Staff Picks – Our Top 5 E-Commerce Credit Cards for 2023

For the discerning business owner, choosing the right credit card plays a huge part in contributing to your success in the e-commerce business. Here, we list down our personal picks for e-commerce credit cards tailored for business owners. We’ll do deep dives into the pros and cons, features, and ultimately, why these credit cards for business owners make it into our top five.

Related Reading: Ecommerce Banking & Finance 101: Getting Cash for Your Company

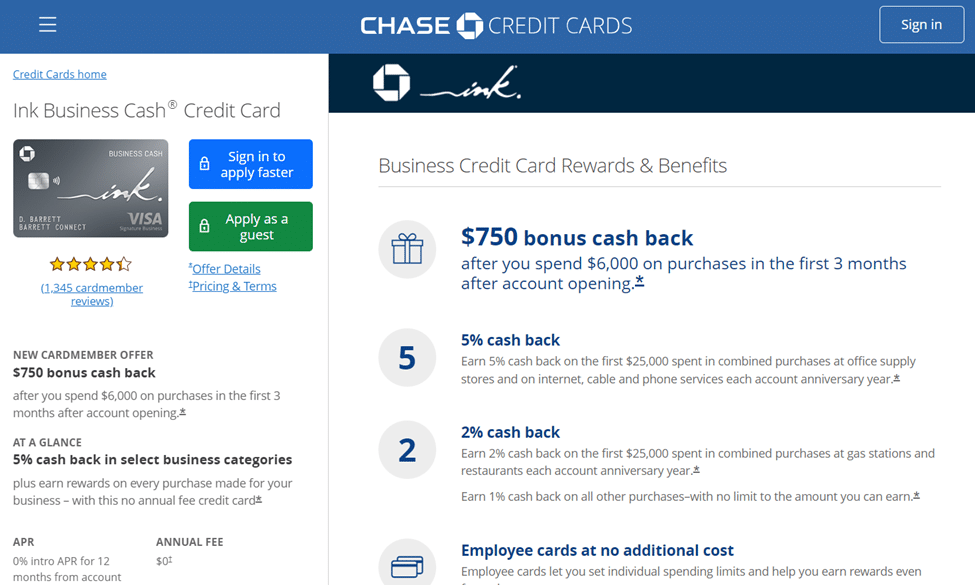

#1Ink Business Cash® Credit Card

To start off strong, let’s talk about an essential: the Ink Business Cash Credit Card. Designed with small businesses in mind, it offers a variety of features and benefits, making it an excellent choice for business owners seeking cash back rewards and flexible financing options. With this card, you can earn cash back on various business expenses, including office supplies, internet services, and telecom purchases.

The Good

- No annual fee.

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services each account anniversary year.

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year.

- Earn 1% cash back on all other purchases.

- 0% introductory APR for the first 12 months on purchases and balance transfers.

- Employee cards at no additional cost, allowing you to earn rewards from their spending.

The Bad

- Requires good to excellent credit to qualify.

- 5% and 2% cash back categories have spending caps.

- Foreign transaction fees apply.

- Cash back rewards cannot be transferred to other loyalty programs.

