Is Amazon Insurance Accelerator Worth It?

Amazon will pay out of pocket for valid customer claims up to $1,000 for injuries or property damage caused by products sold on its platform, regardless of the seller. This will come at no cost to sellers, that is, those who have valid insurance policies.

In this article, we’ll talk about product liability insurance and how you can secure it through the Amazon Insurance Accelerator.

Related Listening: Episode 368: How to Protect Your Business from Lawsuits and Accidents

Contents

- What is Product Liability Insurance?

- Does Amazon Require All Sellers to Have Insurance?

- What is Amazon Insurance Accelerator?

- Do Sellers Have to Obtain Insurance through the Program?

- How Do I Get Insurance through Amazon Insurance Accelerator?

- How Much Does Product Liability Insurance Cost?

- What are Amazon’s Insurance Policy Requirements?

- What are the Pros and Cons of Amazon Insurance Accelerator?

- Which Providers are Under Amazon Insurance Accelerator?

- Conclusion

What is Product Liability Insurance?

Product liability insurance helps protect you from claims arising out of personal injury or property damage caused by your product malfunctioning or by a design flaw.

Under this type of insurance policy, your insurance provider will pay for claims of compensation (up to your policy maximum) and/or damages as well as the legal costs when customers bring lawsuits against you or your company.

While insurance, like other legal considerations sellers have to deal with, is not the most exciting of topics, you might find the peace of mind worth it, especially as you grow your ecommerce business.

Does Amazon Require All Sellers to Have Insurance?

The short answer is yes. Amazon has a long-standing policy that requires sellers to have valid insurance over the products they sell on the marketplace. That being said, they have not been very stringent in enforcing the policy.

Recently, Amazon made significant changes to its policy on sellers holding product liability insurance. Before, you were required to hold a valid insurance policy if you sold $10,000 in three consecutive months. As of the update (effective September 1, 2021), you are now required to have insurance if you sell $10,000 in any month.

The big question is whether Amazon will start to enforce the insurance requirement with the new amendments to its insurance policies? The likely answer is that they will not immediately suspend sellers but at some point in the future they may be more strict about it.

What is Amazon Insurance Accelerator?

Amazon Insurance Accelerator is a program that gives sellers access to Amazon’s network of vetted insurance providers who will evaluate, and if appropriate, offer liability insurance at “competitive rates” to qualified sellers. Amazon put this in place to speed up the process of sellers obtaining product liability insurance over the products they sell on Amazon.

The program was announced as part of the September 1, 2021 policy update mentioned earlier.

Insurance Accelerator is largely similar to Amazon IP Accelerator, which helps sellers get enrolled into Brand Registry faster, and consequently obtain intellectual property rights over their products. The latter program gives you access to Amazon’s network of curated IP law firms that offer competitive rates (at least according to Amazon).

Do All Sellers Have to Get Insurance Through Insurance Accelerator?

As of this writing, Amazon sellers don’t actually have to secure product liability insurance through the Insurance Accelerator program. You can work with any provider of your choice, as long as they fulfill Amazon’s insurance policy requirements.

The key benefit to using Insurance Accelerator is that all insurance providers participating in the program are pre-vetted by Amazon and already comply with policy requirements.

How Do I Sign Up for Insurance Accelerator?

