Rebuilding a Million Dollar Ecommerce Brand, Year End Summary

In this post, I’ll give an update of my newest ecommerce brand after 18 months. As well as giving a progress report, I’ll also share some tips and hints with you for increasing the profitability of your brand, along with growth strategies you can employ.

Related Reading: Rebuilding a Million Dollar Company, 18 Month Update

Related Reading: Rebuilding a Million Dollar Company, 12 Month Update

Related Reading: Rebuilding a Million Dollar Company, 6 month Update

Related Reading: Rebuilding a Million Dollar Company, 60 Day Update

After 21 months, I finally hit my goal of a monthly run rate of over $1million per year. From December 14 to January 14 we had revenues of $92,522.22, meaning the yearly run rate would be just over $1.1million. There was a slight seasonal bump from Christmas but our real sales bump comes in Spring/Summer as our products are mostly fair weather goods.

| July 2017 | November 2017 | April 2018 | October 2018 | January 2019 | |

| Amazon.com | $10,788.50 | $8,192.93 | $32,237.70 | $51,439.02 | $63,729.25 |

| Amazon.ca | $1,180.49 | $986.29 | $12,145.00 | $15,560.54 | $22,938.13 |

| eBay.com | $994.35 | $164.98 | $554.94 | $52.99 | $615.95 |

| Shopify | $552.43 | $200.00 | $629.94 | $5,528.37 | $5,268.89 |

| Total | $13,515.77 | $9,544.20 | $45,567.58 | $72,580.92 | $92,552.22 |

| 12 Month Run Rate: | $162,189 | $114,530 | $546,810 | $870,971 | $1,110,626 |

Actual total revenues for the year were just below $600,000, but the vast majority of this came in the last two quarters of the year.

Our Marketing Flow – What's Working & What's Not

I talk a lot on the blog and podcast about focusing on growing our Amazon sales as much as possible. However, a lot of that effort is done off of Amazon. It's focused on a few primary ways:

- Google Shopping

- Facebook ads, especially retargeting

- Facebook organic marketing

- SEO

- Email marketing

- Content only niche website

Overall, our marketing flow looks as follows:

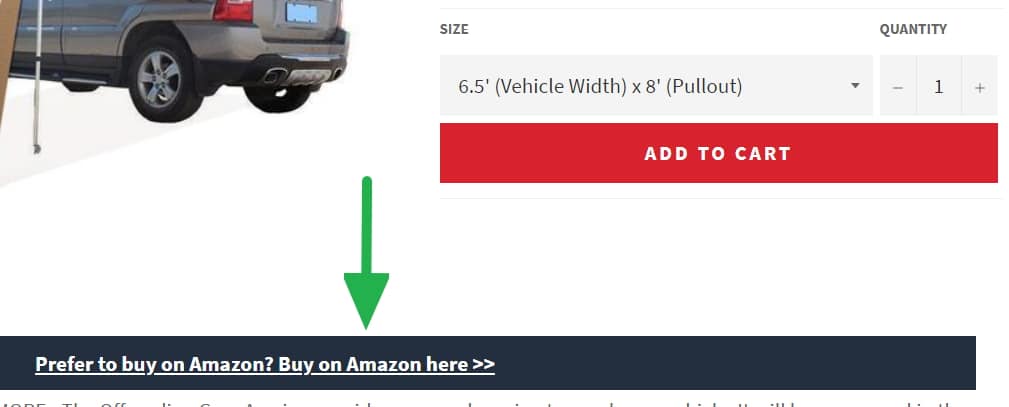

For all of the traffic we send to our Shopify site, we try to persuade them to buy on Amazon as much as possible. We do this by placing “Buy On Amazon” buttons throughout the product listing page (this is simply a hard-coded CSS button with an Amazon affiliate link to our Amazon listing page)

To many this is counter-intuitive, but there is a significant multiplier effect to sending sales from external traffic to Amazon. We can debate what that multiplier is, but in my experience, it is anywhere from 5 to 20x meaning that for every extra sale we send to Amazon it will increase our rankings so much so that those increased rankings will result in five to twenty times MORE customers.

