Shopify Returns, Refunds, and Payments: A Seller’s Ultimate Guide

Shopify is one of the leading ecommerce platforms in the world. It has more than 1.76 million merchants and since 2020, around 457 million people have made a purchase from a merchant’s store.

In this article, we’ll discuss the different payment options available on Shopify, its pros and cons, and how Shopify returns and refunds work then compare it with Amazon.

How Do Sellers Get Paid on Shopify?

To track all the payouts of your Shopify store, here’s what you need to do: Once you’re on your Shopify admin, click on Settings > Payments > View Payouts > Transactions. On this page, you can also find the available balance for your next payout and reserved funds.

If you want to know more about the bills and fees your account has incurred for a certain period, simply go to the Bills section of the Billing page in your Shopify admin.

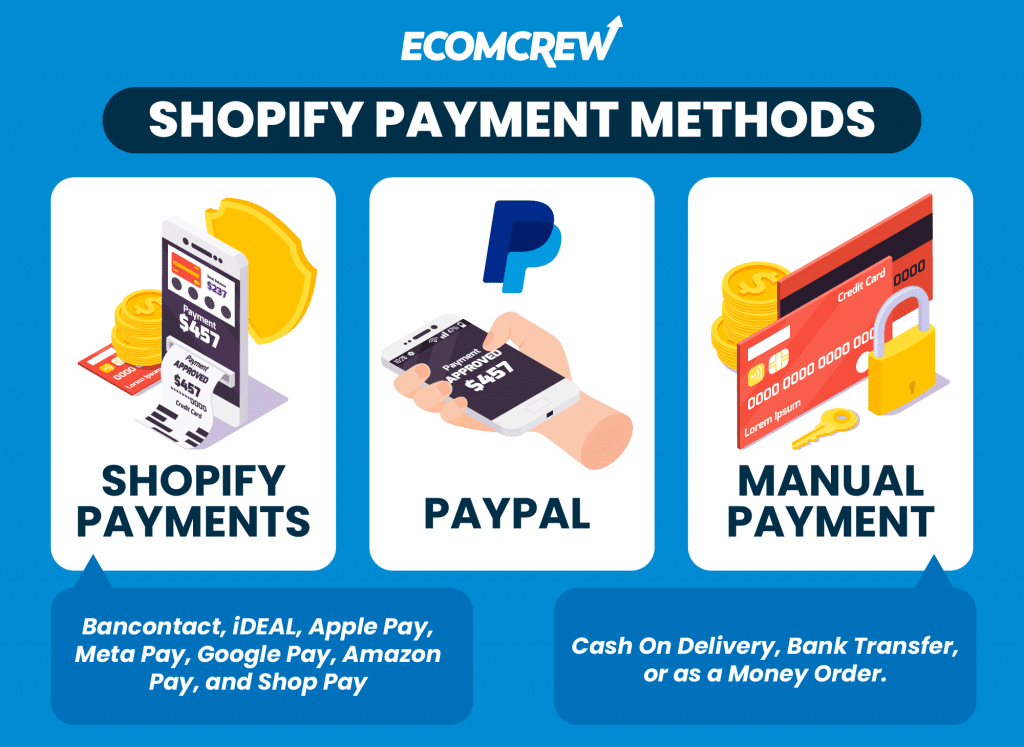

All Shopify-supported payment methods rely on third-party providers to process transactions. Sellers will have three options to choose from, Shopify Payments, PayPal, and manual payment methods. We’ve explained in detail the pros and cons of each payment method in a separate section below.

Oftentimes, payment will be credited to your account within 1 to 3 business days, excluding the fee incurred from customers using Shop Pay installments. If a payout is made over the weekend or on a holiday, a pending state will appear on your bank statement until the next business day.

If you want to receive money into your account in less than one business day, your choices are limited to PayPal or Shopify Balance (limited to sellers with stores based in the United States or Puerto Rico).

