A very good percentage of people who read this blog are importers from China who are selling in America.

Starting August 23, 2018, the Trump Administration put additional tariffs on $16 billion worth of products. It escalated to the point that on May 10, 2019, nearly half of all goods that America imports from China were subject to an additional 25% tariffs. On August 1, 2019, the Trump Administration imposed 10% duties on all remaining products not currently subject to additional duties.

Related Podcast: Episode 257 – How to Deal with the Tariffs for Your Ecommerce Business

The List of Products Affected By Trump's Tariffs

Trump's list of items to be tariffed has come in four stages. The first two affected roughly $50 billion of the United States' $500 billion worth of imports from China. The third list, which went into effect on September 24, 2018, affects $200 billion worth of goods. List 4, not yet in place, will encompass all products not currently hit by List 1, List 2, or List 3.

The first two lists have 25% tariffs. The third list started at 10% and escalated to 25% on May 10, 2019. This is in addition to any existing duties your product may have. So for example, if your product has an existing 8% duty, the new rate would be 8% + 25% = 33%. On August 23, 2019, it was announced that duties on all three of these lists would increase from 25% to 30% on October 1, 2019.

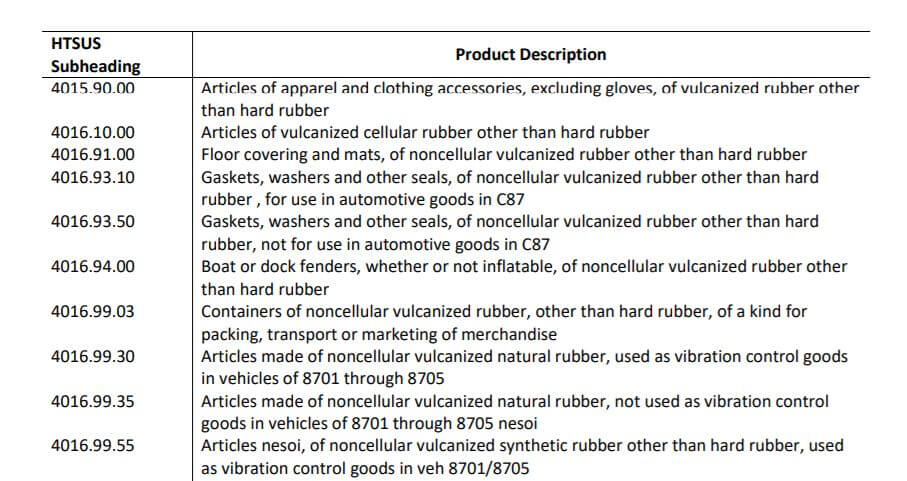

Below is a complete list of all the products affected by Trump's tariffs. These are lists of HS Codes. If you are an importer and do not keep accurate records of your HS codes, now is the time to review your previous customs forms and figure out what these codes are for your products.

| List 1 $34 Billion (25%) |

List 2 $16 Billion (25%) |

List 3 $200 Billion (25%) |

List 4A/4B All Other goods (15%) |

|---|---|---|---|

| Download the list of Affected Items for Round 1, July 6, 2018 | Download the list of Affected Items for Round 2, August 23, 2018 | Download the list of Affected Items for Round 3, September 24, 2018 | Download List 4 |

| Does not include products approved by Congress for exclusion listed here. | |||

Exclusions

Thousands of products have been excluded from the list of affected products. You can view an updated list of exclusions on the United States Trade Representative website. Each of the four lists has its own set of excluded products, but we also found a compiled list of all exclusions across all branches from ST&R.

Also notable are the so-called COVID Exclusions, which were extended until September 30, 2021, but most have since expired. This includes mostly medical care and COVID response products.

List 4 (Effective Spring/Summer 2019)

At the time of writing, the latest list is List 4 (see above), which imposes tariffs on the remaining $300 billion worth of goods not previously subjected to additional duties. Implementation started on September 1, 2019, and the latest modification came on January 2020, which reduced the additional duty on certain products from China from 15 to 7.5 percent.

Are You Affected by These Tariffs?

The first two lists largely targeted non-consumer products such as industrial products, medical products, transportation products, etc. In other words, there is a very good chance that the average Amazon seller was not affected by List 1 or List 2 of increased tariffs.

However, nearly every seller has ultimately been impacted as nearly every product imported from China is facing some type of additional duty (unless it is an excluded product).

