Rebuilding a Million Dollar Ecommerce Brand,18 Month Update

In this post, I'll give an update of my newest ecommerce brand after 18 months. As well as giving a progress report, I'll also share some tips and hints with you for increasing the profitability of your brand, along with growth strategies you can employ.

Related Reading: Rebuilding a Million Dollar Ecommerce Company, 12 Month Update

Related Reading: Rebuilding a Million Dollar Company, 6 month Update

Related Reading: Rebuilding a Million Dollar Company, 60 Day Update

Million Dollar Update

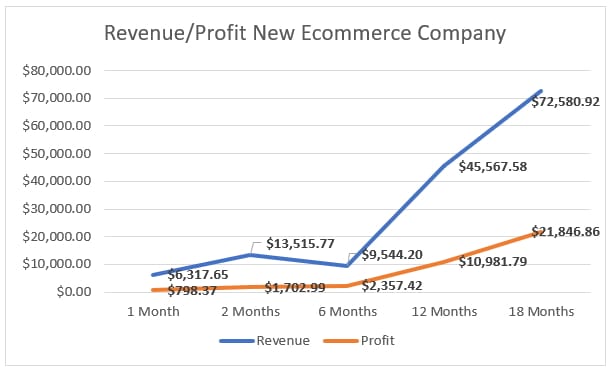

After 18 months I've inched ever closer to my goal of a $1million run rate. Monthly revenue in October (this is actually recorded as of September 16-October 16) was $72,580.92 which works out to an annualized rate of around $870,000. This is still short of my $1million goal but I am happy as it gives me a strong foundation going into 2019.

| July 2017 | November 2017 | April 2018 | October 2018 | |

| Amazon.com | $10,788 | $8,192 | $32,237 | $51,439 |

| Amazon.ca | $1,180 | $986 | $12,145 | $15,560 |

| eBay.com | $994 | $164 | $554 | $52 |

| Shopify | $552 | $200 | $629 | $5,528 |

| Shopify (Canada) | – | – | $0.00 | – |

| Total/month | $13,515 | $9,544 | $45,567 | $72,580 |

| 12 Month Run Rate: | $162,189 | $114,530 | $546,810 | $870,971 |

Wins

Some of the wins I've experienced over the last six months include:

- Brand Registered (finally!): After one rejected trademark, I finally managed to get a design mark registered after 12 months. Tip: if you simply want EBC, get a design mark registered in the UK and it only takes 4 months or so.

- Google Shopping and Facebooks Remarketing Ads going very strong: Google shopping continues to be very profitable (well below 25% ACoS) but unfortunately the traffic is limited relative to Amazon.

- Amazon.ca is 28.8% of our Amazon sales and has higher profit margins: Amazon.ca has continued to be VERY strong even with only about 75% of our inventory. Best of all, profit margins are about 25% higher than .com.

- Hired a full-time VA: He mostly handles our social media posting and writing 1-2 articles for our content based Off-roading website. At $500/month the value is incredible.

Losses

Some of the losses and hiccups I've experienced over the last six months include:

- Major quality issue with a product: We had 300 pieces of a product arrive missing a significant part. The big loss was basically having this inventory be out of stock for 1 month+ while we re-assembled the item. It also ended up temporarily suspended on Amazon due to high returns.

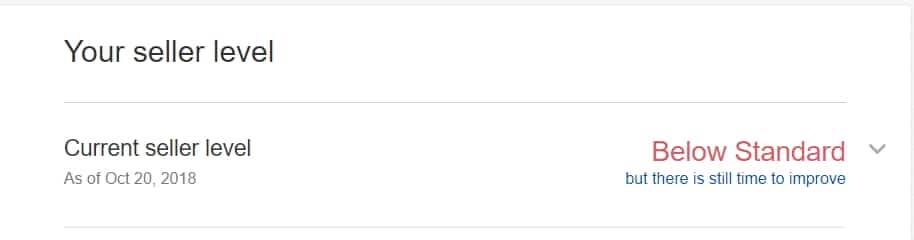

- eBay sales slow: The fact that eBay means anything might sound crazy to most, but automotive with eBay motors is still very strong. I expect it to be 10-20% of our sales. Unfortunately, we fell to a Below Standard rating and it's very hard to pull out of it, for a new seller.