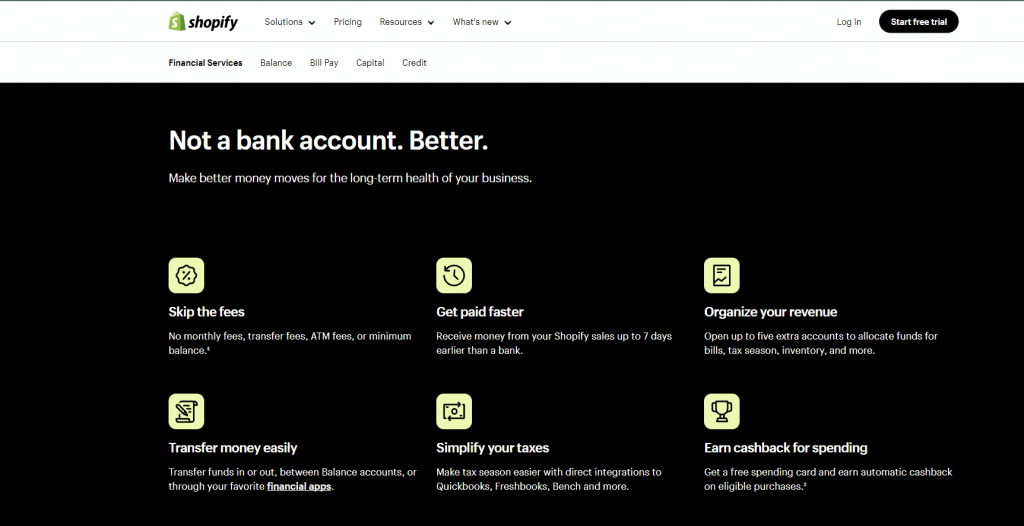

Shopify Balance is a free money management account built into your store's admin. It provides basic banking services at a zero maintaining balance and allows you to earn cashback and pay Shopify bills.

If you qualify for the initial requirement, take note that you must also comply with the following additional requirements:

- Activate Shopify Payments (must be single account owner) and two-step authentication

- Possess a valid US Social Security Number (SSN)

- Register on any Shopify or Shopify Plus plan

- Comply with Shopify’s requirements of being a prohibited business

If an expected payout for an order gets tagged as failed, you will receive an email and a notification on the homepage of your Shopify admin that explains why the payout was unsuccessful.

This sort of situation usually occurs due to issues with a seller’s bank details and should be resolved immediately since Shopify will put a hold on all of your scheduled payments until the issue has been resolved.

Payment Channels Accepted by Shopify

While it’s tempting to offer multiple payment options in your store to keep your business flexible to customers, each payment provider does carry their own set of rules and restrictions. Some will have different payout schedules and issue fees such as transaction and credit card fees.

One example of a restriction is when your store is a dropshipping business. A provider like Stripe will only release a customer’s payment once an order has been completed. To be safe, it’s best to first check with your preferred payment provider before linking with your Shopify store.

If you want to know what payment methods are accepted by your store, go to the Payment Providers area of your Shopify admin.

Shopify Payments

If you want to give customers an option to pay using their credit card, your Shopify Payments should be activated. It’s a payment service that bypasses a third-party payment provider, keeping customers on the same page during the entire payment process and only requires a minimum transaction of $.50, for customers in the United States at least.

Here’s a list of the minimum amount customers need to purchase from your store to avoid getting an error during checkout:

But before you head to the settings of your Shopify store, be sure to check this list from Shopify first since this payment channel is only supported in some countries. Furthermore, each country also has a specific set of requirements sellers need to follow before getting activated.

One of the biggest perks you’ll receive when activating Shopify Payments is that you won’t be charged any third-party transaction fees on any order made from your store. What you will have to pay is credit card processing fees which vary depending on your Shopify plan

| Payout currency | Minimum amount |

| USD, CAD, AUD, NZD, SGD | $0.50 |

| DKK | 2.50-kr |

| EUR | €0.50 |

| GBP | £0.30 |

| HKD | $4.00 |

| JPY | ¥50 |

| RON | lei2.00 |

For businesses that are based in the United States, Shopify Payments accepts debit and credit cards from Visa, Mastercard, American Express, Discover (including Elo, JCB, UnionPay), and Diners Club.

Outside of credit cards, Shopify Payments also lets customers pay using their mobile wallets. This includes Bancontact, iDEAL, Apple Pay, Meta Pay, Google Pay, Amazon Pay, and Shop Pay. The good news for sellers is that in August 2023, Shopify enabled Buy with Prime on its merchant stores, giving sellers the option to add a Buy with Prime badge on their products.

This form of payment channel is ideal for stores that conduct business in different countries since it has no problem adapting to different currencies.

Advantages

- No transaction fees

- The payment channel is supported in different currencies

- Customers stay on the same page during the entire payment process

- Accepts a wide array of credit cards and mobile wallets

- Built-in fraud analysis tool

- US-based merchants can add Buy with Prime badge on their products

Disadvantages

- Limited availability across different countries

- Sellers are charged $15 for every chargeback investigation

- All payouts will get paused whenever there’s a failed transaction

- Customers aren’t allowed to add on an existing order

- Limited to certain business categories

PayPal

As a payment service channel that holds over 40% of the global market share, PayPal is one of the most prominent and trusted payment providers in the world. Due to the sheer amount of users worldwide, there’s a good chance that the customers browsing your store already have a PayPal account and trust them when making orders online.

Integrating PayPal into your Shopify store is easy, especially if your store uses the same email address as your PayPal. In this scenario, PayPal Express Checkout will be activated automatically. If you’re encountering errors, be sure to convert your PayPal account to a business account.