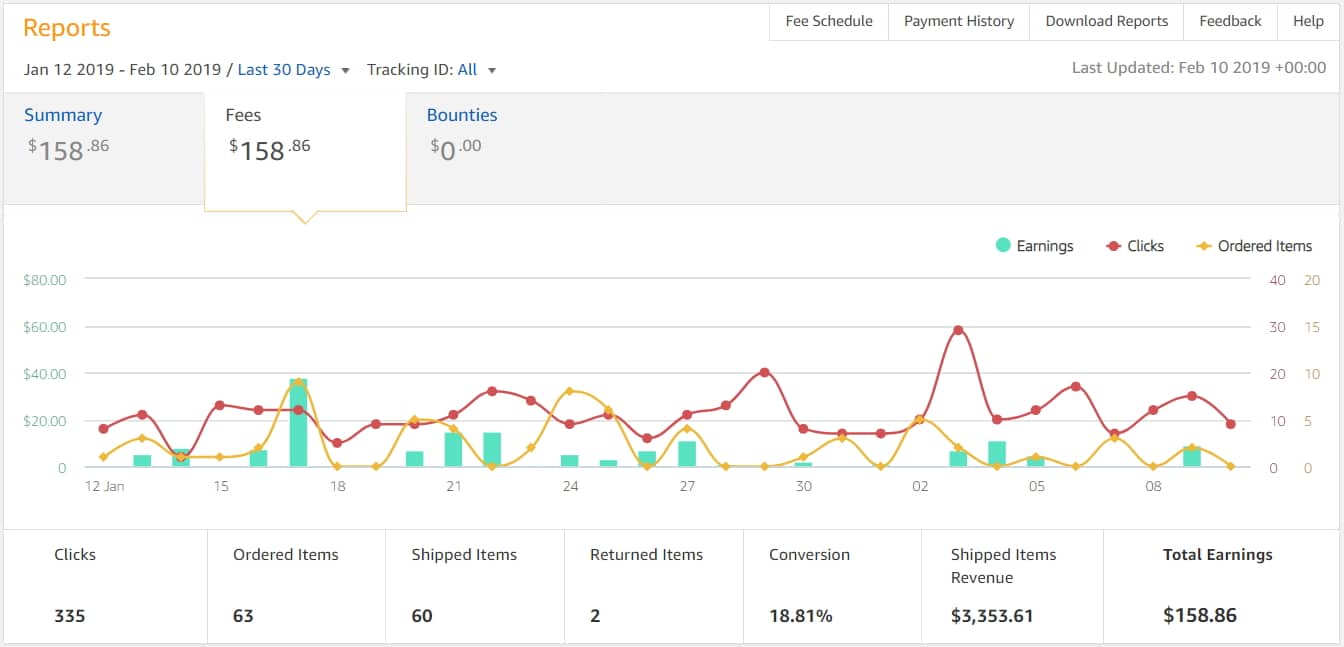

We track everything through an Amazon Affiliate link. Approximately 30-40% of all traffic from our website ends up buying on Amazon (and if I had my choice it would be 100% of our traffic). We get a 4.5% commission for these items. If you consider Shopify's 2.6% merchant rate, this means that the true Amazon referral rate for us is essentially 4.9% (Automotive's 12% referral fee – 2.6% merchant rate – 4.5% commission).

Google Shopping is the most profitable paid advertising medium for us by far. Regular Google Ads perform poorly and are rarely profitable and we've basically turned them all off. Reported costs per conversion for Adwords Shopping campaigns is around $19 (but these figures are in reality 30-40% cheaper due to the untracked conversions on Amazon).

