Interview with Pacific Customs Broker Discussing Common Importing Mistakes

Pacific Customs Broker is the customs broker I have used ever since I began importing, and in fact, I also rely on their freight forwarding division, PCB Freight Management to help move almost every LCL and FCL shipment once it hits the port. They have offices in both Canada and the U.S., which is part of the reason I love them because they help me with shipments entering either Canada or the U.S. Breanna Leininger of Pacific Customs Broker has been generous enough to help answer some of the most common customs questions importers have.

Dave: I think most of our readers understand the basic functions of a customs broker, helping to pay and remit duties for imports. What are some of the other services a broker like Pacific Customs Brokers can perform, especially for the smaller importer?

Breanna: Even if you do not plan to use a customs broker to transact business on your behalf, guidance and advice from a customs broker in the planning stages can help mitigate risks related to your cross-border business. Some areas customs brokers can help importers include:

- Providing advantageous advice on terms of sale

- Making recommendations on countries of origin from which to source

- Providing advice on tariff classification and entry types

- Assisting in the decision making and compliance process

- Delivering the best solutions for your business

- Making you more competitive in the marketplace and

- Helping you gain a more positive relationship with both Canada Border Services Agency and U.S. Customs and Border Protection.

Dave: Are your services only for importers in British Columbia and Washington State, or can you help importers all throughout Canada and the U.S.?

Breanna : No, our services are not limited to British Columbia and Washington State. Pacific Customs Brokers has been helping importers and exporters throughout Canada and the U.S. at all commercial ports of entry.

Dave: For a non-American importing products into the U.S., can they do so without a U.S. company or U.S. EIN? What information/documentation would Pacific Customs Broker need from them?

Breanna : Non-Resident Importers (NRI) do not need a U.S. issued Employer Identification Number (EIN) in order to be the importer of record on U.S. import transactions. For these parties U.S. Customs and Border Protection assigns a Customs Assigned Number (CAN) in order to identify the importer. The Customs Assigned Number (CAN) is applied for during the account setup process, as in order for the customs broker to apply for a Customs Assigned Number (CAN) on the importer's behalf they will need to supply a power of attorney. It is important to note that this only applies to a Non-Resident Importer.

A Non-Resident Importer will still need to declare the Employer Identification Number (EIN) which is also referred to as an Internal Revenue Service (IRS) number or the Social Security Number (SSN) for the U.S. consignee on each import transaction. If the goods arrive unsold, for example they are going to a warehouse or fulfillment center, then the EIN or SSN will need to be supplied at the time of entry for the physical location of the goods (Note, Amazon FBA will be happy to give you their EIN by emailing sellerimports@amazon.com).

Dave: A broad question, but what’s one or two of the biggest mistakes new importers make that result in their shipments being delayed by U.S. customs or worse, refused?

Breanna : The first and foremost is failing to properly research product admissibility and import requirements. Often importers ship goods before they fully understand what is required for the particular import, and this mistake can lead to shipment delays, intensive examinations, refusal of goods, seizure of goods, an increase in landed costs, and monetary penalties. In addition to standard documentation and bond requirements, there are various requirements that are commodity specific so importers should fully understand the requirements for each government agency should their goods fall under the scope of one or more of the Partner Government Agencies (PGAs). To quote U.S. Customs and Border Protection “know before you go.”

The second biggest mistake is failing to develop a professional and knowledgeable logistics team. This includes freight forwarders, carriers and a customs broker. Often importers will pick the cheapest option available and end up paying for it in time and frustration down the road. The importer carries the largest role and holds the greatest responsibility. No matter who is doing the work by filing the entry or declaration with U.S. Customs and applicable Partner Government Agencies (PGAs), be it the importer or the customs broker, the importer of record is ultimately responsible for the payment of all duties, taxes, fees and penalties to US Customs. For this reason, choose your logistics service providers carefully, and make every effort to communicate the details of your shipment in order to ensure the accuracy of your declarations.

