Part 2: Advanced Strategies for Sponsored Products

This is part 2 of our three-month series on optimizing your (and our!) Amazon PPC campaigns. In part 2, we'll be looking at some advanced Amazon Sponsored Products strategies and answer some of the most nagging questions that we, and most sellers, have about Amazon Sponsored Products.

In future posts, we'll look at Sponsored Display, Sponsored Brands, and Amazon PPC software.

In this blog post, we'll try and get answers to a few questions:

- What is the best placement for Sponsored Products and should we optimize for these placements?

- What is the best dynamic bidding strategy – dynamic bids up and down, dynamic bids down only, or fixed bids?

- Does category targeting work?

Related Reading: Part 1: Amazon PPC Overhaul for Five Brands

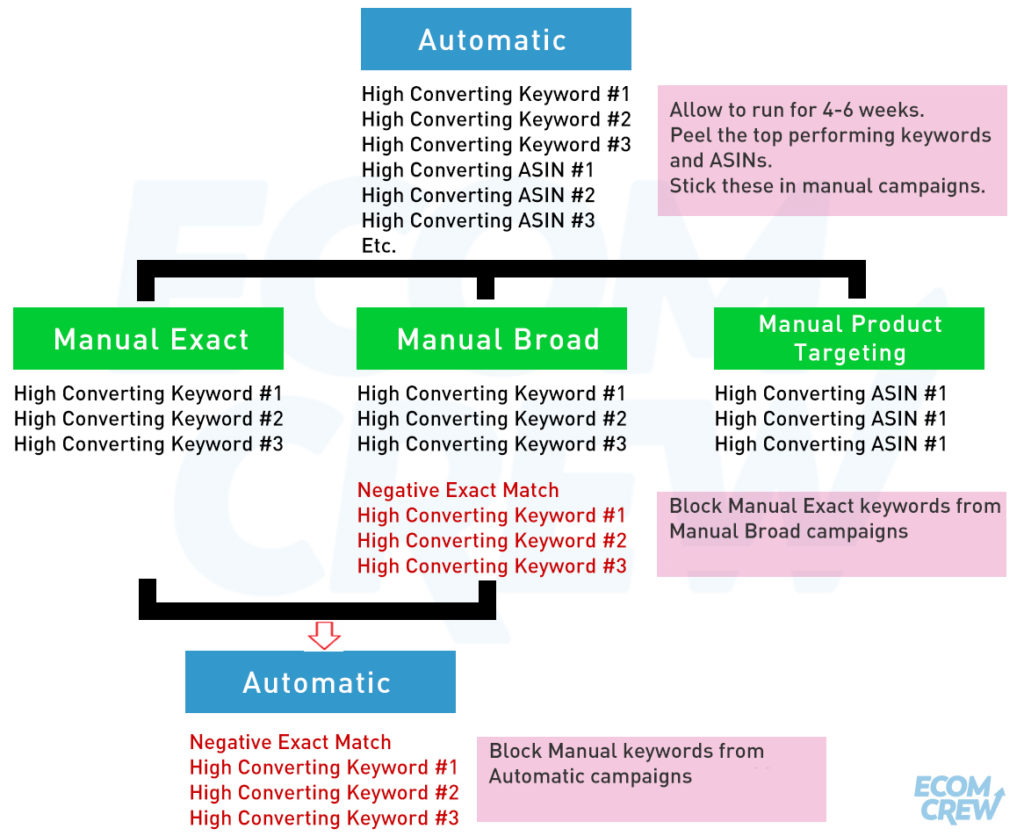

Sponsored Products Basics – Peel, Stick, and Block

Before we dive into some advanced strategies for Sponsored Products, let's review the fundamentals of sound Amazon Sponsored Products strategies.

A sound strategy around Sponsored Products involves a Peel, Stick, and Block campaign. In this strategy, you create an Automatic Campaign to harvest top perform keywords, peel them from these campaigns, stick them in manual campaigns where you can bid more granularly, and block them from appearing in your automatic campaigns.

This is the most fundamental strategy when it comes to running Sponsored Products campaigns. Most of you will already be using some version of this strategy. If you're not, I highly recommend you to check out our Amazon PPC Strategies Article which covers some core Sponsored Products strategies.

What Is the Best Performance by Placement?