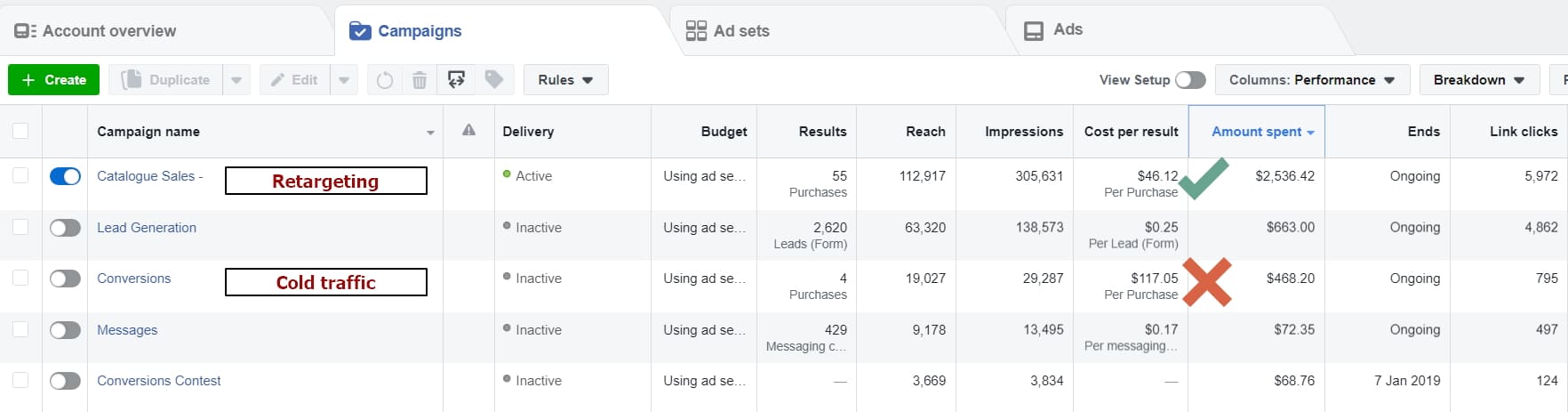

For Facebook ads, retargeting via our catalog is the only method we've found so far to be profitable. We've tried cold traffic with a lookalike audience of our past purchasers but they perform dismally. A big reason for this is that our products are need driven and not impulsive – you either need to replace a part on your vehicle winch or you don't need to.