Dave: You mentioned standard documentation. What does this include?

Breanna : Standard documentation for clearance varies depending on the mode of transportation, however there are some commonalities. Regardless of commodity, standard documentation includes:

- Commercial invoice

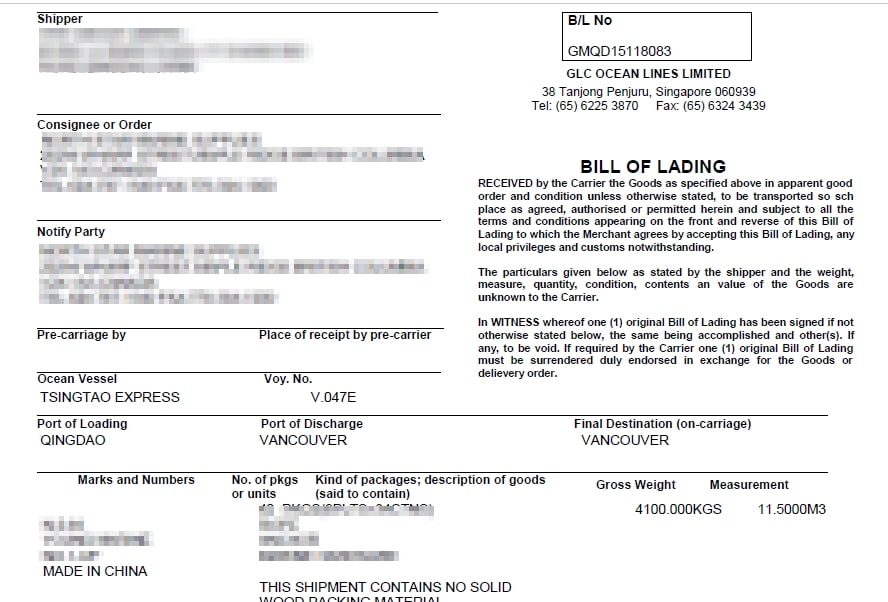

- Copy of the bill of lading, or airway bill

- Arrival notice for air and ocean shipments

If the goods fall under the scope of one or more of the many Partner Government Agencies (i.e. the Food and Drug Administration (FDA), U.S. Department of Agriculture (USDA), U.S. Fish and Wildlife Service, Federal Communications Commission (FCC), U.S. Environmental Protection Agency (EPA), etc.) additional forms and information will be required in order to make entry. A full list of Partner Government Agencies is available from this website.

One piece of advice for importers with ocean shipments is to request an electronic release from the overseas supplier on the bill of lading. Often new importers are surprised when their containers arrive, clear U.S. Customs but they are unable to pick up their goods because the warehouse or container yard requires the Original Bill of Lading (OBL). If an OBL is required the document will need to be couriered from overseas to the importer. The importer will then have to sign the OBL and courier the document to the steamship line in order for the goods to be eligible for pick up. This can take days, even weeks sometimes, and in that time the goods have started to incur storage charges and this can get very expensive. Importers gain an immediate cost savings when they make the request to have the electronic release on the bill of lading.

Dave: That's great advice about having your shipments electronically released. I request for almost all of my shipments to be “Telex Released”.

Can you explain what exactly a custom's bond is and how it impacts importers?

In order to ensure the revenue due to the US government, US Customs requires that every entry be secured by a bond. This can be met in two ways:

- A single entry bond is just that – a bond that covers a single shipment. These can be purchased through a surety company. If you choose this option, it is best to have a customs broker apply for the single entry bond in conjunction with the entry filing in order to ensure that everything matches and that you are properly covered. If you plan on having more than one entry this option can get quite expensive.