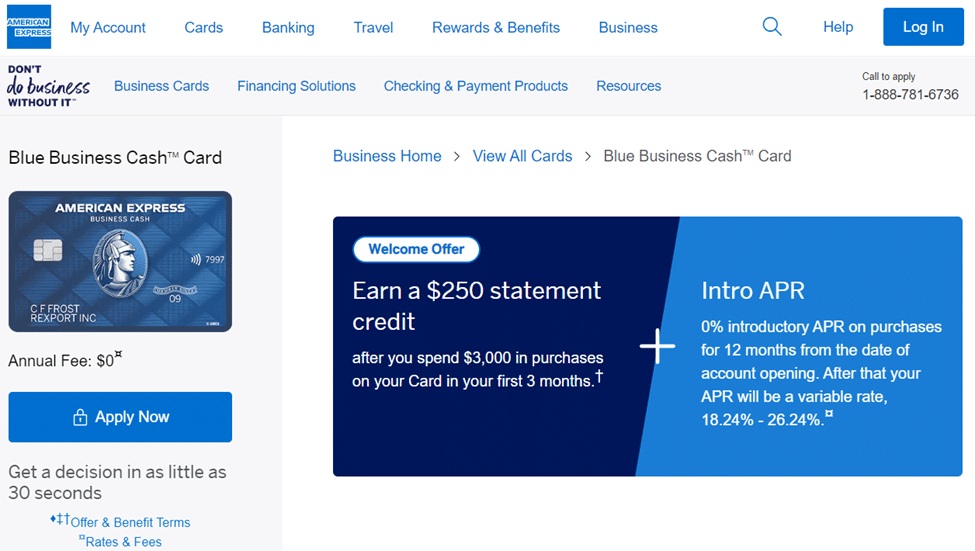

#2 American Express Blue Business Cash™ Card

Stiff competition for Chase’s Ink Business Cash, the American Express Blue Business Cash Card is a straightforward, easy-to-understand cash-back credit card option that offers valuable benefits for business owners. With this card, you can earn cash back on all eligible purchases, making it an appealing choice for businesses with a variety of purchase categories. The generous earnings on spending coupled with its value and simplicity make it hard to beat.

The Good

- No annual fee.

- Earn 2% cash back on all eligible purchases on up to $50,000 per calendar year.

- 0% introductory APR for the first 12 months on purchases and balance transfers.

- Expanded Buying Power feature allows you to spend beyond your credit limit with no over-limit fees.

- Employee cards at no additional cost, with the ability to earn rewards from their spending.

The Bad

- Requires good to excellent credit to qualify.

- Foreign transaction fees apply.

- Cash back rewards cannot be transferred to other loyalty programs.

- 2% cash back rate drops to 1% after reaching $50,000 in eligible purchases per calendar year.

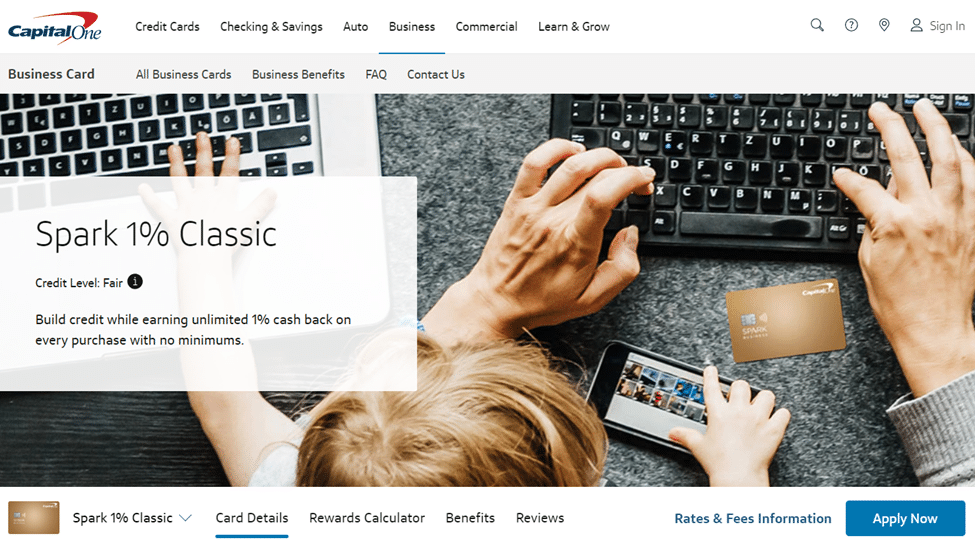

#3Capital One®️ Spark®️ Classic for Business

Just starting out on your e-commerce journey? The Capital One Spark Classic for Business credit card is specifically designed for business owners with average to fair credit. It offers a simple and straightforward rewards structure, making it an accessible choice for those on the journey to establish or rebuild their credit.

The Good

- No annual fee.

- Applicants with limited or fair credit may qualify.

- Earn unlimited 1% cash back on all purchases.

- Fraud coverage and alerts to help protect your business against unauthorized charges.

- Access to Capital One business resources and tools.

The Bad

- No introductory APR offers.

- Limited rewards compared to other cards.

- Foreign transaction fees apply.

