Walmart’s Q3 Earnings Beat Wall Street Forecasts

Despite the problems posed by the supply chain crisis, Walmart has managed to beat Wall Street’s expectation by almost $5 billion. The retail giant even raised its forecast, confident that it can deal with the holiday rush.

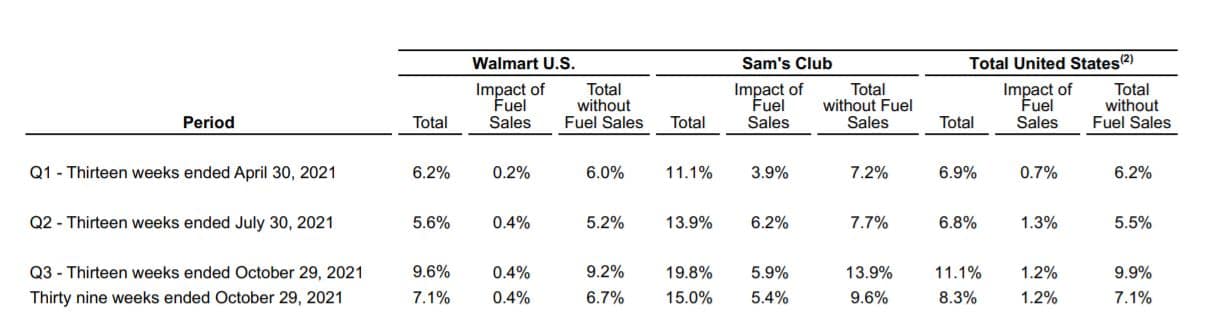

Walmart Saw a 9.2% Sales Increase Compared to 2020

Walmart released its Q3 earnings for FY 2022 last November 16. And as the United States is getting back to normal, the world’s biggest retailer saw a 9.2% increase in sales over last year, and 15.6% on a two-year stack.

It saw a total revenue of $140.5 billion, higher than Wall Street’s expected $135.60 billion. This represents a 4.3% increase from last year’s $134.7 billion.

Here are other salient points of the report:

- US e-commerce sales grew 8% for the quarter and 87% on a two-year stack

- Comparable transactions are up by 5.7%

- Membership income increased 11.3%

- Consolidated operating income is $5.8 billion (up by 0.2%)

- International net sales at $23.6 billion (down by 20.1%)

Such hopeful numbers got Walmart to raise its forecast, from between $6.20 and $6.35 adjusted earnings per share to around $6.40.

Offering Competitive Prices Despite the Inflation

“Save Money. Live Better.”

That’s the Walmart slogan since 2007, and the company plans to stay true to that by continuing to offer low prices despite the fact that we’re experiencing the fastest inflation rate in 31 years.

United States Inflation Rate || Source: tradingeconomics.com

In October, the Labor Department recorded price increases in almost every category, with only Apparel staying the same as the previous months. This, along with rising labor costs and overcrowded ports, pose a grave challenge to any retailer.

However, Walmart CEO Doug McMillon said they will stick to their long-time strategy of undercutting rivals on price. This decision is of course made possible by the company’s size. Cheaper options can be offered by Walmart because they can absorb some of the costs, leading to price-sensitive customers to flock to their stores.

CNBC’s Mad Money host Jim Cramer even called Walmart an “inflation fighter,” saying they’re taking share from everybody. This is after Walmart’s stock saw a decline following concerns about the company not raising the prices enough, resulting in low gross margins.

The operation costs are predicted to rise even more as the holidays approach, further narrowing the margin. But Walmart is confident that they can handle the rush.

Since October, Walmart, along with other retailers, have started taking advantage of the extended operating hours at the Long Beach and Los Angeles Ports. They also hired 200,000 new workers.

Walmart vs. Amazon

The world’s largest ecommerce company also recently released its Q3 Earnings Report. Unlike Walmart, Amazon missed both its top and bottom line predictions. Amazon’s total net sales rose to $110.8 billion, almost a billion dollars short of the predicted $111.6 billion.

| Revenue, in Billions | |||

| Q1 2021 | Q2 2021 | Q3 2021 | |

|---|---|---|---|

| Walmart | $138.3 | $141.0 | $140.5 |

| Amazon | $108.5 | $113.1 | $110.8 |

With Q4 almost coming to an end, the two companies will have to spend more to keep things going smoothly. Amazon has estimated it will spend $4 billion in additional costs, and it’s going to offset that by increasing referral and FBA fees starting January 18, 2022.

Walmart, on the other hand, is planning to offset the added costs through their rising ad sales so they can continue to offer low-priced goods.

Final Thoughts

Walmart had an overall good Q3 based on its Earnings Report, and it seems confident about its capacity to handle the rest of Q4. And although investors may not be too happy about their refusal to increase prices, the company is big enough to afford to lose some of its profits to ensure they’re pricing their products competitively.

We’ll have to see how this move will fare when they release their next report.