip your business for a greater profit down the road

- A strategic investor in your industry looking to buy a competitor

If you're selling your business for $1 million or under, generally you'll be attracting an individual to buy your business instead of some type of institutional investor.

SBA Lending for Purchasing a Business

The Small Business Administration (SBA) in the United States has some fantastic lending programs available for Americans wishing to purchase another small business. Often they'll lend you the entire purchase price of a business for as little as 10% down. Many/most American buyers are using an SBA loan to finance their business purchase.

Unfortunately, the SBA typically only funds the purchase of U.S. based businesses with 2 years or more of sales history. That means businesses not in the U.S. are going to face a smaller buyer pool of American buyers.

What Brokerage Should You Use?

Unless you have a buyer in mind for your business, you almost certainly want to use a business broker. Selling a business is often far more complicated than selling a house and having a good broker is an absolute indispensable part of the equation. If you're selling your business for less than $100,000 you can consider a marketplace like Flippa as well.

Most brokerages are going to take between 8-10% of the final closing amount. Make sure they do not take a percentage of inventory – only the asset sale price.

Brokers

Marketplaces

The “FBA” Rollup

There's a big trend right now in ecommerce: the FBA rollup.

What's an FBA Rollup?

This is where a group of investors buy a bunch of Amazon FBA businesses hoping to both exploit economies of scale by bringing them all together and also capitalizing on low selling multiples. There are countless of these rollups now including:

The premise of these rollups is essentially that ecommerce and FBA businesses are undervalued and the cash flow they'll get from buying a bunch of them is way bigger than the cost of them.

Check out our podcast with 101 Commerce and our podcast with Shakil Prasala who are both running ecommerce and FBA rollups.

Increasing Your Business Value

Do you have a 10 year business that you've poured your heart and soul into? Guess what – buyers won't pay you for your sweat equity. You're still only going to get around a 3x multiple. You get a higher value for your business by INCREASING PROFITS. You can increase profits by either increasing revenue or decreasing costs. Simple.

When you're preparing for a business sale you want to prepare out for about a year. There's two ways to jack up your ecommerce business value considerably: trim costs and increase prices.

Most ecommerce owners are terrified to increase prices but often unjustifiably so. Increasing prices is often the quickest way to increase profits.

Decreasing costs involves making some hard decisions. Fortunately, undertaking some shrewd negotiation is the most guaranteed way to increase profits. Here are some easy wins for cost-cutting:

- Negotiate product costs

- Eliminate unnecessary overhead (including office space and not needed job positions)

- Negotiate with 3PLs on pick & pack fees and storage costs

- Diligently audit Amazon shipments for lost inventory

Whatever actions you take, make sure you take them with the possibility that you may NOT sell your business. First, you want to pass along your company to another buyer in the same condition you would want it. Second, you may not find a buyer for your business for whatever reason. Third, you will likely see your profits soaring after you cut costs/increase prices and you may not want to sell your business.

Should You Sell Your Business?

You may have a lot of reasons to sell your ecommerce business. Perhaps you're stressed out, you have a family emergency, or you hate ecommerce. Whatever your reason, you should never sell your ecommerce business with the incentive of a big pay-day. Here's why:

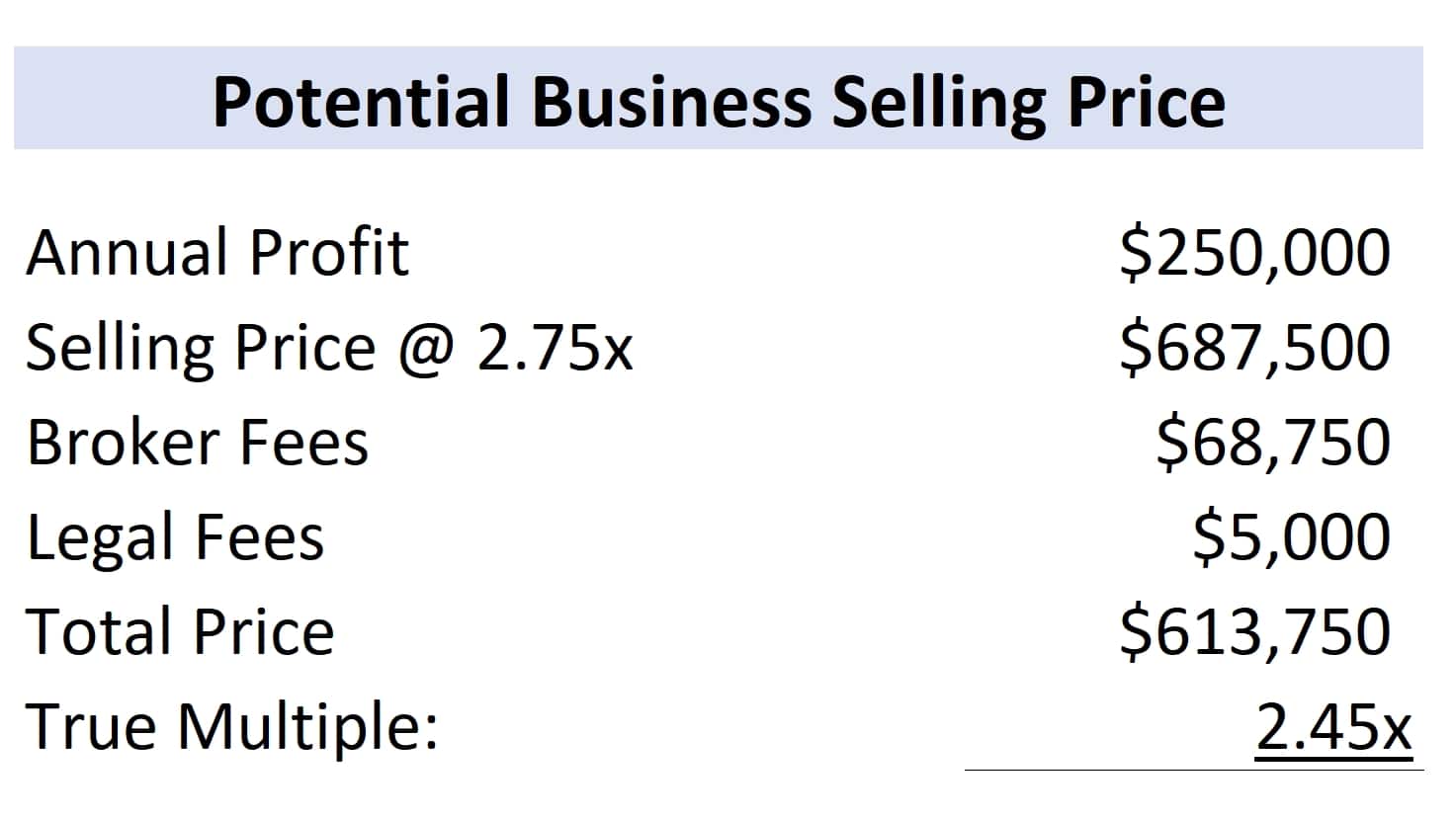

When you sell your ecommerce business, you'll likely get somewhere between a 2.5x-3.0x multiple. Let's take an in-between value and say 2.75x.

Now unfortunately, there will be costs to sell your business. You will pay approximately 10% for a broker and will likely have at least $5000 in legal fees. After all of this, your true multiple will be 2.45x or just 30 months of sales.

There'll also be other costs along the way, such as you'll probably be expected to give some discount on your inventory for “bad inventory” and, not to mention, there'll be lost productivity and the true multiple will be even lower.

As ecommerce entrepreneurs we fret about a lot of ‘single point of failure' events that can sink our entire business, like Amazon suspending our business or some patent troll suing us into oblivion. The reality is though, we often overestimate the true probability of these things happening.

Of all the brands we've sold for EcomCrew, ALL of them have done tremendously well years after we sold them. In fact, some of them have even doubled in size just a couple years after selling them. In hindsight, in all of our exits, we would have been better off financially from holding on to them.

Again, there are a ton of non-financial factors that go into selling a business and no one can discount you and your family wanting to go backpacking through South America for a year. But a big pay-day should not be THE reason for selling your business.

Selling Your Ecommerce Business Negotiation Tips

When you're selling your ecommerce business, here are some good negotiation and closing tips not only with your potential buyer but also with your potential broker.

- Insist your broker not take a commission on inventory

- Insist your broker only take a commission on any portion of seller financed debt AS that debt is paid

- Be aggressive with your seller add-backs but be transparent

- Consider weighting your most recent months and/or future projects into your multiple

Overall, when you're selling your business, there is nothing wrong with being aggressive in almost all regards in determining the asking price as long as you're transparent. If you want to ‘add-back' one of your employees' salary because you don't believe they're essential to the brand then by all means do it but be completely transparent with this add-back and justify it. Your buyer can argue that it shouldn't be an add-back if they don't agree. What you don't want to do is have your buyer discover an aggressive add-back during due diligence. It will undermine your trust.

Also, if your last six months of sales have been through the roof and you can substantiate that sales will continue on this trajectory, then take this into account in your valuation. Again, as long as you're transparent, there's nothing wrong with being aggressive in your asking price. However, by the same token, if buyers feel your business is overpriced it may diminish your potential buying pool and ability to get offers.

The Psychological Effects of Selling Your Business and Seller's Remorse

For most people selling their business, there will be a significant psychological consequence to it. In some ways, it's like seeing a child get married, move out of the house, and go on with their life with another person.

Many sellers will feel regret and remorse at some point after the sale. It means saying goodbye to employees, vendors, customers, and something that has been a significant part of your life for some time. Yes, some sellers feel nothing but jubilation without an ounce of regret, but for most sellers there'll be at least moments of second-guessing their decision. Be ready for these feelings.

Conclusion

Selling your business allows you to cash out one of the biggest assets you likely have in your life: your business.

I've watched other friends and family members try to sell non-digital businesses and the process compared to selling an ecommerce company is night and day. Most small businesses are very localized and as such, are only marketed to a small localized group of buyers. Ecommerce businesses, on the other hand, are national (and often international) businesses that can be marketed to an enormous group of buyers. The result is there's a robust and fairly liquid market for ecommerce businesses and the process of selling your business is relatively easy.

Do you have any questions about selling your ecommerce business? Let me know in the comments section below.

How much of an impact does having multiple sales channels affect the selling price of a business?

I would think that buyers wouldn’t be happy if your only sales channel was Amazon. What if you also sold on Walmart.com, your own website, Sears.com etc?

Also, what about having your products sold in brick and mortar stores? If my products are in several big box brand stores, I’m assuming my business would warrant a higher multiple.

Have you guys ever considered getting your private label brands into retail stores?

Thank you.

Surprisingly, diversified online sales channels won’t affect your multiple that much. Brick and mortar is another story though. Can potentially have a bigger impact on your multiple.