When your email address on PayPal doesn’t match your Shopify store, don’t worry. PayPal gives you the option to add or update your email address. To confirm that your PayPal email address is uniform with your Shopify store, go to Settings > Store details.

If you want to capture payments manually or issue refunds, here’s how. When you’re on your Shopify admin, head over to Settings > Payments.

Next, go to the Additional payment section > PayPal > Manage. After clicking Activate PayPal Express Checkout, you will need to log in to your PayPal account details on a separate page. From there, all there’s left to do is Grant Permission and you should be good to go.

For customers who don’t have PayPal but still prefer to transfer the payment to your PayPal account, simply link a credit card to your PayPal account.

Advantages

- Seamless integration

- Multiple currencies are accepted

- Digital invoicing capabilities are simplified

- Provides a secured method of transaction using encryptions

- A tried and tested payment service

- Integrated with Venmo

Disadvantages

- Customer service for phone users might experience inconsistency

- Digital goods are not covered in the seller's protection

- Prone to failed transactions when one account is linked to multiple stores

- Higher fees

- Customers will be redirected to another page

Manual payment

While manual payments have lost popularity in countries like the US, there are still customers around the world who don’t feel comfortable using their credit cards or mobile wallets for online transactions. In fact, one survey found that over 75% of ecommerce transactions in Asia are done via cash on delivery.

By setting up a manual payment option on your Shopify store, customers can pay through cash on delivery, bank transfer, or as a money order.

* If your store is based in Canada, you may also use email money transfers.

To activate the manual payment method, head to your Shopify admin then go to Settings > Payment. In the Payment Providers section, choose from the available list of manual payment methods accepted by Shopify.

Once you iron out the additional details, you will then be directed to Payment Instructions, This is where you add the steps to certain manual payment methods to help customers make an order. Be sure to keep your instructions simple and easy to understand to avoid any confusion between you and the customer.

This method will require more work on your end since you’ll have to manually approve and complete a customer’s order.

Advantages

- No third-party transaction fees

- Lesser risk for customers

Disadvantages

- More manual work and processes

- Prone to returns from customers, especially those who order in bulk

- Longer wait time to receive payments from orders

How Do Sellers Get Paid From Customers Who Use a Different Currency?

With Shopify’s global reach, there is a chance that you will receive orders from customers who pay in a different currency.

While this will lead to the headache of having to learn the local tax laws of the other country you’re selling to, the good news is that the payouts you receive on international orders will be immediately converted to the currency of the bank linked to your Shopify store.

However, you will be charged with an international currency payout fee on every international order which varies depending on your Shopify plan on top of paying a fee issued from Shopify Payments.

For users with a Shopify Plus plan, you will be charged 1.25% of the international currency fee. All other Shopify plans are charged a 1.50% international currency fee.

How Does Shopify Process Returns and Refunds?

Returns and refunds are expected in any kind of business, and Shopify makes it easy for sellers to deal with this issue to ensure they don’t lose any customers.

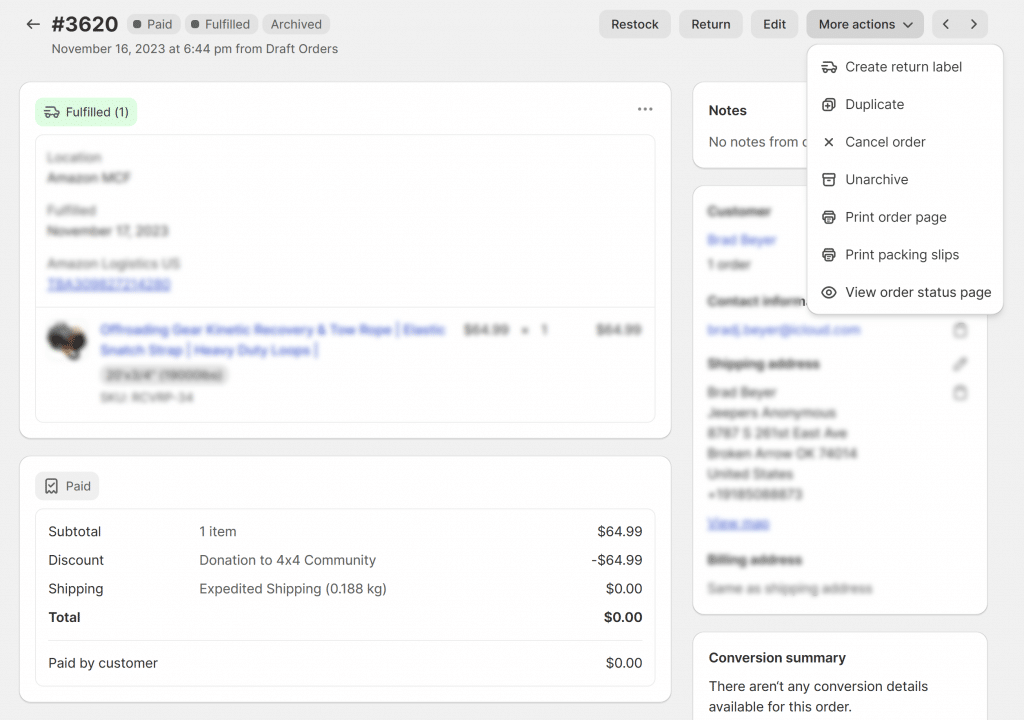

If you want to only issue a refund to your customers, head to the Orders section of your Shopify admin. Once you find the order that needs a refund, you’ll then click on the refund option to start the refund process.