- The next option, and also the most cost-effective if you plan on having multiple shipments in a year, is to purchase a continuous bond. This bond type covers all import transactions for a full year from the date of issue. It is important to note, if you are shipping via ocean you will be required to have a bond in place for both the U.S. Customs entry and the Importer Security Filing (ISF). This is where single entry bonds can get quite expensive because the bond cost nearly doubles for each shipment. A continuous bond will cover both the entry bond requirement and the ISF bond requirement. On ISF transactions, an importer is only allotted five single entry ISF bonds in a lifetime by the surety. Once the five ISF bonds are used, the importer will be required to purchase a continuous bond should they endeavor to continue shipping via this mode of transportation. Simply put, to save time and money the best option is the continuous bond.

Are there a few categories of products, which you see more often than not causing problems for importers upon entry? For example, I often warn readers of any food/vitamins and children’s products often posing problems.

Breanna : Those two categories are certainly notable. The next area to be mindful of may not necessarily be a specific category, but rather goods that fall under anti-dumping and countervailing duties, or import quotas. This can range from simple manufactured items such as coat hangers, pencils and wood flooring to raw materials such as steel and sugar. Again, many of the issues importers run into are a result of incomplete product admissibility research and adequate professional resources. Just because a good is not highly regulated by one or more Partner Government Agencies (PGAs), does not mean it is an “easy” import. Knowledgeable and experienced service providers can assist in successfully navigating even the most complex transactions.

Dave: What does U.S. customs check for in regards to labeling upon entry to the U.S.? I believe they check for country or origin markings, but do they check for safety labels (i.e. suffocation warning labels) and other labeling?

Breanna : One thing that importers should understand is that all goods, domestic or foreign, must meet U.S. requirements in order to be introduced into the commerce of the United States; this includes all labeling requirements.

On imported merchandise, these goods must meet country of origin labeling requirements for U.S. Customs as well as labeling requirements set forth by any applicable Partner Government Agencies. In addition to targeting for security, U.S. Customs is tasked with collecting accurate statistics, any and all duties, taxes and fees owed to the U.S. government on imported merchandise, as well as ensuring that all applicable U.S. laws have been met at the time of importation. They do this by examining shipments and enforcing all labeling laws. If goods fall under the scope of one or more Partner Government Agencies those agencies may also examine shipments to ensure that labeling laws have been met.

Dave: If someone is concerned their product might be subject to special regulation, documentation, and or labeling, who can they contact to confirm? Can a customs broker help? If so, how is this charged? As a flat fee, an hourly fee, etc?

Breanna : If someone unsure of the regulations surrounding the import of their product, the first point of contact should be a professional customs broker. A customs broker can assist with researching product admissibility and tariff classification on a transactional basis, and they can also assist in reviewing a catalogue of items.

With regard to how this service is charged, it all comes down to the scope of work. A variety of factors such as the complexity and the level of expertise required play a role in determining the fees. Pacific Customs Brokers often assists importers who have been shipping for many years, have had issues and would like to do a compliance review, as well as first time importers who may have a single transaction.

Dave: I think we all know of an importer who has a Supplier classify items at very reduced values (and worse, get away with it) to avoid import duties. How does U.S. customs guard against this and if one is caught under classifying products, what are the most common penalties involved?

Breanna : U.S. Customs and Border Protection guards against this in several different ways.

- The first is a review at the single transaction level. This could be at the time of entry, or it could be down the road. U.S. Customs employs many entry and commodity specials who carefully review important transaction for compliance and if a discrepancy has been found they will often issue a Request for Information, also referred to as a CF28. U.S. Customs can also issue a Notice of Action, referred to as a CF29, where they require the importer to make the correction. This is also often accompanied by a duty increase bill.

- The next means is a full U.S. Customs Audit. This is a review of all import transactions. Should an importer be subject to an audit they will also have to prove to U.S. Customs that they are adhering to all import regulations such as recordkeeping requirements, and they must prove that they have been using what U.S. Customs defines as “Reasonable Care”. When looking at the prospect of a U.S. Customs audit, it is not a matter of if an importer will be audited, it is when.