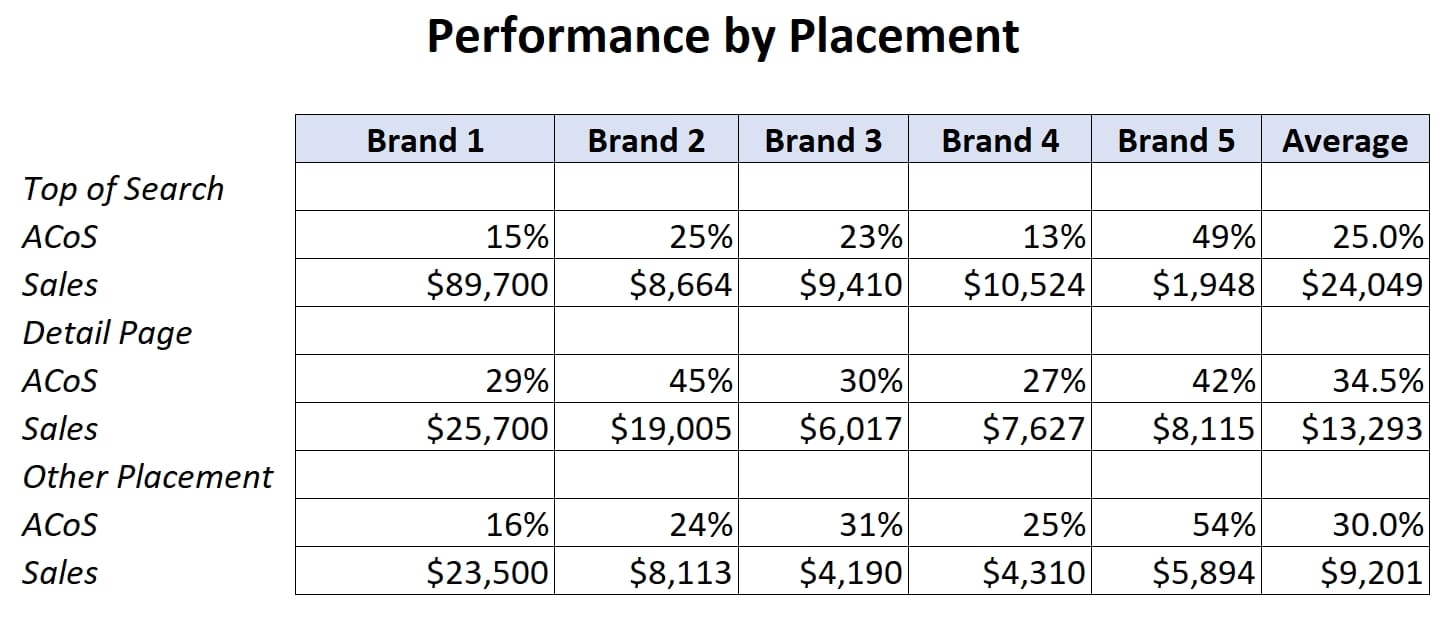

Our first question is What is the best performing placement location: Top of search, Rest of Search, or Product?

As you may know, for Sponsored Products, Amazon allows you to bid more for certain placements. You'll notice I said more only. Amazon only allows you to bid up (up to 900%) and not bid negatively for placements.