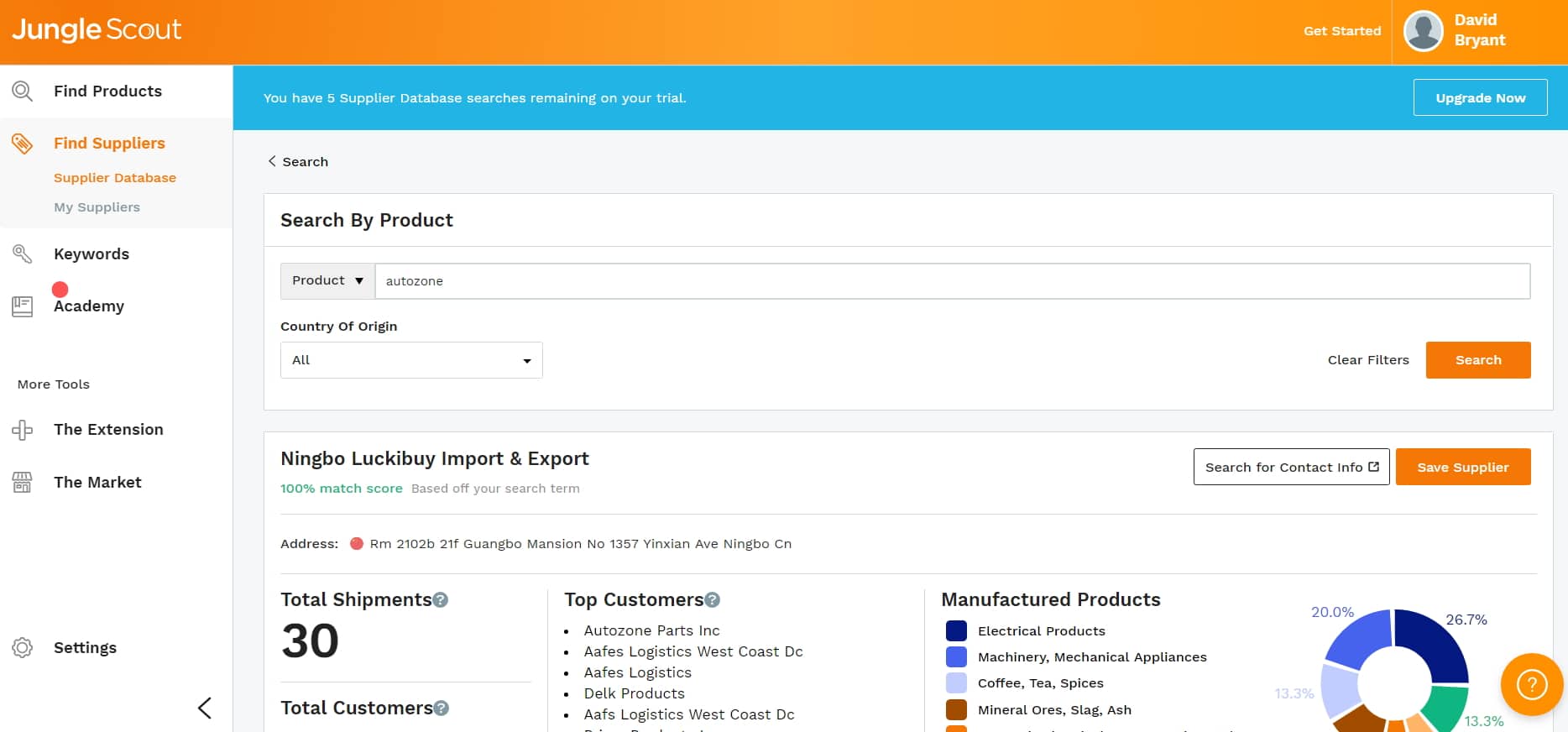

How to See How Much Your Competitors Are Importing from China

Want to see how much your competitors are importing from China?

Custom import records are public information in the United States and there are multiple tools that allow you to simply search for a company name and see exactly how much these companies are importing from China.

My favorite tool for this is Jungle Scout's Supplier Database tool which costs less than $50 a month (other more expensive options include Import Genius and Panjiva). These tools will neatly summarize all of the information included on a particular company's Bill of Lading information such as product type, quantity, and supplier name/address.

What Can You Do to Avoid Tariffs?

There are some things that you can do to minimize the impact of any additional tariffs:

- Review your products' HS codes immediately and determine if they are affected by List 1, List 2, or List 3

- Use the daily $800 de minimis threshold to your advantage

- Diligently plan how much stock you hold considering that tariffs may be removed on very short notice if a trade deal is reached

- Raise prices

What you shouldn't do:

- Deliberately misclassify your goods to avoid lower duties

- Ship goods through an intermediary country like Canada (duties are based on Country of Origin, not the last transit point)

The most important thing you can do is to determine if you will have any products impacted by the new duties and determine if your pricing should be raised to reflect the new tariffs.