Depending on what is found during a transaction review and/or U.S. Customs audit, U.S. Customs can issue penalties any time a U.S. trade law has been broken. These vary depending on the severity of the situation and the level of the violation. It is important to note, if an importer is consistently found to be in violation, U.S. Customs does have the means to revoke their importing privileges.

Dave: This is a reader question: when importing products via UPS to Amazon FBA, I am asked for an Importer of Record. Can a non-American be the Importer of Record? Or does this need to be a U.S. person or company?

Breanna : The Importer of Record (IOR) is the party responsible to U.S. Customs for the payment of all duties, taxes, fees owed to the U.S. government as well as ensuring all requirements to make the entry have been met. The IOR may be a resident or a non-resident of the United States. They must have detailed knowledge of the goods such as what is being shipped, where it came from, and where it is destined. Most importantly, they must be a “Party to the Transaction”, meaning they must be either the buyer or the seller.

Dave: The Pacific Customs Broker blog at blog.pcb.ca is one of my favorite resources for anything importer. Are there any other websites, tools, apps, or otherwise, ‘tricks of the trade’ you can recommend to readers?

Breanna : We highly recommend U.S. Customs and Border Protection’s Informed Compliance Publications (ICPs) “What Every Member of the Trade Community Should Know About: …” series. Here importers can find guidance from CBP on how they treat specific imports, as well as a breakdown of complex regulations. These have proven to be invaluable for the trade community.

Here are a few others:

- U.S. Customs and Border Protection – to stay up-to-date on U.S. Customs business

- Customs Rulings Online Search System – to research product admissibility

- United States International Trade Commission – For a digital copy of the HTSA for classification as well as current U.S. government regulations

In an effort to keep the trade community informed on changing global trade and customs regulations, Pacific Customs Brokers also offers some excellent resources to keep you up-to-date:

- Visit the ‘Your Broker Knows’ Blog

- Sign up for our weekly trade newsletter

- Learn more at one of our many trade compliance education sessions

Dave: If readers need customs brokerage or other help, what’s the best way to reach Pacific Customs Broker?

Breanna : There are more ways than one to reach Pacific Custom Brokers. We are open 24/7 with a highly trained team of receptionists, who are on-site and available to answer your call by phone or live chat.

- Phone: 877.332.8534 (USA) or 888.538.1566 (Canada)

- Website or Live Chat: pcbusa.com or www.pcb.ca

- Email: clientservices@pcbusa.com or clientservices@pcb.ca

- Social Media: Blog, LinkedIn, Twitter, Facebook and YouTube

- Blog – We invite you to visit the ‘Your Broker Knows’ Blog to learn more about trade and customs compliance. Leave us a comment or send us an enquiry at askyourbroker@pcb.ca.

Excellent share! Thank you! Your insights are very valuable

Thank you! Happy to hear you enjoyed our content

Thought-provoking discussion , BTW , if someone has been looking for a NY DTF RP-524 , my business partner filled out and esigned a template version here

http://goo.gl/AP2xwtDavid your articles are very helpful but in this one I am confused right at the start!

Breanna says two conflicting things:

Non-Resident Importers (NRI) do not need a U.S. issued Employer Identification Number (EIN) number in order to be the importer of record on U.S. import transactions.

Then says this:

A Non-Resident Importer will still need to declare the Employer Identification Number (EIN) which is also referred to as an Internal Revenue Service (IRS) number or the Social Security Number (SSN) for the U.S. consignee on each import transaction.

So how do you declare your EIN if you do not have one?

Hi,

Yes, it’s confusing.

I *believe* what she means is that you can be the importer of record without an EIN. But you still need to give EIN of the warehouse where the goods are going. Most warehouses don’t mind giving their EINs for the import records but many don’t want to be the importer of record. Make a bit more sense?

anyone have a good estimate of how long it takes for an LCL load to go from Arrival Notice to Released for Pick up at Seattle Tacoma?

It varies, but it could easily be a couple of weeks. Ship has to dock, the container picked up, and destuffed.