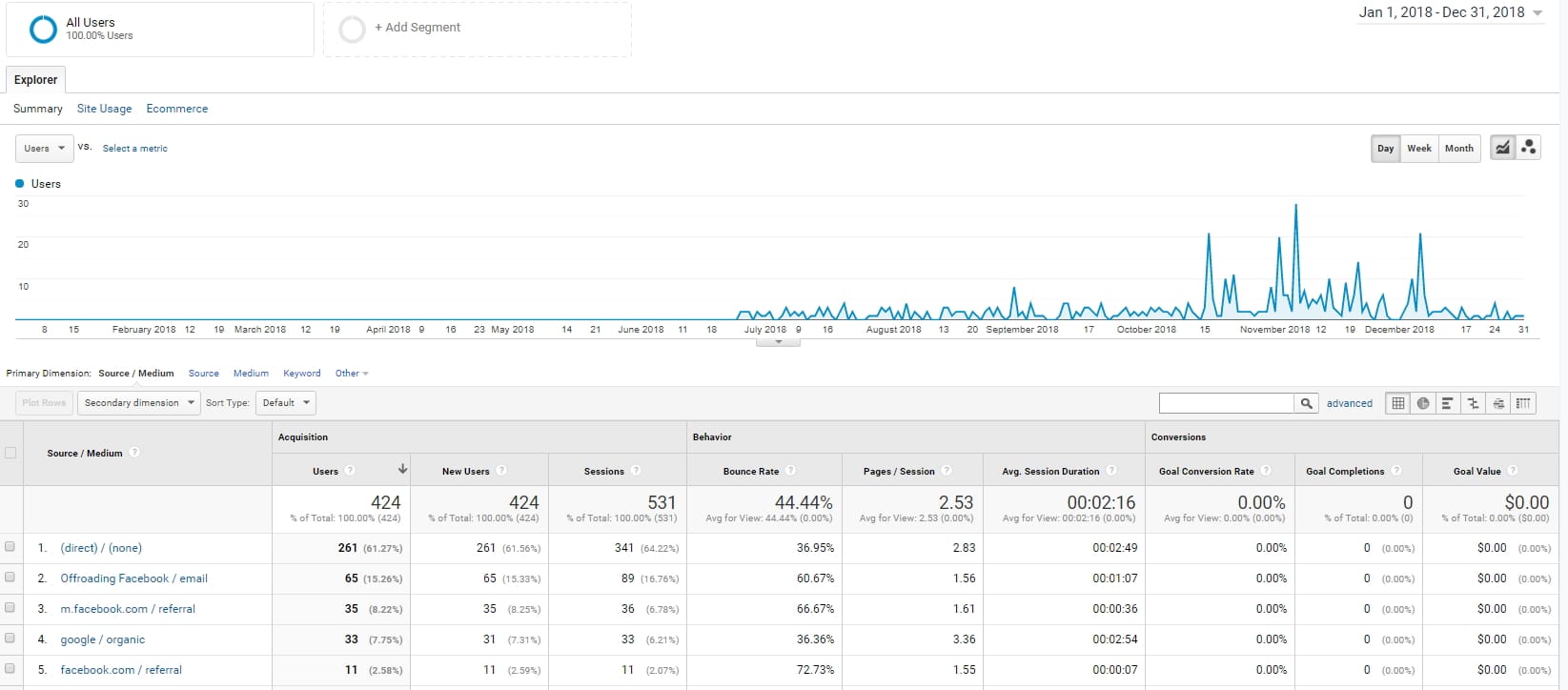

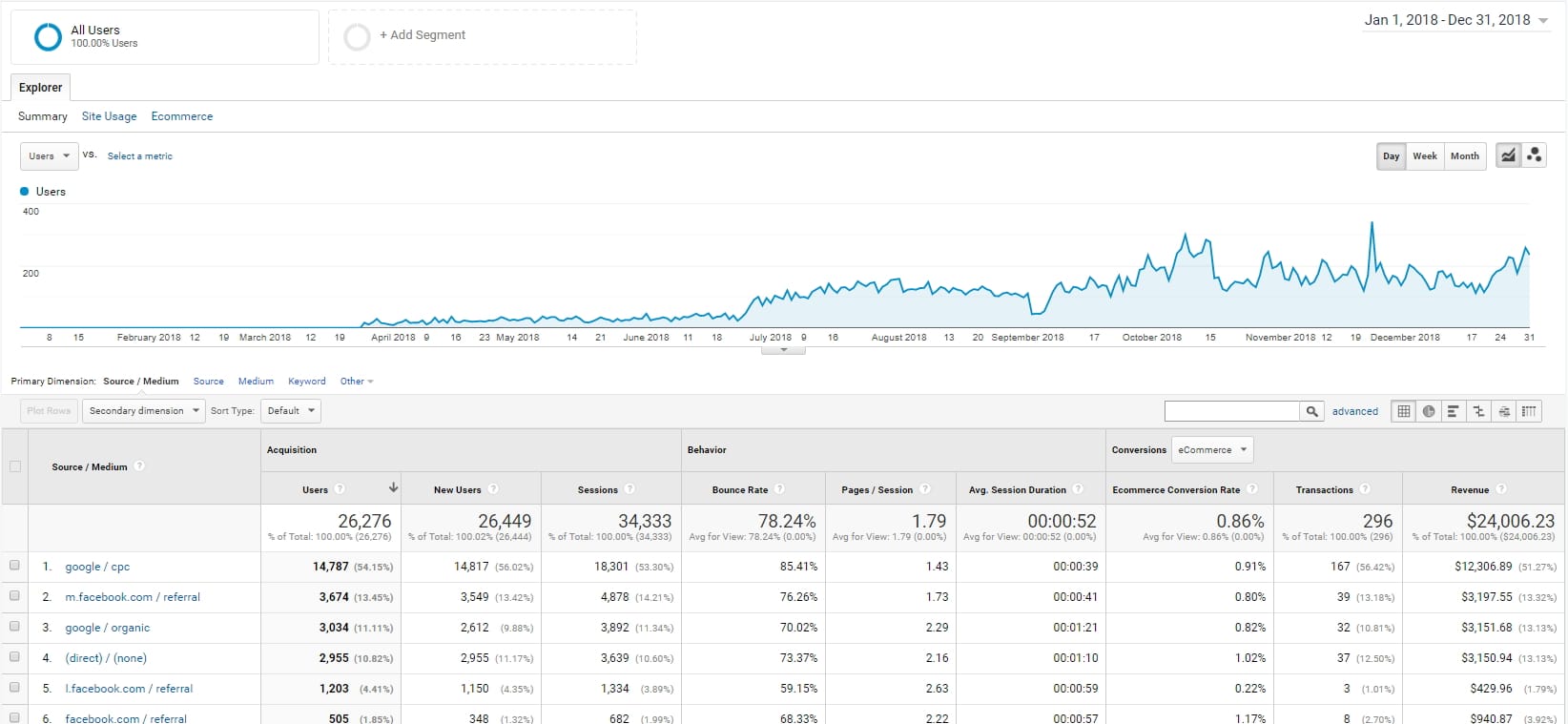

Website traffic overall has grown very consistently from zero in March 2018 to a healthy 200-300 visitors a day. Organic traffic has also grown nicely over this time and we now get about 10-15 organic visitors per day. A big part of this success is having a keyword rich domain that also happens to be our brand name.

We have also started building out a niche, content-only website for off-roading enthusiasts. This is hosted off a high-value domain I purchased a couple of years ago for $13,000. I have hired a VA full time in the Philippines to start writing content for this website. The long-term goal is to build a content base and following that helps add authority to our brand and also helps promote our products.

There has been a predictable struggle to get the writing quality and tone up to speed but the goal is to build a site that gets some initial traction with Google and then, have either myself or another Western writer heavily revise all of the articles after 6-12 months. The success of this venture remains to be seen but it has proven an effective ‘make-work' project for a VA who can also handle customer service.