Additionally, the United States does allow up to $800/day of goods to be imported without paying any duty which you can use to your advantage. Finally, plan your inventory diligently. Ordering 12 months' worth of inventory is probably not a great idea given the fluidness of things and the fact a trade deal could be reached at any time.

What you should not do is look at deliberately misclassifying your items to avoid duties. What many people do not realize is that your shipments are not fully ‘liquidated' until 12 months after clearance into the United States. This means that your shipments can be reviewed for up to 12 months after clearance to assess whether they have had the correct HS Code applied (you know that bond you pay for when importing goods into the United States? This is to pay for your duties in the event you are re-assessed and can't afford to pay up). You can be sure that post-clearance audits of shipments will increase significantly in the future.

Additionally, first importing your goods into another country like Canada will not avoid the tariffs as duties are based on the original country of origin.

Predictions for the Future

As polarizing as Donald Trump is, “getting tough” on China is one issue he has relatively bipartisan support on. As Elizabeth Economy (a well-respected China commentator) from China File said “The trade war signifies far more than President Trump’s desire to rebalance the bilateral trade deficit. It represents the culmination of decades of pent-up frustration within the United States over China’s failure to make good on the promise of its 2001 WTO”.

While the current impasse will likely be resolved, it's likely that strong resentment and disagreements on both sides of the Pacific will remain. Many have raised the possibility that even if the tariffs are removed in the short term, they may be reinstated at a later date. As China expert Michael Hirson said, “[Any] deal’s implementation is likely to be rocky, with a real risk that the U.S. will reimpose tariffs in the next one-two year.”

Conclusion

Importers find the announcement of a new round of duties extremely annoying, at the very least. We, the importers, are paying the costs in the short term and will be loathed to increase prices. But this burden will be passed on to the end-user. Prices will rise and consumers will be the real ones paying the cost in the long run.

The good news is, like most trade disputes, this is one that will likely be resolved eventually. But hopefully, a lasting resolution is reached sooner rather than later.

Why do you continue to call them “Trump’s” tariffs? Biden has been President for 2 years now, and he owns them now. The media bias is so obvious. When Trump put in the tariffs, there was endless screeching from the media about how bad the tariffs were. Now that Biden has chosen to keep the tariffs, you pretty much hear crickets. Personally, I am all for free trade, but it also needs to be fair. China was restricting U.S. access to their markets while we were allowing endless imports tax free. This put U.S. manufacturing at a disadvantage because U.S. companies are required to pay taxes and follow regulations. China not only charged VAT taxes on U.S. goods, but they also required Chinese ownership of any manufacturing in China. The over reliance on China was proven to be a mistake during Covid. “Trump’s” tariffs were proven to be the right thing to do; otherwise, Biden would not have kept them in place.

It’s not a political comment at all – and, in fact, if it was it would probably be considered a positive as the tariffs have proven to be pretty popular strategy despite the negativity at the time (given the fact they haven’t been repealed). However, you are right that we’re probably missing a keyword opportunity in targeting Section 301 as well :)

Hi Dave

Thanks a lot for this great article. Do you know if the 25% tarrif can be recovered if goods are exported? I send a bunch of stuff to Canada but it comes into the US first. I havent been able to find any info around this.

Thanks!

Hi Dave.

We got our products from china 5 months ago, and only now we received a demand from our broker to pay extra fees retroactively due to the tariffs. My questions are: (a) – can the tariff be imposed retroactively? we already got the products in our hands many months ago; (b) the tariff imposed is very high and unexpected for us. Can we just get rid of the products by returning them back to the broker and then be exempted from the tariff?; (c) the imported products are not designed to be sold separately in the US but to be only components as part of a more complex product we are selling out. Are we still be obligated to pay the tariff? Thank you

a) Yes absolutely. Your duties are only an estimate at the time of entry. They can go back a long time in the past to collect b) If items are exported again they may be subject to a duty drawback. The paperwork and fees can be quite expensive ($1000-$2000+) and not guaranteed. Ask your customs broker if worth it. c) Normally won’t make a difference.

Hi Dave,

What about goods produced in China, shipped then to Norway and assembled there together with other components in order to produce “final” product which will be then shipped to US.

For example, we have propeller blades(casting) produced in China and then assembled in Norway to a marine propulsion system and then shipped to US.

Do we need to pay extra tariffs?

This is a complicated question – there are a lot of rules for determining country of origin in circumstances like this. You’ll need to talk to a customs broker.