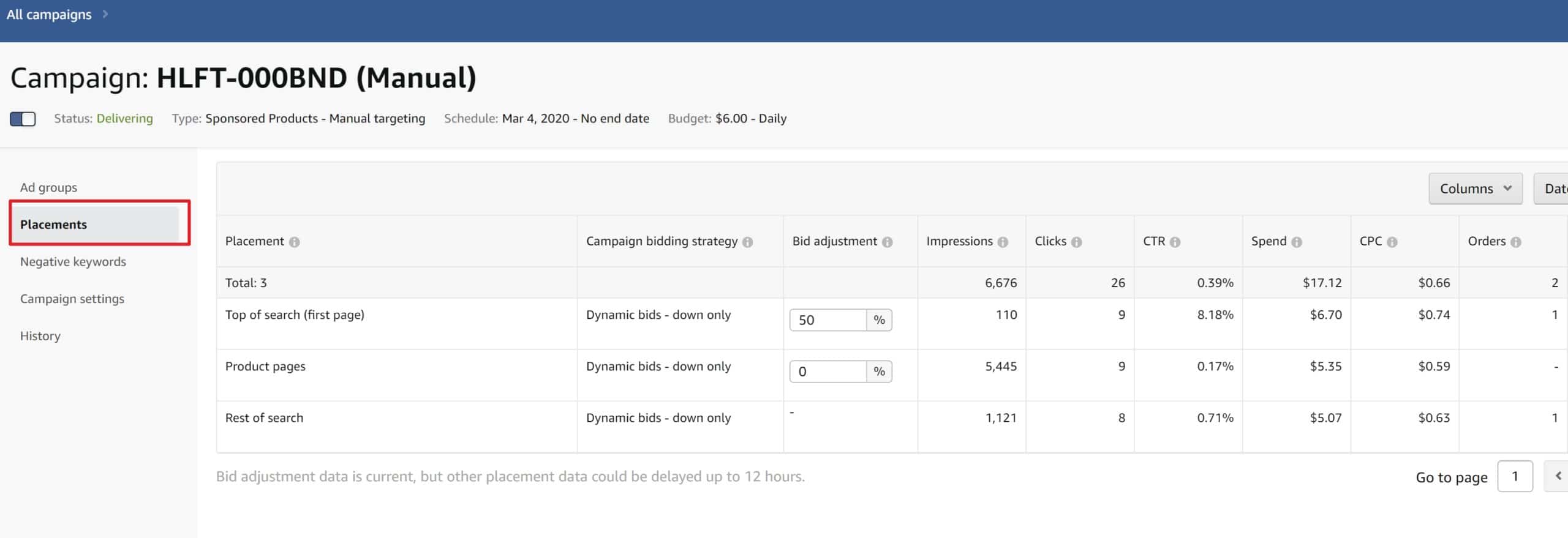

For Sponsored Products, you can see your performance placement within any Sponsored Products campaign by going to the Placements tab.

After looking at the stats from five brands we own and operate, we compiled the following results by placement.

After looking at the performance of five different brands, we found out that Top of Search had an average ACoS of 25% while Product Detail Pages and Other Search Placements were 34.5% and 30%, respectively. I compared these results with other sellers and agencies. And almost universally, Top of Search was the best performing placement amongst other sellers.

We've concluded that Top of Search has the lowest ACoS and produces the most sales. By this logic, it means that you should be bidding more for Top of Search and less for the other placements. More on this later.

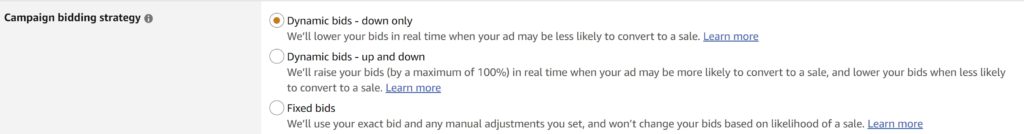

What Works Best: Dynamic Bids Down Only, Dynamic Bids Up and Down, or Fixed Bids?

In 2019, Amazon introduced something called Dynamic Bidding. These are accessible through your Campaign Settings tab.

With Dynamic Bidding, Amazon's algorithm will determine which keywords you are more likely to bid on and either adjust your bids up by up to 100% (if you have Dynamics bids -up and down turned on) or bid down (which will occur as long as you don't have Fixed bids turn on).

The logic here from Amazon is sound. While you as a seller are only looking at one metric when you're making your bids (the actual keyword) Amazon can look at a much wider set of data including a customer's geography, purchase history, etc. So, for example, imagine you sell fishing rods for tuna fishing. If someone from Chicago is searching for fishing rods, Amazon knows no one from Chicago ever purchases tuna fishing rods after searching for fishing rods and will adjust your bids down. Most of the major advertising platforms have some version of machine-learning-based bidding – for Google it's called Enhanced Cost-Per-Click.