- Canadian dedicated version of our website was a complete flop: I tried launching a Canada (.ca) only version of our website and it was a complete flop. We recorded only one sale in 6 months and, eventually. I simply suspended the site – it wasn't worth the effort.

Profit Margins

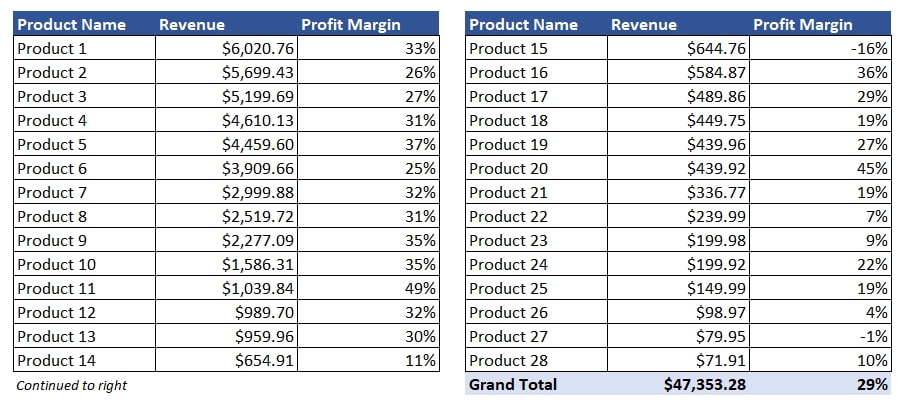

One of the things I have been talking about since I started since recording this series is that in the beginning, I would operate near a break even or small loss and slowly inch my profit margins up. My gross profit margins have now gone from 24% in April to 29% in October. My gross profit margins look at all variable fees (including duties, inbound/outbound freight, Amazon fees). They do not include advertising (which runs around 5-6% overall of my revenue), storage fees, or shrinkage.

Overall, net margins will likely hover around the 13-15% after all the smoke clears and all costs are taken into account.

Ways I've increased profit margins:

- Dedicated containers for Over-size and Standard-size items: By splitting my containers into over-size and standard size items, I significantly reduce the number of FBA warehouses my items go to. Direct shipments to less FCS reduce costs by up to $2000 or more per shipment.

- Optimizing Packaging: Reducing packaging sizes by up to 50% in some cases and increase the quantity of items per master carton.

- Negotiate Costs Down: As my order volume is now growing significantly, I've asked for 5-10% price discounts on most products.

- Raising Prices: I've slowly inched my prices up by as much as 35% in some cases. Higher prices mean higher margins.

My ultimate goal is for our gross profits to be 31-35% overall. The main goal to get there is to negotiate lower pricing due to our higher volumes, cut down on some packaging costs and, most importantly, to achieve better freight efficiencies specifically by shipping more frequently directly from China to FBA. I'll also look at raising our prices 5-20% where possible.

The one variable in increasing profit margins is the uncertainty regarding Trump's tariffs. I am fortunate that so far only two of our products have been hit with 10% tariffs (an increase of 25% in the new year). I fully expect all of our products to be affected some time within 2019 though.

Goals for 2019

My big goal going into 2019 will be to get to $1.75 million in revenue. I believe with the products we have now and simply optimizing those better (specifically by adding video content, improving paid advertising both on and off Amazon, and better inventory planning) I can achieve around $1.25 million in revenue. To reach $1.75million in revenue, we will really need to grow our product line by 40% which means 12 new products, more or less).

- Get to $1.75 million in revenue: By December 2019, my goal is to have a monthly revenue of $145,000 with a $1.75 million run-rate.

- Trim Poor Performing SKUs and Double Down on Top Performing SKUs: I fully expect at least 10% of the SKUs we launch to fail and those SKUs will be killed and the money from these products will be placed into ensuring adequate stock levels of high performing SKUs.