Growth Plans for 2019

- Grow run rate to $1.75million for the year; actual yearly revenues to exceed $1.2 million

- Have net profit exceed $175,000 for year

- Open additional Seller Central account

- Launch 15 new products

When I first launched this new brand in 2017, I was on the fence about whether to keep it a smaller lifestyle business or go all in. I've now more or less committed to the idea of keeping the business small.

By small, I, more or less, mean that I will keep it bootstrapped for financing. This means that growth will be severely limited opposed to if I invested additional personal capital and sought external bank financing.

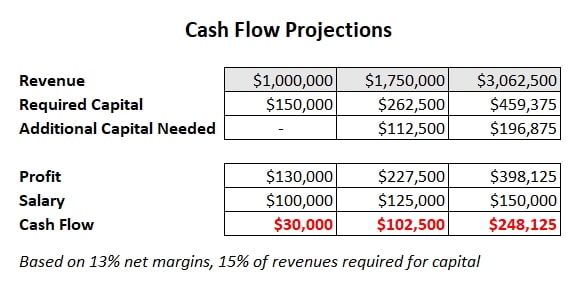

It's very easy to see how quickly you can grow by doing a very quick and dirty cash flow projection. I've done this long enough now to know that net margins, before my salary, are typically around 10-15%. Capital requirements are typically around 15-20% of revenues. With these numbers, it's very easy to figure out the below growth projections which top out around $3million in the next years (or approximately 75% per year).