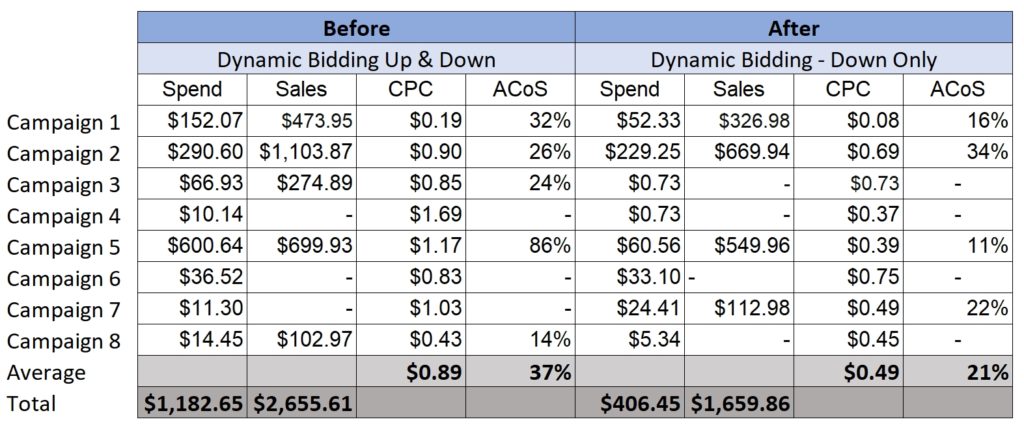

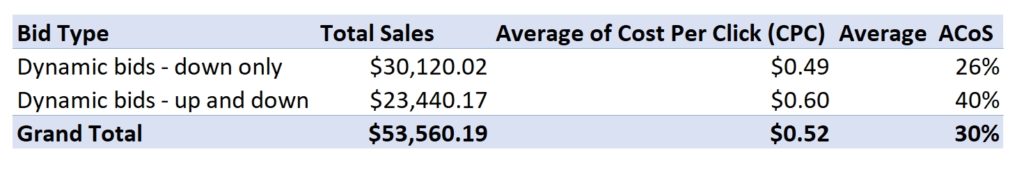

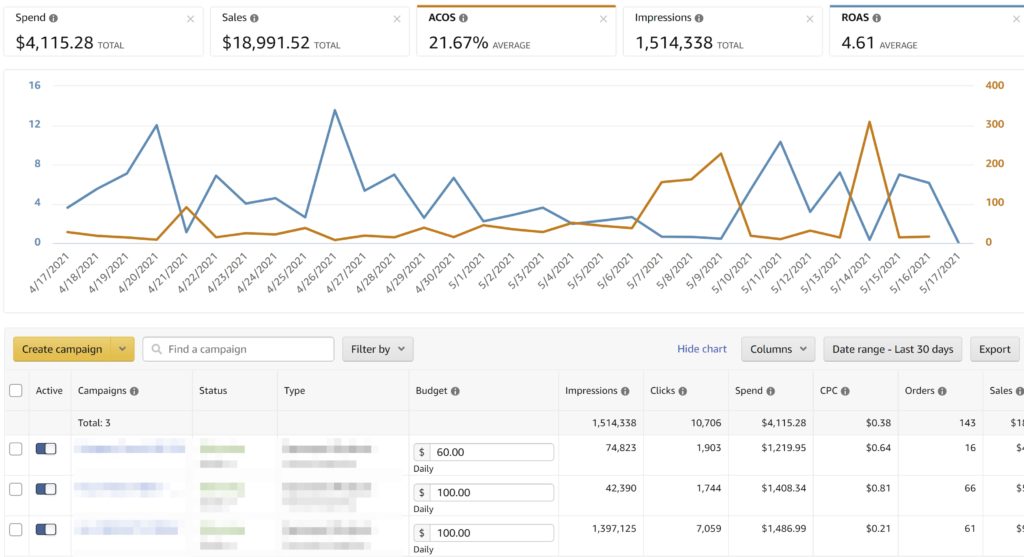

We've done some fairly extensive testing of Dynamic Bidding. Below is a screenshot of our campaigns over the last month. You can see that our campaigns with Dynamic Bids – Up and Down have significantly higher costs per click and ACoS, which is what you would more or less expect. However, proportionately, they generate far more sales given the fact that we have roughly 3x more campaigns using Dynamic Bids – Down Only.

We also tried switching some of our Dynamic Bids – Up and Down campaigns to Dynamic Bids – Down Only. The results were predictable: ACoS and CPC went down dramatically, but so did sales.

So what Dynamic Bidding Strategy works best? This one was not quite as conclusive as Placement Bids.

Sellics recommends that if you already have a good idea of what keywords perform well for you, try turning on Dynamic Bidding Up and Down. I would word this differently – if you have very profitable campaigns, try turning on Dynamic Bids – Up and Down. If you have unprofitable campaigns, turn on Dynamic Bids – Down Only.