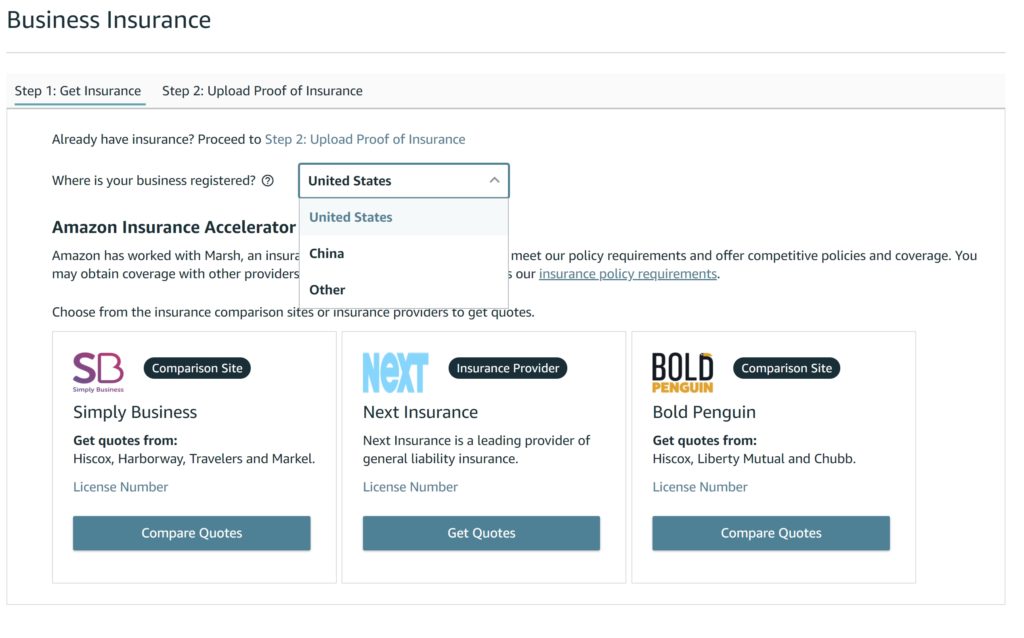

The list of insurance providers within Amazon’s network is found under the Business Insurance section in Seller Central (login required). You can compare quotes and policies from different providers on this interface. We can expect Amazon to populate this interface with more options as more providers join the program.

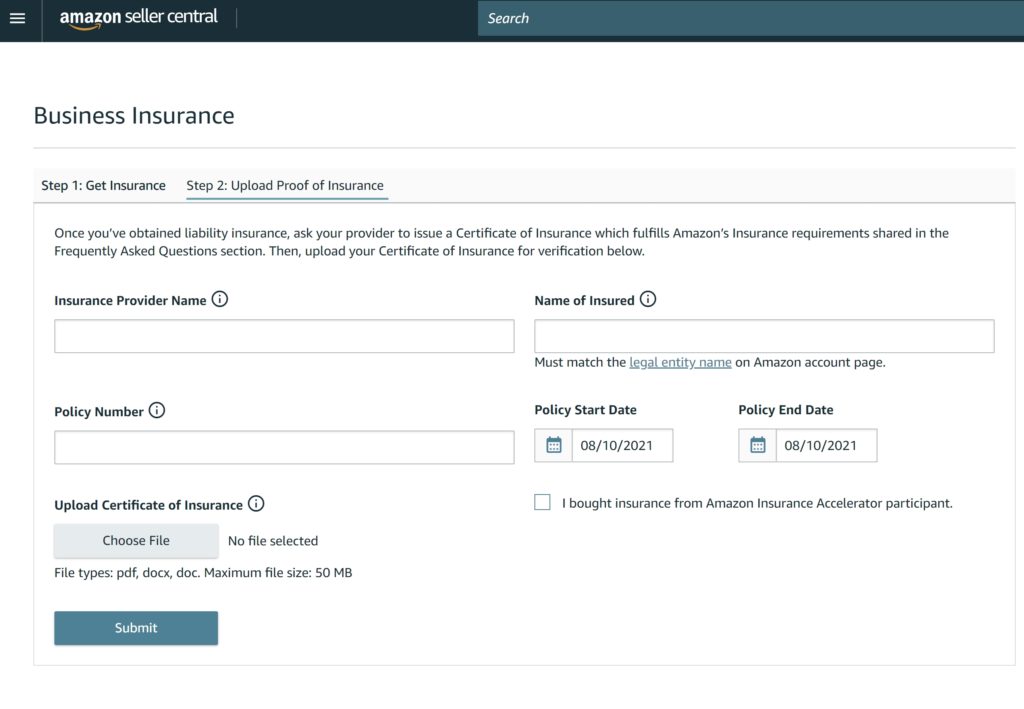

The Step 2 tab is for uploading your proof of insurance, mainly the Certificate of Insurance you receive once you get approved for a policy. If you got your insurance from a provider outside of Amazon’s network, you still have to upload your proof on this tab in order to receive Amazon’s $1000 liability coverage.

How Much Does Product Liability Insurance Cost?

The cost mostly depends on the risk profile of the types of products you are selling and the size of your business. If you sell baby toys (high-risk) you can expect to pay a far greater premium than if you sell dining room furniture (low-risk).

Generally, you can expect to pay a percentage of revenue. Rates vary vastly, but a very rough ballpark is anywhere from 0.25% to 1% of revenue.

