Rebuilding a Million Dollar Brand – 6 Year Update

Every year since 2017, I've chronicled rebuilding a 7-figure brand from absolute scratch after the sale of my previous company. In this blog post, I'll give my 6th edition of this annual update. And this year is quite unique in the fact that this brand is now being listed for sale.

In this post, I'll detail (as usual) some of the wins and losses for the brand and also give a link to the listing at Quiet Light Brokerage where you can potentially make it yours.

We have an episode about this subject on the podcast. If you'd like to listen, you can find the episode by clicking here.

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 60 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 48 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 36 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 24 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 18 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 12 Month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 6 month Update

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 60 Day Update

This Brand Has Been Listed for Sale on Quiet Light Brokerage

The big news for the brand update is that as of this week, this brand is now up for sale on Quiet Light Brokerage. As a plug for QLB, Mike and I have used Quiet Light on multiple brand deals now since 2016 and they are by far our favorite brokerage. If you're looking to sell, reach out directly to Chris Duty (chris.duty@quietlight.com) and mention EcomCrew sent you.

Here are some details of the brand if you're interested in learning more:

- It's in the offroading/camping niche

- 6 years old

- Trailing 12 months Seller's Discretionary Earnings is $192,888. The multiple is 3.47x.

- 95% Amazon (and 25% of the Amazon sales are from Amazon.ca)

- Pending Design Patent on our top-selling product

- Fantastic branding, imagery, and video

- Great sales growth over the last 12 months

See the Listing on Quiet Light Brokerage

Why Am I Selling the Brand?

Whenever I'm looking at other ecommerce brands for sale, the first question I always ask is “Why is the person selling this brand?” You're probably asking the same thing. Here are the main reasons why I'm taking the exit:

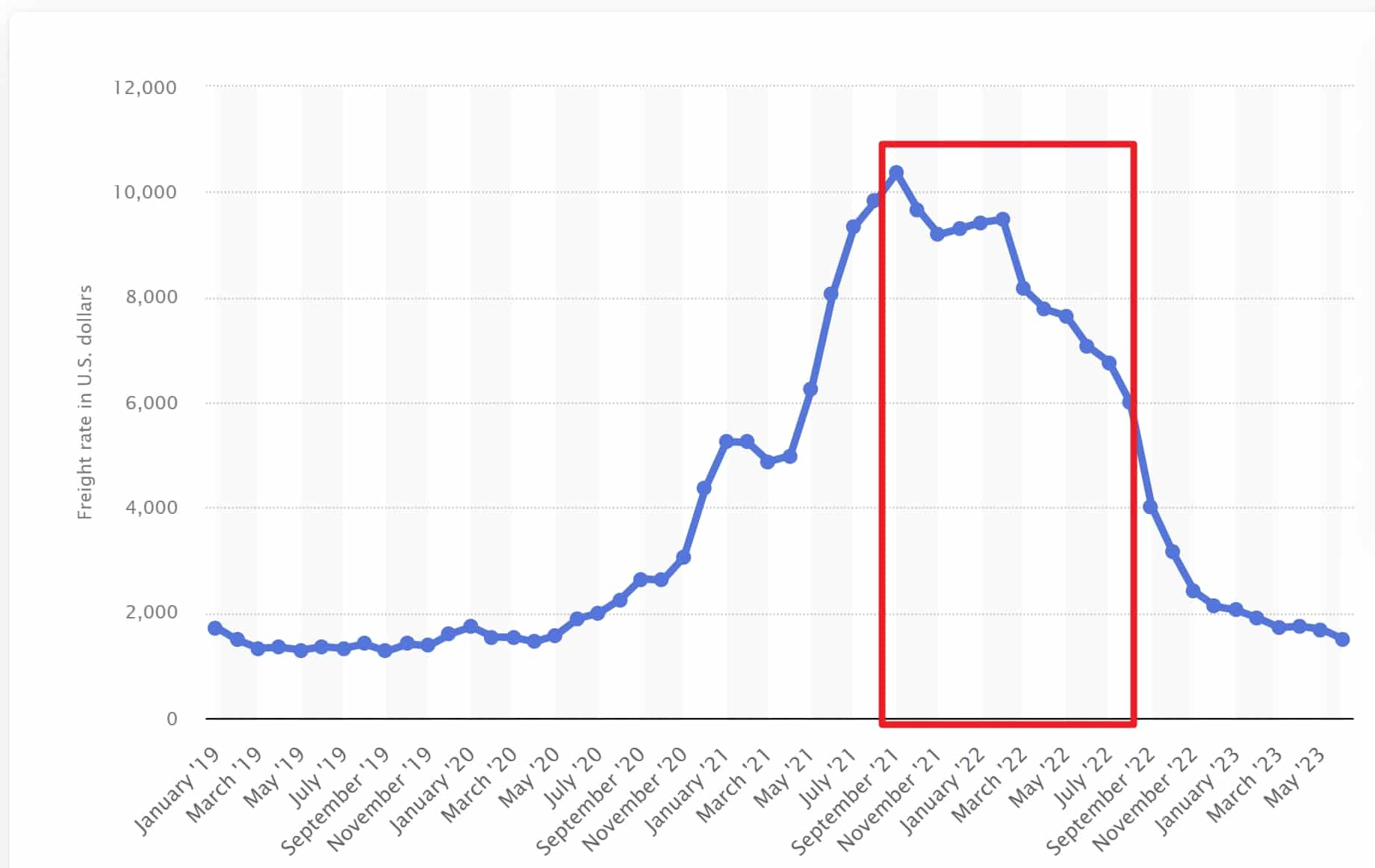

- The goal was always to sell. If you go back over this blog post series, you'll see there's been a lot of open debate about whether to sell or not. My goal was actually to sell last year, but we were in the midst of $10,000 to $15,000 container rates from China, which meant either having to justify a huge add-back for sea freight or taking a massive hit on the valuation. Selling also puts a nice bookend on this blog post series :)

- Too much on my plate. I have two other brands I run along with EcomCrew. I've realized that it's essentially impossible to run three brands with any efficiency. Of the three, this brand is the most ready to sell.

- My home province has begun taxing all Amazon fees. If you're in British Columbia, you know that B.C. has been charging a 7% sales tax on all Amazon fees (EcomCrew has been lobbying our government pretty hard on this issue over the last year). It basically works out to 1% to 1.5% of gross revenue and makes running Amazon-based businesses in the province very difficult.

- Strong US dollar. Currently, 1 USD is about equal to 1.35 CAD – a nice bonus for a Canadian.

Why This Brand Is Good for You

- The brand has been documented for 5 years. You can go back above and go through the 5 years of historical updates for this brand. Maybe you hate me and/or how I've built the brand, or maybe you feel the opposite…but it's all open and saves you figuring that out during due diligence.