Category Bidding

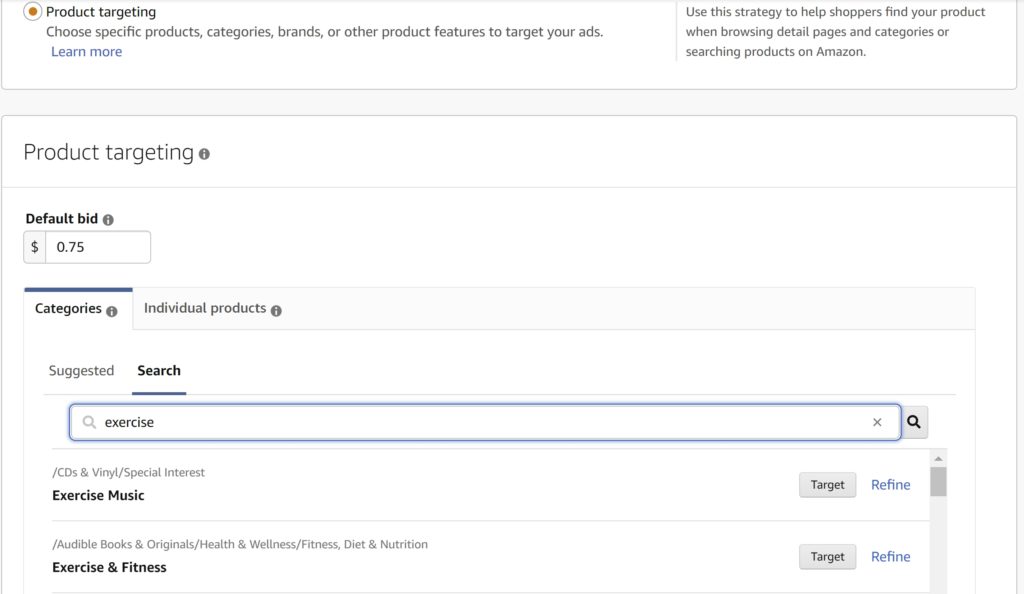

Hopefully, you're using Product Targeting campaigns with Sponsored Products as they can be very profitable. If you are, you've probably noticed that you can target by ASIN or by category.

With Category Targeting, your ads will appear in the same placement as if you targeted by ASIN, but you'll be bidding on basically every product in that particular category.

I've tested category targeting off and on since Amazon introduced this targeting option, and I've almost always had terrible luck with it. ACoS has almost always been far higher than targeting individual products, and I've never been able to get it to a point of profitability.

I had all but given up on category targeting, but, for the purpose of this PPC series, I decided to try and give it one last try to see if I could get it to a point of profitability before I conclude that category targeting never works.

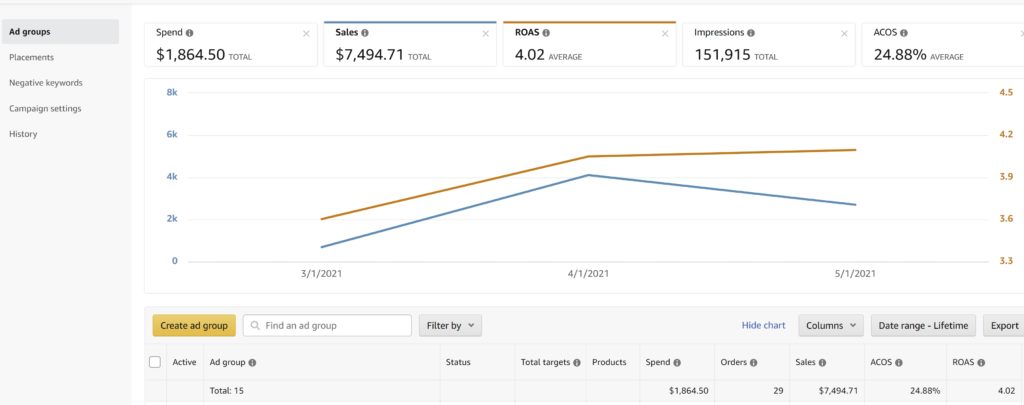

After much testing over the last two months, I've finally been able to get our Category Targeting campaigns to a point of profitability. Below is the screenshot over the last two months.

After testing, I determined the trick was the following:

- You need to bid low. You are casting such a wide net with Category targeting that your conversion rate for these ads is going to be lower than many other ad types. Your bids need to be low enough to offset this low conversion rate.

- You have to try Category Targeting with multiple products. Some categories are far less competitive than others and you can get dirt cheap traffic which justifies casting such a wide net.

Conclusion and Three Bonus Ad Strategies

Over the last year or so, Amazon has made nearly all of their ad types increasingly more complex. Hopefully, this article helped demystify some of the more confusing nuances of Amazon Sponsored Products.

As part of our testing over the last two months, Mike and I have spent tens of thousands of dollars and developed three new ad strategies that we're using on all of our brands right now: an Isolation campaign, a penny campaign, and a category targeting campaign.

These campaigns are now generating upwards of $20,000 in additional revenue each month per brand that we weren't previously getting at a healthy 21% ACoS. During our next EcomCrew premium webinar, I'll be breaking down each of these strategies step by step so that you can implement them in your Amazon campaigns. If you're already a Premium member, I think you'll love this webinar and if not, hopefully you'll check out Premium and enjoy this shameless plug for Premium.

Thanks, Dave!

Very nice article

Glad you like it!