If customers order in bulk and only want specific items refunded, you can add the quantities beside the photo of your product or manually input the amount that needs to be refunded. While the duration of refunding to your customers will depend on the type of bank used in their original payment method, the time a refund is processed is within 2 to 10 business days. When a refund has been issued using Shopify Payments, the amount will be deducted from your next payout.

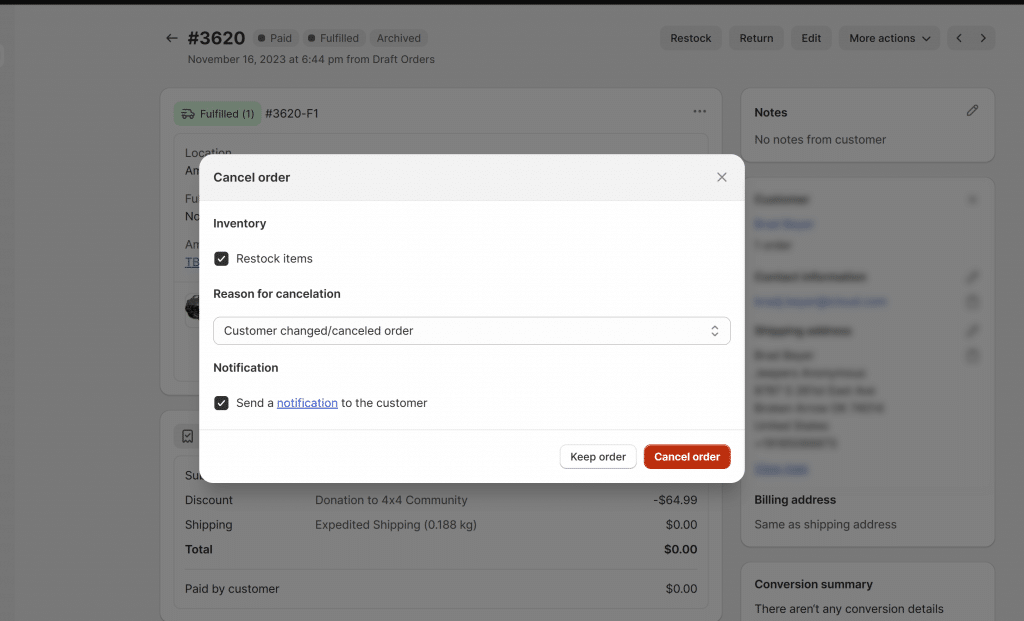

For orders completed via manual payment that need refunds, the process is similar to how you process a return. Once you’re on your Shopify admin, go to Orders > Return. Once you’ve determined the number of items that need to be returned, choose a return shipping option then create the return.

If you do issue refunds in orders made through credit card, the credit card fees charged on the transaction won’t be refunded.

How Different Is Shopify Returns and Refunds Process From Amazon?

How sellers issue refunds and returns on an order via Amazon or Shopify are similar.

You access your Shopify admin, (for Amazon this would be Seller Central) you go to the Orders section (Manage Transactions dropdown from Orders in Amazon) and find the order that needs a refund or return.

Once you fill in the amount that needs to be refunded and complete the refund request, customers are sent an email that a refund has been processed.

Where the two ecommerce giants differ is when a customer issues a chargeback.

If you want to file a dispute, Shopify will only charge a $15 fee (refunded if you win the dispute) while Amazon issues a $20 fee. There is a chance Amazon won’t charge you the $20 fee if it falls in their Payment Protection Policy. If you are required to pay, Amazon won’t issue a refund regardless of the outcome.

Another contrast between the two is the time it takes to respond to a chargeback. Amazon will only wait for your response within 11 calendar days after the email was sent while Shopify has no set deadline. In both cases, chargeback disputes are usually resolved within 75 to 90 days.

Final Thoughts

Dealing with payment terms, returns, and refunds on Shopify can be a headache for any seller. But by having a good understanding of these processes, you can settle any issues or disputes immediately, resulting in happy customers. After all, 81% of customers are likely to make a repeat purchase with a brand as long as they provide a positive experience.

What obstacles do you usually encounter when selling on Shopify? Let us know in the comments below.