- Watch out for Trump's tariffs: This is the big uncertainty. The goal is to time our shipments to avoid getting hit with any increases in tariffs and reconsider products that are hit heavily.

- Complete brand makeover, specifically videography: Video is a huge conversion booster with Enhanced Brand Content. I'll look at hiring a videographer to have high-quality videos done of all of our products.

Conclusion

Moving into 2019, I now have the foundation of a nice ecommerce brand. Around a million dollars in revenue, in my experience, is where you have profits to allow you to do some more fun endeavors like hiring staff, getting brand makeovers, and making bigger bets.

As I get closer to the end of 2020, I'll evaluate whether this is a brand I want to hold for the long run or whether I want to sell it and getting a 3x return on my effort. Which of these choices is the more prudent financial decision (selling vs holding) is a choice that, for me, the jury is still out on.

Thanks for following this series – I look forward to giving you another update in April 2018, which will be a full two-year update. As always, if you have any questions or comments, feel free to posts in the comments section below.

Dave, I’m following your series in 2021 and I’m yet to see you mention your ROI

You mentioned your margin several times and your 100,000 tied in inventory once but not a word about ROI. Since you are in a growth phase, it makes sense to pay close attention to it as you want your current product to finance your expansion (the growth of their own sales AND the first orders of the next products)

I use both both focus on margins out of habit more than anything. ROI is important as well, although it can be misleading without considering turnover (as can margins as well). If I buy a product for $100 and sell it for $200 but it takes me 5 years, that’s not very good use of cash.

Hey Dave, These are my favorite articles on the site … something about seeing the revenue breakdown per product puts things in perspective.

You are making each variation its own product on your chart? Or do you not have any products with variations?

How are you tracking which sales are coming from google shopping? If you’re double dipping with affiliate links instead of using amz attribution from your shopify checkout page to amz, then how to you attribute which channel those sales originated from?

Thanks again for these updates! Love the podcast and site.

Hi Jaco,

Yes, I’m listing each SKU (and each variation would be considered a SKU). For Google shopping/Facebook I’m simply pro-rating the conversions dependent on percentage of ad spend. It’s not 100% accurate but close enough.

Hi Dave,

I just found your website. I actually already have an established e-commerce business I am looking to sell, and wondered if you had any advice or had written a post on how you sold yours? I am struggling on which broker to use/how to get the best price etc.

Thanks so much!

Liam

Check out this post here: https://www.ecomcrew.com/i-sold-my-company-how-to-sell-your-private-label-ecommerce-company/

Thanks for the update, Dave! Inspired by your ambitious goals of growing 200% from 2018. I see that you mentioned videography in Enhanced Branded Content – so I know you have to be a Vendor / Manufacturer to have videos posted on your listing. It sounds like there are exceptions to that rule, and if so, how do you become one of Amazon’s preferred partners enough to have them give you Videography options?

Hi Kevin – Everyone in Brand Registry/EBC gets it now.

Very inspiring Dave, it gives me extra motivation to work on my own business : )

Thanks Nora :)

Congrats on getting the business to good profitability. I’m curious as to what you did to get the

inflection point at the 6th month where your revenue increased dramatically.

Products started to arrive and get traction. It takes about 3-6 months for this.

$1 million per year.

Damn man this sounds so inspiring man. Right now I’m learning more on internet marketing for clients and learning more about Google analytics and want to focus on eCommerce next.

Your website is very comprehensive man. This is a very detailed post.

Dave, out of curiosity, are your running this business solo or do you have a team and if so, how many people?

Nope – this business is solo aside from a full time VA. I had 2 full time employees for my last company of ~$2million. I think with so many services available now it’s easy to get an ecommerce business to $3-4million with no employees.

Nice update Dave, thanks.

What was the deal with the design mark process in the UK? Was it that it was as simpler process or that there was less complexity registering the mark in the UK specifically. ? So far, I’ve struck out with marks in both the US and Aussie. Really frustrating.

cheers

Jamie

With the UK it’s quicker, that’s the only real advantage. If you’re just trying to get EBC, just get a design mark – nearly guaranteed to go through.