Increasing margins or my inventory turnover would allow quicker growth without supplying additional capital but even then there are limits to growth. Ecommerce margins are continuously being pushed down and when importing from overseas, it's very difficult to turn over inventory any quicker than every three months.

Decreasing my salary would also increase cash flow but I am an ardent believer in paying yourself first (a simplified version of the profit first philosophy).

Ultimately what this means is limiting overhead as much as possible primarily via my two no's: no employees and no leases. I do have a significant amount of warehousing space rented on a month-to-month basis and I also have VAs and will be hiring more. However, contractors, software, and employee location arbitrage (i.e. VAs) allow for a company to easily grow to mid-seven figures without the need for any significant fixed overhead.

Limiting Risk

Ultimately I've decided to limit my risk in two primary ways:

- No personally guaranteed loans

- Secondary Amazon account/business

- Other investments

Getting outside financing would also allow quicker growth, but most banks will require a personal guarantee for any financing above $50,000 or so. This is something I do not want to give for a number of reasons, not the least of which is platform risk we all face in ecommerce (whether it's Amazon, Google, or Facebook).

In order to eliminate as much platform risk as possible, I am also in the process of setting up an additional company and secondary Amazon Seller Central account. I've gotten permission for this second account from Amazon but I will operate in stealth as much as possible to avoid setting off any automatic concurrent suspensions should anything ever happen to one of the accounts.

Finally, I try to avoid the situation of having all of my eggs in one basket. This means having my income diversified away from one business. Of course, I have EcomCrew but I also have other investments, thanks in large part to the sale of my previous ecommerce business.

Conclusion

Overall, growth in 2018 began slower than expected and ended quicker than anticipated. My biggest takeaway from the year is how difficult and time consuming it is to develop products for a new brand. Some products have literally taken well over twelve months to launch (and I have one product that is approaching nearly eighteen months and still hasn't launched!). However, once the hard work of product development is done, the stress and need for intensive product launches are mostly eliminated.

How was 2019 for your ecommerce business? Did your revenues grow or decline?

Hi Dave,

Thank you for these blog posts, they are very informative also I love your podcast.

I have some questions, I am from Turkey.

*How many different suppliers did you work with for all of your products?

*1 person – you – is enough for this organization (apart from content production-social media content etc.) What is the limit man/hour or SKU

*Do you have any physical warehouse in USA or Canada just for this organization or only 3pl?

*Where is your LLC located. Canada or USA or both

*I know you sell businesses, so I think, for every project, you open a new LLC, trademark will be on that company, shopify, social media business accounts are all registerd on that business, am I right?

About 4 different suppliers (I try to minimize it as much as possible).

It took close to 40 hours a week for about 6 months to get things up to this point. By now it’s probably closer to 10-20 hours a week.

Just a 3PL in the U.S..

In Canada.

Yes, they’re registered with the business but most things are no problem transferring.

Hi Dave,

Great post I’m currently on my first Amazon business how risk-averse were you with your first business?. I think getting loans and managing cash flow is the most understated topic in the Amazon FBA world. I’m definitely struggling with the, when do I stop reinvesting all my profit/borrowing money at the expense of quicker growth dilemma.

I honestly think a person with average amazon skills but great cash flow management skills will make a lot more than a person the other way round.

Also if you’re ever looking to expand into the 5 EU markets let me know I’m from the UK and have a 3PL warehouse I work with etc.

Thanks

Jonny

Hi Jonny – My first time around I was in university and had everything I owned (plus some) on the line. I totally agree, cash flow management is one THE most important traits. And thanks for the offer for helping with the EU!

Hey Dave, thanks for the writeup and podcast on this. I think I remember you mentioning on the podcast that you’d like a plugin that would remove the add to cart and just have an Amazon buy button with affiliate link and I’m aware of one although I haven’t used it personally. Just thought I’d pass it on in case it’s what you’re looking for: https://bit.ly/2EMMI5r

Cheers!

ROB

Hi Rob – Awesome! That’s exactly what I’ve been looking for.