Thank you for this useful information, Dave.:)

We are about to manufacture products in China and I have checked the 4 HS code lists and it seems our products are ”fortunately” not on the lists. Where and by whom could I check to confirm that my products are not an issue from the T-tariff?

Or it’s better to find manufacturers from the one of FTA countries but with a bit higher costs?

Confirm with a customs broker to be sure. Most will tell you for free as long as you’re an existing client.

Hi Dave,

I am looking at having a plastic kitchenware product made in China which I will import into the US. When I first researched this in 2018 the duty was 3.4% on the product. Am I correct in understanding that the combined import fee is now 3.4% + 25% tariff + 28.4% payable to US customs ?

Yes, unless it’s exempt.

Thank you for your info., do u think Trump will reinforce the tariff to force US companies NOT to purchase from China due to recent serious CV & CCP pan pacific policies. If so, is there any ref figure on upcoming tax policy.

No idea!

Thank you for sharing the information. I would like to ask why the third lists cover more than 5,733 tariff subheadings as announced at USTR.

Hi Dave

thank you for the informative site .

we are a design house out HK, we manufacture in SZ china and ship to the US.

One of our lines is audio players , also known as mp3 players, we have one model with wired headphones and a 2nd model with bluetooth headphones.

we received a PO from a buyer, for a landed in the US order (vs our usual ex works sz china terms ).

My questions is : do you know if audio players / mp3 players, part of the products that we would need to pay a tariff on when sold into the US?

Thank you

gilad

gilad@pdiver.com

Can’t get that specific unfortunately. Any customs broker or a call to CBP can answer though :)

This article has been very helpful – I’ve been sharing it with a lot of contacts. It’s frightening how little updated information there is about the whole subject area online.

Do you know – does the last update from August 23rd, 2019 still hold true? I read a few news pieces that indicated things may have changed, but again, very hard to find reliable info.

Thank you,

Ryan

They’re off for now.

This article helped me a lot Dave thank you

Glad it helped Emad!

Hi Dave we import hair brushes and combs for women’s hair. I found the item denoted in list 4 on page 138. So the tariff will be 10% of the cost we paid to China or 10% of the retail value? How is “value” determined. I can’t find it anywhere online.

It’s always based on cost.

Hi Dave

I’m an importer of jewelry in the USA. Currently we pay 5.8% customs duty. Will we now have to pay additional 10% tariff or the 5.8% becomes 10%?

Thanks

Amit

It would become 15.8% unfortunately.

Hey Dave,

Thanks for the great article!

I sell products made from steel on Amazon, and these tariffs (currently 25% + 10% more coming) is seriously effecting my margins and cashflow. You mention in the article that if you keep shipments to less than $800, you can avoid tariffs. (I assume this is to not go after smaller businesses?)

I was looking online and I cannot find any additional information on this. I am trying to find the exact specifics of what I need to do in terms of paperwork and logistics. The 35% will make such a difference in my business, I am willing to pay to get an expert to guide me through this – and to do it legally.

If you have any additional information, resources, or consultants that could help with this please let me know.

Thanks,

Matt

Hi Matt – just looked up “de minimis USA”. Most countries have this. America just happens to be very high.

Hi Dave, I am yet to start my AMZ journey, still only on EBay and FB. Your continued Blogging certainly assists arming me with the information I require.

Thank you

Kat

Glad to hear it helps!

Hi Dave,

I know the tariffs starts 9-1-19. Does it have to land in the USA before or exit from China before 9-1-19. Also how do I find out if my HS code is effected with the 15% increase.

Thank you,

Has to land before September 1. The lists here will be updated shortly.

Really helpful article. Thanks

You’re welcome :)

Any updated on when List 4 tariff’s will start being implemented?

Not yet.

Can you give detailed information on how can we use the daily $800 de minimis threshold to our advantage

Shipments under $800 are normally not subject to duties.

Hi Dave, any update on when tariffs on List 4 items will start getting implemented?

Hi Dave,

Do you suggest obtaining a broker if planning shipments to come in on a daily basis under the $800 de minimis threshold? If these sort of imports can be done without a broker, could you direct me to a source for guidance on forms and what to expect. Thank you for this information!

You shouldn’t need a broker if everything is under $800.

Hi Dave,

I want to mention a correction for your article. It says if your article currently has a 10% tariff the additional 25% tariff will increase the overall rate to 35%. That is not accurate.

The tariff increased by 15% from 10% to 25%. Meaning if your article currently has a 10% tariff, it’s now 25%. The 25% is not in addition to 10%. I just had a recently arriving shipment subject to the new 25% and that is what was charged on the Duty Summary

Yes, it is 25%. The article said ‘existing duty’ as in pre-trump tariffs. It was an unfortunate choice for an example! I updated the article to make it more clear the implications.