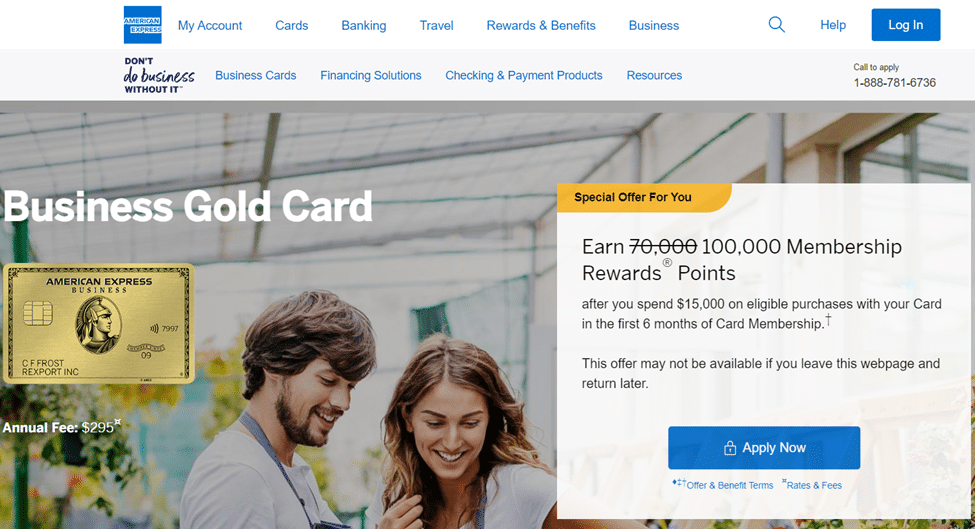

#4American Express Business Gold Card

Where there’s budget options, there’s heavy hitters. The American Express Business Gold Card is a rewards-focused credit card tailored for e-commerce owners gaining momentum. It offers numerous benefits to help manage finances and maximize user rewards. With this card, you can earn Membership Rewards points on various business expenses, providing you with flexible redemption options.

The Good

- Access to the American Express Membership Rewards program.

- Earn 4X Membership Rewards points on the two categories where your business spends the most each billing cycle (up to $150,000 per year).

- 25% airline bonus on flights booked through the American Express Travel portal.

- 1X Membership Rewards point on other eligible purchases.

- Premium benefits such as purchase and return protection, extended warranty coverage, and 24/7 customer service.

The Bad

- Annual fee applies.

- 4X points are limited to the two highest spending categories.

- Points redemption options may vary in value.

- Foreign transaction fees apply.

#5 Brex 30 Card

Saving the most innovative for last, we have Brex. A modern credit card solution catering to startups and e-commerce businesses. It offers a unique approach to credit cards, focusing on refining cash flow management and expense tracking.

For the well-funded startup, the Brex 30 Card is a solid option for business owners with little to no credit history because there is no personal guarantee requirement. Instead, Brex relies solely on your company’s cash flow and financial backing to determine the pre-approved credit limits.

The Good

- No personal guarantee or credit check required for startups.

- Higher spending limits compared to traditional credit cards.

- Streamlined expense tracking with integrations to popular accounting software.

- Rewards program tailored for e-commerce businesses, including discounts on software, advertising, and travel.

- Advanced security features and dedicated support.

The Bad

- Annual fee for premium plans.

- Designed specifically for startups and e-commerce businesses, limiting eligibility for other types of businesses.

- Limited rewards compared to traditional cash-back or points-based programs.

- Foreign transaction fees may apply.

Final Thoughts

Credit cards used for e-commerce businesses come with their perks and drawbacks. On the positive side, credit cards grant the user easy access to funds, streamlined cash flow, various rewards programs, and a better credit score. On the other hand, it's important to be mindful of potential drawbacks such as high-interest rates, debt accumulation, fees and charges, and possible negative impacts on your credit score.

To maximize your credit card, consider allocating your spending to categories that offer higher rewards or cash-back percentages. Further, pay your balance in a timely manner to avoid interest charges and maintain a positive credit score. Finally, utilize online banking to track and manage your credit card expenses.

By carefully considering these factors and implementing smart strategies, you can leverage credit cards to support your e-commerce business's financial needs and make the most of the benefits they offer.