Quotes from Insurance Accelerator Have Big Variances

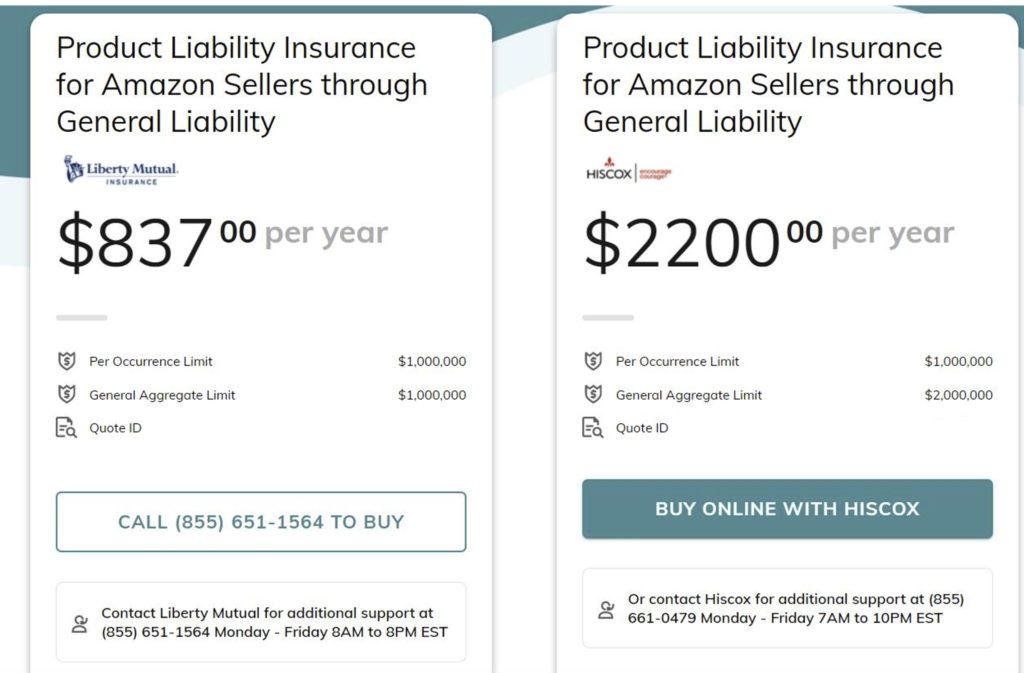

In the few weeks since Insurance Accelerator has been launched, there have been a range of quotes given.

One EcomCrew audience member with revenues of $500,000-$1,000,000 applied through the program and received quotes ranging from $837 to $2,200. In addition, one provider refused to insure any products from China (which of course, is where most seller's products come from). These quotes were non-binding and we're currently working to receiving a binding quote (specifically by providing more detailed information regarding business activities).

What Are Amazon’s Insurance Policy Requirements?

Amazon lists its policy requirements in the insurance requirements page, but the most important ones are that you must secure either commercial general, excess, or umbrella liability insurance. Some key criteria:

- Cover at least $1 million per occurrence and in aggregate;

- “Amazon.com Services LLC., and its affiliates and assignees” must be named as additional insureds;

- The policy must cover all products you list for sale on Amazon;

- The policy must cover all sales from products you have listed on the Amazon website;

- Your insured name must match the “legal entity” name you provided to Amazon.

Once you secure a valid insurance policy, Amazon will directly pay your customers for claims under $1,000 in the event that your products are defective or malfunctioning, which they say accounts for more than 80% of cases, although to be clear, most sellers want insurance to protect themselves from the 20% of claims that are often well above $1000 and can jeopardize their entire business.

Furthermore, if a seller does not respond to a claim, Amazon will step in to directly address the customer concern and pursue the seller separately. And if a seller rejects a claim Amazon believes to be valid, it will also step in, but it says that sellers will still have the opportunity to defend their products against such claims.

According to Amazon, these cases will not affect your order defect rate, and you will be kept informed at every step so you can continue to ensure your products are safe.

Note that only valid personal injury or property damage arising from the use of defective products are eligible. Hence, it will not cover damage arising from the use of products that are not defective or fraudulent claims.

What are the Pros and Cons of Amazon Insurance Accelerator?

As with all Amazon programs, the Insurance Accelerator has its fair share of perks and disadvantages. Check out the table below:

Amazon Insurance Accelerator Pros

- Amazon will shoulder claims up to $1,000

- Pre-vetted list of insurance providers and lets you compare quotes and policies

- Some policies will cover your products even when you sell them outside of Amazon

Amazon Insurance Accelerator Cons

- Smaller selection of insurance providers

- Currently only offered in a handful of countries

- No pre-defined rates like IP Accelerator

Which Insurance Providers are on Amazon Insurance Accelerator?

At the time of writing, some of the names who are confirmed to be participating in the program include:

- Chubb

- Liberty Mutual

- Harborway Insurance underwritten by Spinnaker Insurance Company

- Hiscox

- Markel and Travelers

- Bold Penguin

- Simply Business, Inc.

- Next Insurance

Amazon says it will bring more providers into the program in the future, but it would seem that this list already has plenty of options, so you can work with the best provider for your business.

Conclusion

Having insurance over your products, which Amazon requires for most sellers anyway, is an easy way to defend your brand against compensation claims or even business-threatening lawsuits arising out of product defects.

Do you have product liability insurance? Let us know about your experience in the comments below.

Hi, the problem with these insurance companies, is that they refuse to insure non-resident companies.

So, if a New Zealand based company wished to obtain insurance, they would have to (in addition to already having their NZ company), setup a US-based LLC with a US-based address –

& then suddenly, this information would not match their NZ – based company & address, for which they originally used to verify their Seller-Central account – and in-order to make that work, the NZ – based company would then have to somehow change their business banking details, to reflect the LLC + US registered address.

And should Amazon then request a utility bill – near impossible !