If I am purchasing goods locally from a company in the US – but the Country of origin for their product is China and they are telling me I will get assessed 25% tariff.

I am actually buying the product here in the US for resale to a customer in India. Is there a way I can recover the tariffs that I paid, since it is being re-exported to India. Any advice or further reading is greatly appreciated.

Yes, this is called a drawback. A bit of paperwork and time to recover the duties but totally possible.

Hey Dave, thanks for the update. Am I right in saying Taiwanese manufactured products are exempt?

cheers.

PS.. I missed your meet up at the HK pub by a day!

Hey Jamie – sorry to have missed you! Yes, Taiwan is exempt (until China decides to reclaim its renegade province at least :)).

Always sad to see the phrase “renegade province” related to Taiwan.

Hi Dave

We have a parcel of luggage made in China which has been in Europe for over 2 years.

From what we can see from the HC codes the goods are not subject to the 10% or the new 25% import tariffs if we ship the goods to the US.

How do we ensure our goods are not subject to import duty concerning paperwork to US customs

Les

UK

Best to ask your customs broker to be 100% sure.

Thank you for doing the heavy lifting and providing the 4 lists.

You’re welcome!

Hi Dave,

Are these 3 lists cumulative? In other words, any items on the first two lists are included in the 3rd (10%) round, and then all items on previous lists will be affected by the Jan 1st 25%. Am I understanding that correctly?

Hi – no, the 25% will be the total, i.e. they increase from 10 to 25% not 10% PLUS 25%.

Hi Dave,

Are these tariffs strictly imposed on shipments directly from China? Or, for example, can a UK shipment into the US be imposed these tariffs, if the materials they used for their product was sourced from China? Thanks.

There’s complicated country of origin laws which dictate the country of origin for products with materials/workmanship coming from different countries. BUT with that being said, if a product is “Made in China” and imported into the UK and then re-exported into America, it is still 100% a made in China product.

Good morning – finding your blog little late – but very useful. If a product is partially made in China, exported to another country for converting of that product and then exported to America – would that avoid some of the duties? What is the percentage of product conversion of an item that deems it not “Made in China”

There is a complex set of rules that govern scenarios like this and it is really dependent on the product category. For example, with watches, the ‘movement’ is what determines the country of origin, not the straps/buckles/etc. You really need to talk to a customs broker because it’s sooo product specific.

We have several products that we have imported under an HTS code in the past that is now hit by the third list of tariffs. We’ve actually found a slightly different HTS code that seems to be more appropriate for the products that is not hit by the tariffs. We’ve found CBP rulings where they have classified similar goods under either HTS code. We’re thinking about now importing under the new one we’ve found. Is this a good or bad idea?

If it’s the legitimate classification, then there’s nothing wrong with it. Whether it’s legitimate or not is up to you and a customs broker to decide :-)

Depending on the total value of the imports the best option would be to get a Binding Ruling issued for the specific commodity directly from CBP. No commodity can fall into two different HTS classifications, either the one used previously is incorrect or the proposed one will be incorrect. A binding ruling will guarantee the correct HTS code is being applied something no Customs Broker can do.

Using an incorrect classification can cause serious financial issues for even large multinationals and much more so for smaller importers. Many times the error is not discovered until months/years down the road and which point the imported product has been sold and the profits from its sale don’t cover the cost of the correct duty rate. It is critical that the correct HTS classification is being used especially when a substantial difference existed between the current and proposed classification exist rate.

Thanks for the advice!

Well, the new tariffs are hitting on the 24th. Increasing to 25% at the start of the year. Any advice on how to find suppliers in countries outside of china?

Trade shows are the best, but online, Alibaba is still probably the best place for finding Suppliers outside of China. With that being said, a 10% tariff increase will, the VAST majority of the time, not make other countries cheaper than China (especially relative to quality of goods). 25% though makes you start to think. However, these hikes will almost certainly be worked out at some point and it’s a relatively short term thing.

I also believe that it is important for each of us to share the story of how we are affected so that regular people understand how these tariffs affect small business and will eventually affect them in the end. I have a little side hustle to raise awareness of this at Who Pays Tariffs.

https://whopaystariffs.org/pages/get-involved

I’m super passionate about this and feel like we must highlight this issue at the smaller business level. Other good news is large scaled manufacturers and retailers are starting a lobbing campaign and lobbying group.. they are the large more impactful group to watch! http://tariffshurt.com/

Hi Leslie, good luck with your efforts!