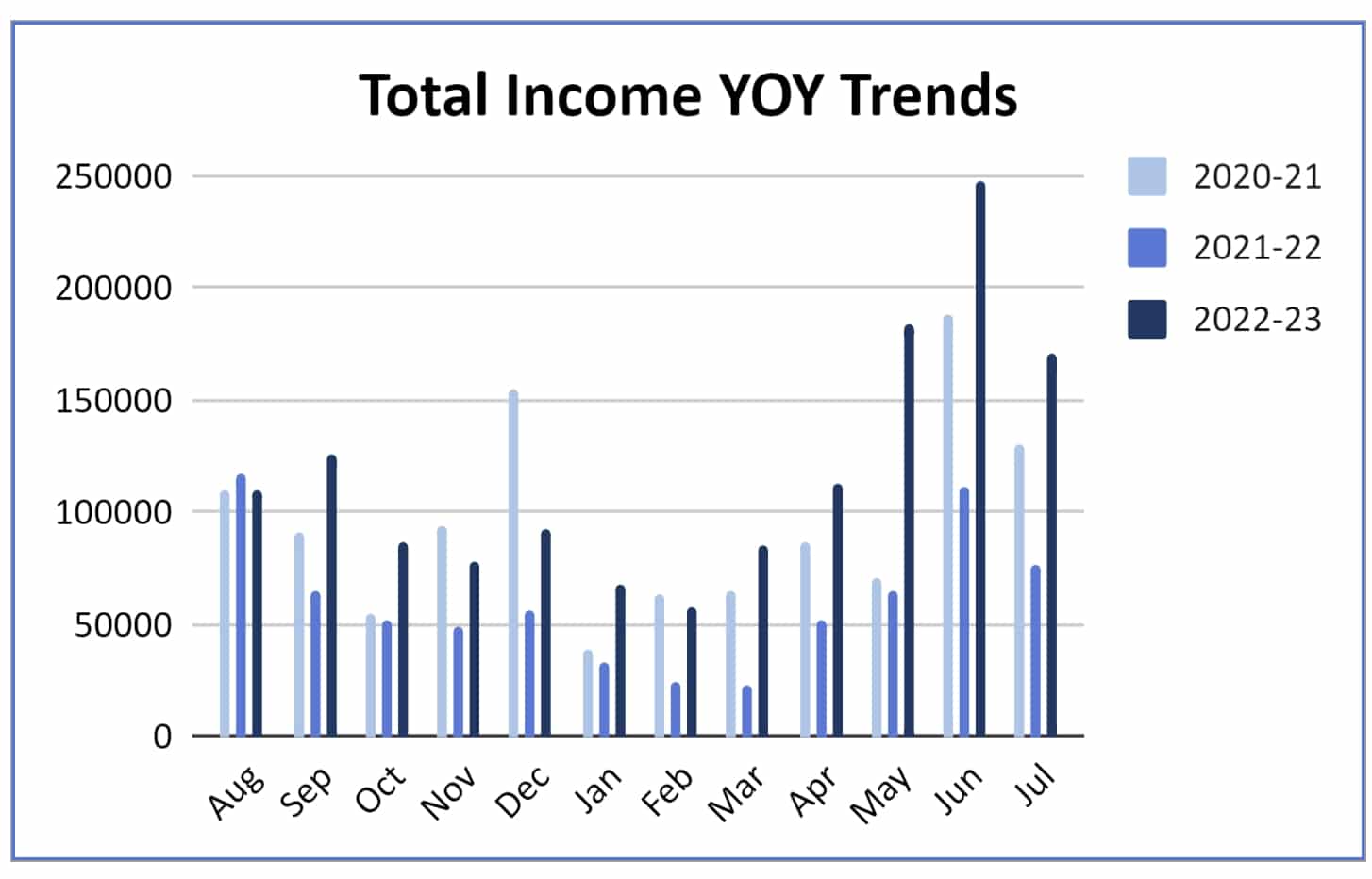

- Strong growth year-over-year. The brand has strong year-over-year growth. The trailing 12 months are up about 35% from the 12 months prior (and essentially the same as revenue even during the absolute height of COVID).

- Design patent (pending) on our top-selling product. Our top-selling product has a pending design patent that, given the nature of the product, should afford some fairly decent protection against competitors.

- Great branding/imagery/video. I spent a lot of time and money in 2022 doing a major brand overhaul. This included a rebranding and having some amazing lifestyle photography and video produced which is not easy to do in this niche (especially for Chinese competitors).

- Good margins. Our top-selling products are sold at roughly 5x our FOB cost, and there's probably some room for lowering costs and increasing prices.

- Lots of potential cost savings for a new buyer. There are a lot of potential areas a new buyer can shave some costs. Specifically, our ad costs in Fall/Winter last year were extremely high (poor management on our part), insurance costs as a Canadian company are much higher than a US buyer can get, and our shipping and logistics are not nearly as tight as they could be.

- Great niche. This brand is in the off-roading/vehicle camping niche. It's a fantastic niche to be in, both from a business standpoint and a lifestyle standpoint, especially if you're passionate or interested in the nice.

Why This Brand Isn't Good for You

- The brand has been documented for 5 years. I've talked pretty openly about the brand. I haven't revealed much of the secret sauce but in a hyper-secretive Amazon seller community (for whatever reason) this is a bit abnormal and may make some people uncomfortable.

- It's 25% Amazon.ca (and isn't SBA eligible). This brand gets roughly 25% of its revenue from Canada (it also makes the business non-SBA eligible). For some, this is a major pro and for others, they don't want to deal with multiple jurisdictions.

- Smallish product catalog. Our catalog consists of about 20 products. There are 2 products (with 3 variations) that consist of roughly 35% and 10% of sales overall. For some people, this catalog will be too big relative to revenue. For others, the catalog won't be big enough.

- Spring/Summer seasonal. This brand is Spring/Summer seasonal. Fall/Winter sales are about 50%-60% less than our Spring/Summer sales.

FYIs

Let me give some FYIs to help save some effort on potential due diligence.

- We switched to A2X in September 2022. For better or worse, prior to September 2022, we were using net Amazon receipts (i.e., revenue minus Amazon fees) as opposed to A2X in our bookkeeping. The result is that revenue and costs look artificially lower prior to this (typically about 25%). The result has no impact on the final profit number.

- A second brand is operated in the same books. I mentioned I run two other brands. One of these brands has been comingled in this company along with the bookkeeping. These brands have been kept entirely separate (specifically a separate Amazon account). The brands are as cleanly separated in QBO as possible but it will make due diligence slightly less clean than if there was only one brand in the company.

- Big SDE drop on August 2021-July 2022. There was a huge SDE drop from August 2021 to July 2022 (basically we were breaking even during that time). Why? Sea freight rates were at their crazy high levels exactly then.

Sea freights were at record highs from July 2021 to August 2022, leading to a significant drop in SDE. - Exceptional Reviews/Ratings with One Exception. Almost all of our products are some of the top-rated in their category. There is one exception regarding a product we launched in 2021 (that I spoke about in that year's update) that had some quality issues. We have rectified them over the last two years but chose never to relaunch the SKU.

- One Canada-only SKU. We have one SKU (with ~6 variations) that is sold only in Canada (the competition is too fierce in the United States). It's a good-margin product with a lot of review history. I mention this only to save a potential buyer from asking why that SKU isn't sold in America.

Conclusion

Again, if you'd like to learn more about the brand, see the Listing on Quiet Light Brokerage.

I am excited to see what the reaction is to the listing and also unsure what the volume of interest will be. We are no longer in the days of the FBA-aggregator madness that existed a couple of years ago, but the non-aggregator market for acquiring ecommerce brands has remained strong. If by chance though we don't find a buyer, I'm fortunately perfectly happy continuing to operate the brand until next summer as I feel like it'll be a fairly easy endeavor to get profits even higher.